Answered step by step

Verified Expert Solution

Question

1 Approved Answer

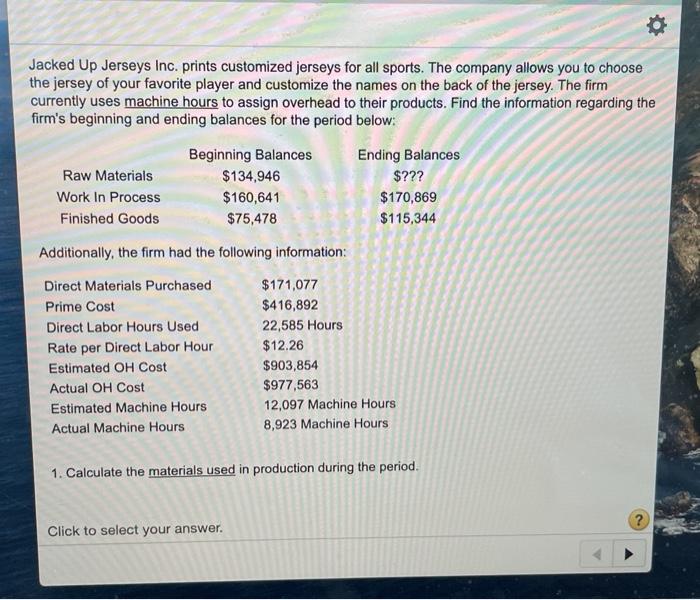

SOS Jacked Up Jerseys Inc. prints customized jerseys for all sports. The company allows you to choose the jersey of your favorite player and customize

