Answered step by step

Verified Expert Solution

Question

1 Approved Answer

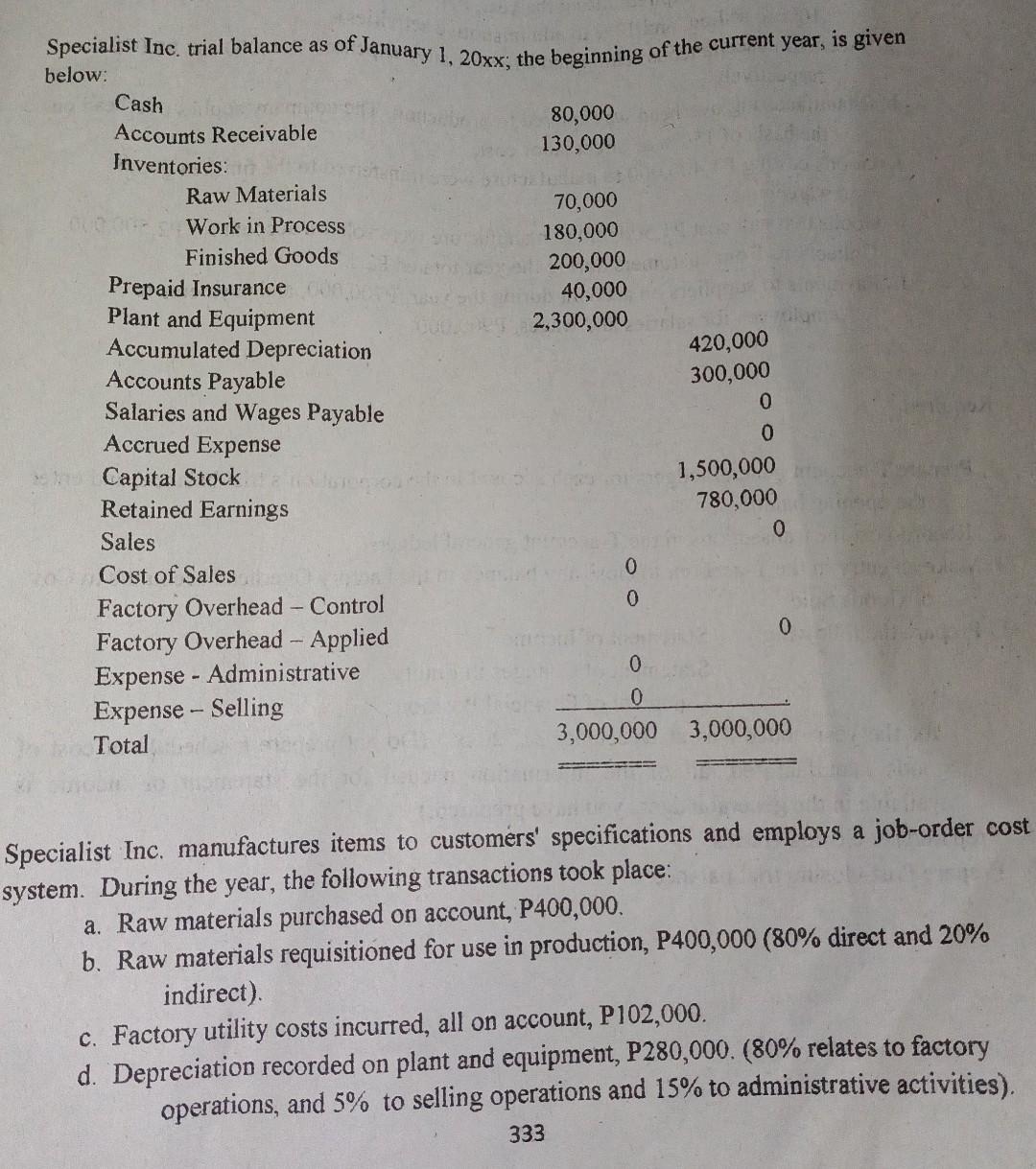

Specialist Inc. trial balance as of January 1, 20xx; the beginning of the current year, is given below: Cash Accounts Receivable Inventories: 000 00

