SOS need help! Thank you very much in advance!

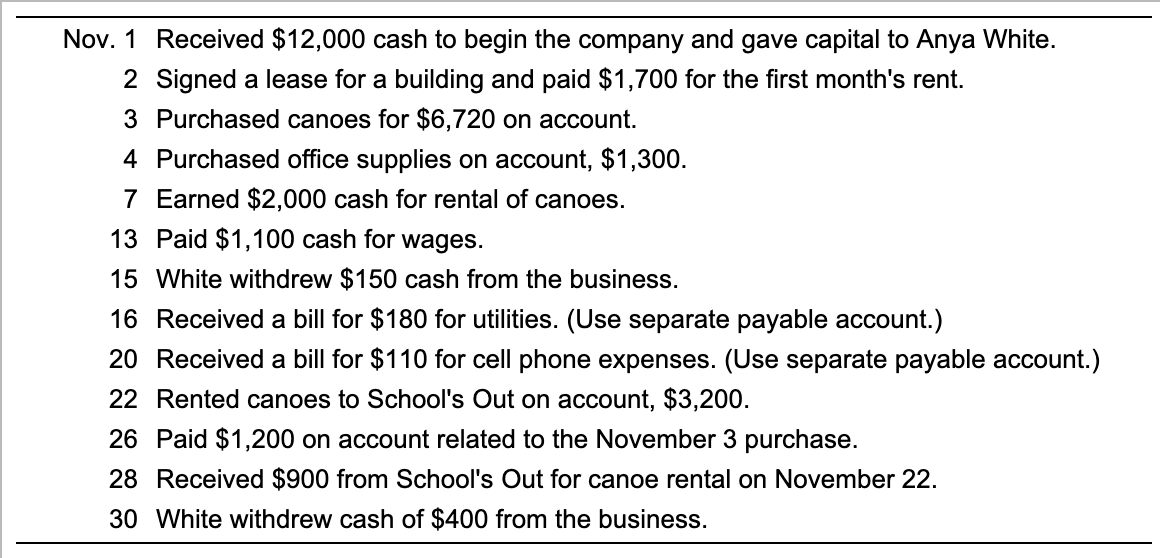

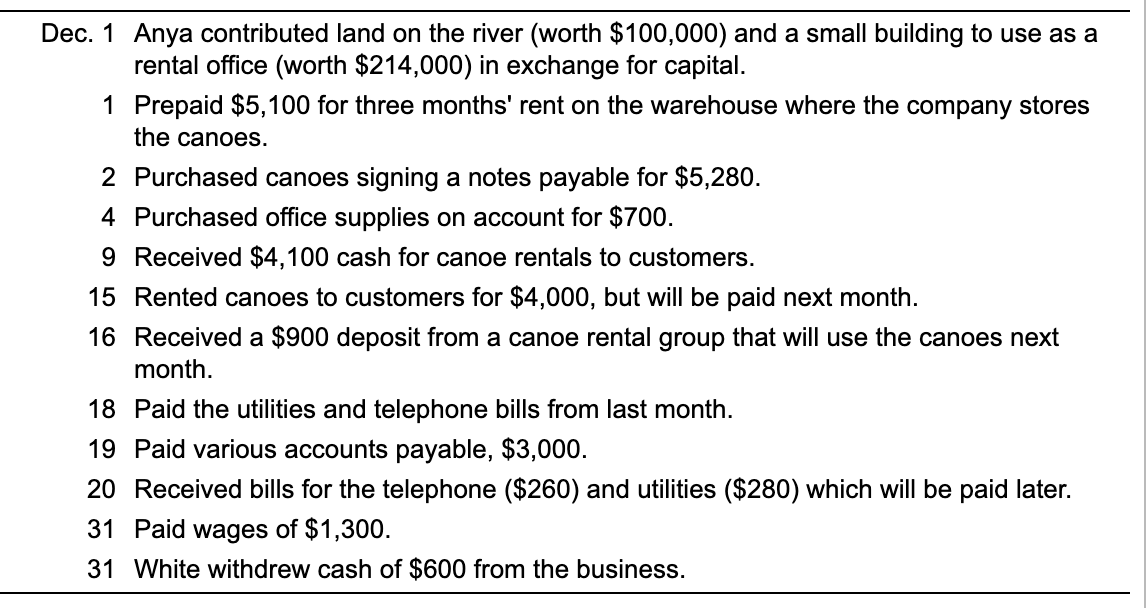

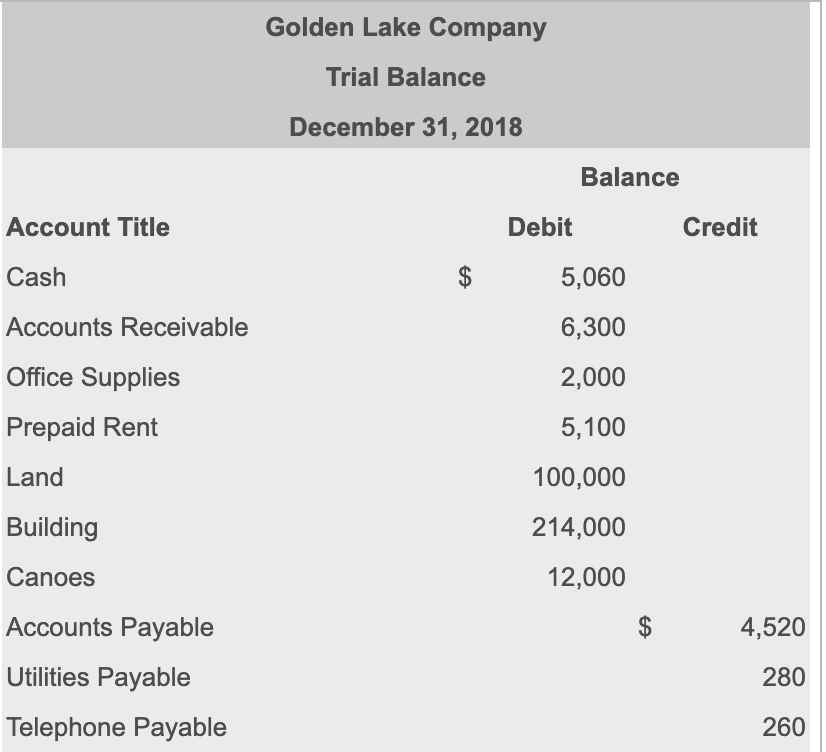

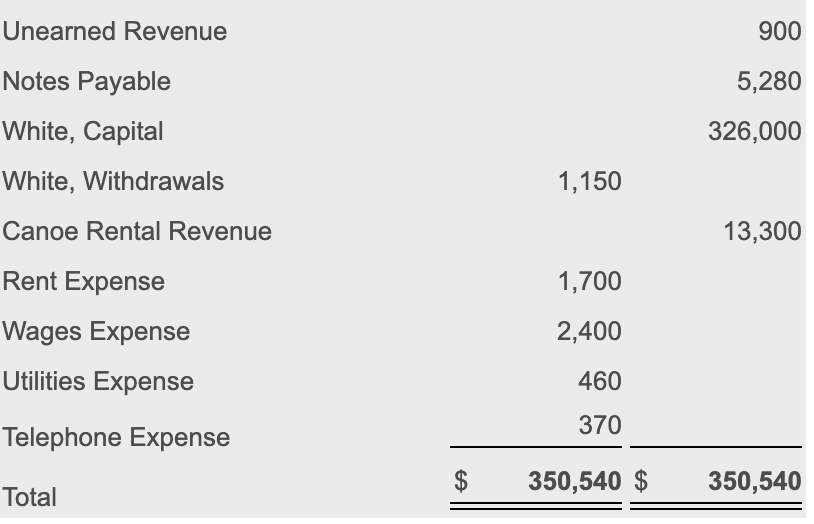

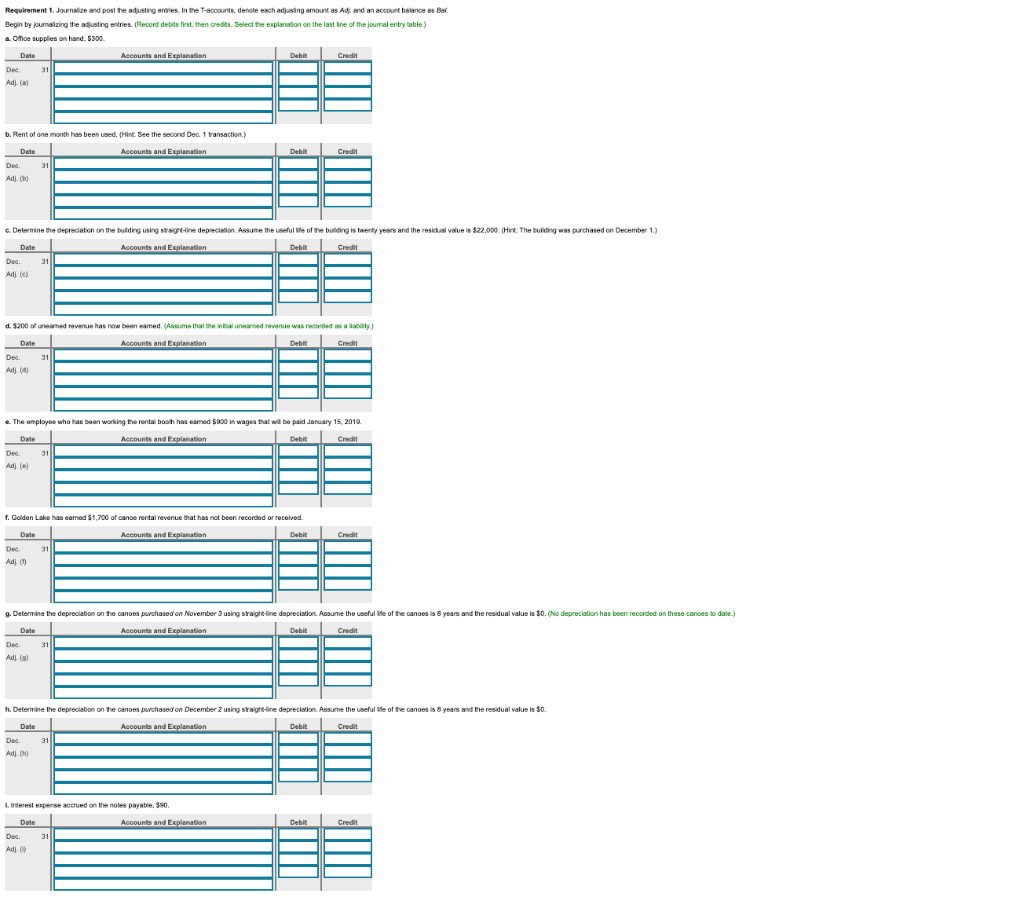

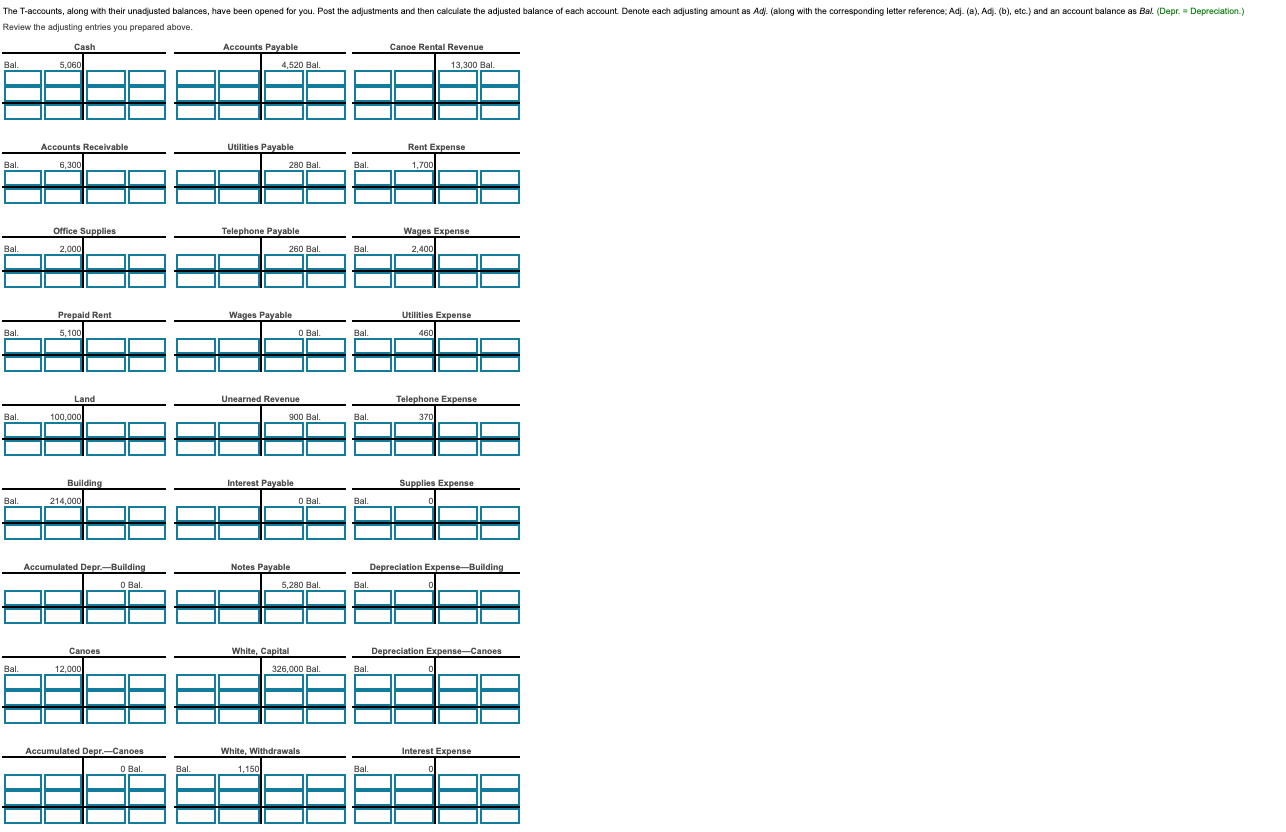

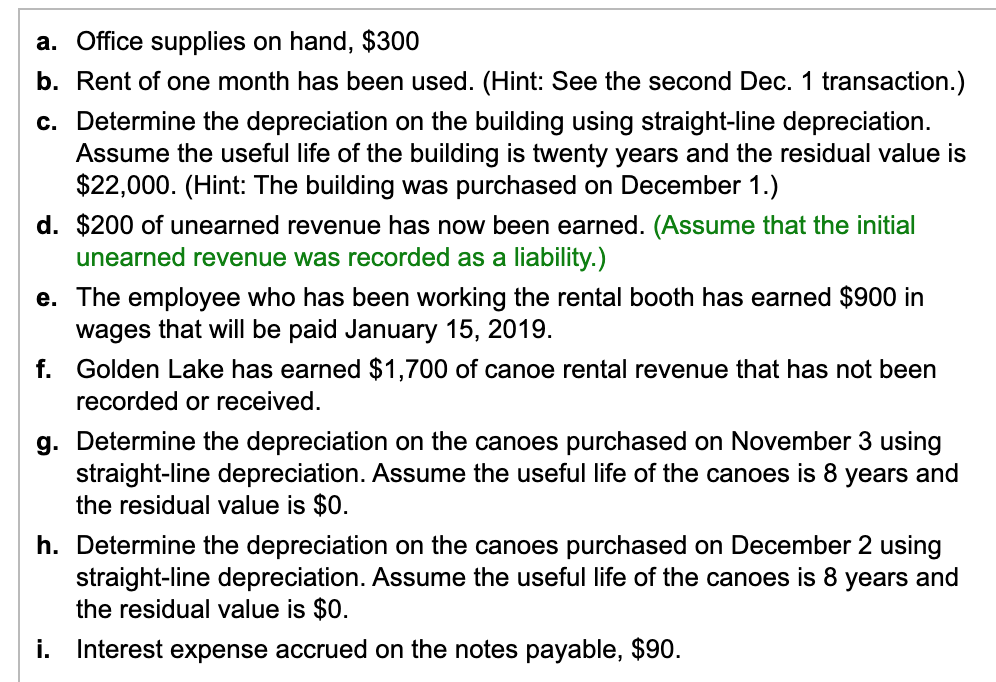

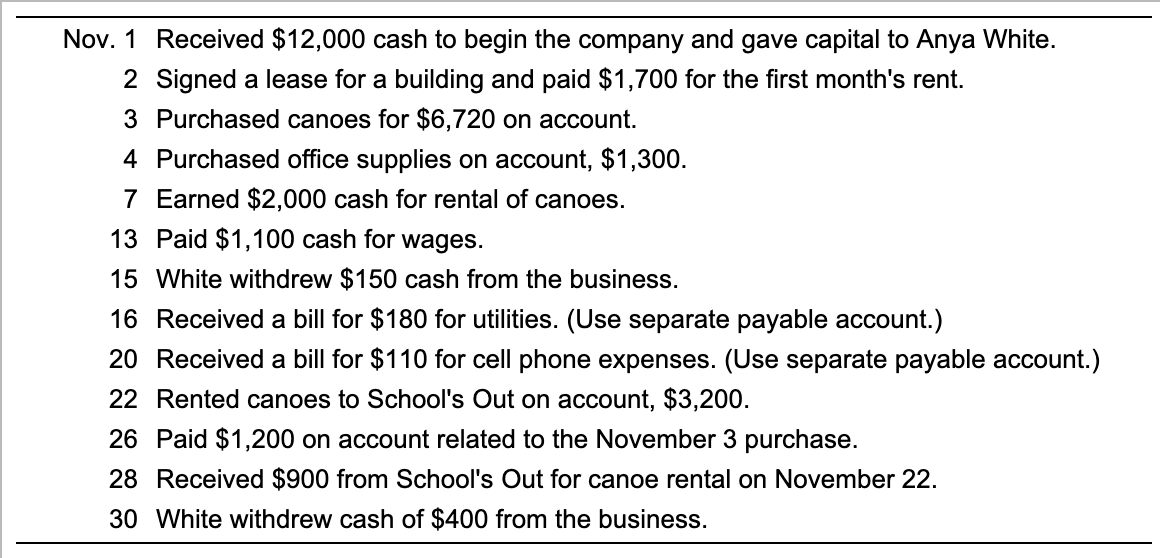

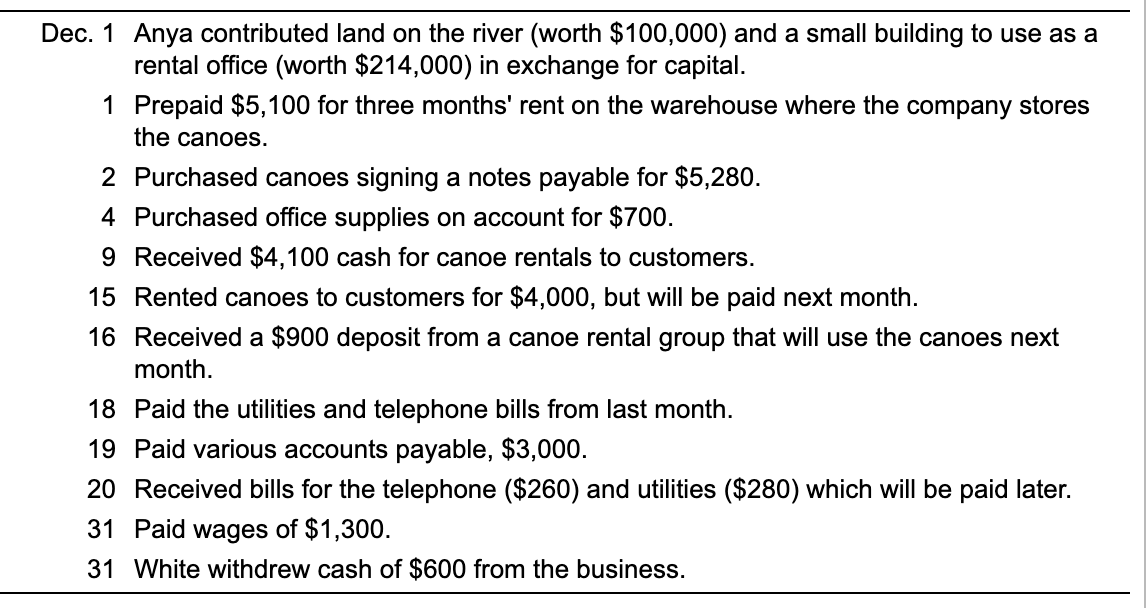

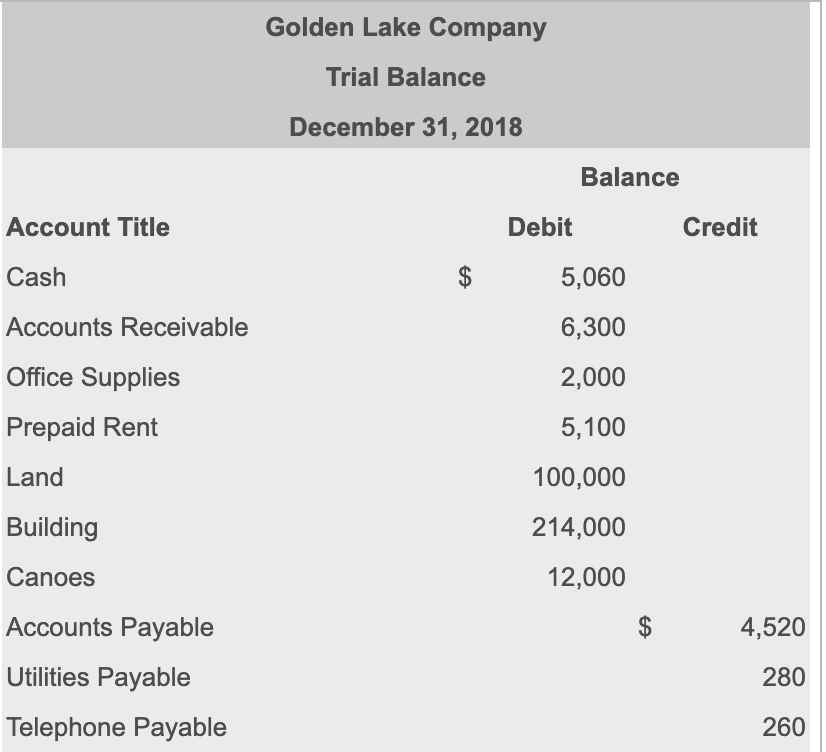

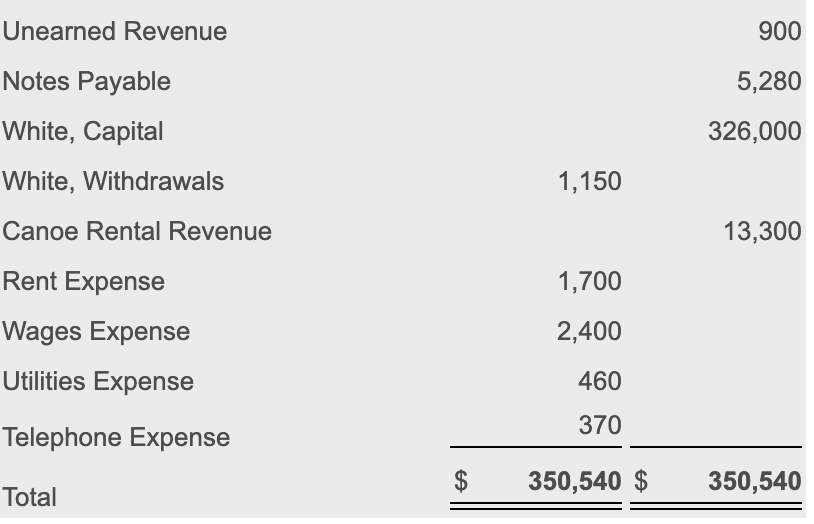

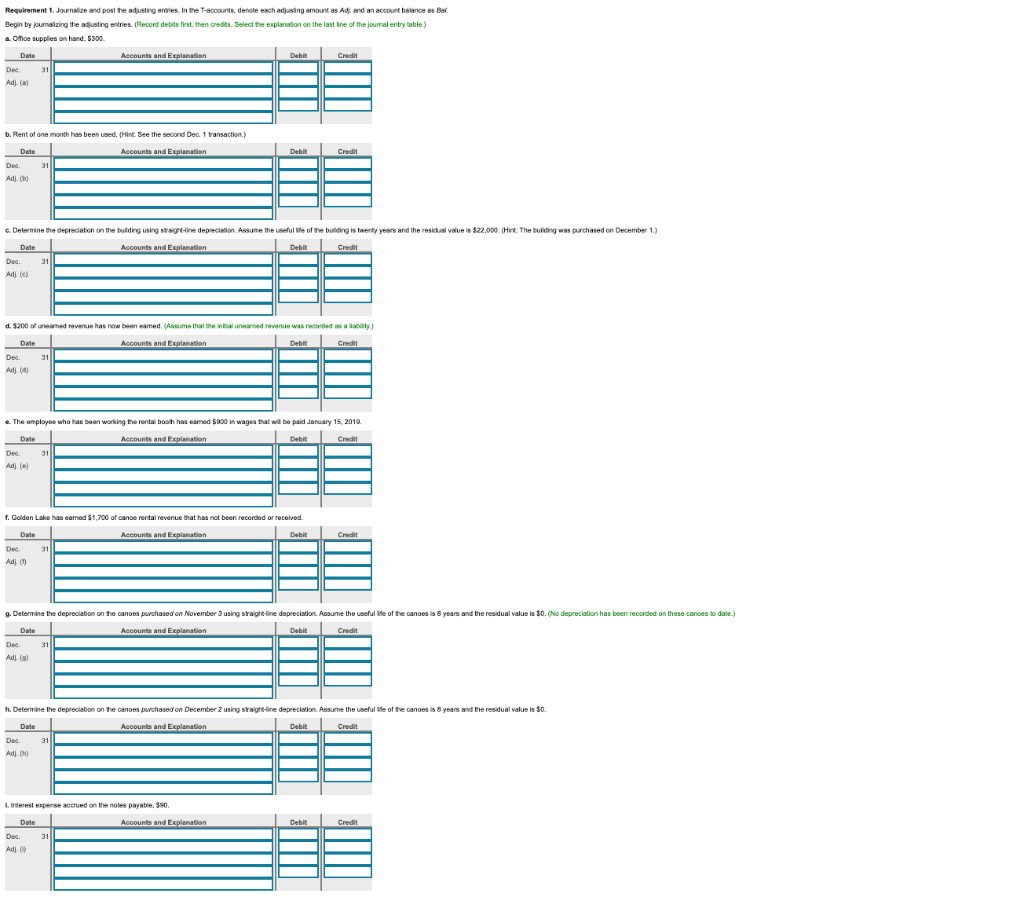

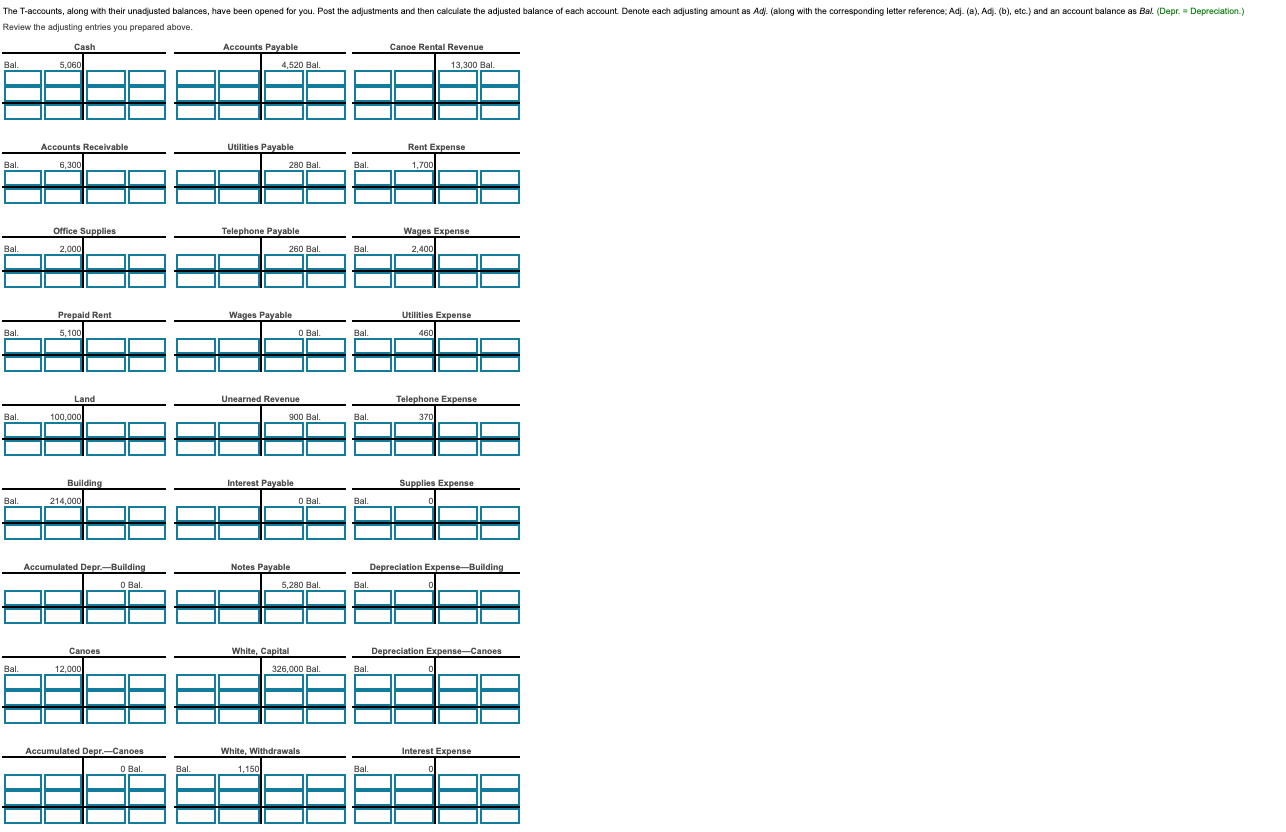

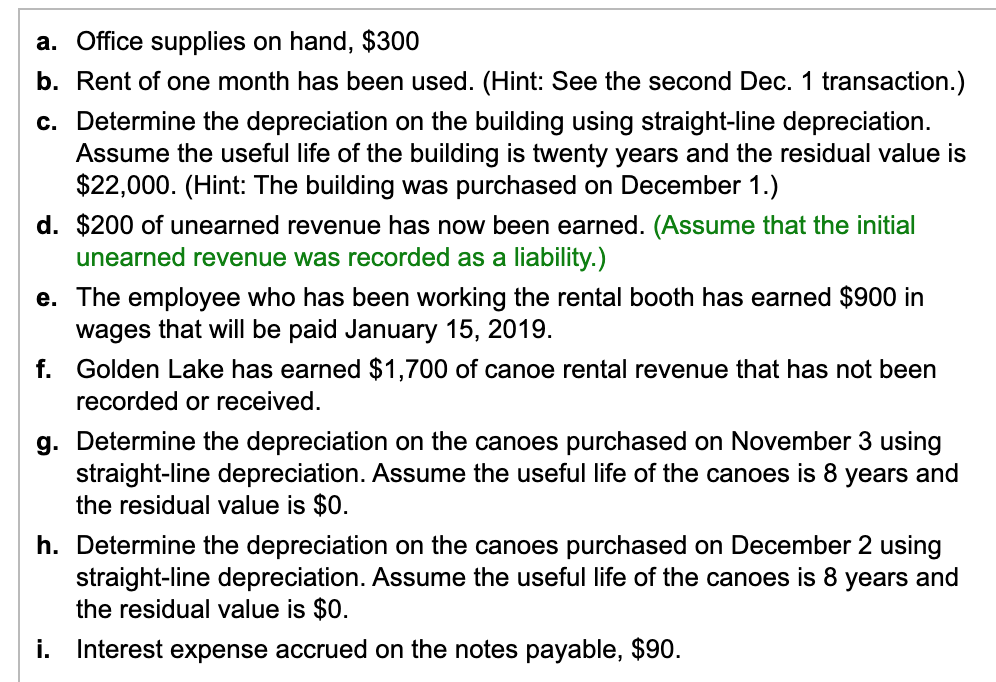

Nov. 1 Received $12,000 cash to begin the company and gave capital to Anya White. 2 Signed a lease for a building and paid $1,700 for the first month's rent. 3 Purchased canoes for $6,720 on account. 