Answered step by step

Verified Expert Solution

Question

1 Approved Answer

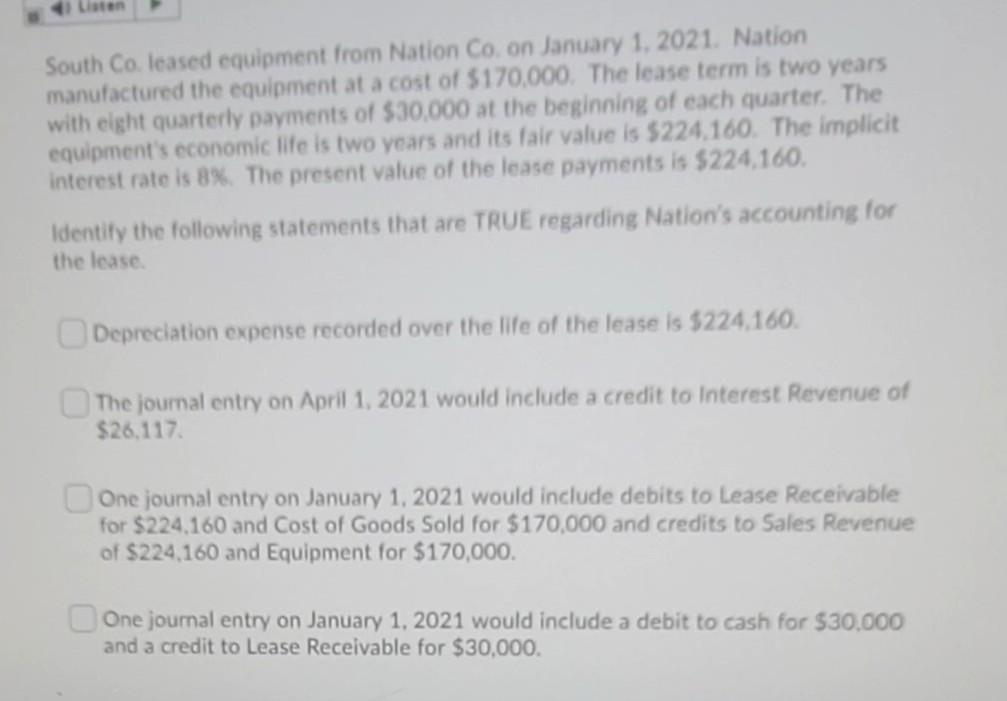

South Co. leased equipment from Nation Co. on January 1, 2021. Nation manufactured the equipment at a cost of $170,000. The lease term is two

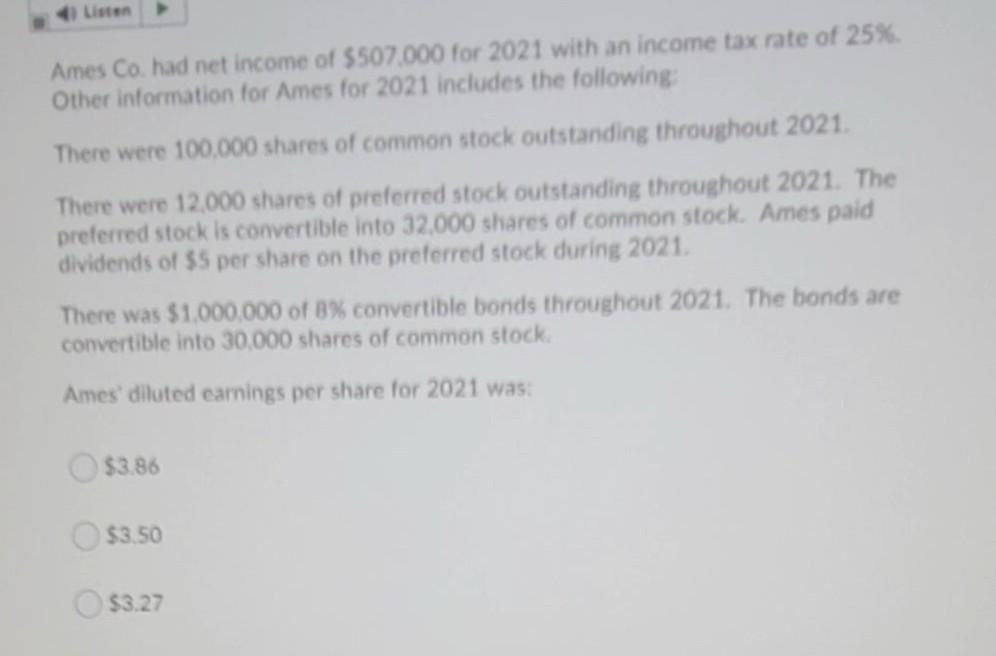

South Co. leased equipment from Nation Co. on January 1, 2021. Nation manufactured the equipment at a cost of $170,000. The lease term is two years with eight quarterly payments of $30.000 at the beginning of each quarter. The equipment's economic life is two years and its fair value is $224.160. The implicit interest rate is 8%. The present value of the lease payments is $224,160, Identify the following statements that are TRUE regarding Nation's accounting for the lease Depreciation expense recorded over the life of the lease Is 5224.160. The journal entry on April 1, 2021 would include a credit to Interest Revenue of $26,117 One journal entry on January 1, 2021 would include debits to Lease Receivable for $224.160 and Cost of Goods Sold for $170,000 and credits to Sales Revenue of $224,160 and Equipment for $170,000. One journal entry on January 1, 2021 would include a debit to cash for $30,000 and a credit to Lease Receivable for $30,000. Listen Ames Co. had net income of $507,000 for 2021 with an income tax rate of 25% Other information for Ames for 2021 includes the following: There were 100,000 shares of common stock outstanding throughout 2021 There were 12.000 shares of preferred stock outstanding throughout 2021. The preferred stock is convertible into 32,000 shares of common stock. Ames paid dividends of $5 per share on the preferred stock during 2021. There was $1,000,000 of 8% convertible bonds throughout 2021. The bonds are convertible into 30,000 shares of common stock. Ames diluted earnings per share for 2021 was: $3.86 $3.50 $3.27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started