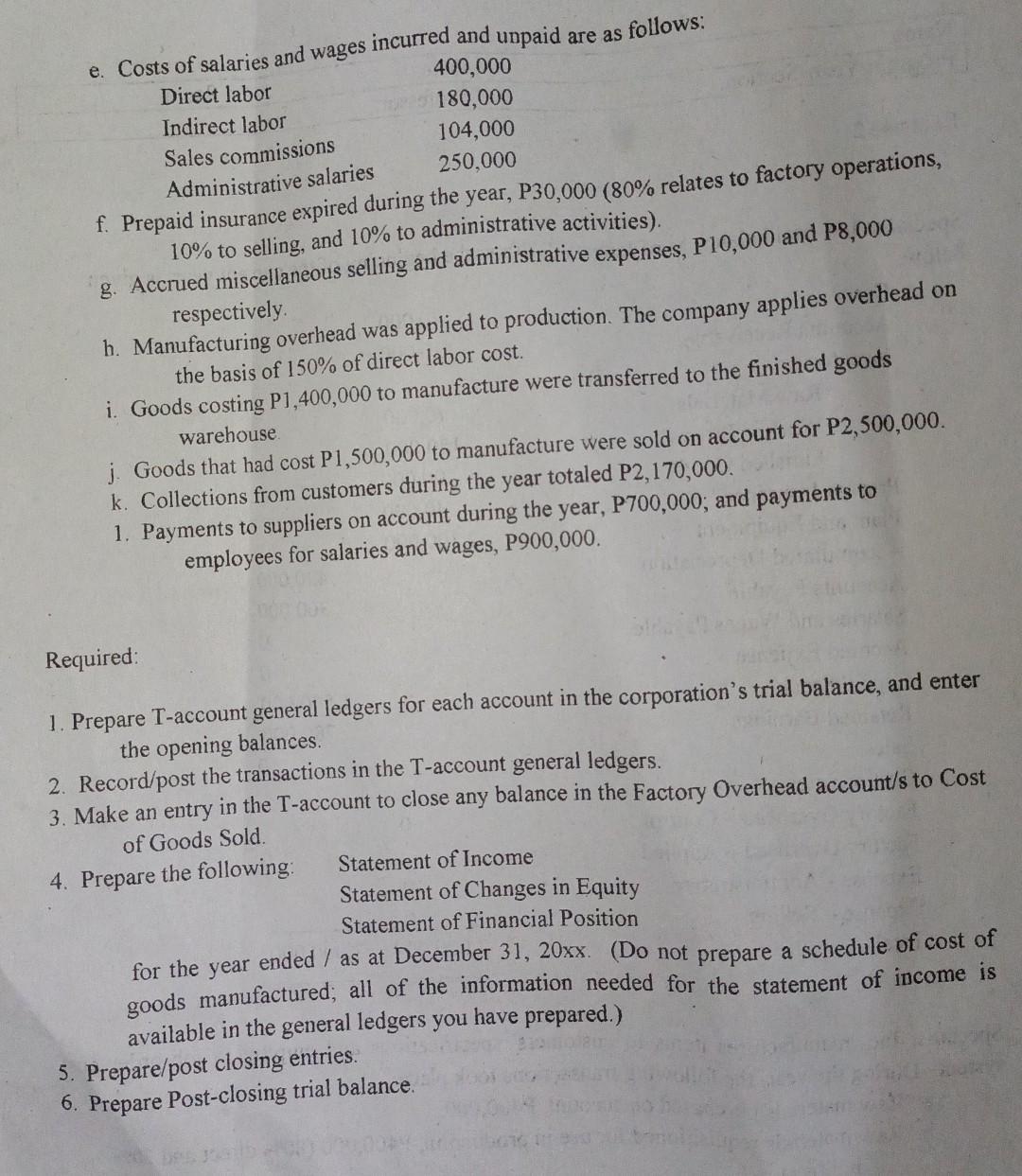

Specialist Inc. trial balance as of January 1, 20xx; the beginning of the current year, is given below: Cash Accounts Receivable Inventories: 000 00 Raw Materials Work in Process Finished Goods Prepaid Insurance Plant and Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Accrued Expense Capital Stock Retained Earnings Sales Cost of Sales Factory Overhead - Control Factory Overhead - Applied Expense - Administrative Expense - Selling Total 80,000 130,000 70,000 180,000 200,000 40,000 2,300,000 0 0 420,000 300,000 0 0 1,500,000 780,000 0 0 0 0 3,000,000 3,000,000 Specialist Inc. manufactures items to customers' specifications and employs a job-order cost system. During the year, the following transactions took place: a. Raw materials purchased on account, P400,000. b. Raw materials requisitioned for use in production, P400,000 (80% direct and 20% indirect). c. Factory utility costs incurred, all on account, P102,000. d. Depreciation recorded on plant and equipment, P280,000. (80% relates to factory operations, and 5% to selling operations and 15% to administrative activities). 333 e. Costs of salaries and wages incurred and unpaid are as follows: 400,000 Direct labor 180,000 Indirect labor 104,000 Sales commissions 250,000 Administrative salaries f. Prepaid insurance expired during the year, P30,000 (80% relates to factory operations, 10% to selling, and 10% to administrative activities). g. Accrued miscellaneous selling and administrative expenses, P10,000 and P8,000 respectively. h. Manufacturing overhead was applied to production. The company applies overhead on the basis of 150% of direct labor cost. i. Goods costing P1,400,000 to manufacture were transferred to the finished goods warehouse j. Goods that had cost P1,500,000 to manufacture were sold on account for P2,500,000. k. Collections from customers during the year totaled P2, 170,000. 1. Payments to suppliers on account during the year, P700,000; and payments to employees for salaries and wages, P900,000. Required: 1. Prepare T-account general ledgers for each account in the corporation's trial balance, and enter the opening balances. 2. Record/post the transactions in the T-account general ledgers. 3. Make an entry in the T-account to close any balance in the Factory Overhead account/s to Cost of Goods Sold. 4. Prepare the following: Statement of Income Statement of Changes in Equity Statement of Financial Position for the year ended / as at December 31, 20xx. (Do not prepare a schedule of cost of goods manufactured; all of the information needed for the statement of income is available in the general ledgers you have prepared.) 5. Prepare/post closing entries. 6. Prepare Post-closing trial balance.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Prepar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started