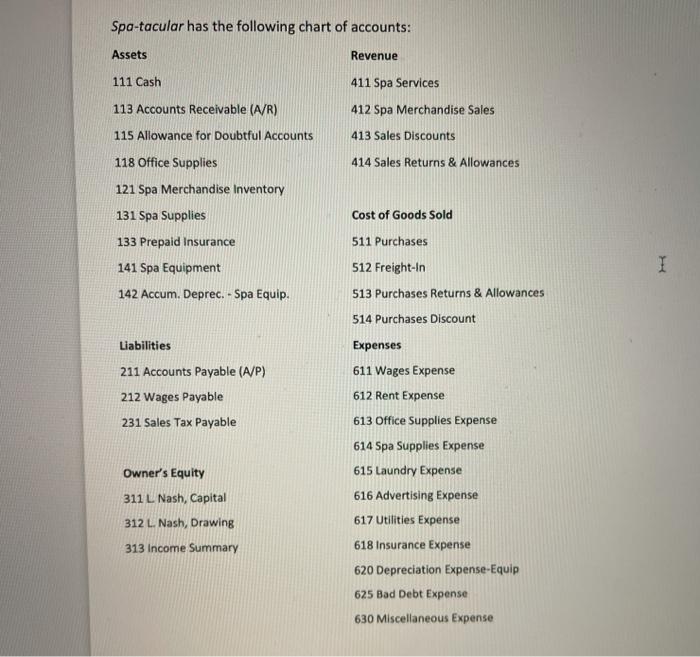

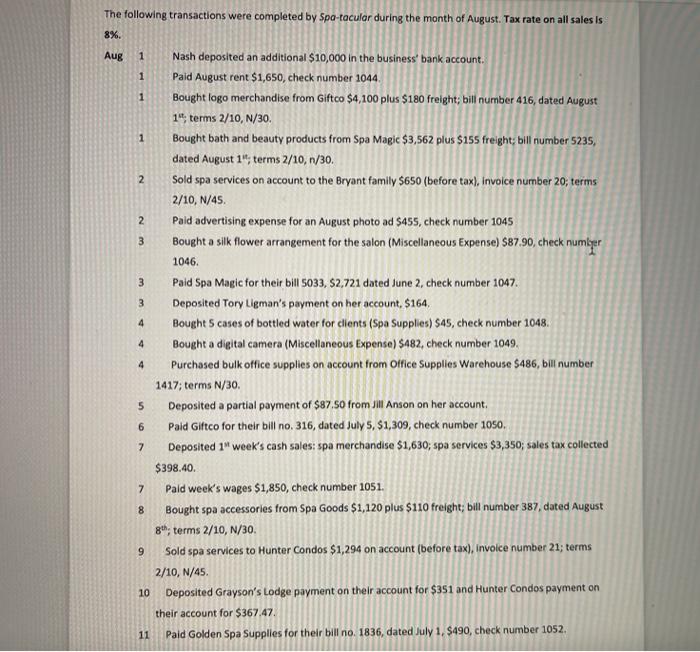

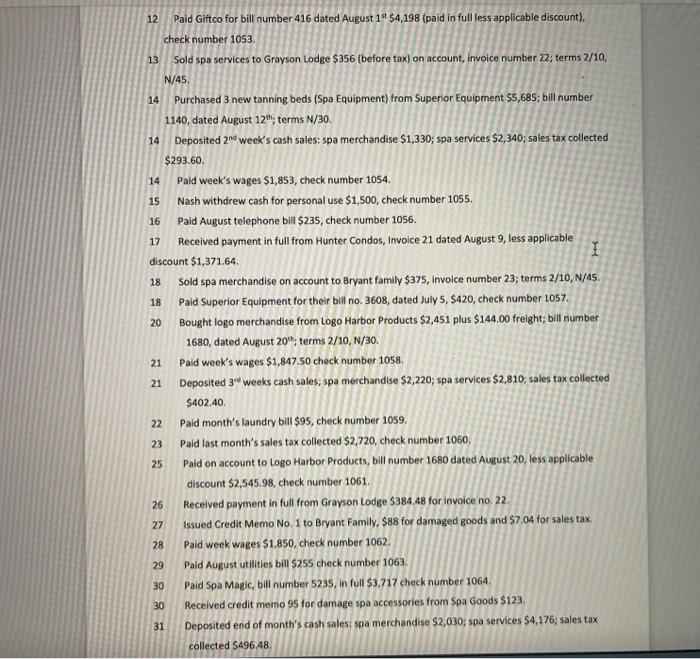

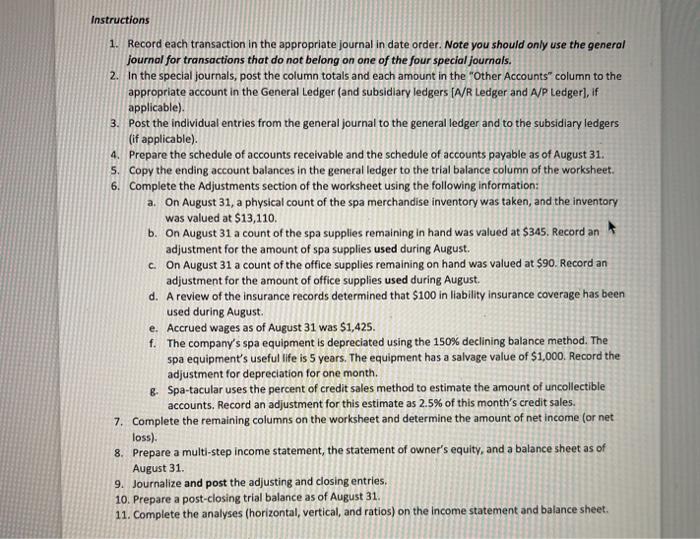

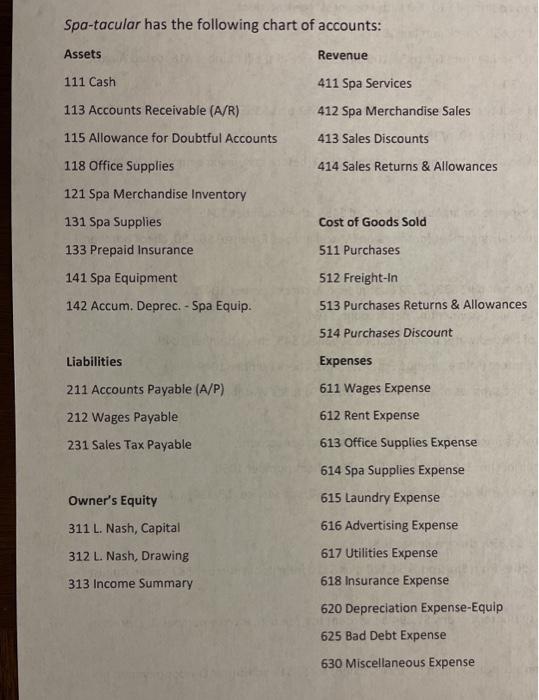

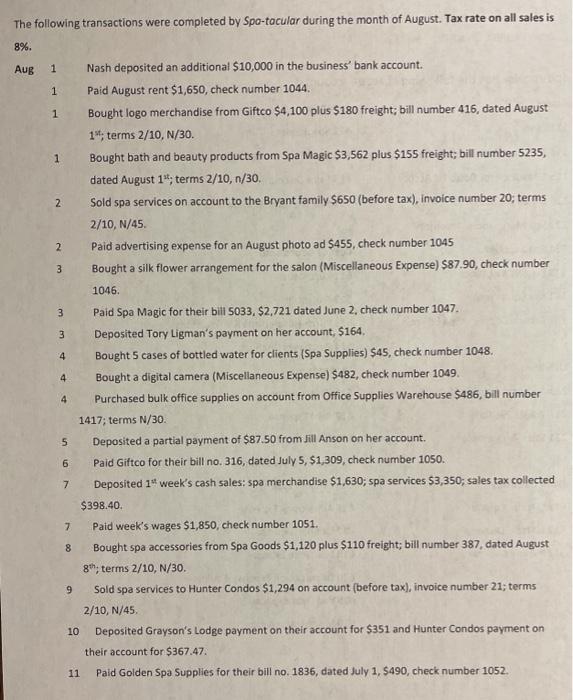

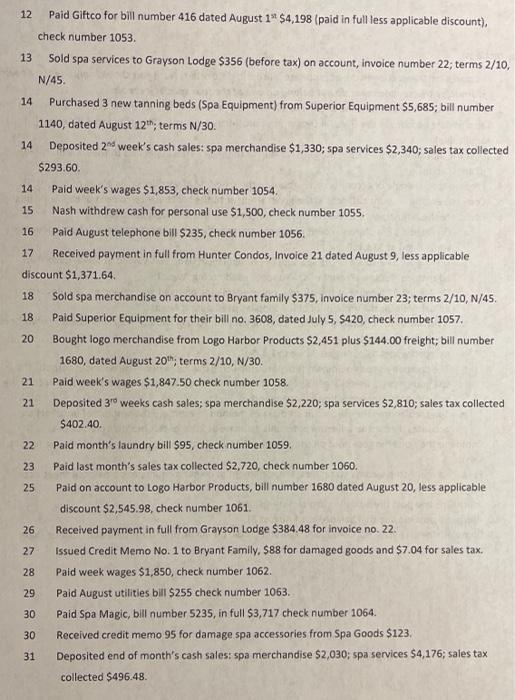

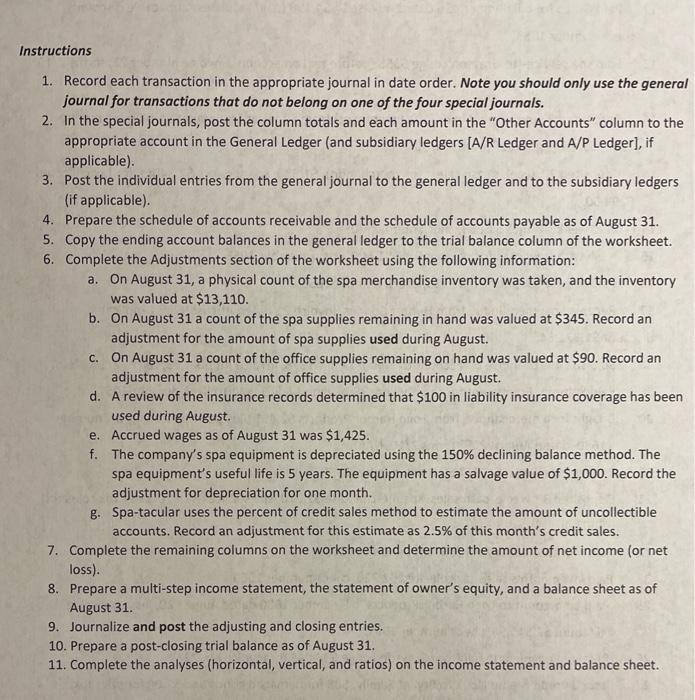

Spa-tacular has the following chart of accounts: Assets Revenue 111 Cash 113 Accounts Receivable (A/R) 411 Spa Services 412 Spa Merchandise Sales 413 Sales Discounts 414 Sales Returns & Allowances 115 Allowance for Doubtful Accounts 118 Office Supplies Cost of Goods Sold 121 Spa Merchandise Inventory 131 Spa Supplies 133 Prepaid Insurance 141 Spa Equipment 142 Accum. Deprec. - Spa Equip. I 511 Purchases 512 Freight-in 513 Purchases Returns & Allowances 514 Purchases Discount Expenses 611 Wages Expense Liabilities 211 Accounts Payable (A/P) 212 Wages Payable 231 Sales Tax Payable 612 Rent Expense Owner's Equity 311 L Nash, Capital 312 L. Nash, Drawing 313 Income Summary 613 Office Supplies Expense 614 Spa Supplies Expense 615 Laundry Expense 616 Advertising Expense 617 Utilities Expense 618 Insurance Expense 620 Depreciation Expense-Equip 625 Bad Debt Expense 630 Miscellaneous Expense The following transactions were completed by Spa-tacular during the month of August. Tax rate on all sales is 8%. Aug 1 1 1 1 2 2 3 3 3 4 4 Nash deposited an additional $10,000 in the business' bank account. Paid August rent $1,650, check number 1044 Bought logo merchandise from Giftco $4,100 plus $180 freight; bill number 416, dated August 14, terms 2/10, N/30. Bought bath and beauty products from Spa Magic $3,562 plus $155 freight; bill number 5235, dated August 1" terms 2/10, 1/30. Sold spa services on account to the Bryant family $650 (before tax), invoice number 20; terms 2/10, N/45. Paid advertising expense for an August photo ad $455, check number 1045 Bought a silk flower arrangement for the salon (Miscellaneous Expense) $87.90, check number 1046. Paid Spa Magic for their bill 5033, $2,721 dated June 2, check number 1047 Deposited Tory Ligman's payment on her account. $164, Bought 5 cases of bottled water for clients (Spa Supplies) $45, check number 1048. Bought a digital camera (Miscellaneous Expense) S482, check number 1049, Purchased bulk office supplies on account from Office Supplies Warehouse $486, bill number 1417; terms N/30 Deposited a partial payment of $87.50 from Jill Anson on her account. Paid Giftco for their bill no. 316, dated July 5, $1,309, check number 1050, Deposited 1" week's cash sales: spa merchandise $1,630; spa services $3,350; sales tax collected $398.40 Pald week's wages $1,850, check number 1051 Bought spa accessories from Spa Goods $1,120 plus $110 freight; bill number 387, dated August 8th; terms 2/10, N/30. Sold spa services to Hunter Condos $1,294 on account (before tax), invoice number 21; terms 2/10, N/45 Deposited Grayson's Lodge payment on their account for $351 and Hunter Condos payment on their account for $367.47. Paid Golden Spa Supplies for their bill no. 1836, dated July 1, $490, check number 1052. 4 5 6 7 7 8 9 10 11 12 13 14 15 Paid Giftoo for bill number 416 dated August 1954,198 (paid in full less applicable discount), check number 1053 Sold spa services to Grayson Lodge $356 (before tax) on account, invoice number 22, terms 2/10, N/45 14 Purchased 3 new tanning beds (Spa Equipment) from Superior Equipment $5,685; bill number 1140, dated August 12"; terms N/30. Deposited 2nd week's cash sales: spa merchandise $1,330; spa services $2,340; sales tax collected $293.60 14 Paid week's wages $1,853, check number 1054. Nash withdrew cash for personal use $1,500, check number 1055. 