Question

Special Tea Products (STP) has an exclusive contract with Tea Distributors. Two brands of Teas are imported, Strong and Mild and these are sold to

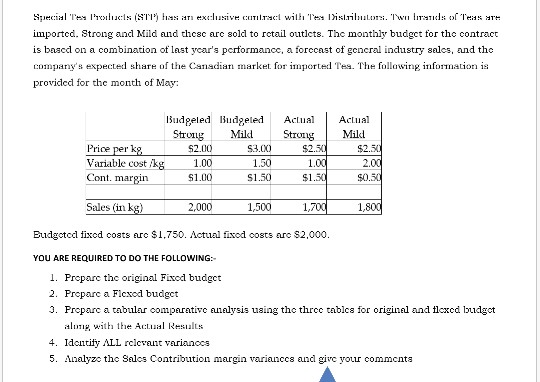

Special Tea Products (STP) has an exclusive contract with Tea Distributors. Two brands of Teas are imported, Strong and Mild and these are sold to retail outlets. The monthly budget for the contract is based on a combination of last year's performance, a forecast of general industry sales, and the company's expected share of the Canadian market for imported Tea. The following information is provided for the month of May: Budgeted Strong Budgeted Mild Actual Strong Actual Mild Price per kg $2.00 $3.00 $2.50 $2.50 Variable cost /kg 1.00 1.50 1.00 2.00 Cont. margin $1.00 $1.50 $1.50 $0.50 Sales (in kg) 2,000 1,500 1,700 1,800 Budgeted fixed costs are $1,750. Actual fixed costs are $2,000. YOU ARE REQUIRED TO DO THE FOLLOWING:- 1. Prepare the original Fixed budget 2. Prepare a Flexed budget 3. Prepare a tabular comparative analysis using the three tables for original and flexed budget along with the Actual Results 4. Identify ALL relevant variances 5. Analyze the Sales Contribution margin variances and give your comments.

Suecial Tea I'roducls (STI has a exclusive cuTlrac wilh Tea Dislaiulor, Twu iTauds of Tes ar imported. Strong and Mild and thesc are sold to rctail outlcts. The monthly budgct for the contract is bascd on a combination of last ycar's performancc, a forccast of gencral industry salcs, and the cOmpany's expected share of the Canadian market for imported Tes. The following information is provided for the month of May Actual dgeled Budgeled Strung Acual Mild Strong $2.50 Mild $2.50 Price per kg, Variable cost /kg Cont. margin $2.00 S3.00 1.00 1,50 1.00 2,00 S1,50 S1.00 S1,50 S0,30 Sales (in kg) 2,000 1,500 1,700 1,800 Eudgctcd fixod costs arc $1,750. Actual fixod costs arc $2,000 YOU ARE REQUIRED TO DO THE FOLLOWING: 1. Prcparc the original Fixcd budgct 2. Preparc a Flexod budgct 3. Preparc a tabular comparative analysis using the thrce tablcs for original and flcxcd budgct alung, with the Actl Results 4. Identify ALL rclevant varianocs 5. Analyze the Salcs Contribution margin varianccs and give vouu comments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started