Answered step by step

Verified Expert Solution

Question

1 Approved Answer

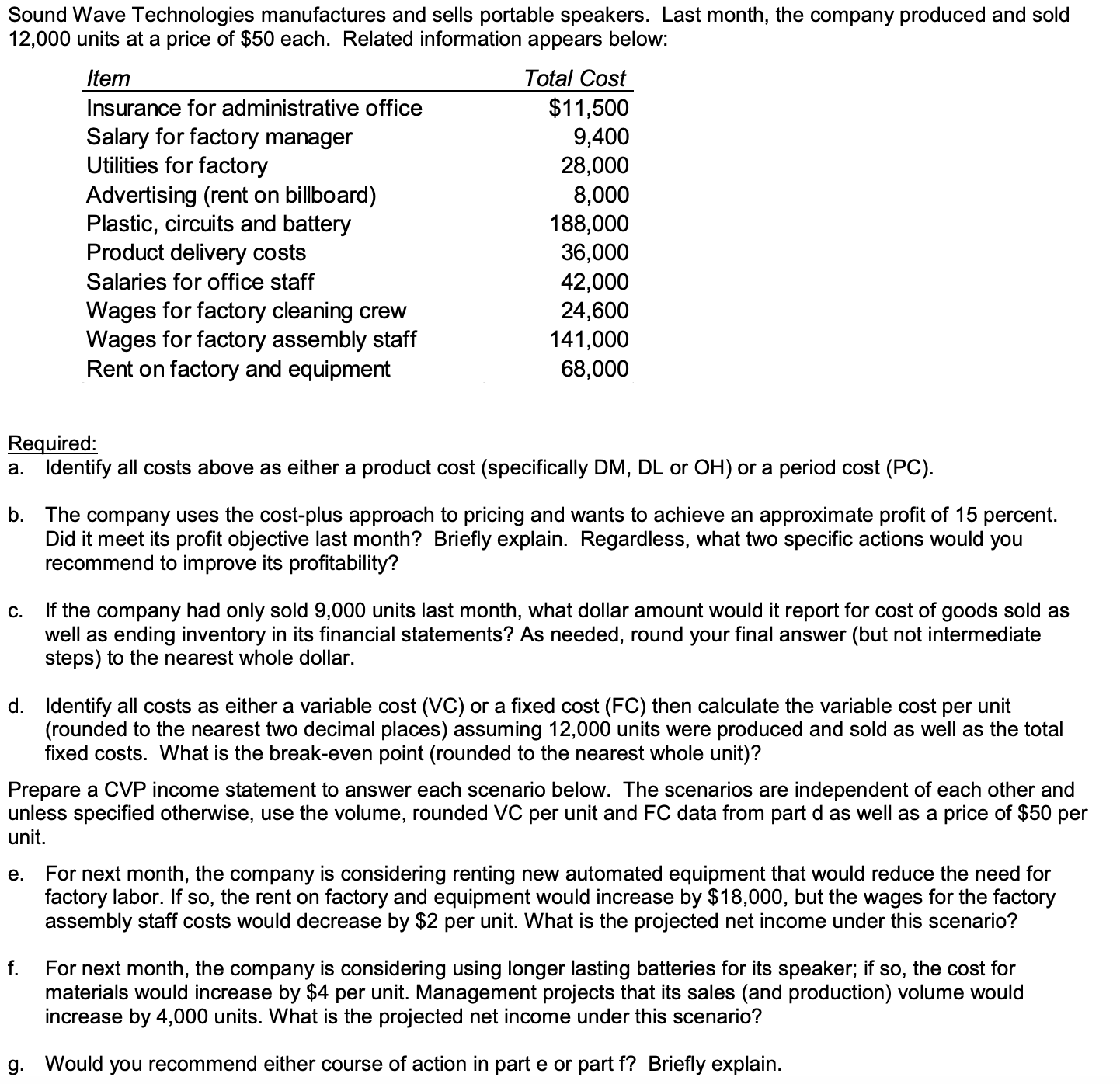

Sound Wave Technologies manufactures and sells portable speakers. Last month, the company produced and sold 1 2 , 0 0 0 units at a price

Sound Wave Technologies manufactures and sells portable speakers. Last month, the company produced and sold

units at a price of $ each. Related information appears below:

Required:

a Identify all costs above as either a product cost specifically DM DL or OH or a period cost PC

b The company uses the costplus approach to pricing and wants to achieve an approximate profit of percent.

Did it meet its profit objective last month? Briefly explain. Regardless, what two specific actions would you

recommend to improve its profitability?

c If the company had only sold units last month, what dollar amount would it report for cost of goods sold as

well as ending inventory in its financial statements? As needed, round your final answer but not intermediate

steps to the nearest whole dollar.

d Identify all costs as either a variable cost VC or a fixed cost FC then calculate the variable cost per unit

rounded to the nearest two decimal places assuming units were produced and sold as well as the total

fixed costs. What is the breakeven point rounded to the nearest whole unit

Prepare a CVP income statement to answer each scenario below. The scenarios are independent of each other and

unless specified otherwise, use the volume, rounded VC per unit and FC data from part d as well as a price of $ per

unit.

e For next month, the company is considering renting new automated equipment that would reduce the need for

factory labor. If so the rent on factory and equipment would increase by $ but the wages for the factory

assembly staff costs would decrease by $ per unit. What is the projected net income under this scenario?

f For next month, the company is considering using longer lasting batteries for its speaker; if so the cost for

materials would increase by $ per unit. Management projects that its sales and production volume would

increase by units. What is the projected net income under this scenario?

g Would you recommend either course of action in part e or part f Briefly explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started