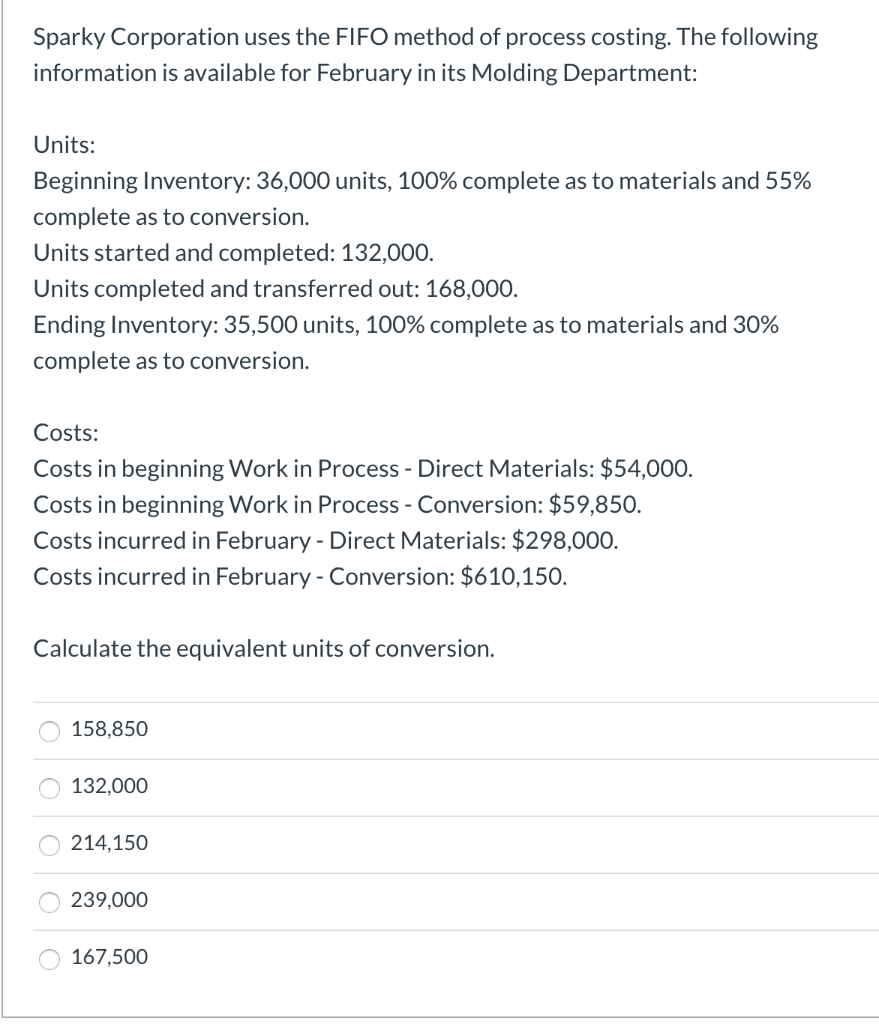

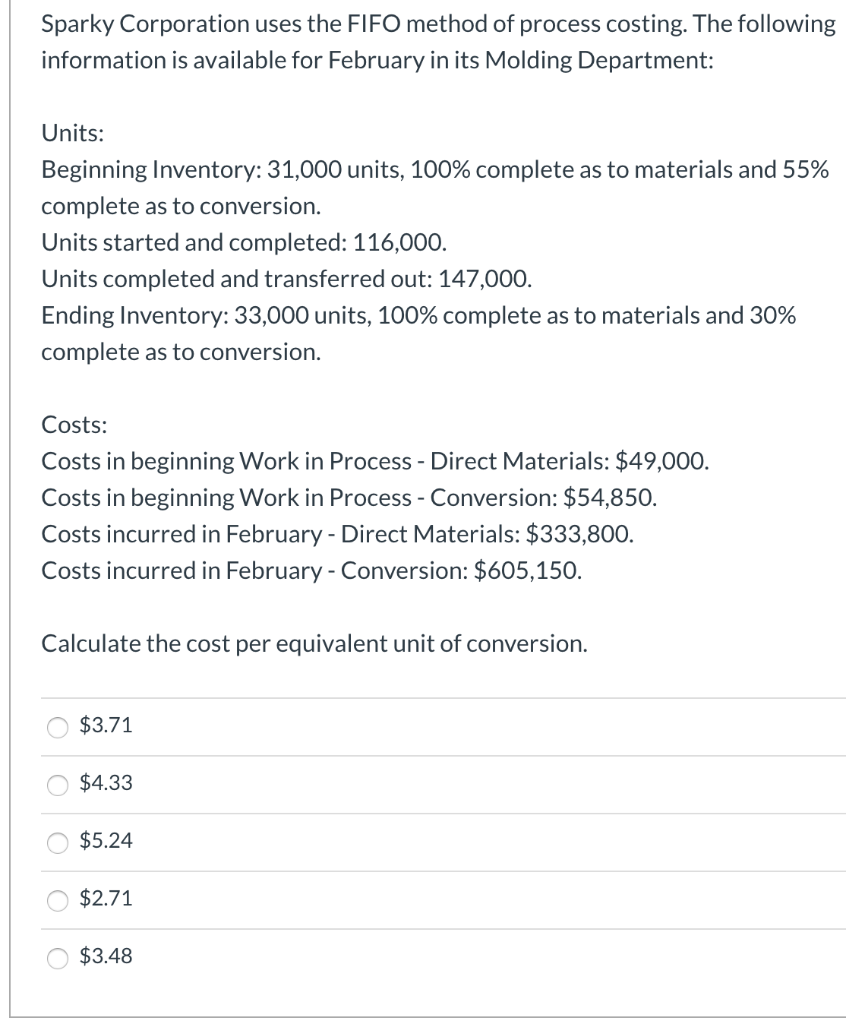

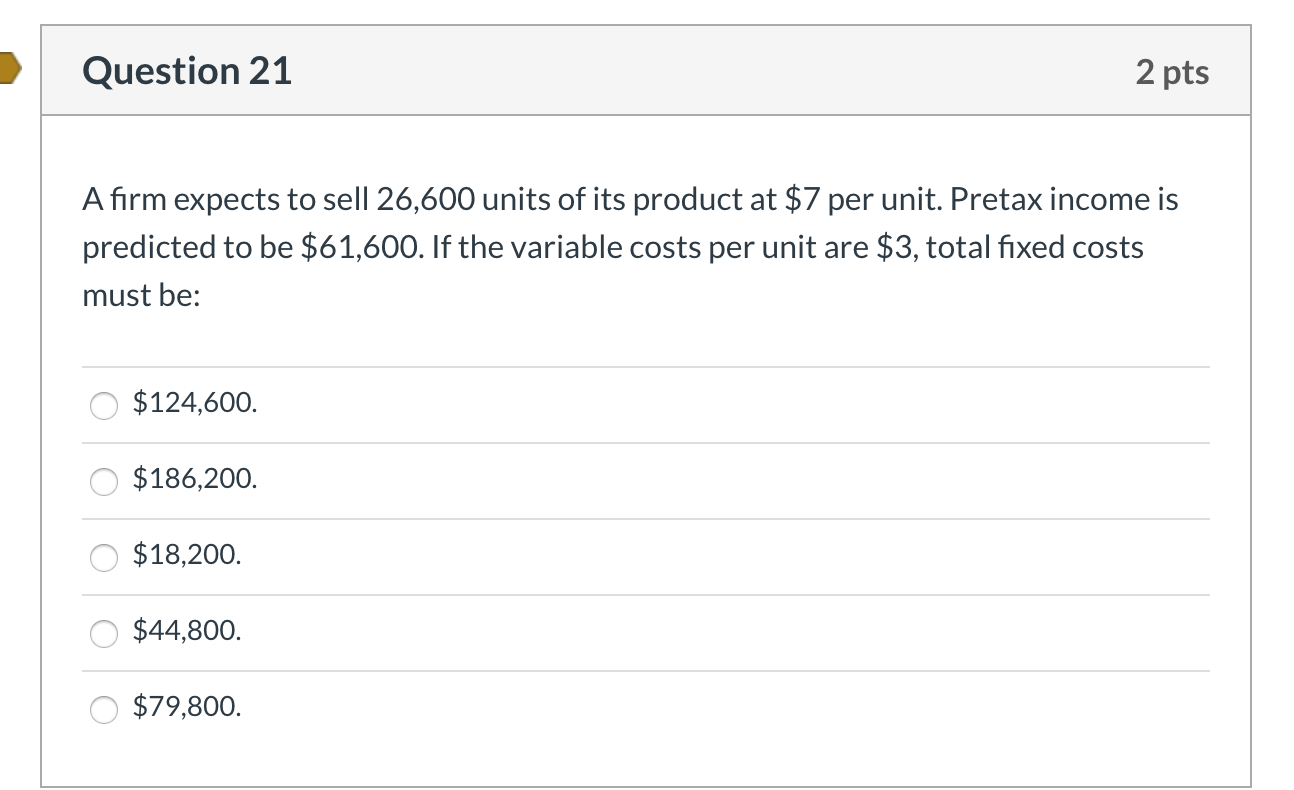

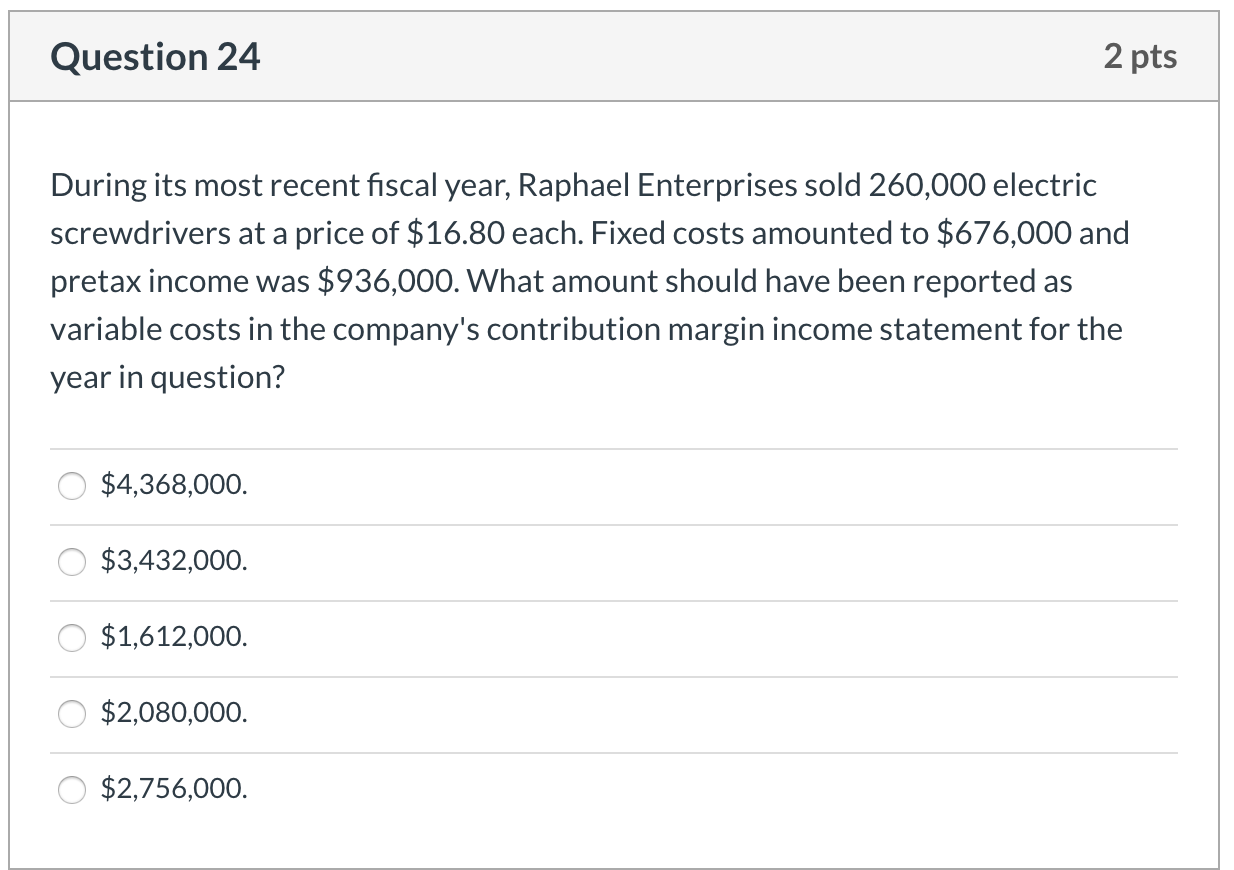

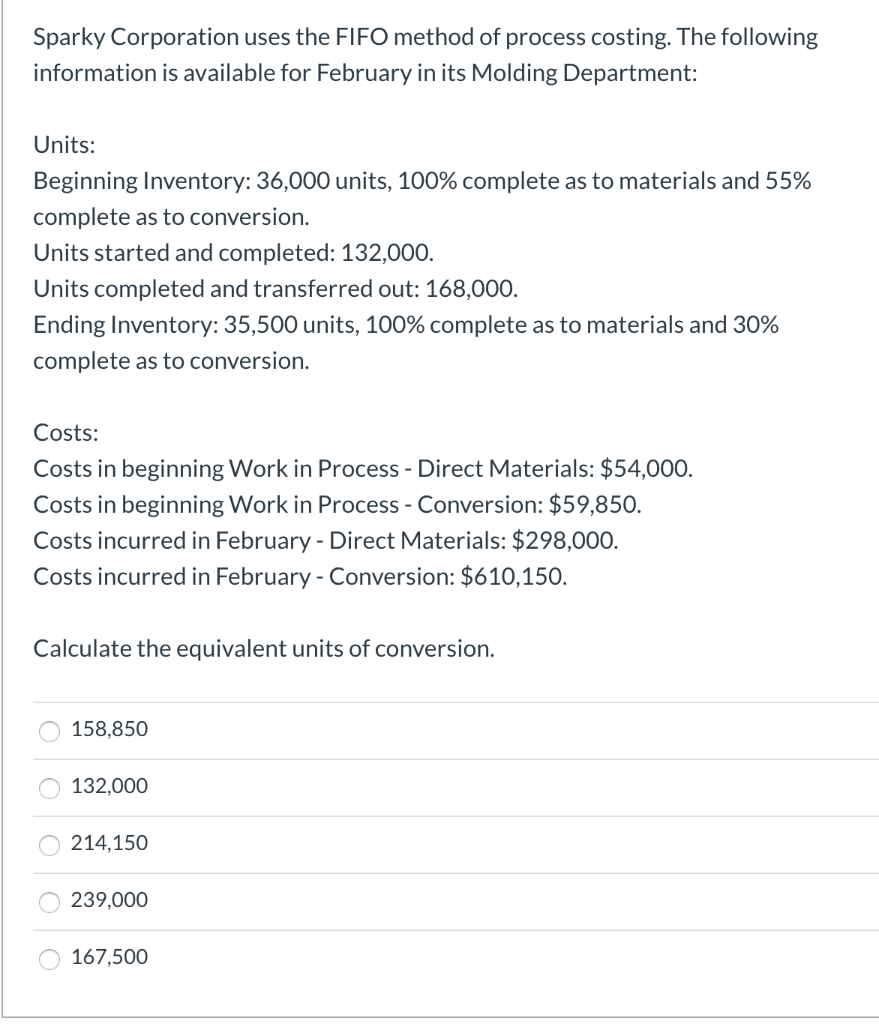

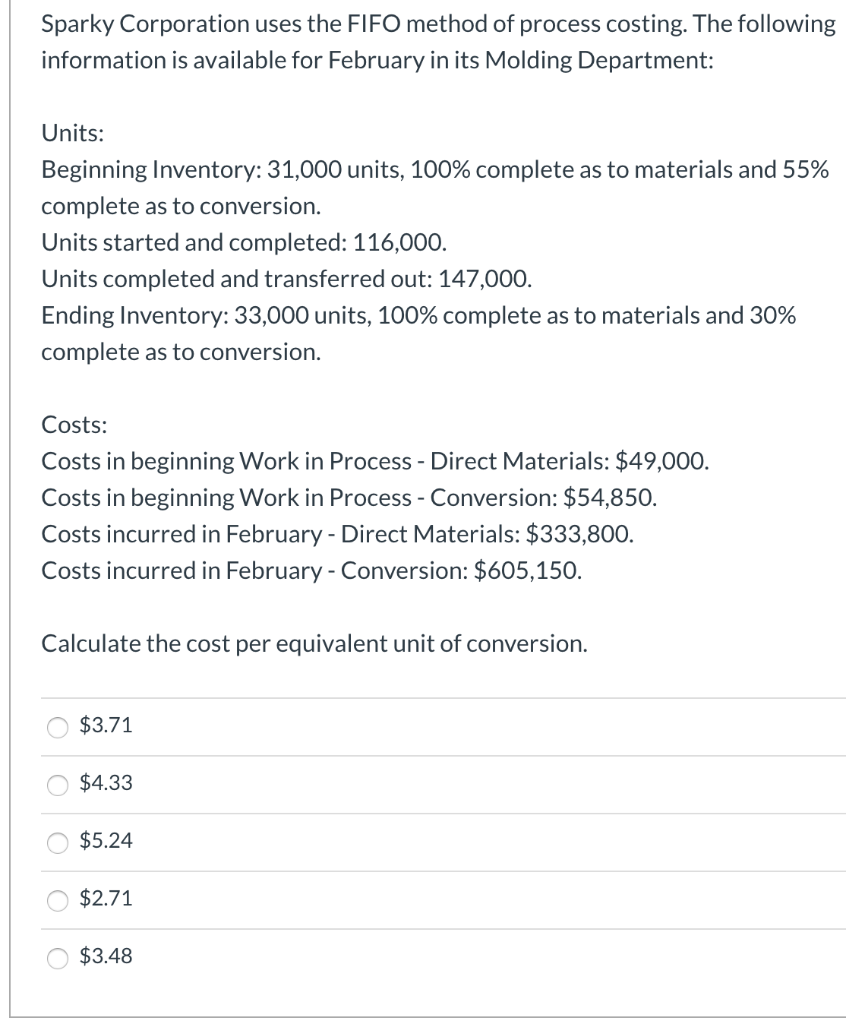

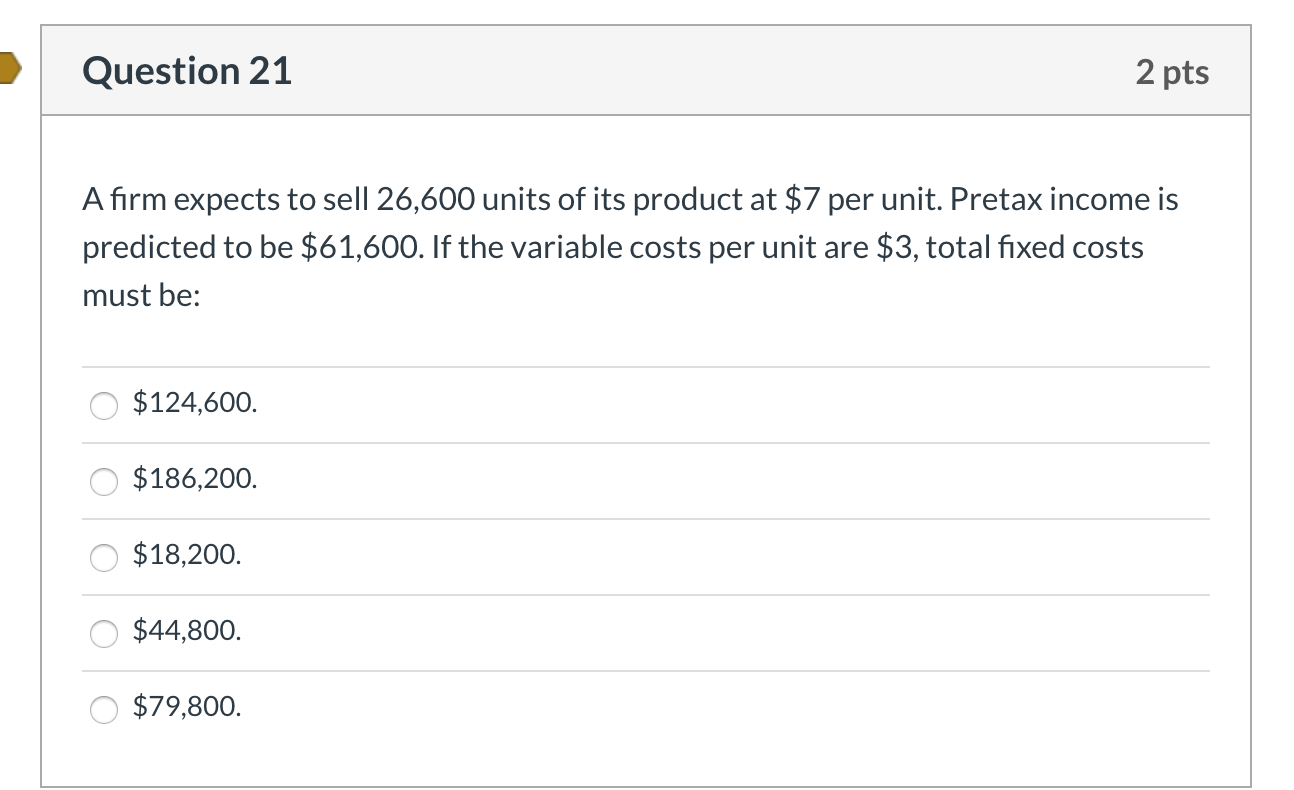

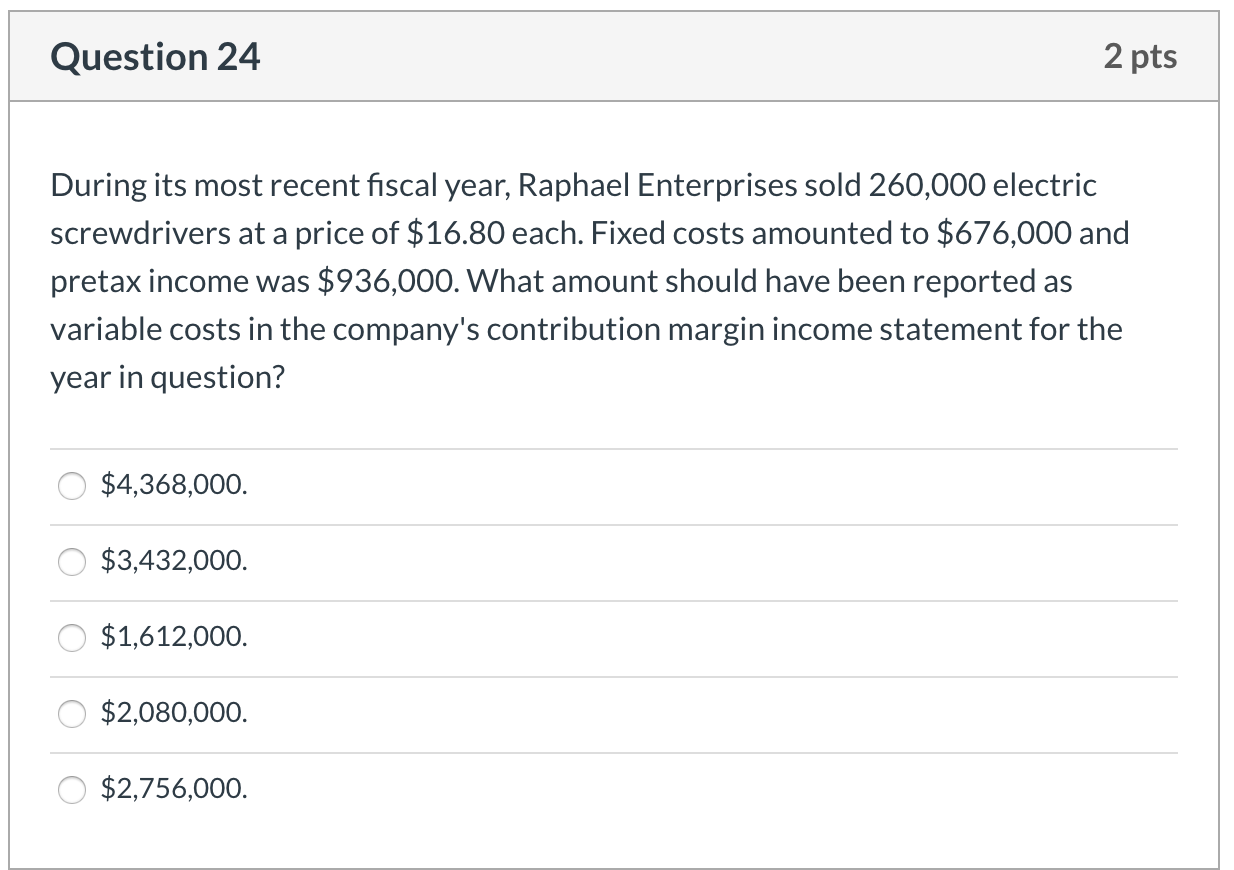

Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department: Units: Beginning Inventory: 36,000 units, 100% complete as to materials and 55% complete as to conversion. Units started and completed: 132,000. Units completed and transferred out: 168,000. Ending Inventory: 35,500 units, 100% complete as to materials and 30% complete as to conversion. Costs: Costs in beginning Work in Process - Direct Materials: $54,000. Costs in beginning Work in Process - Conversion: $59,850. Costs incurred in February - Direct Materials: $298,000. Costs incurred in February - Conversion: $610,150. Calculate the equivalent units of conversion. 158,850 132,000 o 214,150 239,000 O 167,500 Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department: Units: Beginning Inventory: 31,000 units, 100% complete as to materials and 55% complete as to conversion. Units started and completed: 116,000. Units completed and transferred out: 147,000. Ending Inventory: 33,000 units, 100% complete as to materials and 30% complete as to conversion. Costs: Costs in beginning Work in Process - Direct Materials: $49,000. Costs in beginning Work in Process - Conversion: $54,850. Costs incurred in February - Direct Materials: $333,800. Costs incurred in February - Conversion: $605,150. Calculate the cost per equivalent unit of conversion. $3.71 $4.33 $5.24 O $2.71 O $3.48 Question 21 2 pts A firm expects to sell 26,600 units of its product at $7 per unit. Pretax income is predicted to be $61,600. If the variable costs per unit are $3, total fixed costs must be: O $124,600. O $186,200. 0 $18,200. 0 $44,800. 0 $79,800. Question 24 2 pts During its most recent fiscal year, Raphael Enterprises sold 260,000 electric screwdrivers at a price of $16.80 each. Fixed costs amounted to $676,000 and pretax income was $936,000. What amount should have been reported as variable costs in the company's contribution margin income statement for the year in question? O $4,368,000. 0 $3,432,000. $1,612,000. O $2,080,000. 0 $2,756,000