16 Paid August telephone bill $235, check number 1056. 17 Received payment in full from Hunter Condos, Invoice 21 dated August 9, less applicable discount $1,371.64. I 18 Sold spa merchandise on account to Bryant family $375, invoice number 23; terms 2/10, N/45. 18 Paid Superior Equipment for their bill no. 3608, dated July 5, $420, check number 1057. 20 Bought logo merchandise from Logo Harbor Products $2,451 plus $144.00 freight; bill number 1680, dated August 20"; terms 2/10, N/30. 21 Pald week's wages $1,847.50 check number 1058. Deposited 3 weeks cash sales, spa merchandise $2,220; spa services $2,810, sales tax collected $402.40. 22 Paid month's laundry bill $95, check number 1059. 23 Pald last month's sales tax collected $2,720, check number 1060, 25 Paid on account to Logo Harbor Products, bill number 1680 dated August 20, less applicable discount $2,545.98, check number 1061 26 Received payment in full from Grayson Lodge $384.48 for invoice no. 22. 27 Issued Credit Memo No. 1 to Bryant Family, $88 for damaged goods and $7.04 for sales tax. 28 Pald week wages $1,850, check number 1062 29 Pald August utilities bill $255 check number 1063 30 Paid Spa Magic, bill number 5235, in full $3,717 check number 1064 Received credit memo 95 for damage spa accessories from Spa Goods $123 31 Deposited end of month's cash sales: spa merchandise $2,030, spa services $4,176; sales tax collected S49648 21 30 Instructions 1. Record each transaction in the appropriate journal in date order. Note you should only use the general journal for transactions that do not belong on one of the four special journals. 2. In the special journals, post the column totals and each amount in the "Other Accounts" column to the appropriate account in the General Ledger (and subsidiary ledgers (A/R Ledger and A/P Ledger), If applicable) 3. Post the individual entries from the general journal to the general ledger and to the subsidiary ledgers (if applicable) 4. Prepare the schedule of accounts receivable and the schedule of accounts payable as of August 31. 5. Copy the ending account balances in the general ledger to the trial balance column of the worksheet. 6. Complete the Adjustments section of the worksheet using the following information: a. On August 31, a physical count of the spa merchandise inventory was taken, and the inventory was valued at $13,110. b. On August 31 a count of the spa supplies remaining in hand was valued at $345. Record an adjustment for the amount of spa supplies used during August. c. On August 31 a count of the office supplies remaining on hand was valued at $90. Record an adjustment for the amount of office supplies used during August. d. A review of the insurance records determined that $100 in liability insurance coverage has been used during August e. Accrued wages as of August 31 was $1,425. f. The company's spa equipment is depreciated using the 150% declining balance method. The spa equipment's useful life is 5 years. The equipment has a salvage value of $1,000. Record the adjustment for depreciation for one month. & Spa-tacular uses the percent of credit sales method to estimate the amount of uncollectible accounts. Record an adjustment for this estimate as 2.5% of this month's credit sales. 7. Complete the remaining columns on the worksheet and determine the amount of net income (or net loss). 8. Prepare a multi-step income statement, the statement of owner's equity, and a balance sheet as of August 31. 