SOS

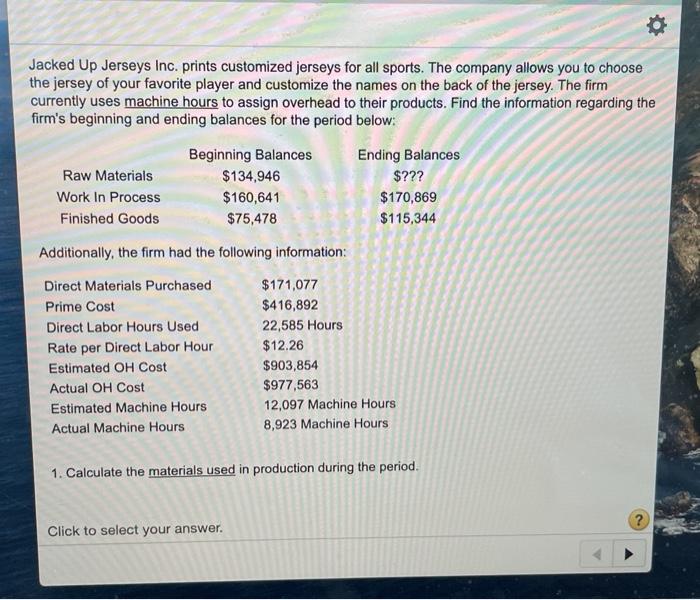

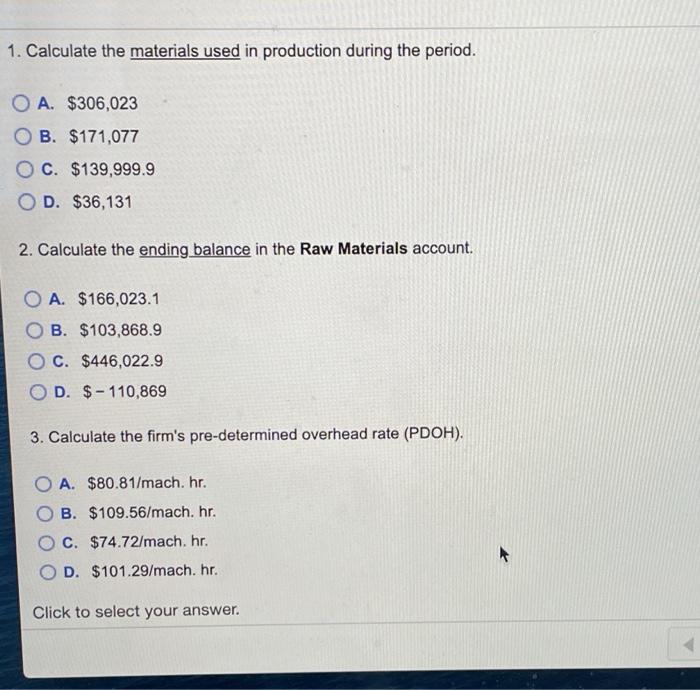

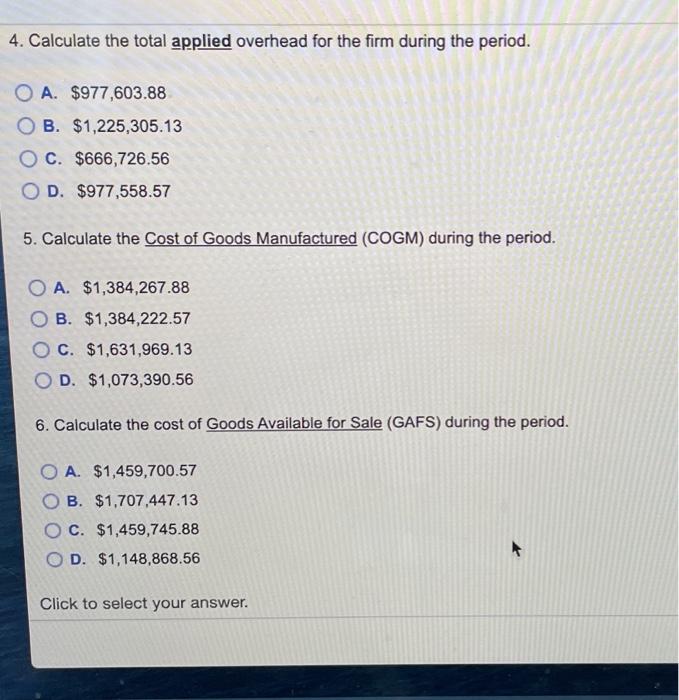

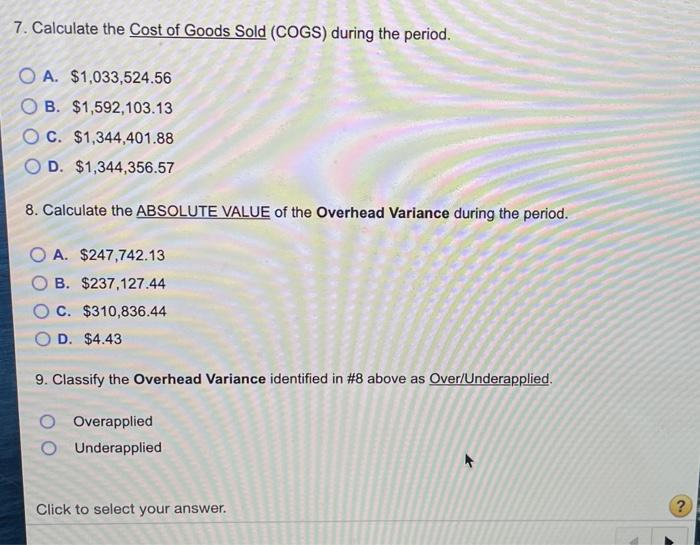

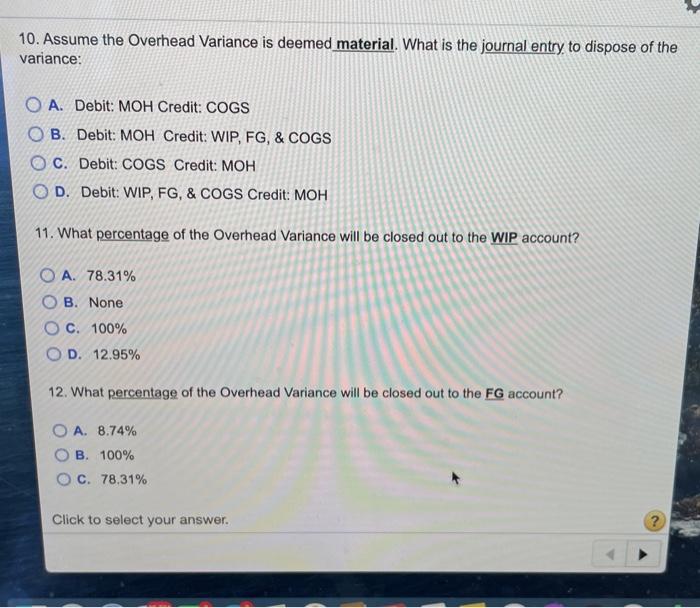

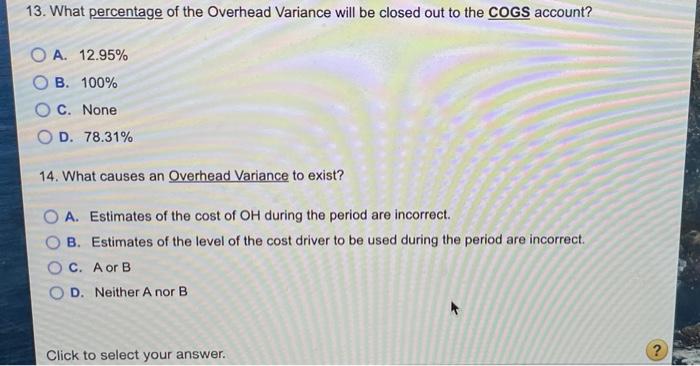

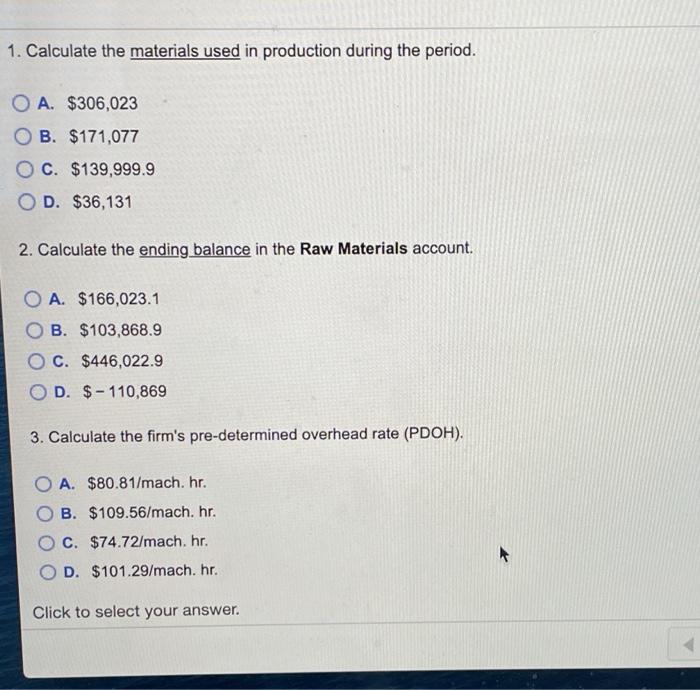

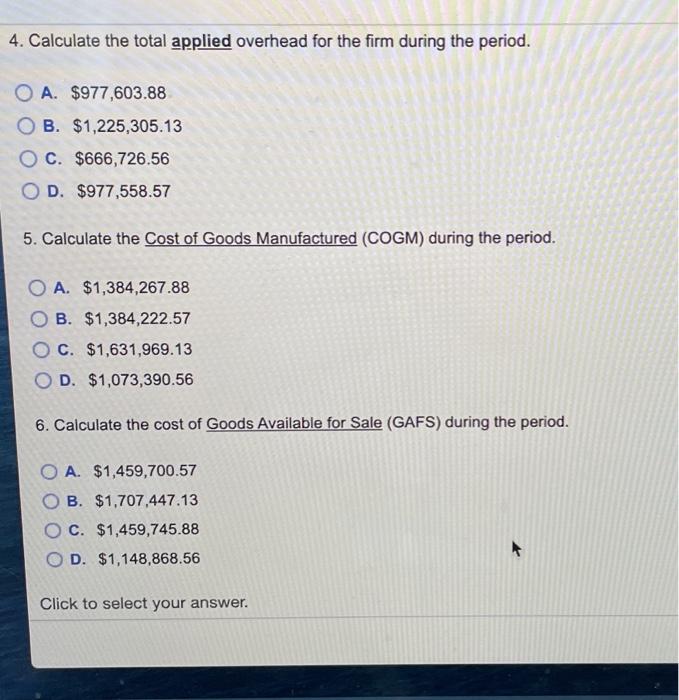

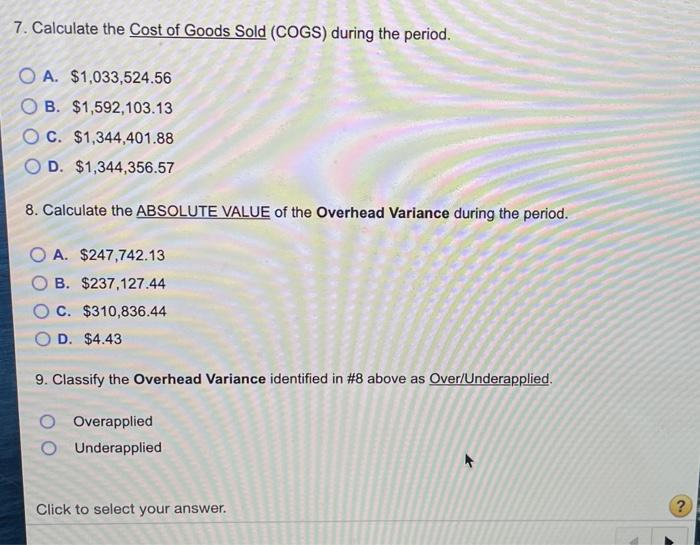

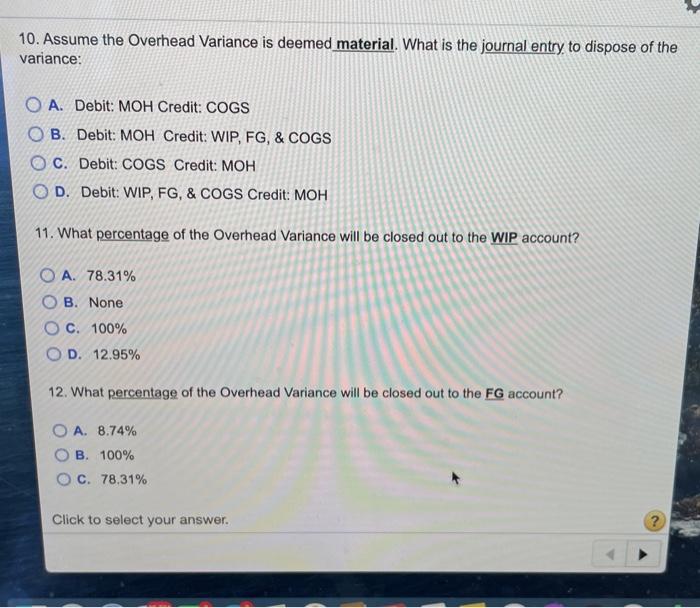

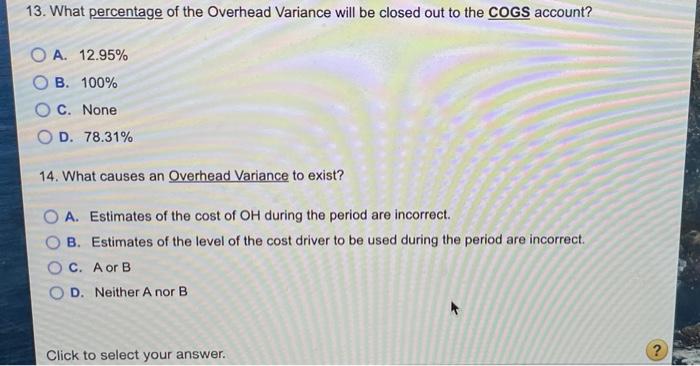

Jacked Up Jerseys Inc. prints customized jerseys for all sports. The company allows you to choose the jersey of your favorite player and customize the names on the back of the jersey. The firm currently uses machine hours to assign overhead to their products. Find the information regarding the firm's beginning and ending balances for the period below: Beginning Balances Ending Balances Raw Materials $134.946 $??? Work In Process $160,641 $170,869 Finished Goods $75,478 $115,344 Additionally, the firm had the following information: Direct Materials Purchased Prime Cost Direct Labor Hours Used Rate per Direct Labor Hour Estimated OH Cost Actual OH Cost Estimated Machine Hours Actual Machine Hours $171,077 $416,892 22,585 Hours $12.26 $903,854 $977,563 12,097 Machine Hours 8,923 Machine Hours 1. Calculate the materials used in production during the period. ? Click to select your answer. 1. Calculate the materials used in production during the period. O A. $306,023 B. $171,077 O C. $139,999.9 OD. $36,131 2. Calculate the ending balance in the Raw Materials account O A. $166,023.1 O B. $103,868.9 O C. $446,022.9 OD. $-110,869 3. Calculate the firm's pre-determined overhead rate (PDOH). O A. $80.81/mach.hr. B. $109.56/mach. hr. O c. $74.72/mach, hr. D. $101.29/mach, hr. Click to select your answer. 4. Calculate the total applied overhead for the firm during the period. O A. $977,603.88 OB. $1,225,305.13 O C. $666,726.56 OD. $977,558.57 5. Calculate the cost of Goods Manufactured (COGM) during the period. O A. $1,384,267.88 OB. $1,384,222.57 O C. $1,631,969.13 OD. $1,073,390.56 6. Calculate the cost of Goods Available for Sale (GAFS) during the period. O A. $1,459,700.57 B. $1,707,447.13 O C. $1,459,745.88 OD. $1,148,868.56 Click to select your answer. 7. Calculate the cost of Goods Sold (COGS) during the period. O A. $1,033,524.56 OB. $1,592,103.13 O C. $1,344,401.88 OD. $1,344,356.57 8. Calculate the ABSOLUTE VALUE of the Overhead Variance during the period. O A. $247,742.13 B. $237,127.44 C. $310,836.44 D. $4.43 9. Classify the Overhead Variance identified in #8 above as Over/Underapplied. Overapplied Underapplied Click to select your answer. 10. Assume the Overhead Variance is deemed material. What is the journal entry to dispose of the variance: O A. Debit: MOH Credit: COGS OB. Debit: MOH Credit: WIP, FG, & COGS O C. Debit: COGS Credit: MOH OD. Debit: WIP, FG, & COGS Credit: MOH 11. What percentage of the Overhead Variance will be closed out to the WIP account? O A. 78.31% B. None O C. 100% OD. 12.95% 12. What percentage of the Overhead Variance will be closed out to the FG account? O A. 8.74% B. 100% OC. 78.31% Click to select your answer. ? 13. What percentage of the Overhead Variance will be closed out to the COGS account? O A. 12.95% OB. 100% OC. None D. 78.31% 14. What causes an Overhead Variance to exist? A. Estimates of the cost of OH during the period are incorrect. B. Estimates of the level of the cost driver to be used during the period are incorrect. C. A or B D. Neither A nor B Click to select your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started