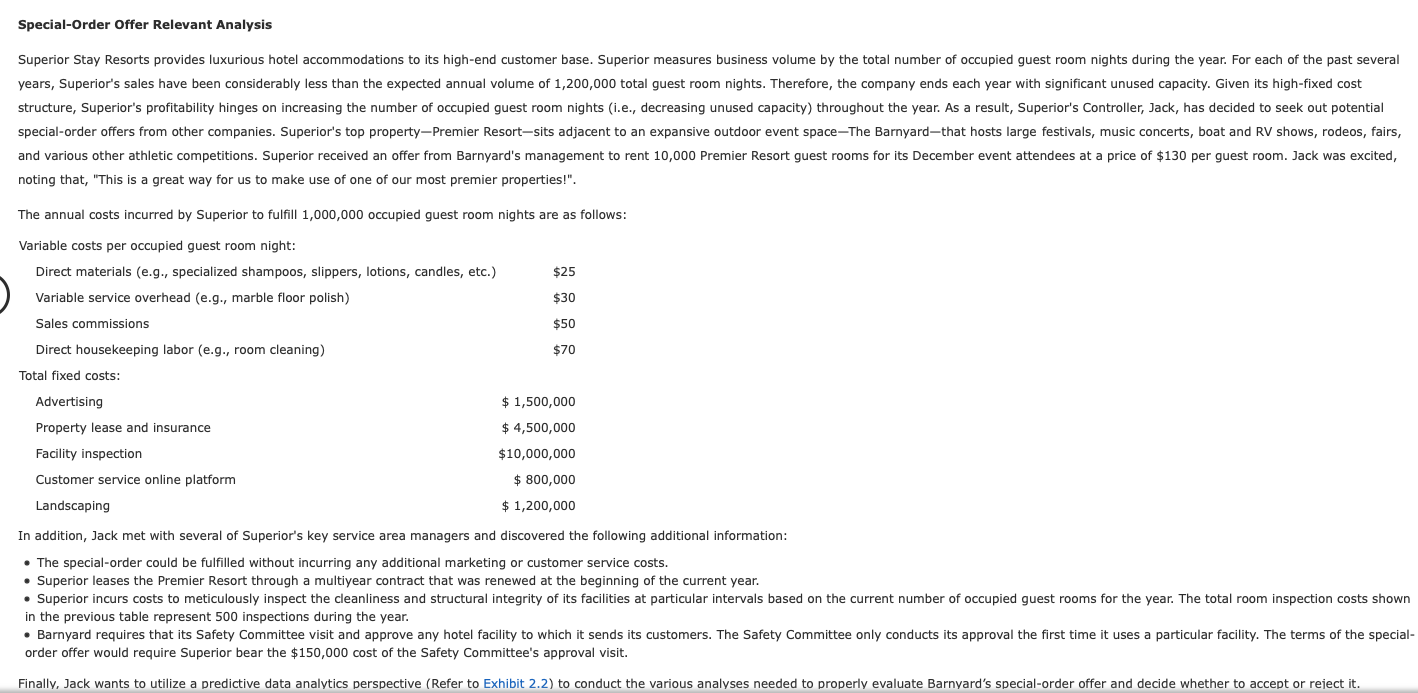

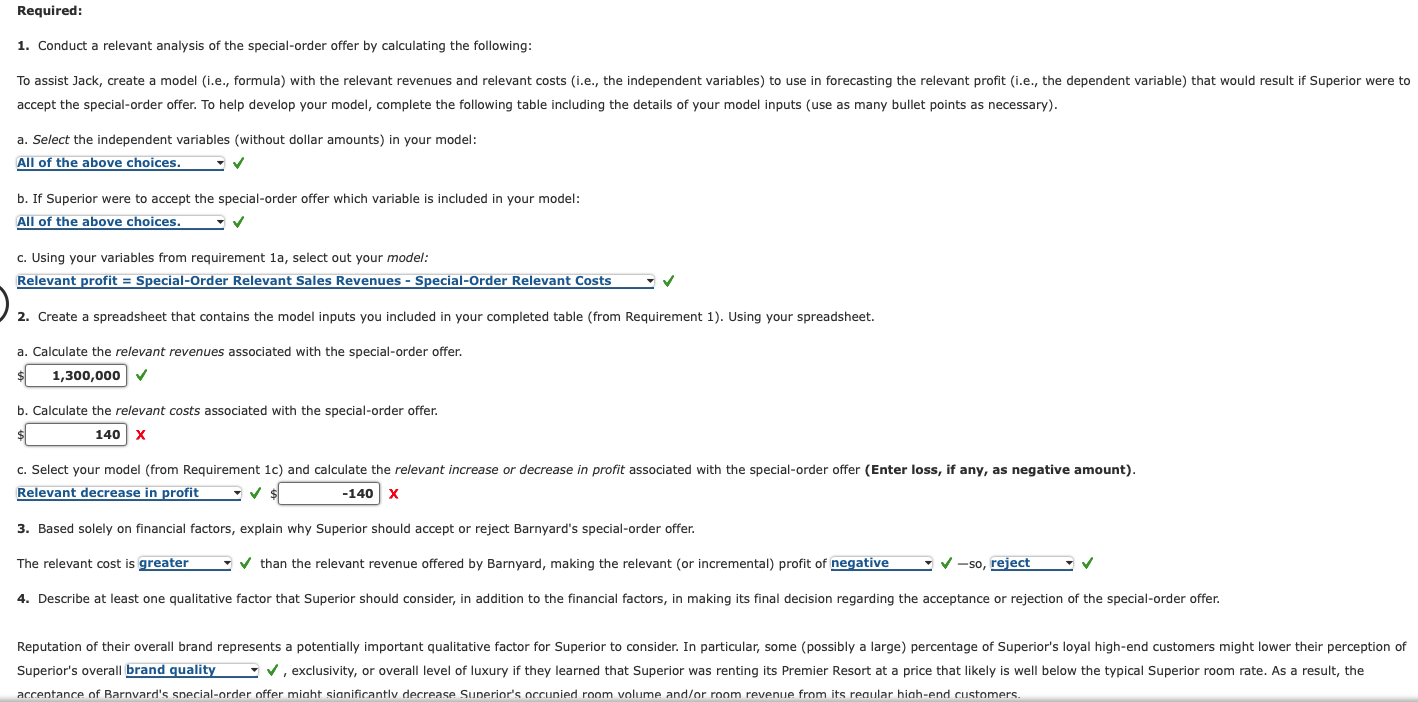

