Question

Sparkle Snowflake , Jack Frost , and Jill Icicles are partners in Ice Architects and share income and losses in a 3 : 1 :

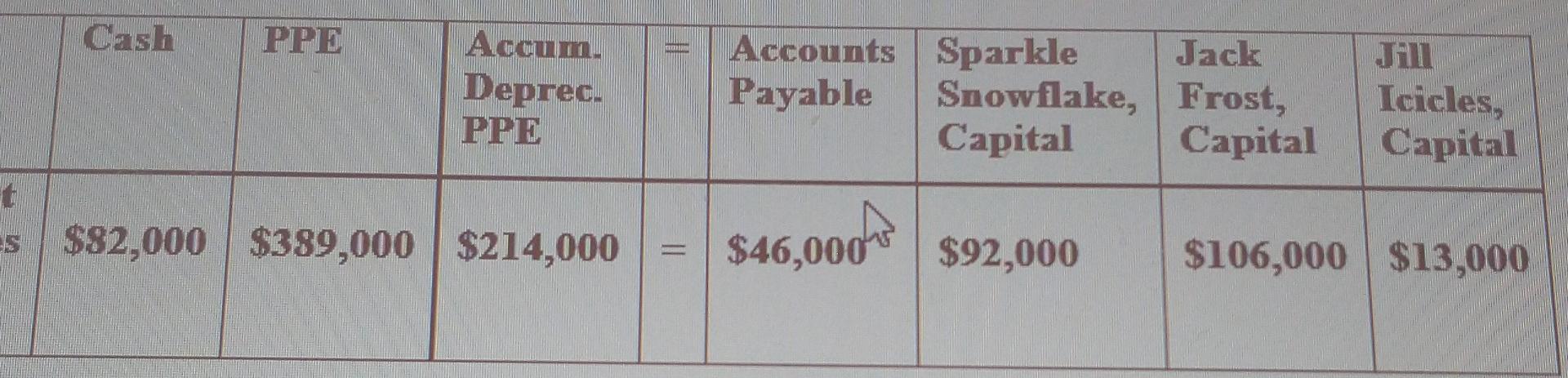

Sparkle Snowflake , Jack Frost , and Jill Icicles are partners in Ice Architects and share income and losses in a 3 : 1 : 1 ratio . On March 31 , 2022 , the partnership showed the following account balances just prior to

liquidation as photo 1. Prepare the journal entry to record the sale of the PPE assuming it is sold for $ 110,000 . 2. Prepare the journal entry to record the allocation of the gain or loss of the PPE . 3. Prepare the journal entry to record the payment of liabilities . 4. Prepare the journal entry to record the final distribution of cash .

Cash PPE Accum. Deprec. PPE Accounts Sparkle Jack Payable Snowflake, Frost, Capital Capital Jiu Icicles, Capital t Es $82,000 $389,000 $214,000 $46,000" $ $92,000 $106,000 $13,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started