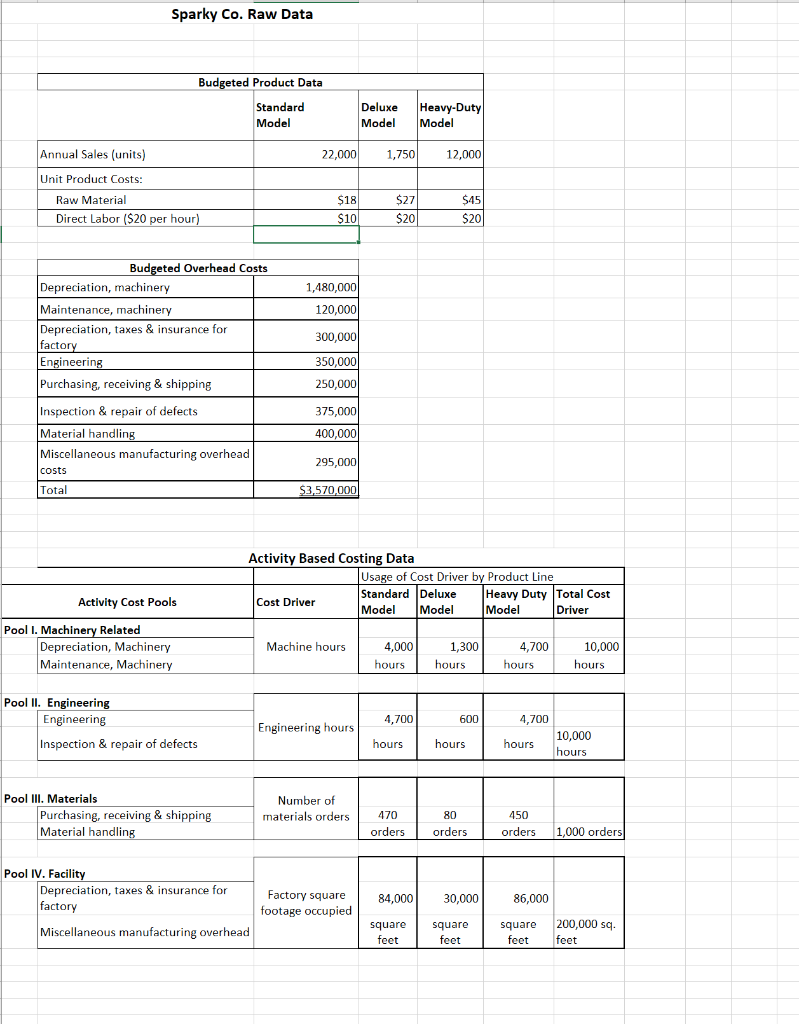

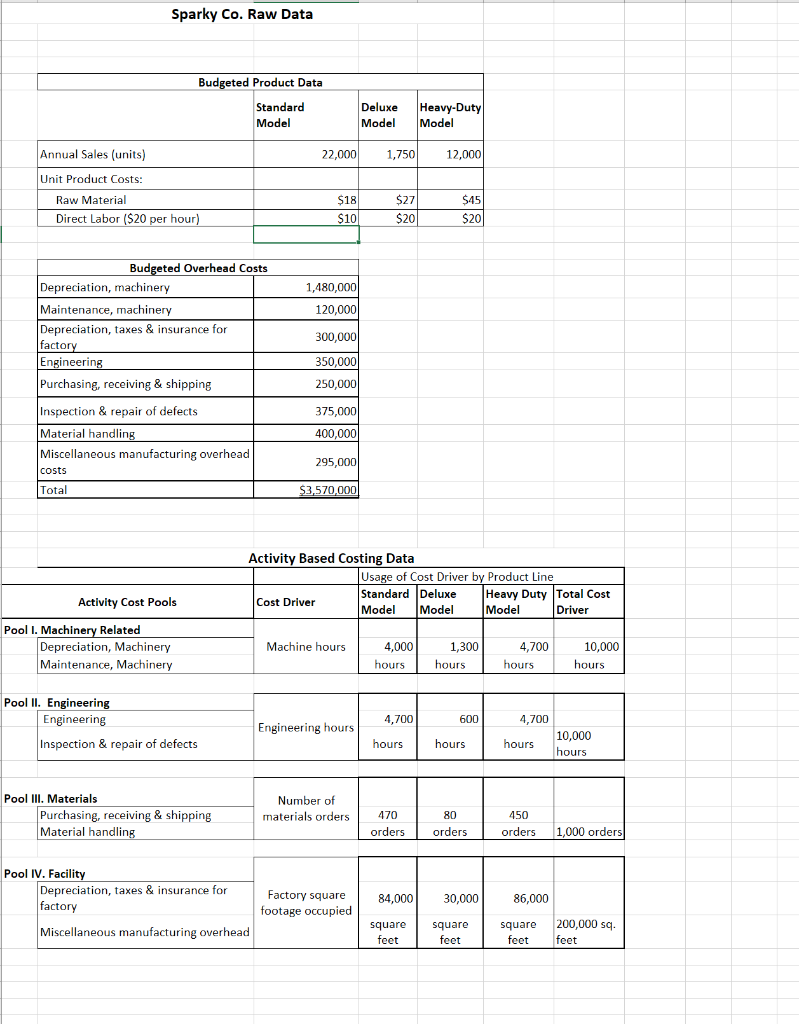

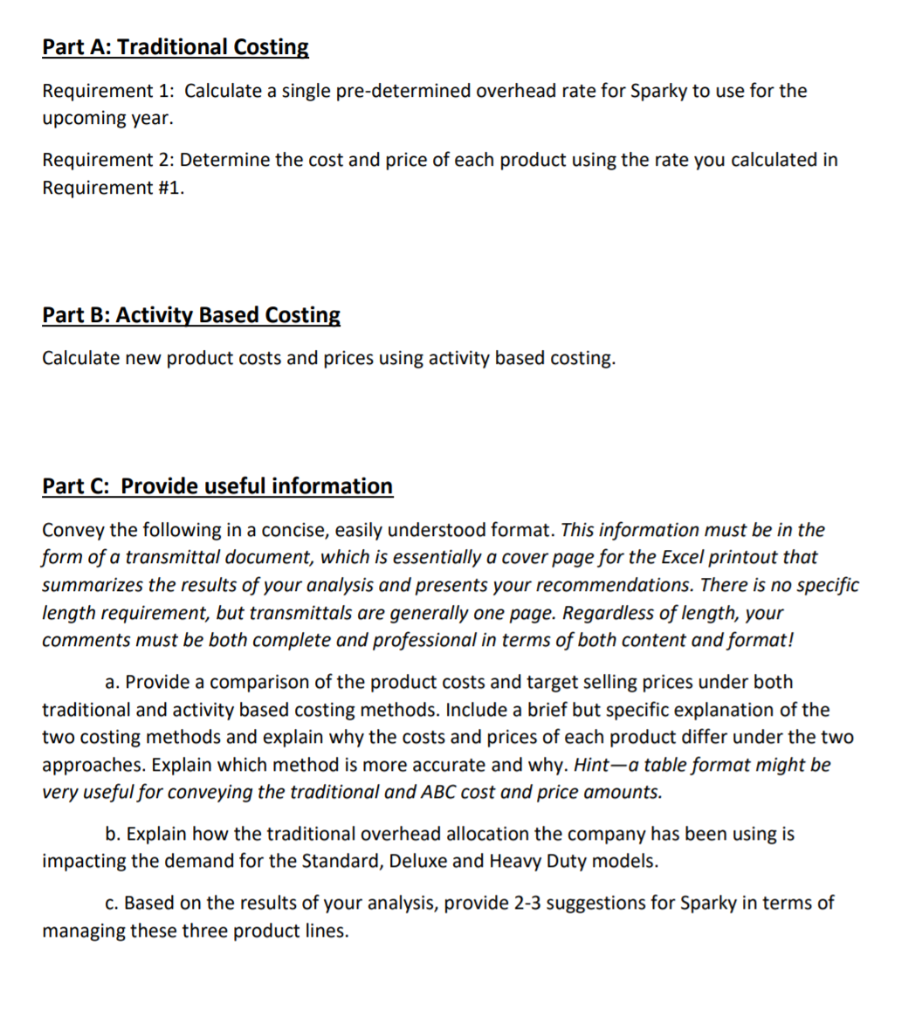

Sparky Electric Motor Corporation manufactures electric motors for commercial use. The company produces three models, designated as standard, deluxe, and heavy-duty. The company uses a job-order cost-accounting system with manufacturing overhead applied on the basis of direct-labor hours. The system has been in place with little change for 25 years. For the past 10 years, the company's pricing formula has been to set each product's target price at a 10% markup on the full product cost. Recently, however, the standard-model motor has come under increasing price pressure from offshore competitors. The result was that the price on the standard model has been lowered to $109. On the other hand, demand for the Deluxe model is soaring and the company is struggling to keep up with orders even after increasing the price to $225. The Deluxe model is a complex product and thus Sparky has much less capacity for building this model compared to the other two. Overall company profitability in the past few years has been stagnant to slightly declining with some years better than others. After considering the product pricing using the existing cost structure, the company president asked the controller, "Why can't we compete with other companies? They're selling motors just like our standard model for $105. Matching that price cuts our profit in half. Are we really that inefficient? What gives?" The controller responded by saying, "I think this is due to an outmoded product-costing system. As you may remember, I