4 Purchased office supplies on account, $1,300. 7 Earned $2,000 cash for rental of canoes. 13 Paid $1,100 cash for wages. 15 White withdrew $150 cash from the business. 16 Received a bill for $180 for utilities. (Use separate payable account.) 20 Received a bill for $110 for cell phone expenses. (Use separate payable account.) 22 Rented canoes to School's Out on account, $3,200. 26 Paid $1,200 on account related to the November 3 purchase. 28 Received $900 from School's Out for canoe rental on November 22. 30 White withdrew cash of $400 from the business. Dec. 1 Anya contributed land on the river (worth $100,000) and a small building to use as a rental office (worth $214,000) in exchange for capital. 1 Prepaid $5,100 for three months' rent on the warehouse where the company stores the canoes. 2 Purchased canoes signing a notes payable for $5,280. 4 Purchased office supplies on account for $700. 9 Received $4,100 cash for canoe rentals to customers. 15 Rented canoes to customers for $4,000, but will be paid next month. 16 Received a $900 deposit from a canoe rental group that will use the canoes next month. 18 Paid the utilities and telephone bills from last month. 19 Paid various accounts payable, $3,000. 20 Received bills for the telephone ($260) and utilities ($280) which will be paid later. 31 Paid wages of $1,300. 31 White withdrew cash of $600 from the business. Golden Lake Company Trial Balance December 31, 2018 Balance Account Title Debit Credit Cash $ 5,060 Accounts Receivable 6,300 Office Supplies 2,000 Prepaid Rent 5,100 Land 100,000 Building 214,000 Canoes 12,000 Accounts Payable $ 4,520 Utilities Payable 280 Telephone Payable 260 900 Unearned Revenue Notes Payable 5,280 White, Capital 326,000 