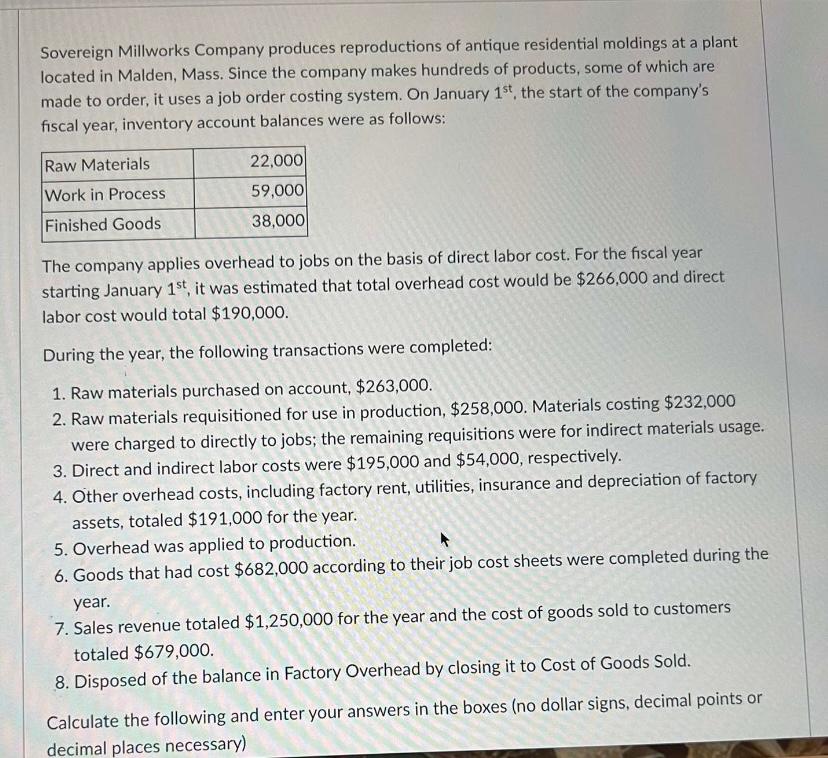

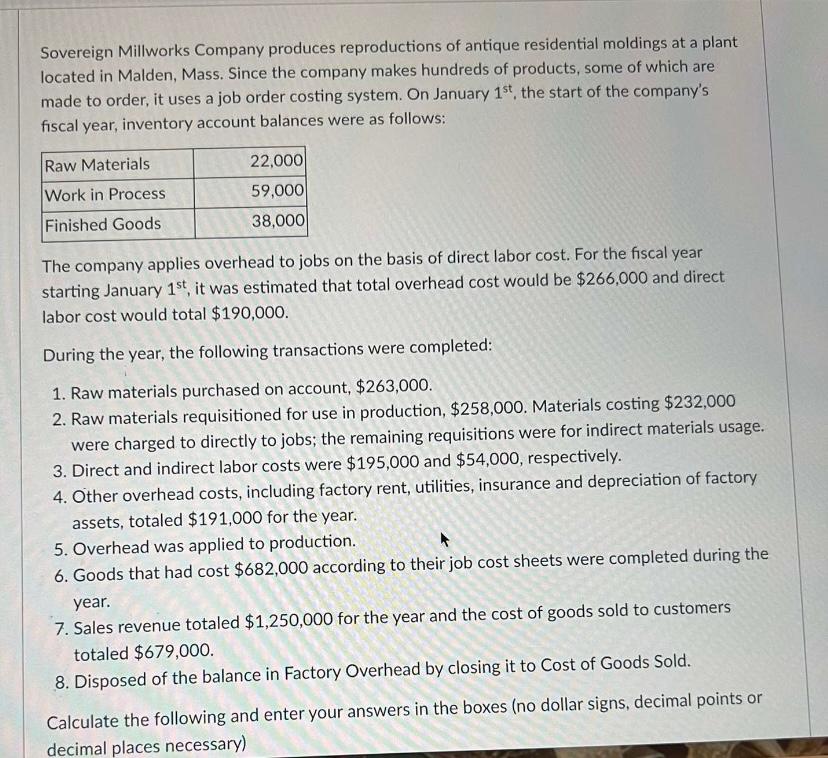

Sovereign Millworks Company produces reproductions of antique residential moldings at a plant located in Malden, Mass. Since the company makes hundreds of products, some of which are made to order, it uses a job order costing system. On January 1st, the start of the company's fiscal year, inventory account balances were as follows: The company applies overhead to jobs on the basis of direct labor cost. For the fiscal year starting January 1st, it was estimated that total overhead cost would be $266,000 and direct labor cost would total $190,000. During the year, the following transactions were completed: 1. Raw materials purchased on account, $263,000. 2. Raw materials requisitioned for use in production, $258,000. Materials costing $232,000 were charged to directly to jobs; the remaining requisitions were for indirect materials usage. 3. Direct and indirect labor costs were $195,000 and $54,000, respectively. 4. Other overhead costs, including factory rent, utilities, insurance and depreciation of factory assets, totaled $191,000 for the year. 5. Overhead was applied to production. 6. Goods that had cost $682,000 according to their job cost sheets were completed during the 7. Sales revenue totaled $1,250,000 for the year and the cost of goods sold to customers year. totaled $679,000. 8. Disposed of the balance in Factory Overhead by closing it to Cost of Goods Sold. Calculate the following and enter your answers in the boxes (no dollar signs, decimal points or decimal places necessary) Sovereign Millworks Company produces reproductions of antique residential moldings at a plant located in Malden, Mass. Since the company makes hundreds of products, some of which are made to order, it uses a job order costing system. On January 1st, the start of the company's fiscal year, inventory account balances were as follows: The company applies overhead to jobs on the basis of direct labor cost. For the fiscal year starting January 1st, it was estimated that total overhead cost would be $266,000 and direct labor cost would total $190,000. During the year, the following transactions were completed: 1. Raw materials purchased on account, $263,000. 2. Raw materials requisitioned for use in production, $258,000. Materials costing $232,000 were charged to directly to jobs; the remaining requisitions were for indirect materials usage. 3. Direct and indirect labor costs were $195,000 and $54,000, respectively. 4. Other overhead costs, including factory rent, utilities, insurance and depreciation of factory assets, totaled $191,000 for the year. 5. Overhead was applied to production. 6. Goods that had cost $682,000 according to their job cost sheets were completed during the 7. Sales revenue totaled $1,250,000 for the year and the cost of goods sold to customers year. totaled $679,000. 8. Disposed of the balance in Factory Overhead by closing it to Cost of Goods Sold. Calculate the following and enter your answers in the boxes (no dollar signs, decimal points or decimal places necessary)