9. Journalize and post the adjusting and closing entries. 10. Prepare a post-closing trial balance as of August 31. 11. Complete the analyses (horizontal, vertical, and ratios) on the income statement and balance sheet. Spa-tacular has the following chart of accounts: Assets Revenue 111 Cash 411 Spa Services 113 Accounts Receivable (A/R) 412 Spa Merchandise Sales 115 Allowance for Doubtful Accounts 413 Sales Discounts 118 Office Supplies 414 Sales Returns & Allowances 121 Spa Merchandise Inventory 131 Spa Supplies Cost of Goods Sold 511 Purchases 133 Prepaid Insurance 141 Spa Equipment 142 Accum. Deprec. - Spa Equip. 512 Freight-In 513 Purchases Returns & Allowances 514 Purchases Discount Liabilities Expenses 611 Wages Expense 211 Accounts Payable (A/P) 212 Wages Payable 612 Rent Expense 231 Sales Tax Payable 613 Office Supplies Expense 614 Spa Supplies Expense Owner's Equity 615 Laundry Expense 616 Advertising Expense 311 L. Nash, Capital 312 L. Nash, Drawing 617 Utilities Expense 313 Income Summary 618 Insurance Expense 620 Depreciation Expense-Equip 625 Bad Debt Expense 630 Miscellaneous Expense The following transactions were completed by Spa-tacular during the month of August. Tax rate on all sales is 8%. Aug 1 Nash deposited an additional $10,000 in the business' bank account. 1 Paid August rent $1,650, check number 1044 1 Bought logo merchandise from Giftco $4,100 plus $180 freight; bill number 416, dated August 1; terms 2/10, N/30. 1 Bought bath and beauty products from Spa Magic $3,562 plus $155 freight; bill number 5235, dated August 14, terms 2/10,n/30 2 Sold spa services on account to the Bryant family $650 (before tax), invoice number 20; terms 2/10, N/45. 2 Paid advertising expense for an August photo ad $455, check number 1045 3 Bought a silk flower arrangement for the salon (Miscellaneous Expense) $87.90, check number 1046 3 Paid Spa Magic for their bill 5033. $2,721 dated June 2, check number 1047. 3 Deposited Tory Ligman's payment on her account, $164. Bought 5 cases of bottled water for clients (Spa Supplies) $45, check number 1048. 4 Bought a digital camera (Miscellaneous Expense) $482, check number 1049. 4 Purchased bulk office supplies on account from Office Supplies Warehouse $486, bill number 1417; terms N/30 5 Deposited a partial payment of $87.50 from Fill Anson on her account. Paid Giftco for their bill no. 316, dated July 5, $1,309, check number 1050. 7 Deposited 1 week's cash sales: spa merchandise $1,630, spa services $3,350, sales tax collected $398.40 Paid week's wages $1,850, check number 1051, 8 Bought spa accessories from Spa Goods $1,120 plus $110 freight; bill number 387, dated August 8th; terms 2/10, N/30. 9 Sold spa services to Hunter Condos $1,294 on account (before tax), invoice number 21; terms 2/10, N/45 10 Deposited Grayson's Lodge payment on their account for $351 and Hunter Condos payment on their account for $367.47. 4 6 7 11 Paid Golden Spa Supplies for their bill no. 1836, dated July 1, $490, check number 1052 12 Paid Giftco for bill number 416 dated August 19 $4,198 (paid in full less applicable discount), check number 1053. 13 Sold spa services to Grayson Lodge $356 (before tax) on account, invoice number 22; terms 2/10, N/45 14 Purchased 3 new tanning beds (Spa Equipment) from Superior Equipment $5,685; bill number 1140, dated August 12"; terms N/30. 14 Deposited 2nd week's cash sales: spa merchandise $1,330; spa services $2,340; sales tax collected $293.60 14 Paid week's wages $1,853, check number 1054 15 Nash withdrew cash for personal use $1,500, check number 1055. 