Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sparkle Ltd was incorporated on 1 January 2017 with an authorized share capital consisting of the following: 400 000 ordinary shares of NS 10 100

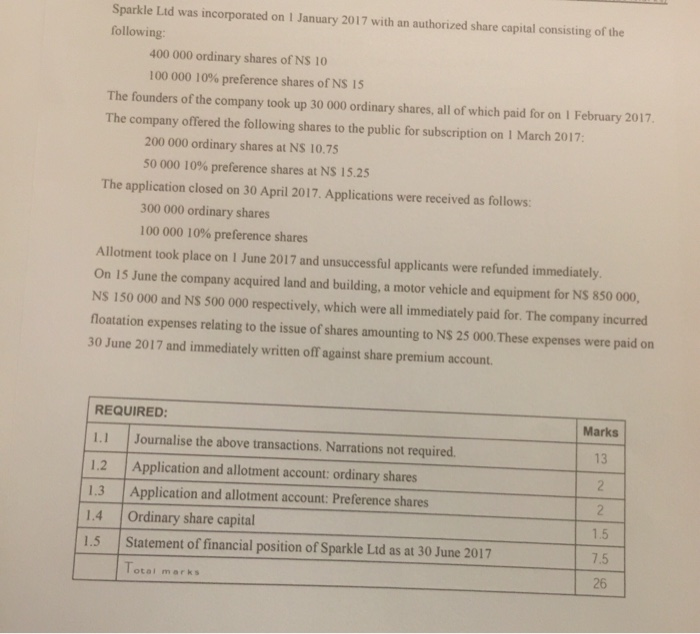

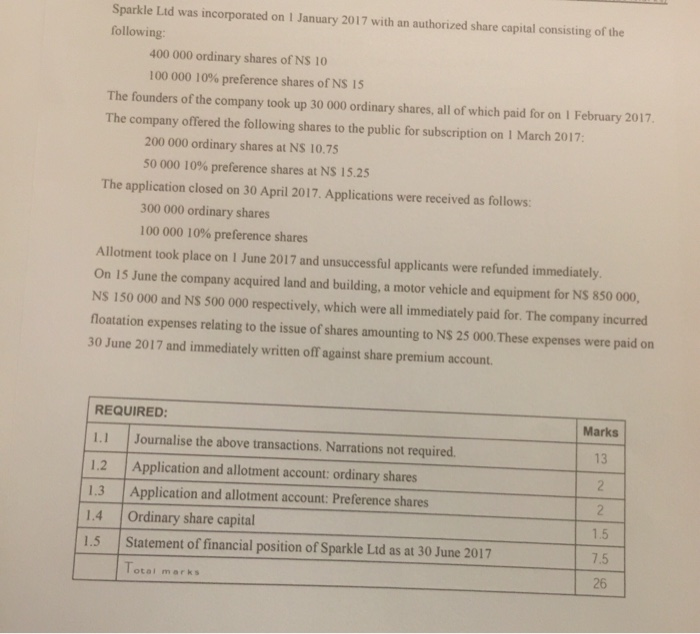

Sparkle Ltd was incorporated on 1 January 2017 with an authorized share capital consisting of the following: 400 000 ordinary shares of NS 10 100 000 10% preference shares of NS 15 The founders of the company took up 30 000 ordinary shares, all of which paid for on 1 February 2017 The company offered the following shares to the public for subscription on March 2017: 200 000 ordinary shares at NS 10,75 50 000 10% preference shares at NS 15.25 The application closed on 30 April 2017. Applications were received as follows: 300 000 ordinary shares 100 000 10% preference shares Allotment took place on 1 June 2017 and unsuccessful applicants were refunded immediately. On 15 June the company acquired land and building, a motor vehicle and equipment for NS 850 000, NS 150 000 and NS 500 000 respectively, which were all immediately paid for. The company incurred floatation expenses relating to the issue of shares amounting to NS 25 000. These expenses were paid on 30 June 2017 and immediately written off against share premium account REQUIRED: 1.1 Marks 13 1.2 1.3 Journalise the above transactions. Narrations not required. Application and allotment account: ordinary shares Application and allotment account: Preference shares Ordinary share capital Statement of financial position of Sparkle Ltd as at 30 June 2017 2 1.4 2 1.5 1.5 7.5 Total marks 26

Sparkle Ltd was incorporated on 1 January 2017 with an authorized share capital consisting of the following: 400 000 ordinary shares of NS 10 100 000 10% preference shares of NS 15 The founders of the company took up 30 000 ordinary shares, all of which paid for on 1 February 2017 The company offered the following shares to the public for subscription on March 2017: 200 000 ordinary shares at NS 10,75 50 000 10% preference shares at NS 15.25 The application closed on 30 April 2017. Applications were received as follows: 300 000 ordinary shares 100 000 10% preference shares Allotment took place on 1 June 2017 and unsuccessful applicants were refunded immediately. On 15 June the company acquired land and building, a motor vehicle and equipment for NS 850 000, NS 150 000 and NS 500 000 respectively, which were all immediately paid for. The company incurred floatation expenses relating to the issue of shares amounting to NS 25 000. These expenses were paid on 30 June 2017 and immediately written off against share premium account REQUIRED: 1.1 Marks 13 1.2 1.3 Journalise the above transactions. Narrations not required. Application and allotment account: ordinary shares Application and allotment account: Preference shares Ordinary share capital Statement of financial position of Sparkle Ltd as at 30 June 2017 2 1.4 2 1.5 1.5 7.5 Total marks 26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started