Sound Sleepers operates 3 divisions that each manufacture a unique bed

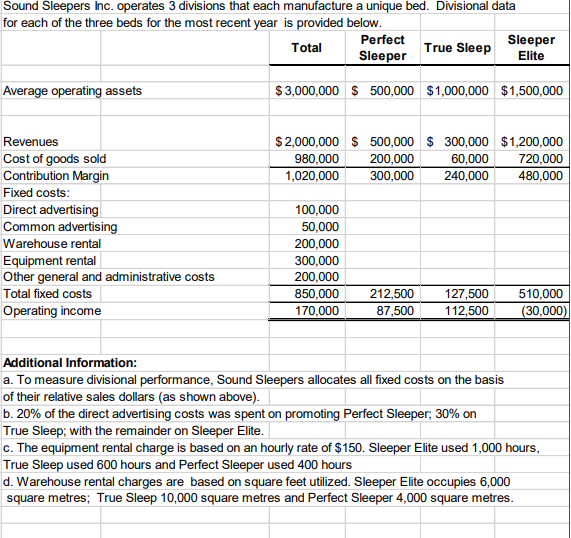

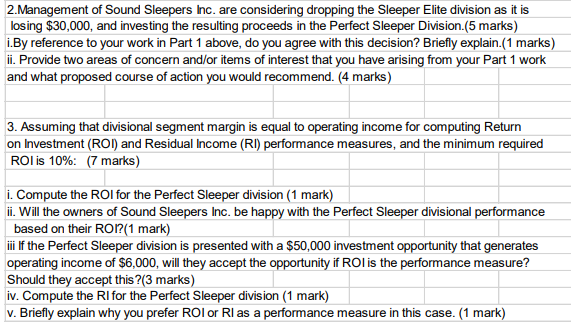

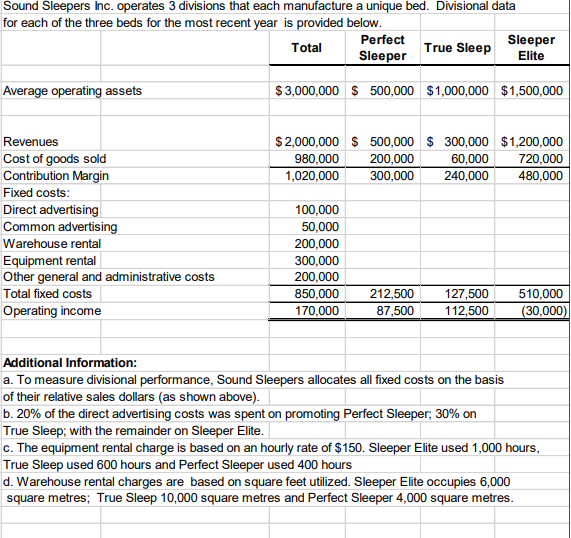

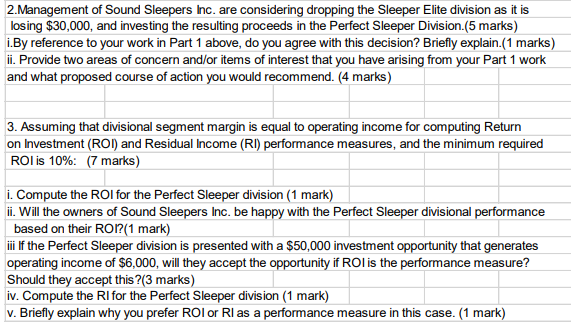

Sound Sleepers Inc. operates 3 divisions that each manufacture a unique bed. Divisional data for each of the three beds for the most recent year is provided below. Total Perfect True Sleep Sleeper Sleeper Elite Average operating assets $3,000,000 $ 500,000 $1,000,000 $1,500,000 $ 2,000,000 $ 500,000 980,000 200,000 1,020,000 300,000 $ 300,000 $1,200,000 60,000 720,000 240,000 480,000 Revenues Cost of goods sold Contribution Margin Fixed costs: Direct advertising Common advertising Warehouse rental Equipment rental Other general and administrative costs Total fixed costs Operating income 100,000 50,000 200,000 300,000 200,000 850,000 170,000 212,500 87,500 127,500 112,500 510,000 (30,000) Additional Information: a. To measure divisional performance, Sound Sleepers allocates all fixed costs on the basis of their relative sales dollars (as shown above). b. 20% of the direct advertising costs was spent on promoting Perfect Sleeper, 30% on True Sleep; with the remainder on Sleeper Elite. c. The equipment rental charge is based on an hourly rate of $150. Sleeper Elite used 1,000 hours, True Sleep used 600 hours and Perfect Sleeper used 400 hours d. Warehouse rental charges are based on square feet utilized. Sleeper Elite occupies 6,000 square metres; True Sleep 10,000 square metres and Perfect Sleeper 4,000 square metres. 2. Management of Sound Sleepers Inc. are considering dropping the Sleeper Elite division as it is losing $30,000, and investing the resulting proceeds in the Perfect Sleeper Division(5 marks) i.By reference to your work in Part 1 above, do you agree with this decision? Briefly explain.(1 marks) ii. Provide two areas of concern and/or items of interest that you have arising from your Part 1 work and what proposed course of action you would recommend. (4 marks) 3. Assuming that divisional segment margin is equal to operating income for computing Return on Investment (ROI) and Residual Income (RI) performance measures, and the minimum required ROI is 10%: (7 marks) i. Compute the ROI for the Perfect Sleeper division (1 mark) ii. Will the owners of Sound Sleepers Inc. be happy with the Perfect Sleeper divisional performance based on their ROI?(1 mark) iii If the Perfect Sleeper division is presented with a $50,000 investment opportunity that generates operating income of $6,000, will they accept the opportunity if ROI is the performance measure? Should they accept this ?(3 marks) iv. Compute the RI for the Perfect Sleeper division (1 mark) v. Briefly explain why you prefer ROI or RI as a performance measure in this case. (1 mark)