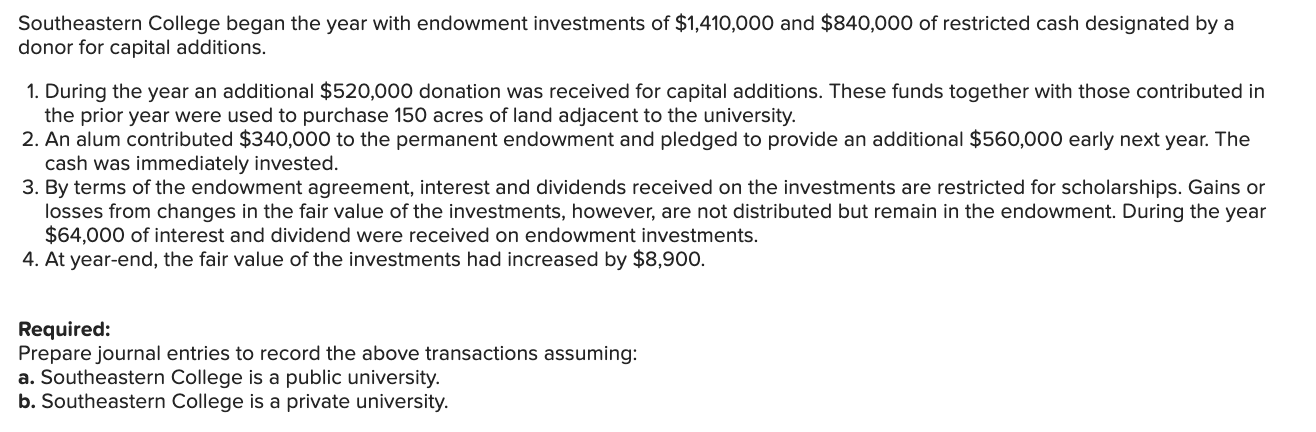

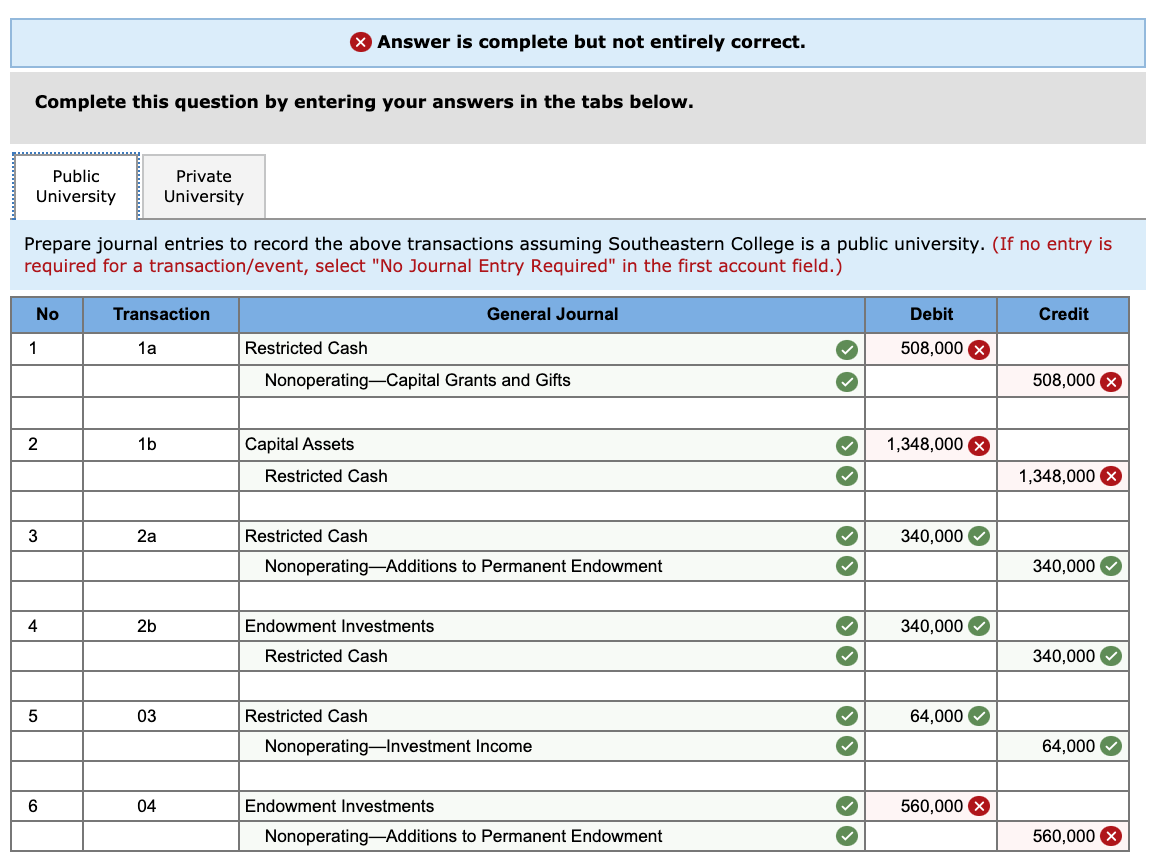

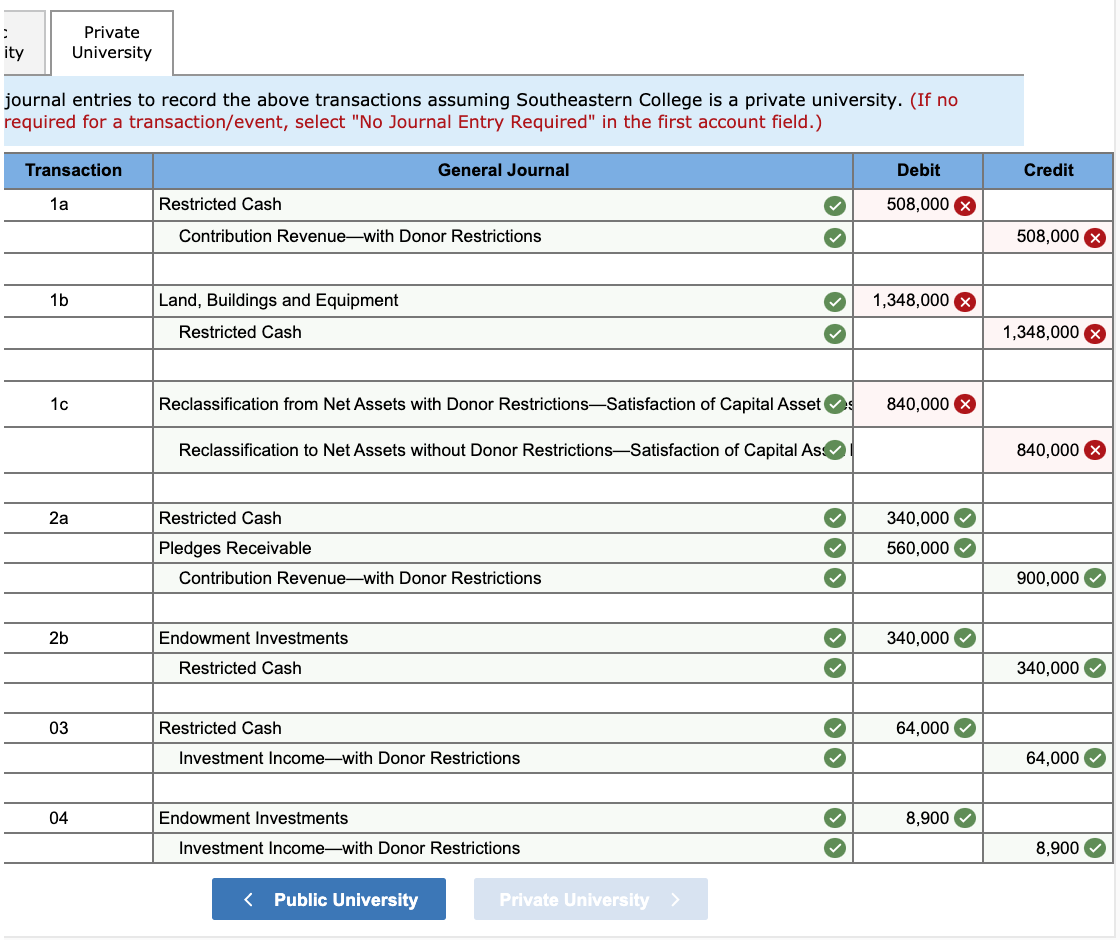

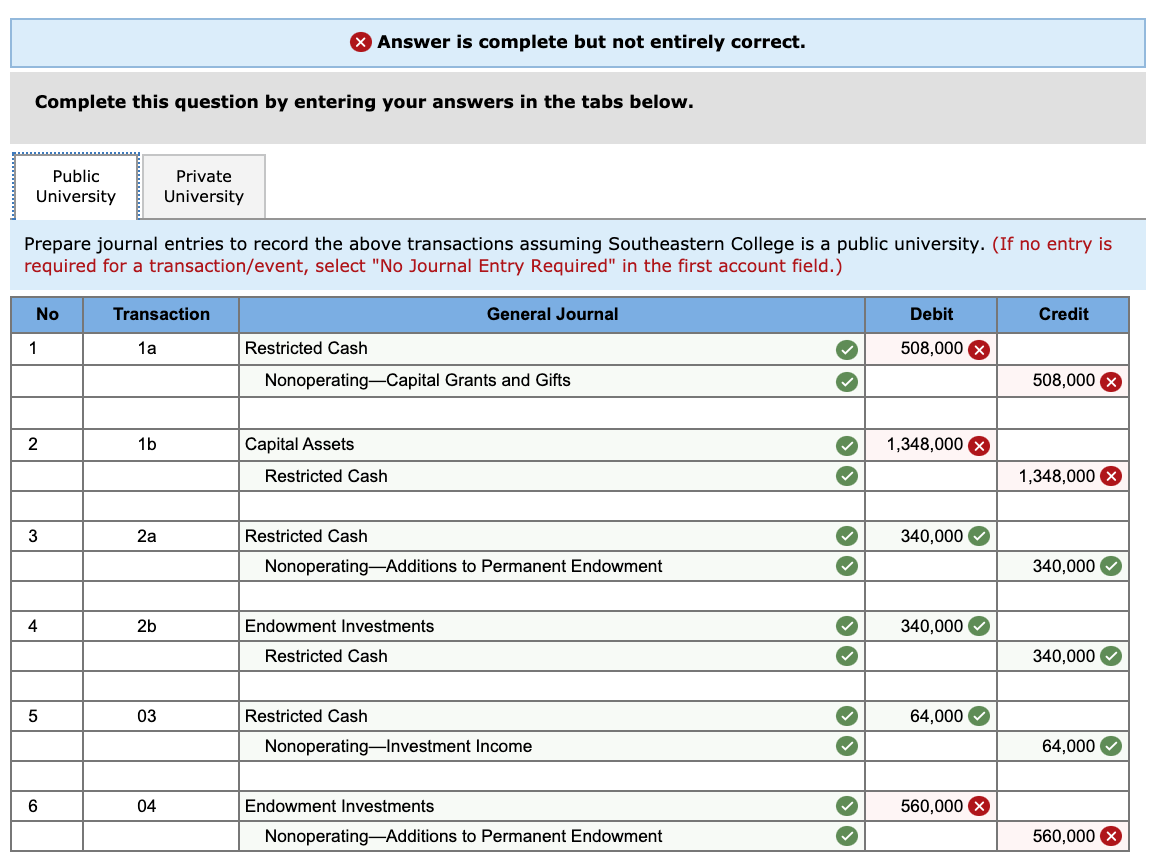

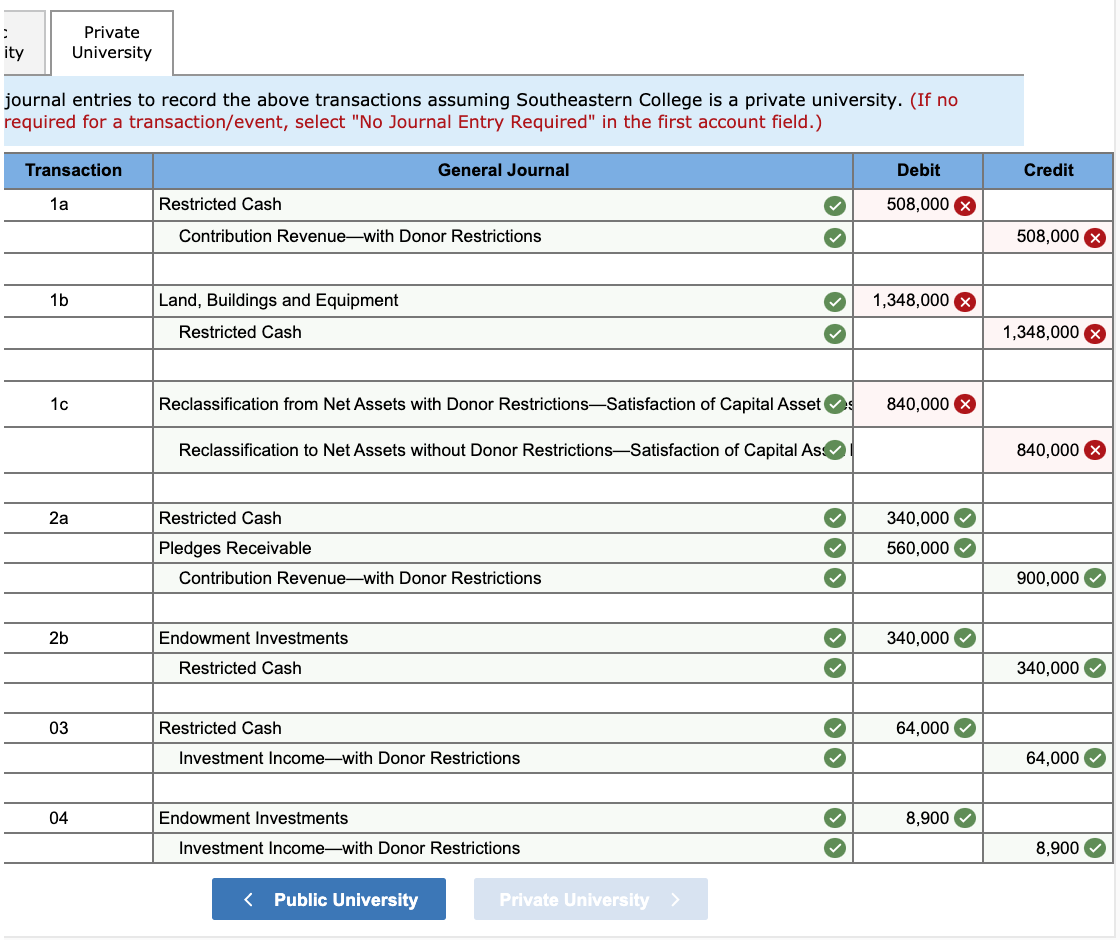

Southeastern College began the year with endowment investments of $1,410,000 and $840,000 of restricted cash designated by a donor for capital additions. 1. During the year an additional $520,000 donation was received for capital additions. These funds together with those contributed in the prior year were used to purchase 150 acres of land adjacent to the university. 2. An alum contributed $340,000 to the permanent endowment and pledged to provide an additional $560,000 early next year. The cash was immediately invested. 