Question

Special order analysis. Framar Inc. manufactures automation machinery according to customer specifications. The company is relatively new and has grown each year. Framar operated at

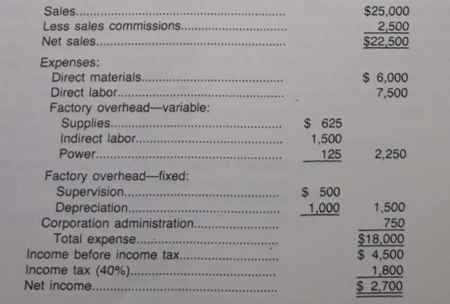

Special order analysis. Framar Inc. manufactures automation machinery according to customer specifications. The company is relatively new and has grown each year. Framar operated at about 75% of practical capacity during its most recent fiscal year ended September 30, with operating results as follows

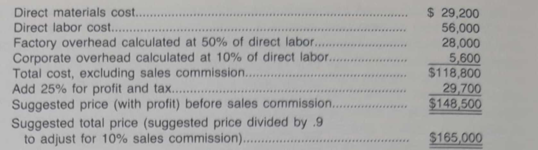

Framar management has developed a pricing formula based on current operating costs, which are expected to prevail for the next year. This formula was used in developing the following bid for APA Inc.:

Required:

(1) Compute the impact on net income if APA accepts the bid.

(2) Determine the suggested decision if APA is willing to pay only $127,000.

(3) Calculate the lowest price Framar can quote without reducing current net income.

(4) Determine the effect on the most recent fiscal years profit if all work were done at prices similar to APAs $127,000 counteroffer. (ICMA adapted)

Sales. Less sales commissions. Net sales... $25,0002,500$22,500 Expenses: Direct materials. Direct labor... Factory overhead-variable: Supplies.. Indirect labor. Power... $6,000 7,500 Factory overhead-fixed: Supervision. Depreciation... Corporation administration. Total expense. Income before income tax. Income tax (40%). Net income. \begin{tabular}{rr} $500 & \\ 1,000 & 1,500 \\ & 750 \\ \\ $,500 \\ & 1,800 \\ & $2,700 \\ \hline \end{tabular} Direct materials cost. Direct labor cost. Factory overhead calculated at 50% of direct labor. Corporate overhead calculated at 10% of direct labor. Total cost, excluding sales commission. Add 25% for profit and tax. Suggested price (with profit) before sales commission. Suggested total price (suggested price divided by .9 to adjust for 10% sales commission)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started