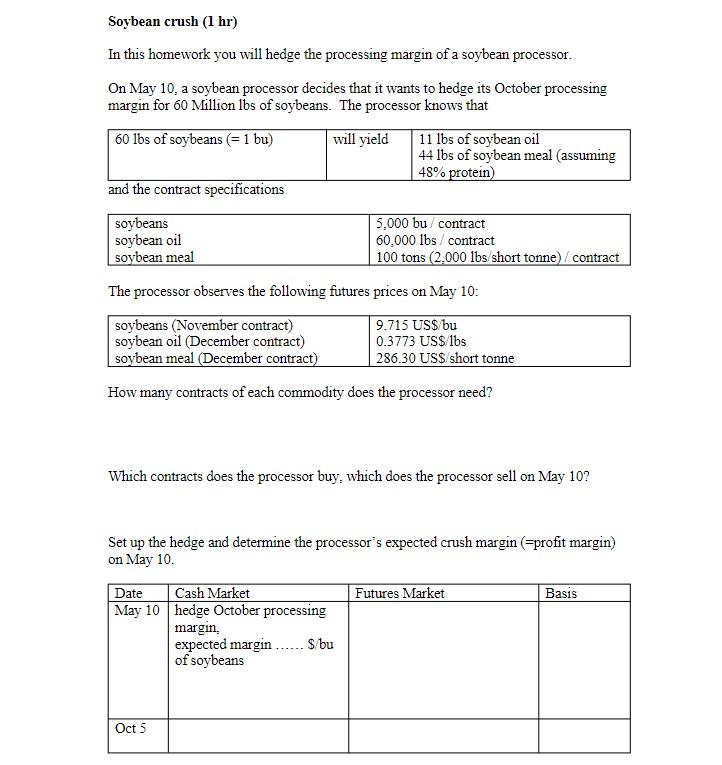

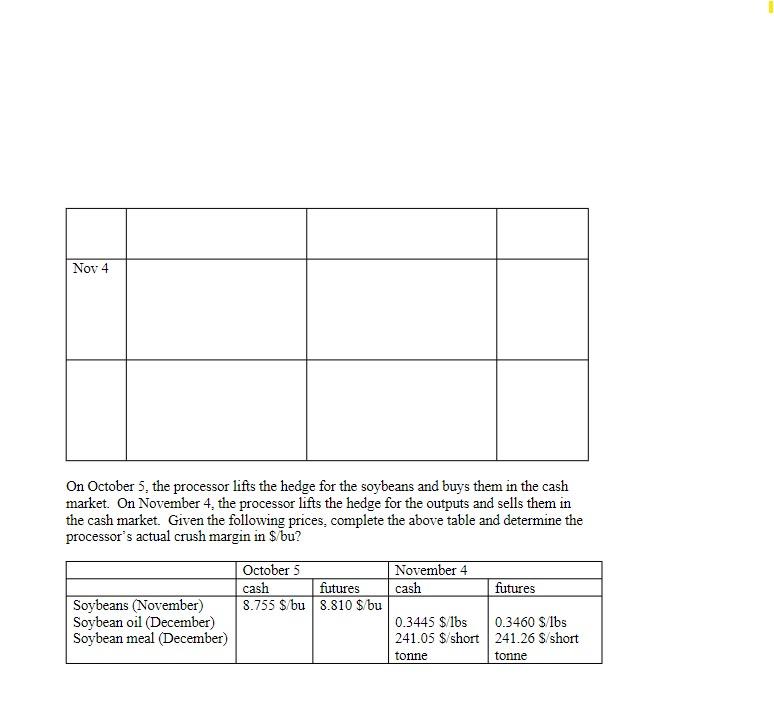

Soybean crush (1 hr) In this homework you will hedge the processing margin of a soybean processor. On May 10, a soybean processor decides that it wants to hedge its October processing margin for 60 Million lbs of soybeans. The processor knows that 60 lbs of soybeans (= 1 bu) will yield 11 lbs of soybean oil 44 lbs of soybean meal (assuming 48% protein and the contract specifications soybeans 5,000 bu contract soybean oil 60,000 lbs/contract soybean meal | 100 tons (2,000 lbs short tonne) /contract The processor observes the following futures prices on May 10: soybeans (November contract) 9.715 US$ bu soybean oil (December contract) 0.3773 US$/lbs soybean meal (December contract) 286.30 USS short tonne How many contracts of each commodity does the processor need? Which contracts does the processor buy, which does the processor sell on May 10? Set up the hedge and determine the processor's expected crush margin (=profit margin) on May 10. Date Cash Market Futures Market Basis May 10 hedge October processing margin expected margin..... $/bu of soybeans Oct 5 Nov 4 On October 5, the processor lifts the hedge for the soybeans and buys them in the cash market. On November 4, the processor lifts the hedge for the outputs and sells them in the cash market. Given the following prices, complete the above table and determine the processor's actual crush margin in S bu? Soybeans (November) Soybean oil (December) Soybean meal (December) October 5 November 4 cash futures cash futures 8.755 $/bu 8.810 S bu 0.3445 $/lbs 0.3460 S/Ibs 241.05 $ short 241.26 S/short tonne tonne Soybean crush (1 hr) In this homework you will hedge the processing margin of a soybean processor. On May 10, a soybean processor decides that it wants to hedge its October processing margin for 60 Million lbs of soybeans. The processor knows that 60 lbs of soybeans (= 1 bu) will yield 11 lbs of soybean oil 44 lbs of soybean meal (assuming 48% protein and the contract specifications soybeans 5,000 bu contract soybean oil 60,000 lbs/contract soybean meal | 100 tons (2,000 lbs short tonne) /contract The processor observes the following futures prices on May 10: soybeans (November contract) 9.715 US$ bu soybean oil (December contract) 0.3773 US$/lbs soybean meal (December contract) 286.30 USS short tonne How many contracts of each commodity does the processor need? Which contracts does the processor buy, which does the processor sell on May 10? Set up the hedge and determine the processor's expected crush margin (=profit margin) on May 10. Date Cash Market Futures Market Basis May 10 hedge October processing margin expected margin..... $/bu of soybeans Oct 5 Nov 4 On October 5, the processor lifts the hedge for the soybeans and buys them in the cash market. On November 4, the processor lifts the hedge for the outputs and sells them in the cash market. Given the following prices, complete the above table and determine the processor's actual crush margin in S bu? Soybeans (November) Soybean oil (December) Soybean meal (December) October 5 November 4 cash futures cash futures 8.755 $/bu 8.810 S bu 0.3445 $/lbs 0.3460 S/Ibs 241.05 $ short 241.26 S/short tonne tonne