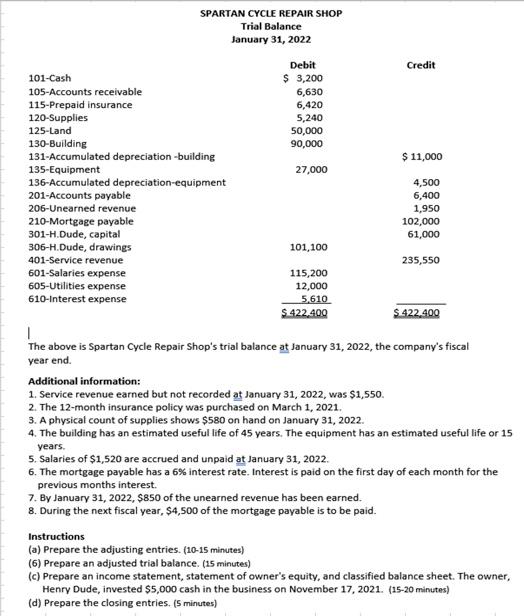

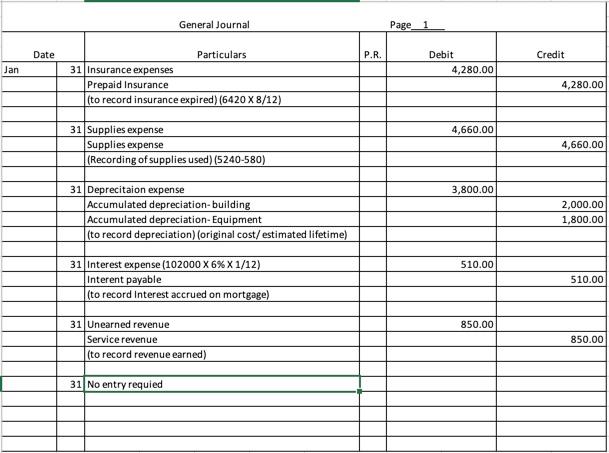

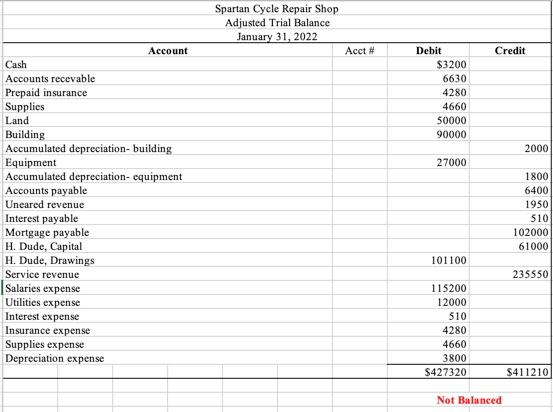

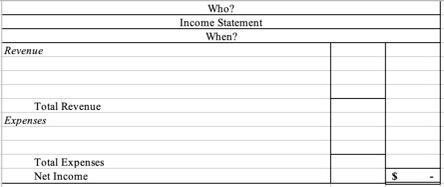

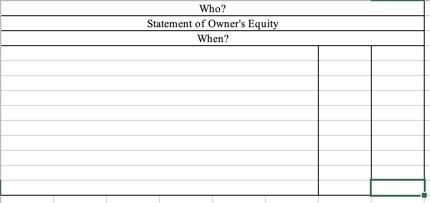

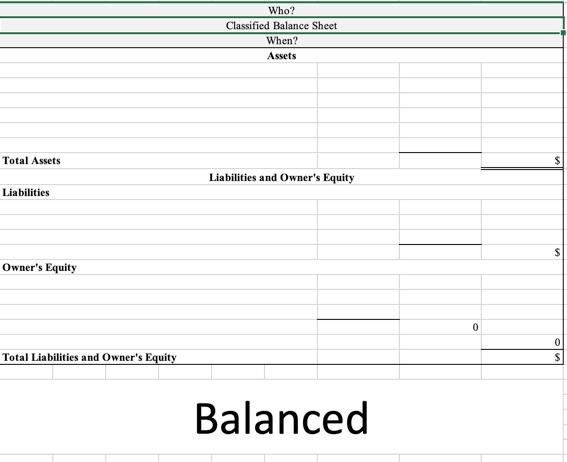

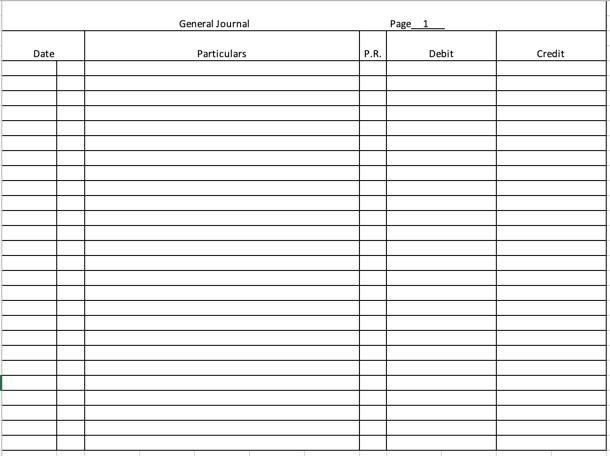

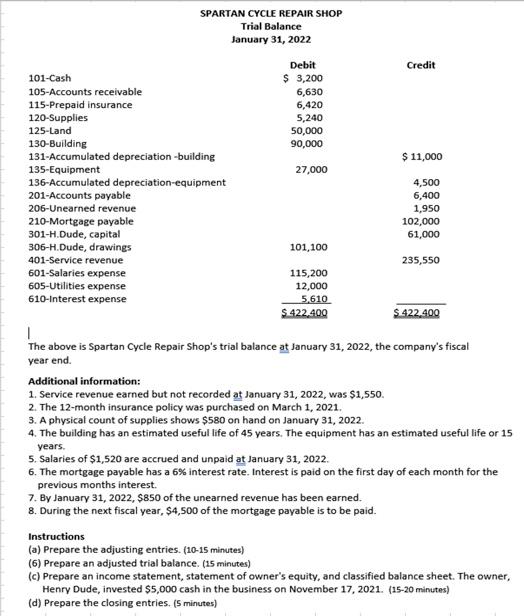

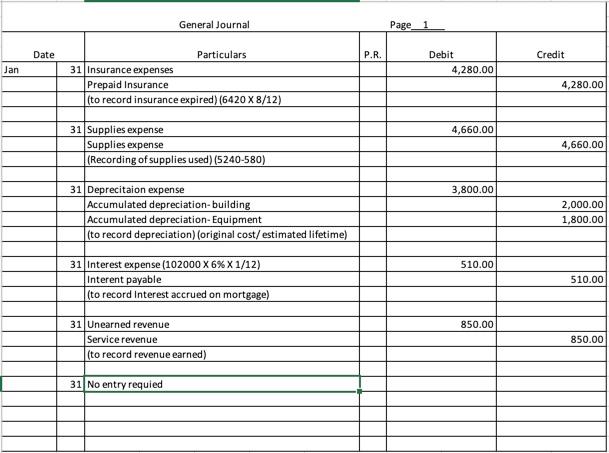

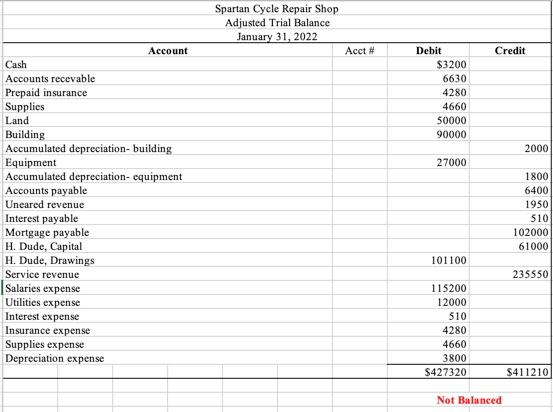

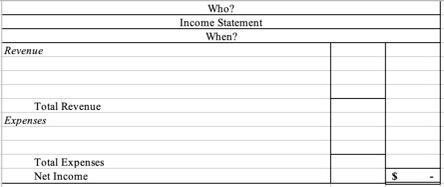

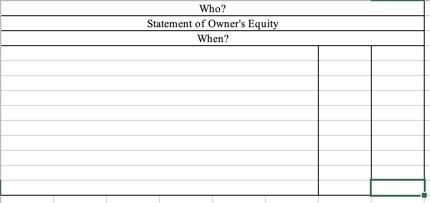

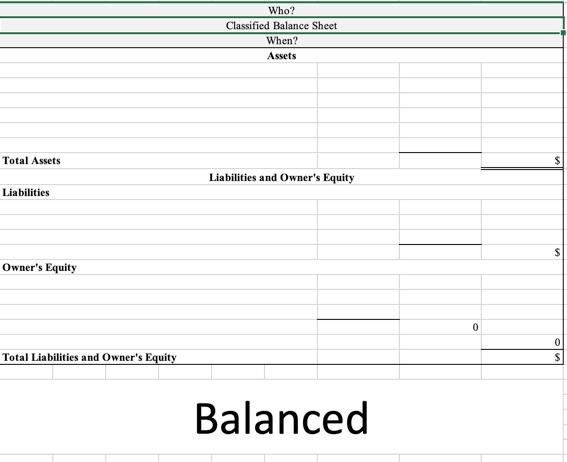

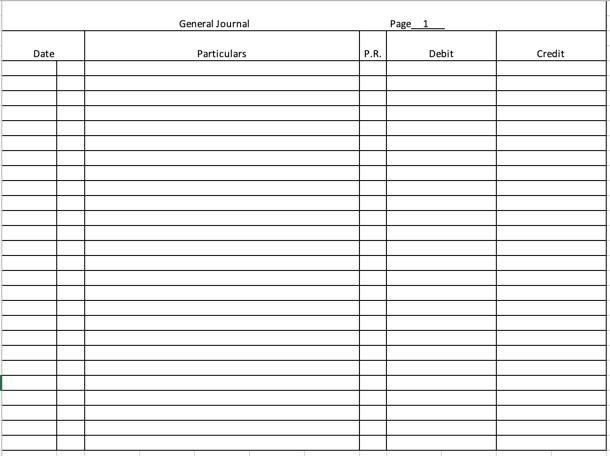

SPARTAN CYCLE REPAIR SHOP Trial Balance January 31, 2022 Debit Credit 101-Cash $ 3,200 105-Accounts receivable 6,630 115-Prepaid insurance 6,420 120-Supplies 5,240 125-Land 50,000 130-Building 90,000 131-Accumulated depreciation - building $ 11,000 135-Equipment 27,000 136-Accumulated depreciation-equipment 4,500 201-Accounts payable 6,400 206-Unearned revenue 1,950 210-Mortgage payable 102,000 301-H.Dude, capital 61,000 306-H.Dude, drawings 101,100 401-Service revenue 235,550 601-Salaries expense 115,200 605-Utilities expense 12,000 610-interest expense 5,610 S 422.400 S 422.400 1 The above is Spartan Cycle Repair Shop's trial balance at January 31, 2022, the company's fiscal year end Additional information: 1. Service revenue earned but not recorded at January 31, 2022, was $1,550 2. The 12-month insurance policy was purchased on March 1, 2021. 