White, Withdrawals 1,150 Canoe Rental Revenue 13,300 Rent Expense 1,700 2,400 Wages Expense Utilities Expense 460 370 Telephone Expense $ 350,540 $ 350,540 Total Requirement 1. Journalize and post the adjusting entries. In the T-accounts, denote each adjusting amount as A. and an account balance as Bel. Begin by Jumalizing the adjusting entries. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) a Office supplies on hand $300 Date Accounts and Explanation Debit Credit Dee 31 Ad(a) Debit Credit b. Rent of one month has been used. (Hint See the second Dec 1 transaction.) Date Accounts and Explanation Dec. 31 Adj. (6) c. Determine the depreciation on the building using straight line depreciation. Assume the useful life of the building is twenty years and the residual value is $22,000. (Hint: The building was purchased on December 1.) . $1 Date Accounts and Explanation De Credit Dec. 31 d. 5200 of uneared revenue has now been eamed. Assume that the initial need revenue was recorded as a liability) Date Accounts and Explanation Debit Credit Dec. 31 3 Adj ( The amployee who has been working the rental both has med 5900 in wages that will be paid January 15, 2019 Date Accounts and Explanation Debit Credit 31 Dec Adj. () Credit f. Golden Lake has eamed $1,700 of cance rental revenue that has not been recorded or received. Date Accounts and explanation Debit Dec 31 Ad Date 9. Determine the depreciation on the cances purchased on November 3 using straight line depreciation. Assume the useful life of the cances is 8 years and the residual value is $O. (No depreciation has been recorded on these cances to date.) Accounts and Explanation Debit Credit Dec. Adil 31 h. Determine the depreciation