16 Paid August telephone bill $235, check number 1056 17 Received payment in full from Hunter Condos, Invoice 21 dated August 9, less applicable discount $1,371.64. 18 Sold spa merchandise on account to Bryant family $375, Invoice number 23; terms 2/10, N/45. 18 Paid Superior Equipment for their bill no. 3608, dated July 5, 5420, check number 1057. 20 Bought logo merchandise from Logo Harbor Products $2,451 plus $144.00 freight; bill number 1680, dated August 20th; terms 2/10, N/30. 21 Paid week's wages $1,847.50 check number 1058. 21 Deposited 3 weeks cash sales; spa merchandise $2,220; spa services $2,810; sales tax collected $402.40. 22 Paid month's laundry bill $95, check number 1059. 23 Paid last month's sales tax collected $2,720, check number 1060. 25 Pald on account to Logo Harbor Products, bill number 1680 dated August 20, less applicable discount $2,545.98, check number 1061. 26 Received payment in full from Grayson Lodge $384.48 for invoice no. 22. 27 Issued Credit Memo No. 1 to Bryant Family, $88 for damaged goods and $7.04 for sales tax. 28 Paid week wages $1,850, check number 1062. 29 Paid August utilities bill $255 check number 1063 30 Paid Spa Magic, bill number 5235, in full $3,717 check number 1064. 30 Received credit memo 95 for damage spa accessories from Spa Goods $123 31 Deposited end of month's cash sales: spa merchandise $2,030; spa services $4,176; sales tax collected $496.48. Instructions 1. Record each transaction in the appropriate journal in date order. Note you should only use the general journal for transactions that do not belong on one of the four special journals. 2. In the special journals, post the column totals and each amount in the "Other Accounts" column to the appropriate account in the General Ledger (and subsidiary ledgers (A/R Ledger and A/P Ledger], if applicable) 3. Post the individual entries from the general journal to the general ledger and to the subsidiary ledgers (if applicable). 4. Prepare the schedule of accounts receivable and the schedule of accounts payable as of August 31. 5. Copy the ending account balances in the general ledger to the trial balance column of the worksheet. 6. Complete the Adjustments section of the worksheet using the following information: a. On August 31, a physical count of the spa merchandise inventory was taken, and the inventory was valued at $13,110. b. On August 31 a count of the spa supplies remaining in hand was valued at $345. Record an adjustment for the amount of spa supplies used during August. c. On August 31 a count of the office supplies remaining on hand was valued at $90. Record an adjustment for the amount of office supplies used during August. d. A review of the insurance records determined that $100 in liability insurance coverage has been used during August. e. Accrued wages as of August 31 was $1,425. f. The company's spa equipment is depreciated using the 150% declining balance method. The spa equipment's useful life is 5 years. The equipment has a salvage value of $1,000. Record the adjustment for depreciation for one month. 8. Spa-tacular uses the percent of credit sales method to estimate the amount of uncollectible accounts. Record an adjustment for this estimate as 2.5% of this month's credit sales. 7. Complete the remaining columns on the worksheet and determine the amount of net income (or net loss). 8. Prepare a multi-step income statement, the statement of owner's equity, and a balance sheet as of August 31. 9. Journalize and post the adjusting and closing entries. 