Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SPECIALIZED ACCOUNTING TECHNIQUES ABC Ltd. Obtained a 20 year lease of land from GHL Ltd. Effective from 1 January 2019 , for the purposes of

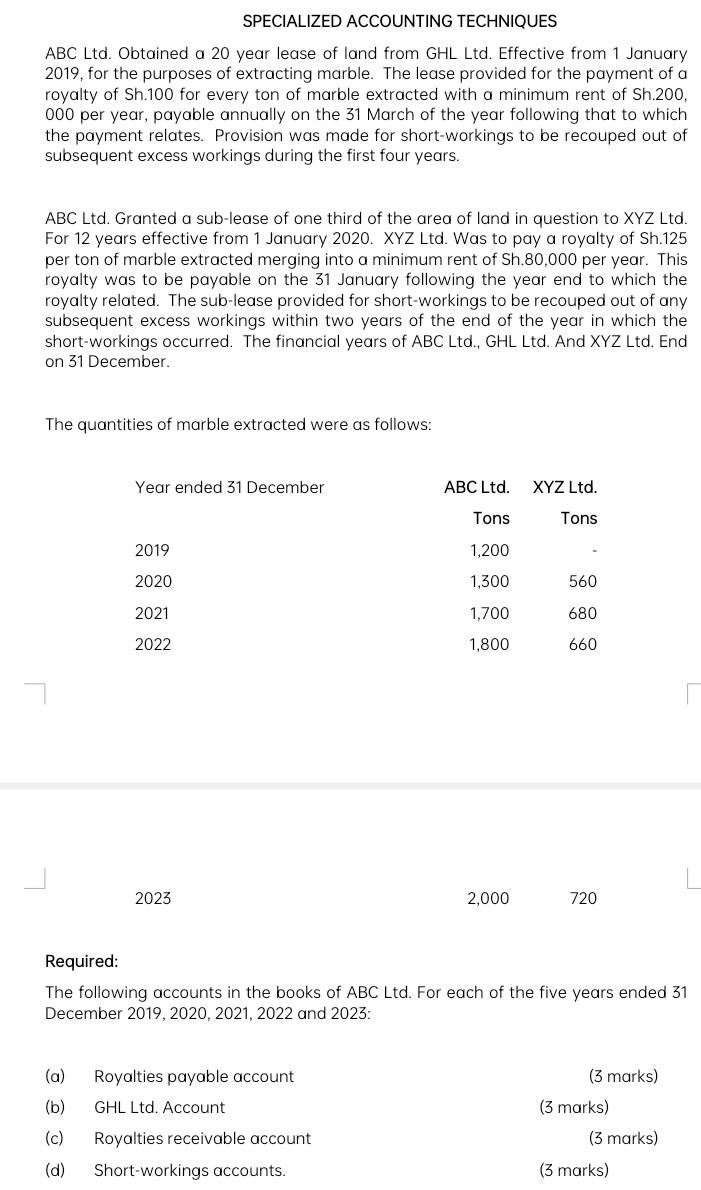

SPECIALIZED ACCOUNTING TECHNIQUES ABC Ltd. Obtained a 20 year lease of land from GHL Ltd. Effective from 1 January 2019 , for the purposes of extracting marble. The lease provided for the payment of a royalty of Sh.100 for every ton of marble extracted with a minimum rent of Sh.200, 000 per year, payable annually on the 31 March of the year following that to which the payment relates. Provision was made for short-workings to be recouped out of subsequent excess workings during the first four years. ABC Ltd. Granted a sub-lease of one third of the area of land in question to XYZLLd. For 12 years effective from 1 January 2020. XYZ Ltd. Was to pay a royalty of Sh.125 per ton of marble extracted merging into a minimum rent of Sh.80,000 per year. This royalty was to be payable on the 31 January following the year end to which the royalty related. The sub-lease provided for short-workings to be recouped out of any subsequent excess workings within two years of the end of the year in which the short-workings occurred. The financial years of ABC Ltd., GHL Ltd. And XYZ Ltd. End on 31 December. The quantities of marble extracted were as follows: 2023 2,000 720 Required: The following accounts in the books of ABC Ltd. For each of the five years ended 31 December 2019, 2020, 2021, 2022 and 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started