Answered step by step

Verified Expert Solution

Question

1 Approved Answer

South African Home Loans is a mortgage finance company and insurance provider in South Africa. It was founded in February 1 9 9 9 and

South African Home Loans is a mortgage finance company and insurance provider in South Africa. It was founded in February and is headquartered in uMhlanga, South Africa, near Durban. Its services cover origination and credit approval through registration and ongoing loan servicing.

SA Home Loans is an independent, nonbank home loan provider that has pioneered a more diverse financial infrastructure in South Africa SA

From a modest startup operation opening for business in SA Home Loans Pty Ltd SAHL has flourished amid powerfully entrenched competition and global financial turmoil. It has become SA's th most significant and largest nonbank home loan provider. After over years, it is solidly established with a solid and recognizable local brand. It has serviced a sizable mortgage portfolio that originated over R billion approx US $ billion and enabled home ownership to more than clients since inception.

As a nonbank home loan provider, SAHL pioneered new techniques for raising funding from the South African markets to fund its loan portfolios securitization

As a specialist home loan provider, its operations cover the full spectrum of home financing, from its sales force for origination and inhouse credit structures to ongoing client and loan servicing and related insurance products. The South African Home Loans works closely with uMhlanga brokers based in uMhlanga near Durban.

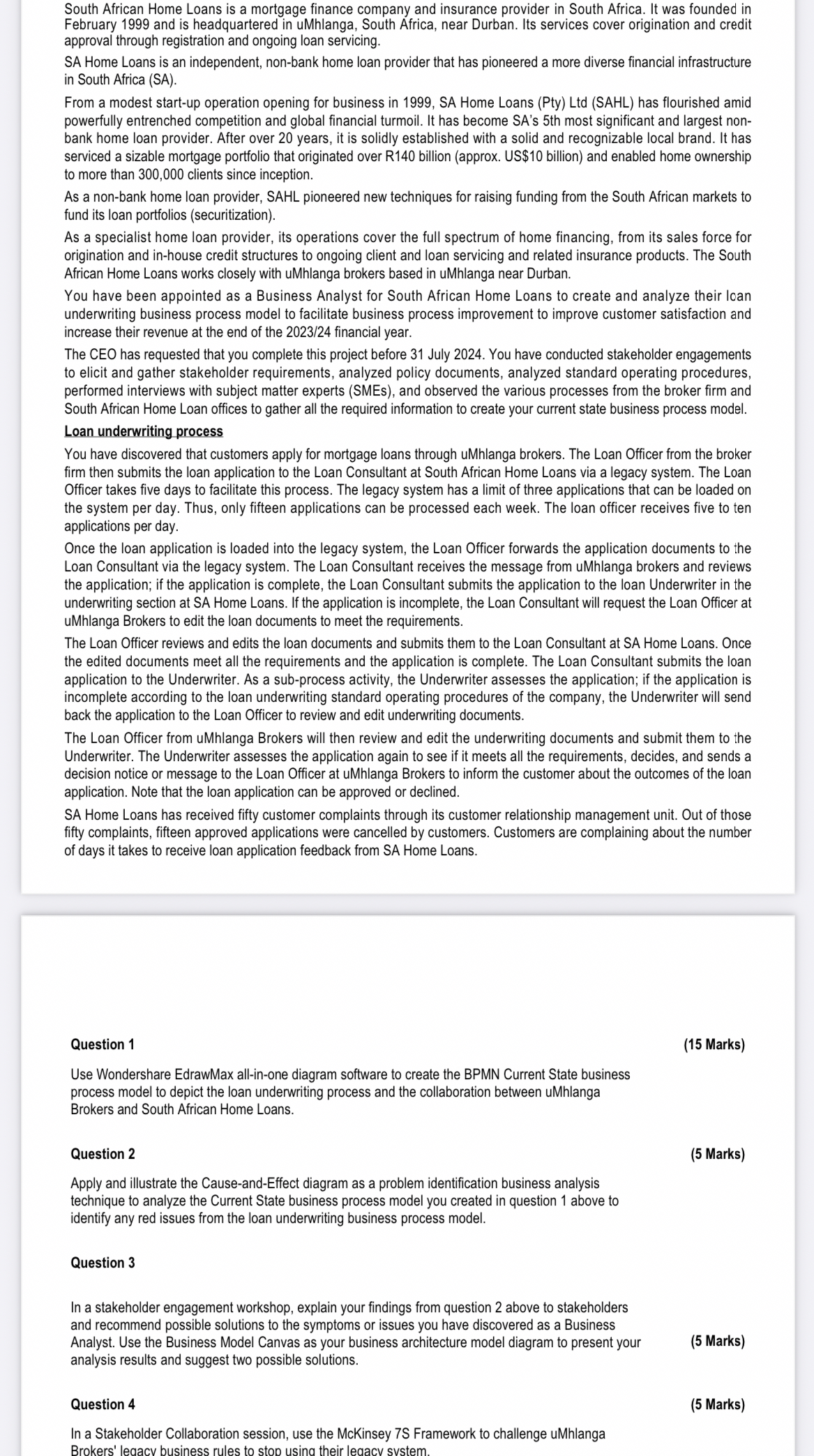

You have been appointed as a Business Analyst for South African Home Loans to create and analyze their Ioan underwriting business process model to facilitate business process improvement to improve customer satisfaction and increase their revenue at the end of the financial year.

The CEO has requested that you complete this project before July You have conducted stakeholder engagements to elicit and gather stakeholder requirements, analyzed policy documents, analyzed standard operating procedures, performed interviews with subject matter experts SMEs and observed the various processes from the broker firm and South African Home Loan offices to gather all the required information to create your current state business process model.

Loan underwriting process