3. A physical count of supplies shows $580 on hand on January 31, 2022. 4. The building has an estimated useful life of 45 years. The equipment has an estimated useful life or 15 years. 5. Salaries of $1,520 are accrued and unpaid at January 31, 2022 6. The mortgage payable has a 6% interest rate. Interest is paid on the first day of each month for the previous months interest. 7. By January 31, 2022, $850 of the unearned revenue has been earned. 8. During the next fiscal year, $4,500 of the mortgage payable is to be paid. Instructions (a) Prepare the adjusting entries. (10-15 minutes) (6) Prepare an adjusted trial balance. (15 minutes) (c) Prepare an income statement statement of owner's equity, and classified balance sheet. The owner, Henry Dude, invested $5,000 cash in the business on November 17, 2021. (15-20 minutes) (d) Prepare the closing entries. (5 minutes) General Journal Page_1 Date P.R. Credit Debit 4,280.00 Jan Particulars 31 Insurance expenses Prepaid Insurance (to record insurance expired) (6420 X 8/12) 4,280.00 4,660.00 31 Supplies expense Supplies expense (Recording of supplies used) (5240-580) 4,660.00 3,800.00 31 Deprecitaion expense Accumulated depreciation-building Accumulated depreciation-Equipment (to record depreciation) (original cost/estimated lifetime) 2,000.00 1,800.00 510.00 31 Interest expense (102000 X 6XX1/12) Interent payable (to record interest accrued on mortgage) 510.00 850.00 31 Unearned revenue Service revenue (to record revenue earned) 850.00 31 No entry requied Spartan Cycle Repair Shop Adjusted Trial Balance January 31, 2022 Acct # Credit Debit $3200 6630 4280 4660 50000 90000 2000 27000 Account Cash Accounts recevable Prepaid insurance Supplies Land Building Accumulated depreciation-building Equipment Accumulated depreciation equipment Accounts payable Uneared revenue Interest payable Mortgage payable H. Dude, Capital H. Dude, Drawings Service revenue Salaries expense Utilities expense Interest expense Insurance expense Supplies expense Depreciation expense 1800 6400 1950 510 102000 61000 101100 235550 115200 12000 510 4280 4660 3800 $427320 S411210 Not Balanced Who? Income Statement When? Revenue Total Revenue Expenses Total Expenses Net Income $ Who? Statement of Owner's Equity When? Who? Classified Balance Sheet When? Assets Total Assets Liabilities and Owner's Equity Liabilities $ S Owner's Equity 0 0 Total Liabilities and Owner's Equity $ Balanced General Journal Page_1 Date Particulars P.R. Debit Credit