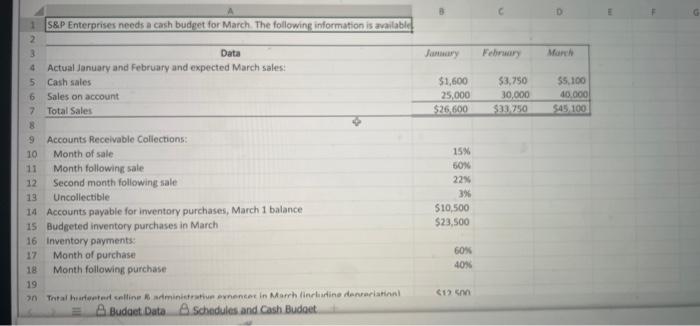

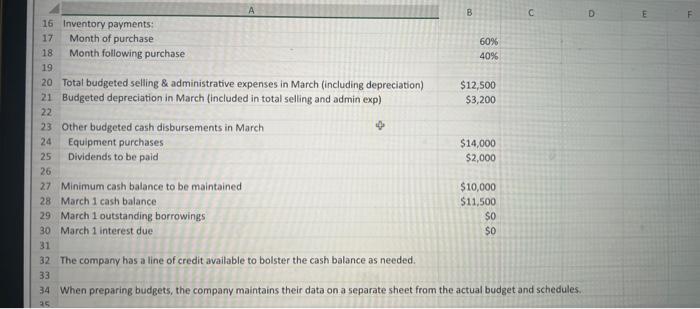

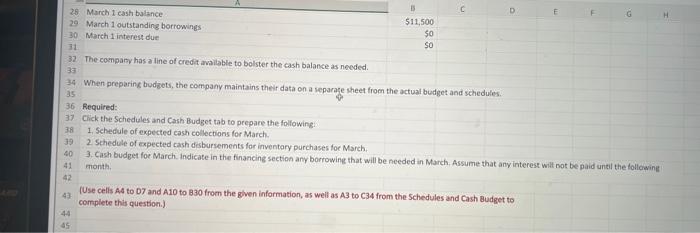

S\&P Enterprises has provided data from the first three months of the year. The Controller has asked you to prepare the Cash Budget and the related Schedules for Expected cash collections and Payments to suppliers. Here are some tips for using Excel: - Cell Reference: Allows you to refer to data from another cell in the worksheet. If you entered " =85 into a blank cell, the formula would output the value from cell B5. - Multi-Tab Cell Reference: Allows you to refer to data from another cell in a separate tab in the worksheet. When using the multi-tab cell reference, type the equal sign first, then click on the other tab and then click on the cell you want to reference. The syntax of a multi-tab cell reference looks different than a normal cell reference, since it includes the tab name surrounded by apostrophes and also an exclamation point before the cell location. From the Excel Simulation below, if in a blank cell on the Sheet1 tab " ='Future Value of \$1'.C13" was entered, the formula would output the result from cell C13 in the Future Value of $1 tab, or 1.10462 in this example. - Basic Math Functionsi Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract). I' (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered " 84+B5" in a blank cell, the formula would add the values from those cells and output the result. - SUM Function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered "=SUM (C4,C5,C6)" into a blank cell, the formula would output the result of adding those three separate cells. Similarly, if you entered "=SUM(C4:C6)", the formula would output the same result of adding those cells. 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. 1 S8P Enterprises needs a cash budpet for March. The following information is avalable, 9 Accounts Recelvable Coliections: 10 Month of sale 11 Month following sale 12 Second month following sale 13 Uncollectible 14 Accounts payable for inventory purchases, March 1 balance 15. Budgeted inventory purchases in March 15% 60% 22% 3% 510,500 $23,500 60%5 40%5 16 inventory parments: 17 Month of purchase 18. Month following purchase 19 ets enn A B 16 Inventory payments: 17 Month of purchase 18. Month following purchase 60% 19 40% 20 Total budgeted selling \& administrative expenses in March (including depreciation) $12,500 21 Budgeted depreciation in March (included in total selling and admin exp) $3,200 22 23 Other budgeted cash disbursements in March 24 Equipment purchases 25 Dividends to be paid 26 $14,000 27 Minimum cash balance to be maintained $2,000 28 March 1 cash balance $10,000 29 March 1 outstanding borrowings $11,500 30 March 1 interest due $0 31 $0 32 The company has a line of credit available to bolster the cash balance as needed. 33 34 When preparing budgets, the company maintains their data on a separate sheet from the actual budget and schedules. 25 25 March 1 cash bulance 29 March 1 outstanding borrowings 30 March 1 interest due $11,500 50 so 32 The company has a line of credit avaibable to bolster the cash balance as needed. 38 34. When preparing budzets, the company maintains their data on a separage sheet from the actual budget and schedules. 36 Required: 37 Chick the Schedules and Cash Budget tab to prepare the following: 38 1, Schedule of expected cash collections for March. 39.2 schedule of expected cash disbursements for inventory purchases foe March. 41 gonth, 42 4) CUse cells A4 to D7 and A10 to 830 from the given information, as well as A3 to C34 from the Schedules and Cash Budget to complete this question.)