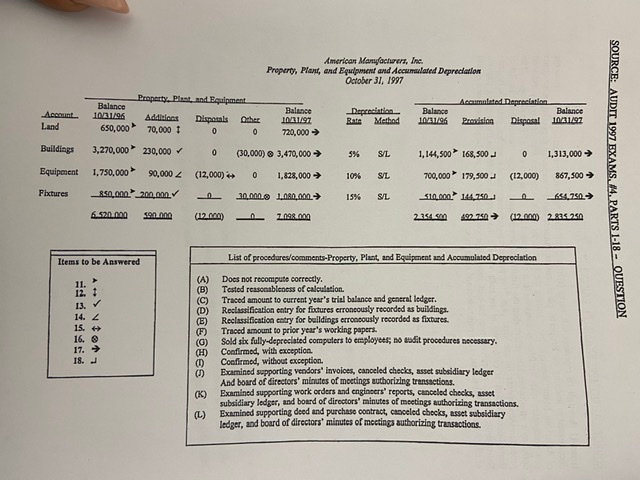

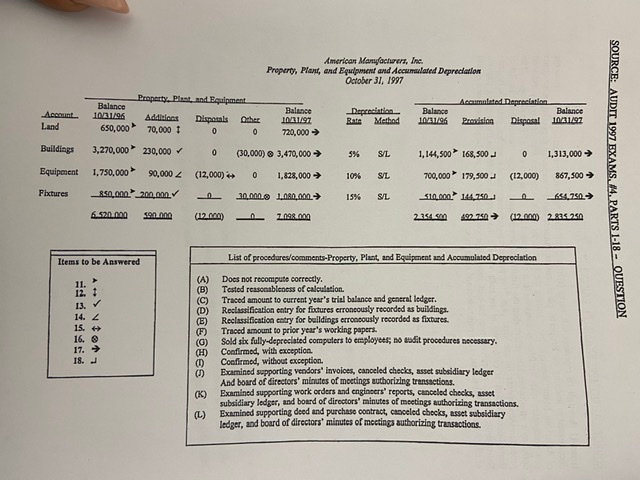

SOURCE: AUDIT 1997 EXAMS, #4, PARTS 1-18-QUESTION Items 11 through 18 represent tick marks (symbols) that indicate procedures performed or comments documented in auditing the Property, plant, and equipment and Accumulated depreciation accounts of American Manufacturers, Inc. During the year under audit, American Manufacturers purchased new computers directly from wholesalers and constructed an addition to one of its buildings. The company's employees also refurbished the fixtures of several older buildings. Select, from the list of procedures/comments on the next page, the procedure/comment that the auditor most likely per- formed/documented at each point of the audit where a tick mark was made on the working papers. Select only one procedure/comment for each item. A procedure/comment may be selected once or not at all. Assume that the working papers foot and cross foot. American Manfacturers, Ine. Preperty, Plant, and Equlpment and Accumalated Depreciation October 31, 1997 Property Plant and Equipment Accumnlated Depreciation Balance 10/31/96 Balance 1/97 Balance 10/31/96 Balance 10/31/97 Depcociation Account Additioes Disposals Orher Rate Method Prodslon Dispasal Land 650,000 70,000 720,000 0 0 3,270,000 230,000 Buildings 0 (30,000) 3,470,000 1,144,500 168,500 1,313,000 S/L 5% 0 1,750,000 Equipment 90,000 (12,000) 700,000 179,500 1,828,000 867,500 0 SL (12,000) 10% Fixtures 850,000-200000 30,000. 1080,000 10.000 144,250 64,250 15% SL 6.520.000 on 000 7.098.000 2.354 500 2.35 250 (12.000) 492 750 (12 000) List of procedares/comments-Property, Plant, and Equipment and Accumulated Depreciation Items to be Answered (A) (B) (C) (D) Docs not recompute correctly. Testod reasonsbleness of calculation. 11. 12. Traced amount to current year's trial balance and general ledger. Reclassification entry for fixtures erroneously recorded as buildings. 13. 14. Reclassification eotry for bulldings erroncously recorded as fixbures (E) 15. Traced amount to prior year's working papers (F) Sold six fully-depreciated computers to employees; no andit procedures necessary Confirmed, with exception Coafirmed, without exception. Examined supporting vendors' invoices, canceled checks, asset subsidiary ledger And board of directors' minutes of metings authorizing treanssctions. Examined supporting work orders and cngineers' reports, canceled checks, asset 16. 17. 18. J (K) subsidiary ledger, and board of directors' minutes of meetings authorizing transactions Examined supporting deed and purchase contract, canceled checks, asset subsidiary (L) ledger, and board of directors' minutes of mectings authorizing transactions. SOURCE: AUDIT 1997 EXAMS, 4, PARTS 1-18-QUESIONI SOURCE: AUDIT 1997 EXAMS, #4, PARTS 1-18-QUESTION Items 11 through 18 represent tick marks (symbols) that indicate procedures performed or comments documented in auditing the Property, plant, and equipment and Accumulated depreciation accounts of American Manufacturers, Inc. During the year under audit, American Manufacturers purchased new computers directly from wholesalers and constructed an addition to one of its buildings. The company's employees also refurbished the fixtures of several older buildings. Select, from the list of procedures/comments on the next page, the procedure/comment that the auditor most likely per- formed/documented at each point of the audit where a tick mark was made on the working papers. Select only one procedure/comment for each item. A procedure/comment may be selected once or not at all. Assume that the working papers foot and cross foot. American Manfacturers, Ine. Preperty, Plant, and Equlpment and Accumalated Depreciation October 31, 1997 Property Plant and Equipment Accumnlated Depreciation Balance 10/31/96 Balance 1/97 Balance 10/31/96 Balance 10/31/97 Depcociation Account Additioes Disposals Orher Rate Method Prodslon Dispasal Land 650,000 70,000 720,000 0 0 3,270,000 230,000 Buildings 0 (30,000) 3,470,000 1,144,500 168,500 1,313,000 S/L 5% 0 1,750,000 Equipment 90,000 (12,000) 700,000 179,500 1,828,000 867,500 0 SL (12,000) 10% Fixtures 850,000-200000 30,000. 1080,000 10.000 144,250 64,250 15% SL 6.520.000 on 000 7.098.000 2.354 500 2.35 250 (12.000) 492 750 (12 000) List of procedares/comments-Property, Plant, and Equipment and Accumulated Depreciation Items to be Answered (A) (B) (C) (D) Docs not recompute correctly. Testod reasonsbleness of calculation. 11. 12. Traced amount to current year's trial balance and general ledger. Reclassification entry for fixtures erroneously recorded as buildings. 13. 14. Reclassification eotry for bulldings erroncously recorded as fixbures (E) 15. Traced amount to prior year's working papers (F) Sold six fully-depreciated computers to employees; no andit procedures necessary Confirmed, with exception Coafirmed, without exception. Examined supporting vendors' invoices, canceled checks, asset subsidiary ledger And board of directors' minutes of metings authorizing treanssctions. Examined supporting work orders and cngineers' reports, canceled checks, asset 16. 17. 18. J (K) subsidiary ledger, and board of directors' minutes of meetings authorizing transactions Examined supporting deed and purchase contract, canceled checks, asset subsidiary (L) ledger, and board of directors' minutes of mectings authorizing transactions. SOURCE: AUDIT 1997 EXAMS, 4, PARTS 1-18-QUESIONI