10. Prepare a post-closing trial balance as of August 31. 11. Complete the analyses (horizontal, vertical, and ratios) on the income statement and balance sheet. Spa-tacular has the following chart of accounts: Assets Revenue 111 Cash 113 Accounts Receivable (A/R) 411 Spa Services 412 Spa Merchandise Sales 413 Sales Discounts 414 Sales Returns & Allowances 115 Allowance for Doubtful Accounts 118 Office Supplies Cost of Goods Sold 121 Spa Merchandise Inventory 131 Spa Supplies 133 Prepaid Insurance 141 Spa Equipment 142 Accum. Deprec. - Spa Equip. I 511 Purchases 512 Freight-in 513 Purchases Returns & Allowances 514 Purchases Discount Expenses 611 Wages Expense Liabilities 211 Accounts Payable (A/P) 212 Wages Payable 231 Sales Tax Payable 612 Rent Expense Owner's Equity 311 L Nash, Capital 312 L. Nash, Drawing 313 Income Summary 613 Office Supplies Expense 614 Spa Supplies Expense 615 Laundry Expense 616 Advertising Expense 617 Utilities Expense 618 Insurance Expense 620 Depreciation Expense-Equip 625 Bad Debt Expense 630 Miscellaneous Expense The following transactions were completed by Spa-tacular during the month of August. Tax rate on all sales is 8%. Aug 1 1 1 1 2 2 3 3 3 4 4 Nash deposited an additional $10,000 in the business' bank account. Paid August rent $1,650, check number 1044 Bought logo merchandise from Giftco $4,100 plus $180 freight; bill number 416, dated August 14, terms 2/10, N/30. Bought bath and beauty products from Spa Magic $3,562 plus $155 freight; bill number 5235, dated August 1" terms 2/10, 1/30. Sold spa services on account to the Bryant family $650 (before tax), invoice number 20; terms 2/10, N/45. Paid advertising expense for an August photo ad $455, check number 1045 Bought a silk flower arrangement for the salon (Miscellaneous Expense) $87.90, check number 1046. Paid Spa Magic for their bill 5033, $2,721 dated June 2, check number 1047 Deposited Tory Ligman's payment on her account. $164, Bought 5 cases of bottled water for clients (Spa Supplies) $45, check number 1048. Bought a digital camera (Miscellaneous Expense) S482, check number 1049, Purchased bulk office supplies on account from Office Supplies Warehouse $486, bill number 1417; terms N/30 Deposited a partial payment of $87.50 from Jill Anson on her account. Paid Giftco for their bill no. 316, dated July 5, $1,309, check number 1050, Deposited 1" week's cash sales: spa merchandise $1,630; spa services $3,350; sales tax collected $398.40 Pald week's wages $1,850, check number 1051 Bought spa accessories from Spa Goods $1,120 plus $110 freight; bill number 387, dated August 8th; terms 2/10, N/30. Sold spa services to Hunter Condos $1,294 on account (before tax), invoice number 21; terms 2/10, N/45 Deposited Grayson's Lodge payment on their account for $351 and Hunter Condos payment on their account for $367.47. Paid Golden Spa Supplies for their bill no. 1836, dated July 1, $490, check number 1052. 4 5 6 7 7 8 9 10 11 12 13 14 15 Paid Giftoo for bill number 416 dated August 1954,198 (paid in full less applicable discount), check number 1053 Sold spa services to Grayson Lodge $356 (before tax) on account, invoice number 22, terms 2/10, N/45 14 Purchased 3 new tanning beds (Spa Equipment) from Superior Equipment $5,685; bill number 1140, dated August 12"; terms N/30. Deposited 2nd week's cash sales: spa merchandise $1,330; spa services $2,340; sales tax collected $293.60 14 Paid week's wages $1,853, check number 1054. Nash withdrew cash for personal use $1,500, check number 1055. 16 Paid August telephone bill $235, check number 1056. 