Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SouthWest Holiday is considering making an offer to acquire NorthEast Holiday Company. The CFO SouthWest has collected the following information: The securities analysts expect the

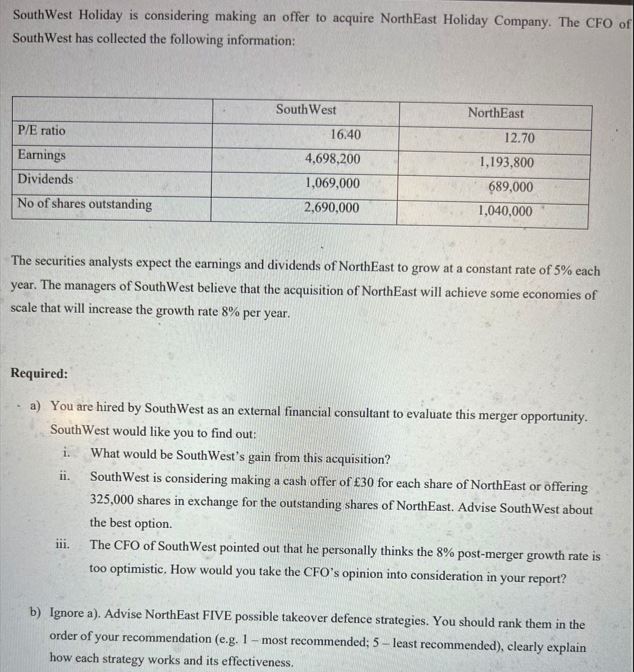

SouthWest Holiday is considering making an offer to acquire NorthEast Holiday Company. The CFO SouthWest has collected the following information: The securities analysts expect the carnings and dividends of NorthEast to grow at a constant rate of 5% each year. The managers of SouthWest believe that the acquisition of NorthEast will achieve some economies of scale that will increase the growth rate 8% per year. Required: a) You are hired by SouthWest as an external financial consultant to evaluate this merger opportunity. SouthWest would like you to find out: i. What would be SouthWest's gain from this acquisition? ii. SouthWest is considering making a cash offer of 30 for each share of NorthEast or offering 325,000 shares in exchange for the outstanding shares of NorthEast. Advise SouthWest about the best option. iii. The CFO of SouthWest pointed out that he personally thinks the 8% post-merger growth rate is too optimistic. How would you take the CFO's opinion into consideration in your report? b) Ignore a). Advise NorthEast FIVE possible takeover defence strategies. You should rank them in the order of your recommendation (e.g. 1 -most recommended; 5-least recommended), clearly explain how each strategy works and its effectiveness

SouthWest Holiday is considering making an offer to acquire NorthEast Holiday Company. The CFO SouthWest has collected the following information: The securities analysts expect the carnings and dividends of NorthEast to grow at a constant rate of 5% each year. The managers of SouthWest believe that the acquisition of NorthEast will achieve some economies of scale that will increase the growth rate 8% per year. Required: a) You are hired by SouthWest as an external financial consultant to evaluate this merger opportunity. SouthWest would like you to find out: i. What would be SouthWest's gain from this acquisition? ii. SouthWest is considering making a cash offer of 30 for each share of NorthEast or offering 325,000 shares in exchange for the outstanding shares of NorthEast. Advise SouthWest about the best option. iii. The CFO of SouthWest pointed out that he personally thinks the 8% post-merger growth rate is too optimistic. How would you take the CFO's opinion into consideration in your report? b) Ignore a). Advise NorthEast FIVE possible takeover defence strategies. You should rank them in the order of your recommendation (e.g. 1 -most recommended; 5-least recommended), clearly explain how each strategy works and its effectiveness Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started