Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SP 2 4 _ FIRST Home Syllabus Announcements Modules Grades Discussion Question 2 EA 1 4 Toren Inc. employs one person to run its solar

SPFIRST

Home

Syllabus

Announcements

Modules

Grades

Discussion Question

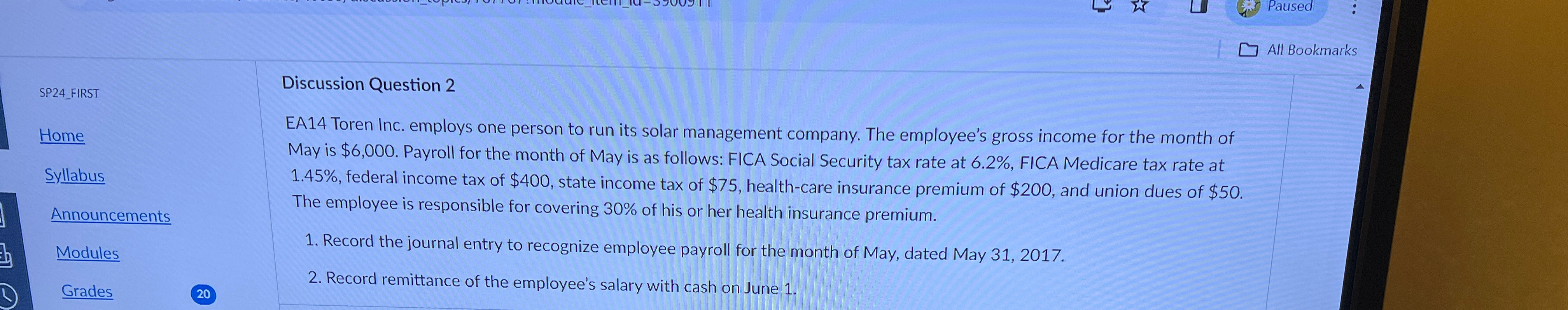

EA Toren Inc. employs one person to run its solar management company. The employee's gross income for the month of May is $ Payroll for the month of May is as follows: FICA Social Security tax rate at FICA Medicare tax rate at federal income tax of $ state income tax of $ healthcare insurance premium of $ and union dues of $ The employee is responsible for covering of his or her health insurance premium.

Record the journal entry to recognize employee payroll for the month of May, dated May

Record remittance of the employee's salary with cash on June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started