Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the after tax cost of debt? What is the WACC for Rays Racks? What is the project NPV? What is the project IRR?

What is the after tax cost of debt?

What is the WACC for Rays Racks?

What is the project NPV?

What is the project IRR?

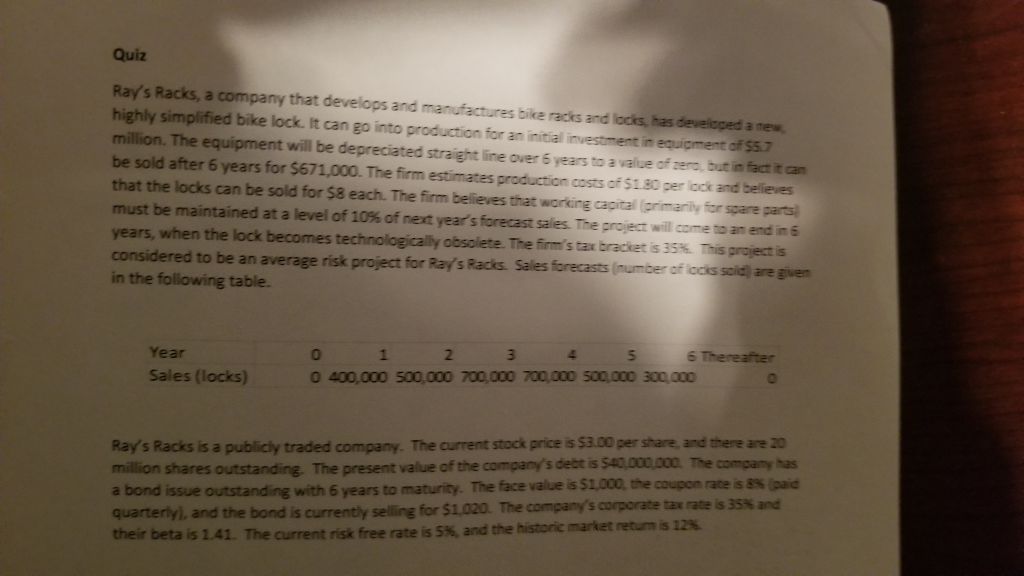

Quiz Ray's Racks, a company that develops and manufactures bike racks and lacks, has developed a new highly simplified bike lock. It can go into production for an initial investment in million. The equipment will be depreciated straight line over 6 years to a value of zerd, but in fact it can be sold after 6 years for $671,000. The firm estimates production costs of $1.80 per lock and believes that the locks can be sold for $8 each. The firm believes that working capital (primariy for spare parts must be maintained at a level of 10% of next year's forecast sales. The project will come to an end 6 years, when the lock considered to be an average risk project for Ray's Racks. Sales forecasts (number of locks soldl are given in the following table. of $5.7 becomes technologically obsolete. The firm's tax bracket is 35%. This project s 5 5 Thereafter 3 2 1 Year 0 0 400,000 500,000 700,.000 700,000 500 000 300,000 Sales (locks) Rays Racks is a publicly traded company. The current stock price is $3.00 per share, and there are 20 million shares outstanding. The present value of the company's debt is $40000.000 The company has a bond issue outstanding with 6 years to maturity. The face value is quarterly), and the bond is currently selling for $1,020. The their beta is 1.41. The current risk free rate is 5% and the historic market retumsx s8% $1,000, the coupon company's corporate tax rate is 35% and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started