3. By terms of the endowment agreement, interest and dividends received on the investments are restricted for scholarships. Gains or losses from changes in the fair value of the investments, however, are not distributed but remain in the endowment. During the year $64,000 of interest and dividend were received on endowment investments. 4. At year-end, the fair value of the investments had increased by $8,900. Required: Prepare journal entries to record the above transactions assuming: a. Southeastern College is a public university. b. Southeastern College is a private university. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Public University Private University Prepare journal entries to record the above transactions assuming Southeastern College is a public university. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) No Transaction General Journal Debit Credit 1 1a Restricted Cash 508,000 Nonoperating-Capital Grants and Gifts 508,000 X 2 1b Capital Assets 1,348,000 X Restricted Cash 1,348,000 X 3 2a Restricted Cash 340,000 Nonoperating-Additions to Permanent Endowment 340,000 4 2b Endowment Investments 340,000 Restricted Cash 340,000 5 03 64,000 Restricted Cash Nonoperating Investment Income OO 64,000 6 04 560,000 X Endowment Investments NonoperatingAdditions to Permanent Endowment OO 560,000 X ity Private University journal entries to record the above transactions assuming Southeastern College is a private university. (If no required for a transaction/event, select "No Journal Entry Required" in the first account field.) Transaction General Journal Debit Credit 1a Restricted Cash 508,000 X Contribution Revenue with Donor Restrictions 508,000 X 1b 1,348,000 X Land, Buildings and Equipment Restricted Cash 1,348,000 X 1c Reclassification from Net Assets with Donor RestrictionsSatisfaction of Capital Asset 840,000 X Reclassification to Net Assets without Donor RestrictionsSatisfaction of Capital Ass 840,000 X 2a Restricted Cash 340,000 560,000 OO Pledges Receivable Contribution Revenue with Donor Restrictions 900,000 2b Endowment Investments 340,000 olol Restricted Cash 340,000 03 Restricted Cash 64,000 Investment Incomewith Donor Restrictions 64,000 04 Endowment Investments 8,900 Investment Incomewith Donor Restrictions 8,900