raised a red flag about our system when I came on board last year. But the decision was to keep our current system in place. In my judgment, our product-costing system is distorting our product costs. Let me run a few numbers to demonstrate what I mean. Getting the president's go-ahead, the controller compiled the basic data needed to implement an activity-based costing system, the raw data compiled by the controller is available in the Excel file given. Sparky Co. Raw Data Budgeted Product Data Standard Model Deluxe Heavy-Duty Model Model Annual Sales (units) Unit Product Costs: Raw Material 22,0001,75012,000 S18 $10 $27 $20 45 Direct Labor ($20 per hour) $20 Budgeted Overhead Costs Depreciation, machineny Maintenance, machinery Depreciation, taxes & insurance for factor Engineerin Purchasing, receiving & shipping 1,480,000 120,000 300,000 350,000 250,000 375,000 400,000 295,000 3,570,000 Inspection & repair of defects Material handlin Miscellaneous manufacturing overhead costs Total Activity Based Costing Data Usage of Cost Driver by Product Line Standard Deluxe Heavy Duty Total Cost Model Model Activity Cost Pools Cost Driver Model Driver Pool I. Machinery Related Machine hours Depreciation, Machinery Maintenance, Machinery 4,000 hourshours 4,700 hours 1,300 10,000 hours Pool I1. Engineering Engineering 4,700 600 4,700 Engineering hours 10,000 hours Inspection & repair of defects hours hours hours Pool. Materials Number of materials orders470 Purchasing, receiving & shipping Material handlin 80 450 orders 1,000 orders orders orders Pool IV. Facili Depreciation, taxes & insurance for factory Factory square footage occupied 84,000 30,000 86,000 square 200,000 sq Miscellaneous manufacturing overhead square feet feet feet feet Part A: Traditional Costing Requirement 1: Calculate a single pre-determined overhead rate for Sparky to use for the upcoming year. Requirement 2: Determine the cost and price of each product using the rate you calculated in Requirement #1 Part B: Activity Based Costing Calculate new product costs and prices using activity based costing. Part C: Provide useful information Convey the following in a concise, easily understood format. This information must be in the form of a transmittal document, which is essentially a cover page for the Excel printout that summarizes the results of your analysis and presents your recommendations. There is no specific length requirement, but transmittals are generally one page. Regardless of length, your comments must be both complete and professional in terms of both content and format! a. Provide a comparison of the product costs and target selling prices under both traditional and activity based costing methods. Include a brief but specific explanation of the two costing methods and explain why the costs and prices of each product differ under the two approaches. Explain which method is more accurate and why. Hint-a table format might be very useful for conveying the traditional and ABC cost and price amounts. b. Explain how the traditional overhead allocation the company has been using is impacting the demand for the Standard, Deluxe and Heavy Duty models. C. Based on the results of your analysis, provide 2-3 suggestions for Sparky in terms of managing these three product lines