Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sparkle Scooters manufactures motor scooters. The company has automated production, so it allocates manufacturing overhead based on machine hours. Sparkle expects to incur $ 292,

Sparkle Scooters manufactures motor scooters. The company has automated production, so it allocates manufacturing overhead based on machine hours.

Sparkle expects to incur $ 292, 500 of manufacturing overhead costs and to use 4, 500 machine hours during 2018 . At the end of 2017 , Sparkle reported the following inventories:

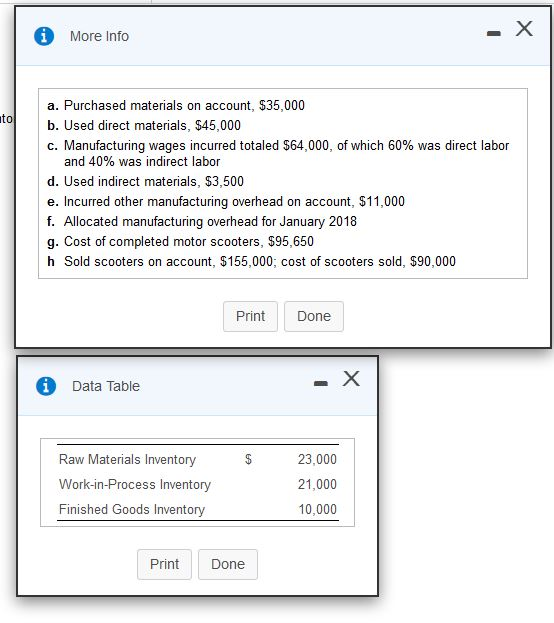

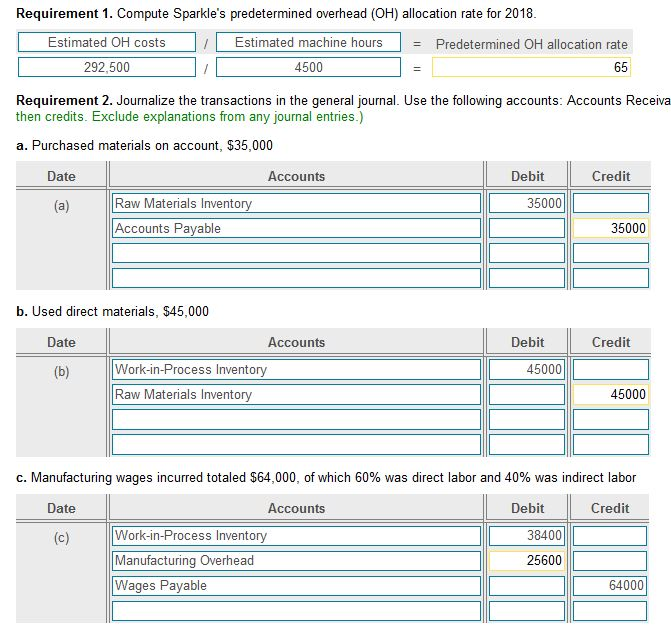

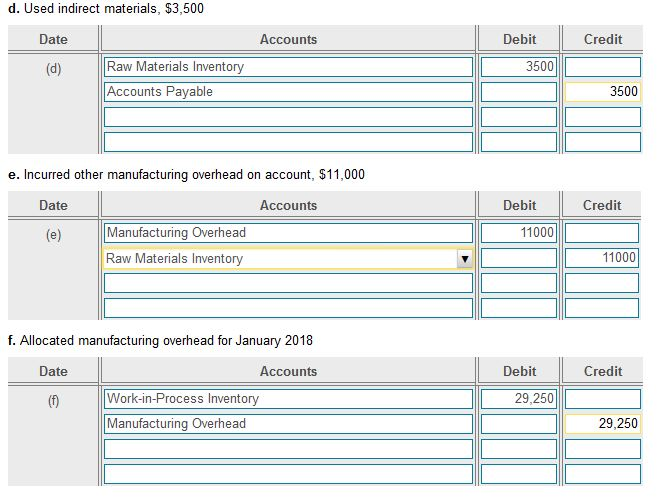

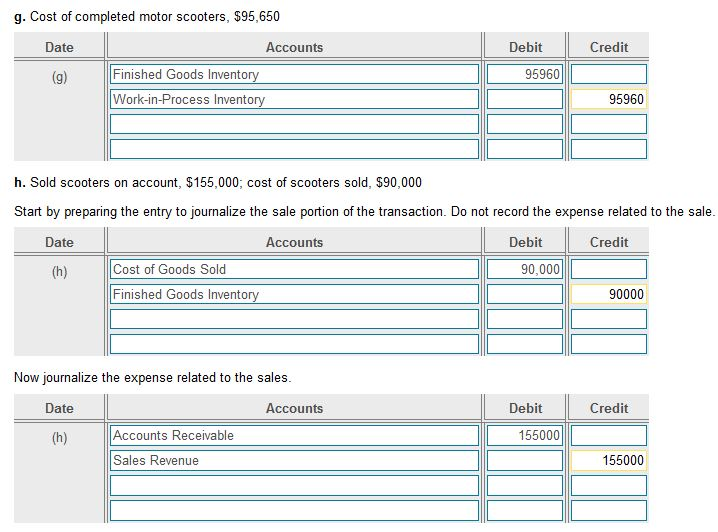

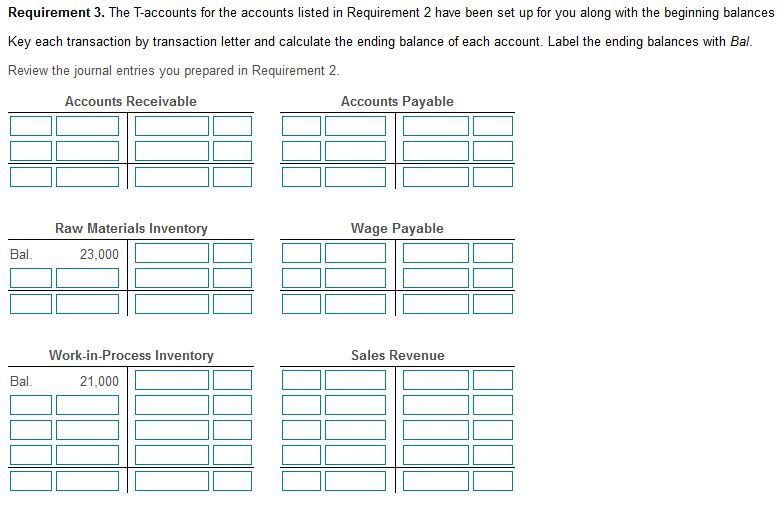

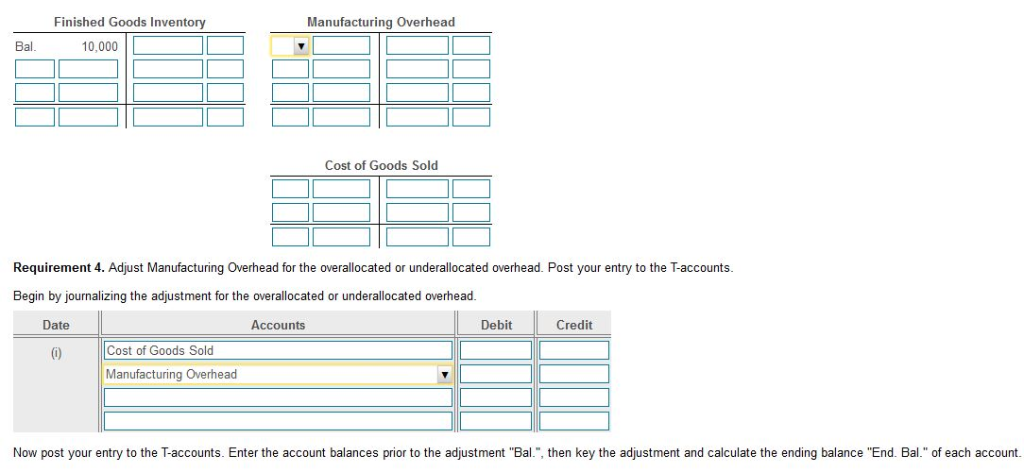

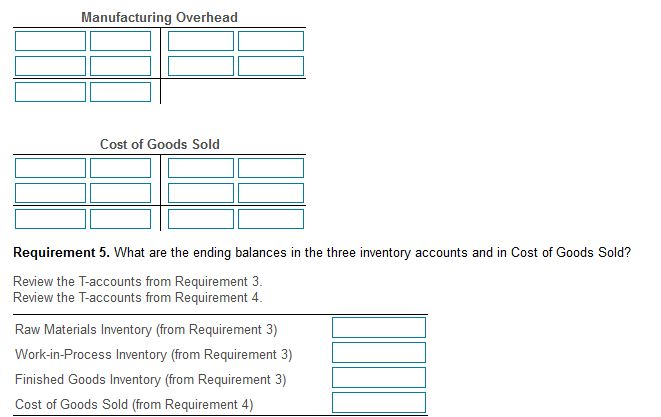

More Info a. Purchased materials on account, $35,000 b. Used direct materials, $45,000 c. Manufacturing wages incurred totaled $64,000, of which 60% was direct labor to and 40% was indirect labor d. Used indirect materials, $3,500 e. Incurred other manufacturing overhead on account, $11,000 f. Allocated manufacturing overhead for January 2018 g. Cost of completed motor scooters, $95,650 h Sold scooters on account, $155,000; cost of scooters sold, $90,000 PrintDone i Data Table Raw Materials Inventory Work-in-Process Inventory Finished