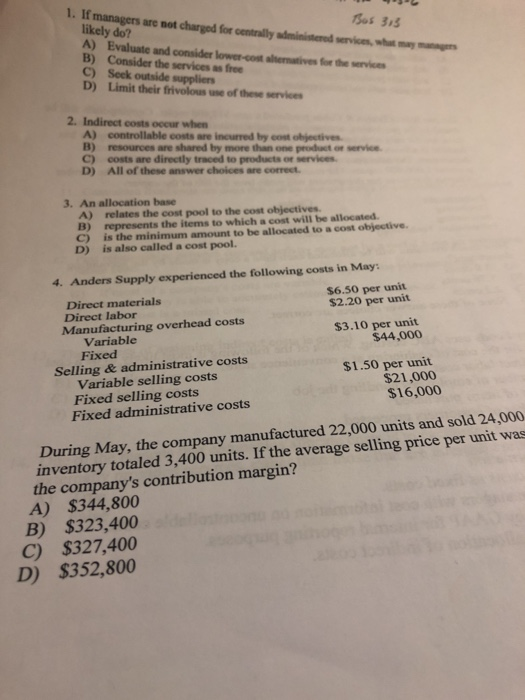

Sos 315 1. If managers are not charged for centrally administered services, what may likely do? A) Evaluate and consider low -cost semnatives for the B) Consider the services as free C) Seck outside suppliers D) Limit their frivolous use of these services 2. Indirect costs occur when A) controllable costs are incurred by con t ives B) resources are shared by more than one product or service C) costs are directly traced to products or services. D) All of these answer choices are correct. 3. An allocation base A) relates the cost pool to the cost objectives B) represents the items to which cost will be allocated C) is the minimum amount to be allocated to a cost objective D) is also called a cost pool. 4. Anders Supply experienced the following costs in May. Direct materials $6.50 per unit Direct labor $2.20 per unit Manufacturing overhead costs Variable $3.10 per unit Fixed $44,000 Selling & administrative costs Variable selling costs $1.50 per unit Fixed selling costs $21,000 Fixed administrative costs $16,000 During May, the company manufactured 22,000 units and sold 24,000 inventory totaled 3,400 units. If the average selling price per unit was the company's contribution margin? A) $344,800 B) $323,400 C) $327,400 D) $352,800 Sos 315 1. If managers are not charged for centrally administered services, what may likely do? A) Evaluate and consider low -cost semnatives for the B) Consider the services as free C) Seck outside suppliers D) Limit their frivolous use of these services 2. Indirect costs occur when A) controllable costs are incurred by con t ives B) resources are shared by more than one product or service C) costs are directly traced to products or services. D) All of these answer choices are correct. 3. An allocation base A) relates the cost pool to the cost objectives B) represents the items to which cost will be allocated C) is the minimum amount to be allocated to a cost objective D) is also called a cost pool. 4. Anders Supply experienced the following costs in May. Direct materials $6.50 per unit Direct labor $2.20 per unit Manufacturing overhead costs Variable $3.10 per unit Fixed $44,000 Selling & administrative costs Variable selling costs $1.50 per unit Fixed selling costs $21,000 Fixed administrative costs $16,000 During May, the company manufactured 22,000 units and sold 24,000 inventory totaled 3,400 units. If the average selling price per unit was the company's contribution margin? A) $344,800 B) $323,400 C) $327,400 D) $352,800