17 Received payment in full from Hunter Condos, Invoice 21 dated August 9, less applicable discount $1,371.64. I 18 Sold spa merchandise on account to Bryant family $375, invoice number 23; terms 2/10, N/45. 18 Paid Superior Equipment for their bill no. 3608, dated July 5, $420, check number 1057. 20 Bought logo merchandise from Logo Harbor Products $2,451 plus $144.00 freight; bill number 1680, dated August 20"; terms 2/10, N/30. 21 Pald week's wages $1,847.50 check number 1058. Deposited 3 weeks cash sales, spa merchandise $2,220; spa services $2,810, sales tax collected $402.40. 22 Paid month's laundry bill $95, check number 1059. 23 Pald last month's sales tax collected $2,720, check number 1060, 25 Paid on account to Logo Harbor Products, bill number 1680 dated August 20, less applicable discount $2,545.98, check number 1061 26 Received payment in full from Grayson Lodge $384.48 for invoice no. 22. 27 Issued Credit Memo No. 1 to Bryant Family, $88 for damaged goods and $7.04 for sales tax. 28 Pald week wages $1,850, check number 1062 29 Pald August utilities bill $255 check number 1063 30 Paid Spa Magic, bill number 5235, in full $3,717 check number 1064 Received credit memo 95 for damage spa accessories from Spa Goods $123 31 Deposited end of month's cash sales: spa merchandise $2,030, spa services $4,176; sales tax collected S49648 21 30 Instructions 1. Record each transaction in the appropriate journal in date order. Note you should only use the general journal for transactions that do not belong on one of the four special journals. 2. In the special journals, post the column totals and each amount in the "Other Accounts" column to the appropriate account in the General Ledger (and subsidiary ledgers (A/R Ledger and A/P Ledger), If applicable) 3. Post the individual entries from the general journal to the general ledger and to the subsidiary ledgers (if applicable) 4. Prepare the schedule of accounts receivable and the schedule of accounts payable as of August 31. 5. Copy the ending account balances in the general ledger to the trial balance column of the worksheet. 6. Complete the Adjustments section of the worksheet using the following information: a. On August 31, a physical count of the spa merchandise inventory was taken, and the inventory was valued at $13,110. b. On August 31 a count of the spa supplies remaining in hand was valued at $345. Record an adjustment for the amount of spa supplies used during August. c. On August 31 a count of the office supplies remaining on hand was valued at $90. Record an adjustment for the amount of office supplies used during August. d. A review of the insurance records determined that $100 in liability insurance coverage has been used during August e. Accrued wages as of August 31 was $1,425. f. The company's spa equipment is depreciated using the 150% declining balance method. The spa equipment's useful life is 5 years. The equipment has a salvage value of $1,000. Record the adjustment for depreciation for one month. & Spa-tacular uses the percent of credit sales method to estimate the amount of uncollectible accounts. Record an adjustment for this estimate as 2.5% of this month's credit sales. 7. Complete the remaining columns on the worksheet and determine the amount of net income (or net loss). 8. Prepare a multi-step income statement, the statement of owner's equity, and a balance sheet as of August 31. 9. Journalize and post the adjusting and closing entries. 10. Prepare a post-closing trial balance as of August 31. 