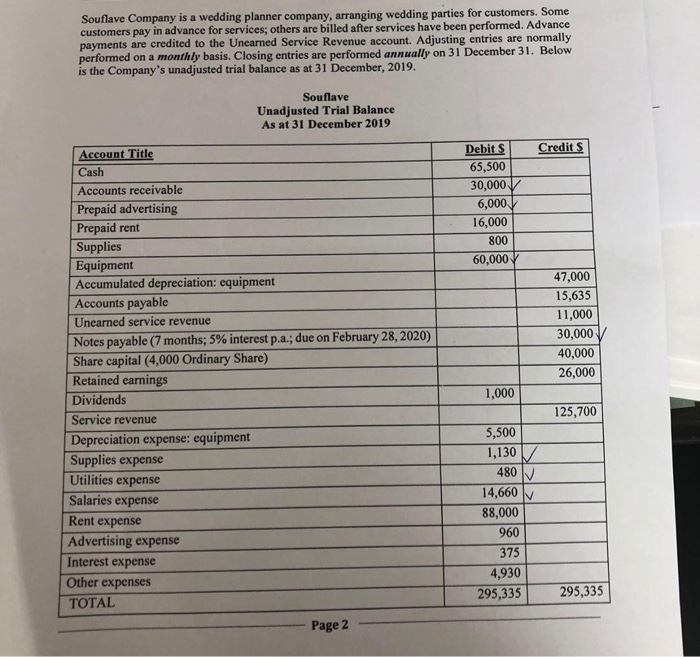

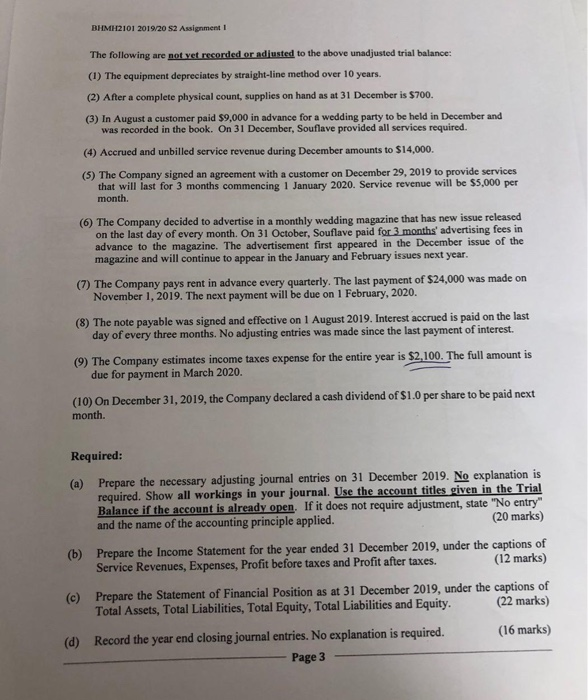

Souflave Company is a wedding planner company, arranging wedding parties for customers. Some customers pay in advance for services; others are billed after services have been performed. Advance payments are credited to the Unearned Service Revenue account. Adjusting entries are normally performed on a monthly basis. Closing entries are performed annually on 31 December 31. Below is the Company's unadjusted trial balance as at 31 December, 2019. Souflave Unadjusted Trial Balance As at 31 December 2019 Credits Debits 65,500 30,000 6,000 16,000 800 60,000 47,000 15,635 11,000 30,000 40,000 26,000 Account Title Cash Accounts receivable Prepaid advertising Prepaid rent Supplies Equipment Accumulated depreciation: equipment Accounts payable Unearned service revenue Notes payable (7 months; 5% interest p.a.; due on February 28, 2020) Share capital (4,000 Ordinary Share) Retained earnings Dividends Service revenue Depreciation expense: equipment Supplies expense Utilities expense Salaries expense Rent expense Advertising expense Interest expense Other expenses TOTAL Page 2 1,000 125,700 5,500 1,130/ 480 V 14,660 88,000 960 375 4,930 295,335 295,335 BHMH2101 2019/20 S2 Assignment 1 The following are not yet recorded or adjusted to the above unadjusted trial balance: (1) The equipment depreciates by straight-line method over 10 years. (2) After a complete physical count, supplies on hand as at 31 December is $700. (3) In August a customer paid $9,000 in advance for a wedding party to be held in December and was recorded in the book. On 31 December, Souflave provided all services required. (4) Accrued and unbilled service revenue during December amounts to $14,000. (5) The Company signed an agreement with a customer on December 29, 2019 to provide services that will last for 3 months commencing 1 January 2020. Service revenue will be $5,000 per month. (6) The Company decided to advertise in a monthly wedding magazine that has new issue released on the last day of every month. On 31 October, Souflave paid for 3 months' advertising fees in advance to the magazine. The advertisement first appeared in the December issue of the magazine and will continue to appear in the January and February issues next year. (7) The Company pays rent in advance every quarterly. The last payment of $24,000 was made on November 1, 2019. The next payment will be due on 1 February, 2020. (8) The note payable was signed and effective on 1 August 2019. Interest accrued is paid on the last day of every three months. No adjusting entries was made since the last payment of interest. (9) The Company estimates income taxes expense for the entire year is $2,100. The full amount is due for payment in March 2020. (10) On December 31, 2019, the Company declared a cash dividend of $1.0 per share to be paid next month. Required: (a) Prepare the necessary adjusting journal entries on 31 December 2019. No explanation is required. Show all workings in your journal. Use the account titles given in the Trial Balance if the account is already open. If it does not require adjustment, state "No entry" and the name of the accounting principle applied. (20 marks) (b) Prepare the Income Statement for the year ended 31 December 2019, under the captions of Service Revenues, Expenses, Profit before taxes and Profit after taxes. (12 marks) (e) Prepare the Statement of Financial Position as at 31 December 2019, under the captions of Total Assets, Total Liabilities, Total Equity, Total Liabilities and Equity. (22 marks) (d) Record the year end closing journal entries. No explanation is required. (16 marks) Page 3