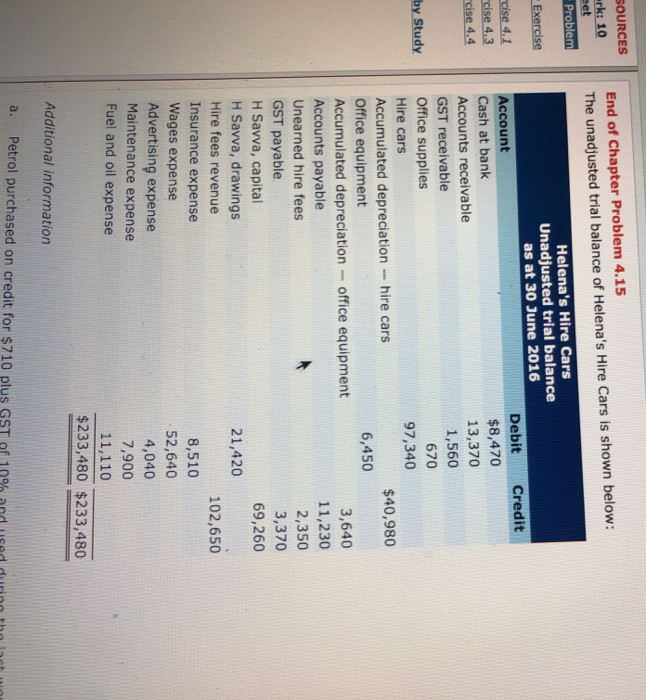

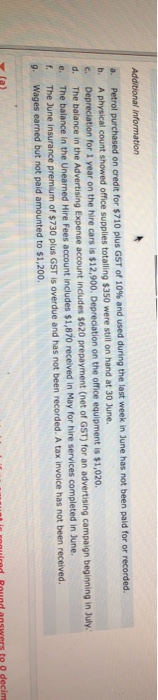

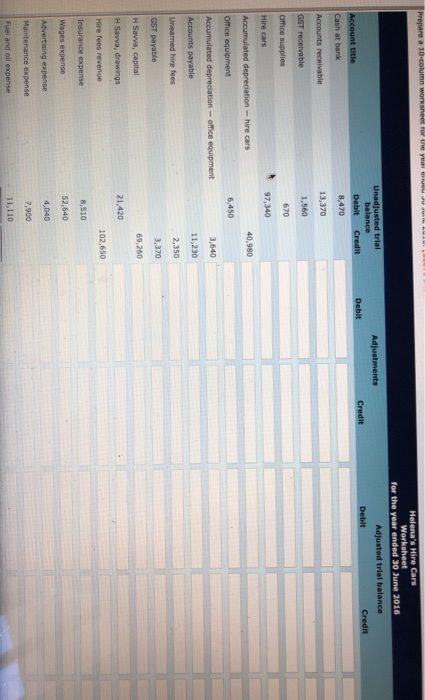

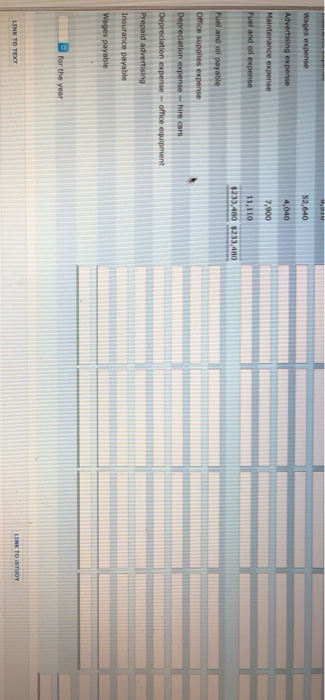

SOURCES End of Chapter Problem 4.15 rk: 10 eet The unadjusted trial balance of Helena's Hire Cars is shown below: Problem Helena's Hire Cars Unadjusted trial balance as at 30 June 2016 Exercise Debit Credit cise 4.1 Account $8,470 13,370 1,560 cise 4.3 Cash at bank cise 4.4 Accounts receiva ble GST receivable 670 by Study Office supplies 97,340 Hire cars hire cars $40,980 Accumulated depreciation Office equipment Accumulated depreciation- office equipment Accounts payable 6,450 3,640 11,230 Unearned hire fees 2,350 GST payable 3,370 H Savva, capital 69,260 H Savva, drawings 21,420 Hire fees revenue 102,650 Insurance expense 8,510 Wages expense 52,640 Advertising expense Maintenance expense 4,040 7,900 Fuel and oil expense 11,110 $233,480 $233,480 Additional information a. Petrol purchased on credit for $710 plus GST of 10 Additional information a Petrol purchased on credit for $710 plus GST of 10 % and used during the last week in June has not been paid for or recorded. A physical count showed office supplies totalling $350 were still on hand at 30 June. Depreciation for 1 year on the hire cars is $12,900. Depreciation on the office equipment is $1,020. The balance in the Advertising Expense account includes $620 prepayment (net of GST) for an advertising campaign beginning in July. The balance in the Unearned Hire Fees account includes $1,870 received in May for hire services completed in June. The June insurance premium of $730 plus GST is overdue and has not been recorded. A tax invoice has not been received. C d. e. f Wages earned but not paid amounted to $1,200 to 0 decim Prepare a 10-column worksheel for Ue yeal en Ju JUILLUI0 L Helena's Hire Cars Worksheet for the year ended 30 June 2016 Unadjusted trial balance Adjustments Adjusted trial balance Account title Debit Credit Debit Credit Debit Credit Cash at bank 8,470 Accounts receivable 13,370 GST receivable 1,560 Office supplies 670 Hire cars 97,340 Accumulated depreciation-hire cars 40,980 Office equipment 6,450 Accumulated depreciation- office equipment 3,640 Accounts payable 11,230 Unearned hire fees 2,350 GST payable 3,370 H Savva, capital 69,260 H Savva, drawings 21,420 Hire fees revenue 102,650 Insurance expenses 8,510 Wages expense 52,640 Advertising expense 4,040 Maintenance expense 7,900 Fuel and oil expense 11,110 Wages expense 52,640 Advertising expenser 4,040 Maintenance expense 7,900 Fuel and oil expense 11,110 $233,480 $233,480 Fuel and oil payable Office supplies expense Depreciation expense-hire cars Depreciation expense-office equipment Prepaid advertising Insurance payable Wages payable for the year LUNK TO ISTUDY LINK TO TEXT