11. Complete the analyses (horizontal, vertical, and ratios) on the income statement and balance sheet. Spa-tacular has the following chart of accounts: Assets Revenue 111 Cash 411 Spa Services 113 Accounts Receivable (A/R) 412 Spa Merchandise Sales 115 Allowance for Doubtful Accounts 413 Sales Discounts 118 Office Supplies 414 Sales Returns & Allowances 121 Spa Merchandise Inventory 131 Spa Supplies Cost of Goods Sold 511 Purchases 133 Prepaid Insurance 141 Spa Equipment 142 Accum. Deprec. - Spa Equip. 512 Freight-In 513 Purchases Returns & Allowances 514 Purchases Discount Liabilities Expenses 611 Wages Expense 211 Accounts Payable (A/P) 212 Wages Payable 612 Rent Expense 231 Sales Tax Payable 613 Office Supplies Expense 614 Spa Supplies Expense Owner's Equity 615 Laundry Expense 616 Advertising Expense 311 L. Nash, Capital 312 L. Nash, Drawing 617 Utilities Expense 313 Income Summary 618 Insurance Expense 620 Depreciation Expense-Equip 625 Bad Debt Expense 630 Miscellaneous Expense The following transactions were completed by Spa-tacular during the month of August. Tax rate on all sales is 8%. Aug 1 Nash deposited an additional $10,000 in the business' bank account. 1 Paid August rent $1,650, check number 1044 1 Bought logo merchandise from Giftco $4,100 plus $180 freight; bill number 416, dated August 1; terms 2/10, N/30. 1 Bought bath and beauty products from Spa Magic $3,562 plus $155 freight; bill number 5235, dated August 14, terms 2/10,n/30 2 Sold spa services on account to the Bryant family $650 (before tax), invoice number 20; terms 2/10, N/45. 2 Paid advertising expense for an August photo ad $455, check number 1045 3 Bought a silk flower arrangement for the salon (Miscellaneous Expense) $87.90, check number 1046 3 Paid Spa Magic for their bill 5033. $2,721 dated June 2, check number 1047. 3 Deposited Tory Ligman's payment on her account, $164. Bought 5 cases of bottled water for clients (Spa Supplies) $45, check number 1048. 4 Bought a digital camera (Miscellaneous Expense) $482, check number 1049. 4 Purchased bulk office supplies on account from Office Supplies Warehouse $486, bill number 1417; terms N/30 5 Deposited a partial payment of $87.50 from Fill Anson on her account. Paid Giftco for their bill no. 316, dated July 5, $1,309, check number 1050. 7 Deposited 1 week's cash sales: spa merchandise $1,630, spa services $3,350, sales tax collected $398.40 Paid week's wages $1,850, check number 1051, 8 Bought spa accessories from Spa Goods $1,120 plus $110 freight; bill number 387, dated August 8th; terms 2/10, N/30. 9 Sold spa services to Hunter Condos $1,294 on account (before tax), invoice number 21; terms 2/10, N/45 10 Deposited Grayson's Lodge payment on their account for $351 and Hunter Condos payment on their account for $367.47. 4 6 7 11 Paid Golden Spa Supplies for their bill no. 1836, dated July 1, $490, check number 1052 12 Paid Giftco for bill number 416 dated August 19 $4,198 (paid in full less applicable discount), check number 1053. 13 Sold spa services to Grayson Lodge $356 (before tax) on account, invoice number 22; terms 2/10, N/45 14 Purchased 3 new tanning beds (Spa Equipment) from Superior Equipment $5,685; bill number 1140, dated August 12"; terms N/30. 14 Deposited 2nd week's cash sales: spa merchandise $1,330; spa services $2,340; sales tax collected $293.60 14 Paid week's wages $1,853, check number 1054 15 Nash withdrew cash for personal use $1,500, check number 1055. 16 Paid August telephone bill $235, check number 1056 17 Received payment in full from Hunter Condos, Invoice 21 dated August 9, less applicable discount $1,371.64. 