Goods Inventory 23,000 21,000 10,000 Print Done Requirement 1. Compute Sparkle's predetermined overhead (OH) allocation rate for 2018 tdcstsEstimated machine hours- Predetermined OH llcation rate Estimated OH costs 292,500 4500 65 Requirement 2. Journalize the transactions in the general journal. Use the following accounts: Accounts Receiva then credits. Exclude explanations from any journal entries.) a. Purchased materials on account, $35,000 Date Accounts Debit Credit Raw Materials Invento 35000 Accounts Pavable 35000 b. Used direct materials, $45,000 Date Accounts Debit Credit 45000 Work-in-Process Inventory Raw Materials Inventory 45000 c. Manufacturing wages incurred totaled $64,000, of which 60% was direct labor and 40% was indirect labor Date Accounts Debit Credit Work-in-Process Inventory Manufacturing Overhead Wages Payable 38400 25600 64000 g. Cost of completed motor scooters, $95,650 Date Accounts Debit Credit Finished Goods Invento 95960 Work-in-Process Invent 95960 h. Sold scooters on account, $155,000; cost of scooters sold, $90,000 Start by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale Date Accounts Debit Credit Cost of Goods Sold 90,000 Finished Goods Invento 90000 Now journalize the expense related to the sales Date Accounts Debit Credit Accounts Receivable 155000 Sales Revenue 155000 Requirement 3. The Taccounts for the accounts listed in Requirement 