You have discovered that customers apply for mortgage loans through uMhlanga brokers. The Loan Officer from the broker firm then submits the loan application to the Loan Consultant at South African Home Loans via a legacy system. The Loan Officer takes five days to facilitate this process. The legacy system has a limit of three applications that can be loaded on the system per day. Thus, only fifteen applications can be processed each week. The loan officer receives five to ten applications per day.

Once the loan application is loaded into the legacy system, the Loan Officer forwards the application documents to the Loan Consultant via the legacy system. The Loan Consultant receives the message from uMhlanga brokers and reviews the application; if the application is complete, the Loan Consultant submits the application to the loan Underwriter in the underwriting section at SA Home Loans. If the application is incomplete, the Loan Consultant will request the Loan Officer at uMhlanga Brokers to edit the loan documents to meet the requirements.

The Loan Officer reviews and edits the loan documents and submits them to the Loan Consultant at SA Home Loans. Once the edited documents meet all the requirements and the application is complete. The Loan Consultant submits the loan application to the Underwriter. As a subprocess activity, the Underwriter assesses the application; if the application is incomplete according to the loan underwriting standard operating procedures of the company, the Underwriter will send back the application to the Loan Officer to review and edit underwriting documents.

The Loan Officer from uMhlanga Brokers will then review and edit the underwriting documents and submit them to the Underwriter. The Underwriter assesses the application again to see if it meets all the requirements, decides, and sends a decision notice or message to the Loan Officer at uMhlanga Brokers to inform the customer about the outcomes of the loan application. Note that the loan application can be approved or declined.

SA Home Loans has received fifty customer complaints through its customer relationship management unit. Out of those fifty complaints, fifteen approved applications were cancelled by customers. Customers are complaining about the number of days it takes to receive loan application feedback from SA Home Loans.

Question

Marks

Use Wondershare EdrawMax allinone diagram software to create the BPMN Current State business process model to depict the loan underwriting process and the collaboration between uMhlanga Brokers and South African Home Loans.

Question

Marks

Apply and illustrate the CauseandEffect diagram as a problem identification business analysis technique to an

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started