18 Sold spa merchandise on account to Bryant family $375, Invoice number 23; terms 2/10, N/45. 18 Paid Superior Equipment for their bill no. 3608, dated July 5, 5420, check number 1057. 20 Bought logo merchandise from Logo Harbor Products $2,451 plus $144.00 freight; bill number 1680, dated August 20th; terms 2/10, N/30. 21 Paid week's wages $1,847.50 check number 1058. 21 Deposited 3 weeks cash sales; spa merchandise $2,220; spa services $2,810; sales tax collected $402.40. 22 Paid month's laundry bill $95, check number 1059. 23 Paid last month's sales tax collected $2,720, check number 1060. 25 Pald on account to Logo Harbor Products, bill number 1680 dated August 20, less applicable discount $2,545.98, check number 1061. 26 Received payment in full from Grayson Lodge $384.48 for invoice no. 22. 27 Issued Credit Memo No. 1 to Bryant Family, $88 for damaged goods and $7.04 for sales tax. 28 Paid week wages $1,850, check number 1062. 29 Paid August utilities bill $255 check number 1063 30 Paid Spa Magic, bill number 5235, in full $3,717 check number 1064. 30 Received credit memo 95 for damage spa accessories from Spa Goods $123 31 Deposited end of month's cash sales: spa merchandise $2,030; spa services $4,176; sales tax collected $496.48. Instructions 1. Record each transaction in the appropriate journal in date order. Note you should only use the general journal for transactions that do not belong on one of the four special journals. 2. In the special journals, post the column totals and each amount in the "Other Accounts" column to the appropriate account in the General Ledger (and subsidiary ledgers (A/R Ledger and A/P Ledger], if applicable) 3. Post the individual entries from the general journal to the general ledger and to the subsidiary ledgers (if applicable). 4. Prepare the schedule of accounts receivable and the schedule of accounts payable as of August 31. 5. Copy the ending account balances in the general ledger to the trial balance column of the worksheet. 6. Complete the Adjustments section of the worksheet using the following information: a. On August 31, a physical count of the spa merchandise inventory was taken, and the inventory was valued at $13,110. b. On August 31 a count of the spa supplies remaining in hand was valued at $345. Record an adjustment for the amount of spa supplies used during August. c. On August 31 a count of the office supplies remaining on hand was valued at $90. Record an adjustment for the amount of office supplies used during August. d. A review of the insurance records determined that $100 in liability insurance coverage has been used during August. e. Accrued wages as of August 31 was $1,425. f. The company's spa equipment is depreciated using the 150% declining balance method. The spa equipment's useful life is 5 years. The equipment has a salvage value of $1,000. Record the adjustment for depreciation for one month. 8. Spa-tacular uses the percent of credit sales method to estimate the amount of uncollectible accounts. Record an adjustment for this estimate as 2.5% of this month's credit sales. 7. Complete the remaining columns on the worksheet and determine the amount of net income (or net loss). 8. Prepare a multi-step income statement, the statement of owner's equity, and a balance sheet as of August 31. 9. Journalize and post the adjusting and closing entries. 10. Prepare a post-closing trial balance as of August 31. 11. Complete the analyses (horizontal, vertical, and ratios) on the income statement and balance sheet