on the cances purchased on December 2 using straight-line depreciation. Assume the useful life of the canoes is 8 years and the residual value is $0. Date Accounts and Explanation Debit Credit Dec 31 Adj Linterest expense served on the roles payable, 590 Date Accounts and Explanation Dec. 31 Adj Debit Credit The T-accounts, along with their unadjusted balances, have been opened for you. Post the adjustments and then calculate the adjusted balance of each account. Denote each adjusting amount as Ad). (along with the corresponding letter reference: Adj. (a), Adj. (b), etc.) and an account balance as Bal (Depr. - Depreciation.) Review the adjusting entries you prepared above. Cash 5,060 Accounts Payable 4,520 Bal. Canoe Rental Revenue 13,300 Bal. Bal Rent Expense Accounts Receivable 6.3001 Utilities Payable 280 Bai Bal Bal. . 1,700 Office Supplies Telephone Payable Wages Expense 2,4001 Bal. 2.000 260 Bal. Bal. Prepaid Rent Wages Payable Utilities Expense Bal. 5,100 O Bal Bal. 460 Land Unearned Revenue Telephone Expense Bal. 100,000 900 Bal. Bal. 3701 Building Interest Payable Supplies Expense Bal. 214,000 O Bal Bal. Accumulated Depr.-Building Depreciation Expense-Building Notes Payable 5.280 Bal. O Bal Bal. Canoes White, Capital 326,000 Bal. Depreciation Expense-Canoes Bal. Bal. 12.000/ Accumulated Depr.-Canoes Interest Expense White, Withdrawals , 1,150 0 Bal. . Bal. Bal. Requirement 2. Prepare an adjusted trial balance as of December 31, 2018 Review the ending balances of the T-accounts that you prepared above. Golden Lake Company Adjusted Trial Balance December 31, 2018 Balance Account Title Debit Credit Total a. Office supplies on hand, $300 b. Rent of one month has been used. (Hint: See the second Dec. 1 transaction.) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is twenty years and the residual value is $22,000. (Hint: The building was purchased on December 1.) d. $200 of unearned revenue has now been earned. (Assume that the initial unearned revenue was recorded as a liability.) e. The employee who has been working the rental booth has earned $900 in wages that will be paid January 15, 2019. f. Golden Lake has earned $1,700 of canoe rental revenue that has not been recorded or received. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is 8 years and the residual value is $0. h. Determine the depreciation on the canoes purchased on December 2 using straight-line depreciation. Assume the useful life of the canoes is 8 years and the residual value is $0. i. Interest expense accrued on the notes payable, $90