2 have been set up for you along with the beginning balances Key each transaction by transaction letter and calculate the ending balance of each account. Label the ending balances with Bal. Review the journal entries you prepared in Requirement 2 Accounts Receivable Accounts Payable Raw Materials Inventory Wage Payable Bal. 23,000 Work-in-Process Inventory Sales Revenue Bal 21,000 Finished Goods Inventory Manufacturing Overhead Bal. 10,000 Cost of Goods Sold Requirement 4. Adjust Manufacturing Overhead for the overallocated or underallocated overhead. Post your entry to the T-accounts Begin by journalizing the adjustment for the overallocated or underallocated overhead. Date Accounts Debit Credit 0Cost of Goods Sold Manufacturing Overhead Now post your entry to the T-accounts. Enter the account balances prior to the adjustment "Bal., then key the adjustment and calculate the ending balance "End. Bal." of each account. Manufacturing Overhead Cost of Goods Sold Requirement 5. What are the ending balances in the three inventory accounts and in Cost of Goods Sold? Review the T-accounts from Requirement 3. Review the T-accounts from Requirement 4 Raw Materials Inventory (rom Requirement 3) Work-in-Process Inventory (from Requirement 3) Finished Goods Inventory (from Requirement 3) L Cost of Goods Sold (from Requirement 4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started