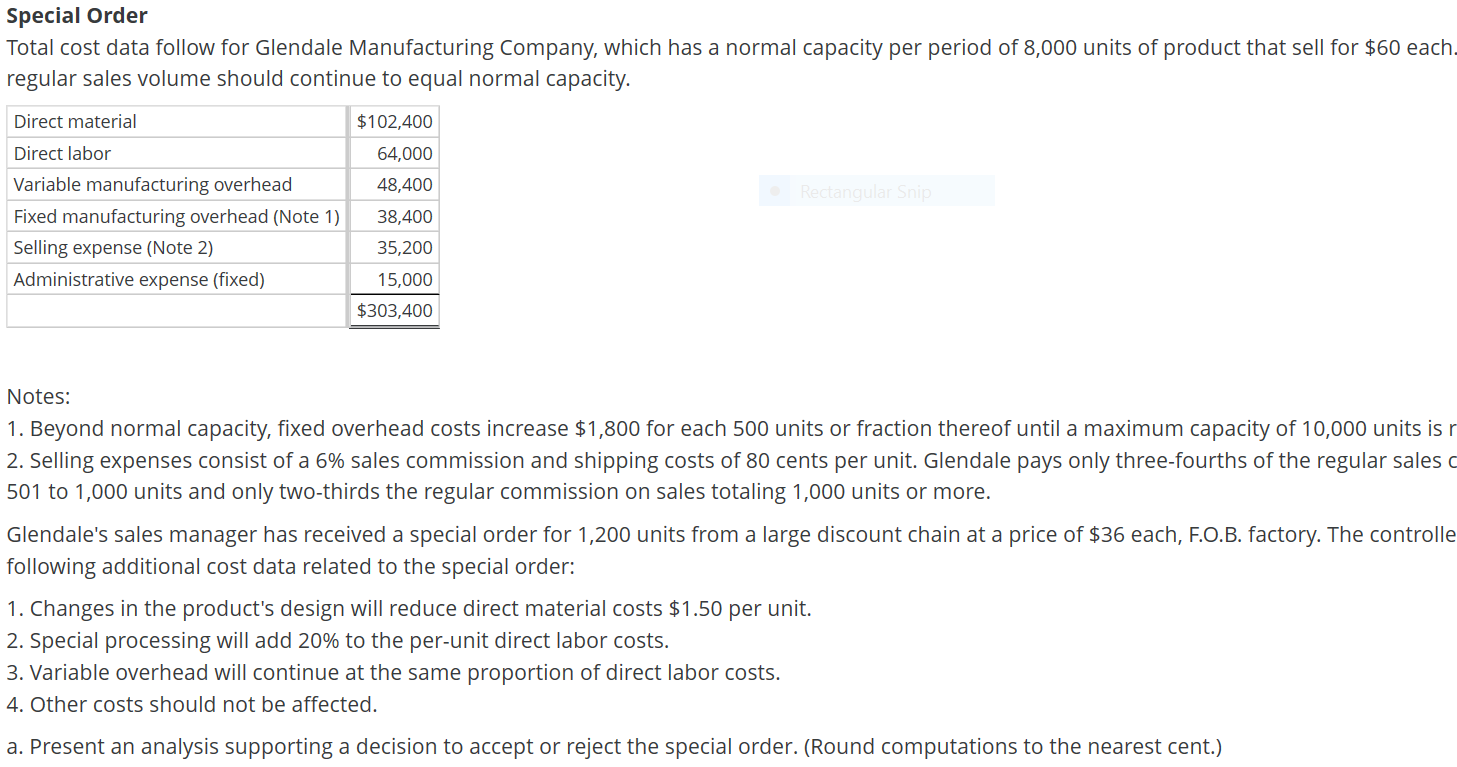

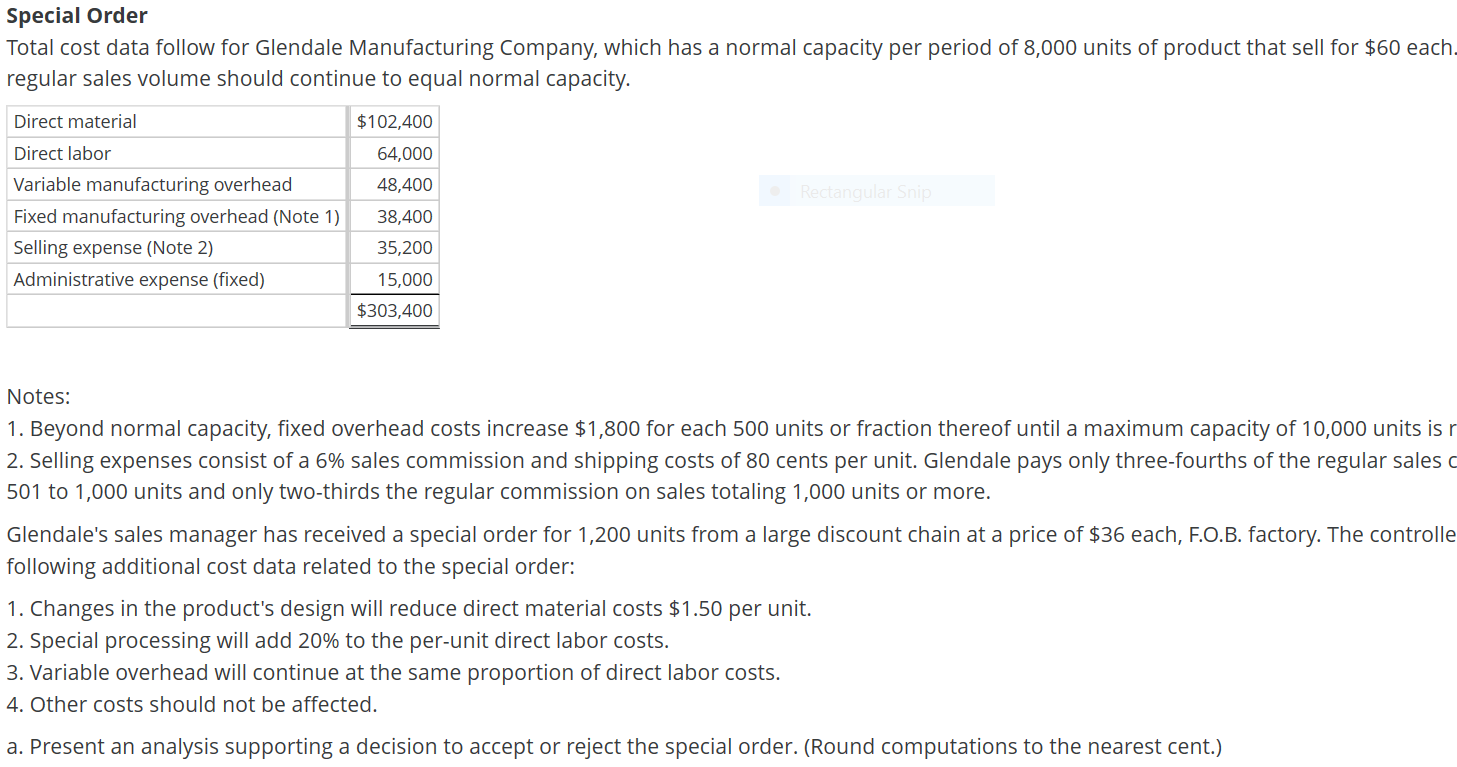

Special Order Total cost data follow for Glendale Manufacturing Company, which has a normal capacity per period of 8,000 units of product that sell for $60 each. regular sales volume should continue to equal normal capacity. Direct material $102,400 Direct labor 64,000 Rectangular Snip Variable manufacturing overhead 48,400 Fixed manufacturing overhead (Note 1) 38,400 Selling expense (Note 2) 35,200 Administrative expense (fixed) 15,000 $303,400 Notes: 1. Beyond normal capacity, fixed overhead costs increase $1,800 for each 500 units or fraction thereof until a maximum capacity of 10,000 units is r 2. Selling expenses consist of a 6% sales commission and shipping costs of 80 cents per unit. Glendale pays only three-fourths of the regular sales c 501 to 1,000 units and only two-thirds the regular commission on sales totaling 1,000 units or more. Glendale's sales manager has received a special order for 1,200 units from a large discount chain at a price of $36 each, F.O.B. factory. The controlle following additional cost data related to the special order: 1. Changes in the product's design will reduce direct material costs $1.50 per unit. 2. Special processing will add 20% to the per-unit direct labor costs 3. Variable overhead will continue at the same proportion of direct labor costs. 4. Other costs should not be affected. a. Present an analysis supporting a decision to accept or reject the special order. (Round computations to the nearest cent.) a. Present an analysis supporting a decision to accept or reject the special order. (Round computations to the nearest cent.) Differential Analysis Total Per Unit Differential revenue $ 0 Differential costs Direct material $ 0 Rectangular Snip Direct labor Variable manufacturing overhead 0 Selling: Commission 0 Shipping (F.O.B. factory terms) 0 Total variable cost 0 0 Contribution margin from special order 0 Fixed cost increment: Extra cost 0 $ Profit on special order 0 b. What is the lowest price Glendale could receive and still make a profit of $3,600 before income taxes on the special order? Round answer to two decimal places, if applicable. 0 O OC