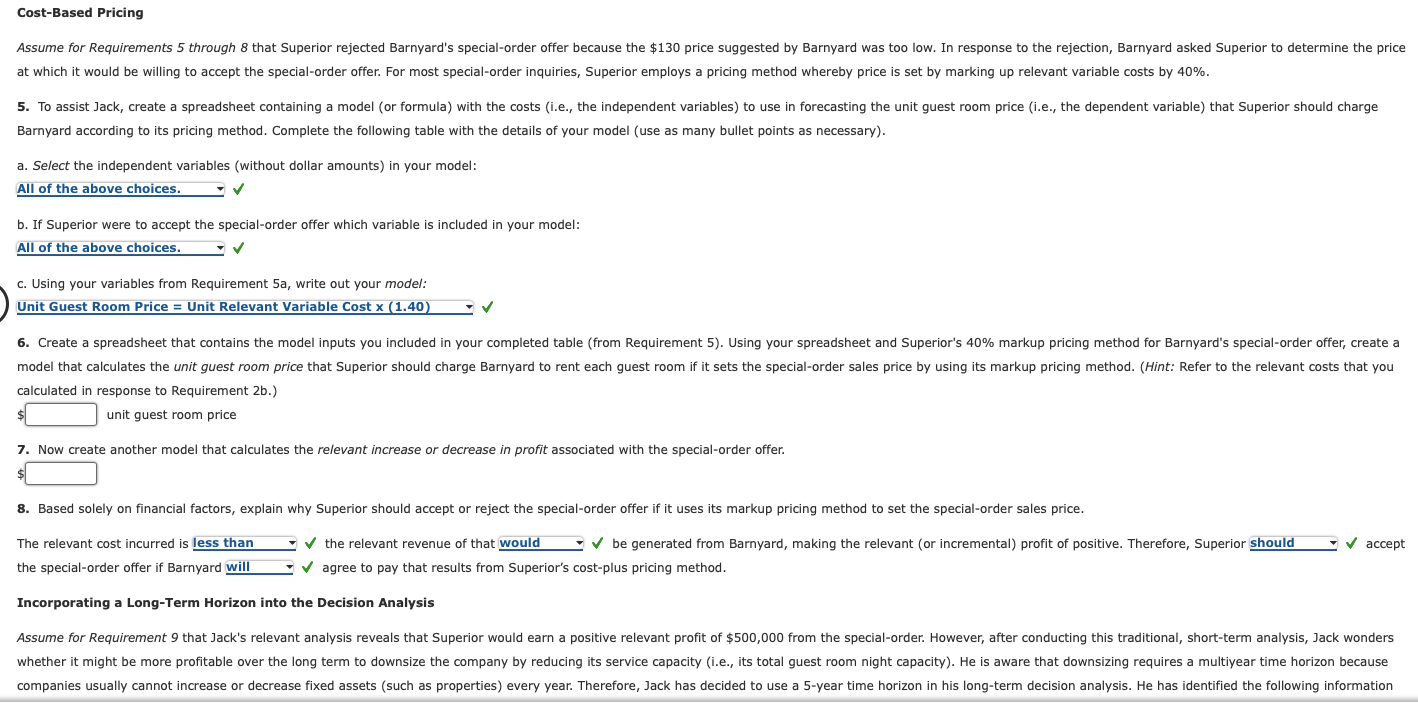

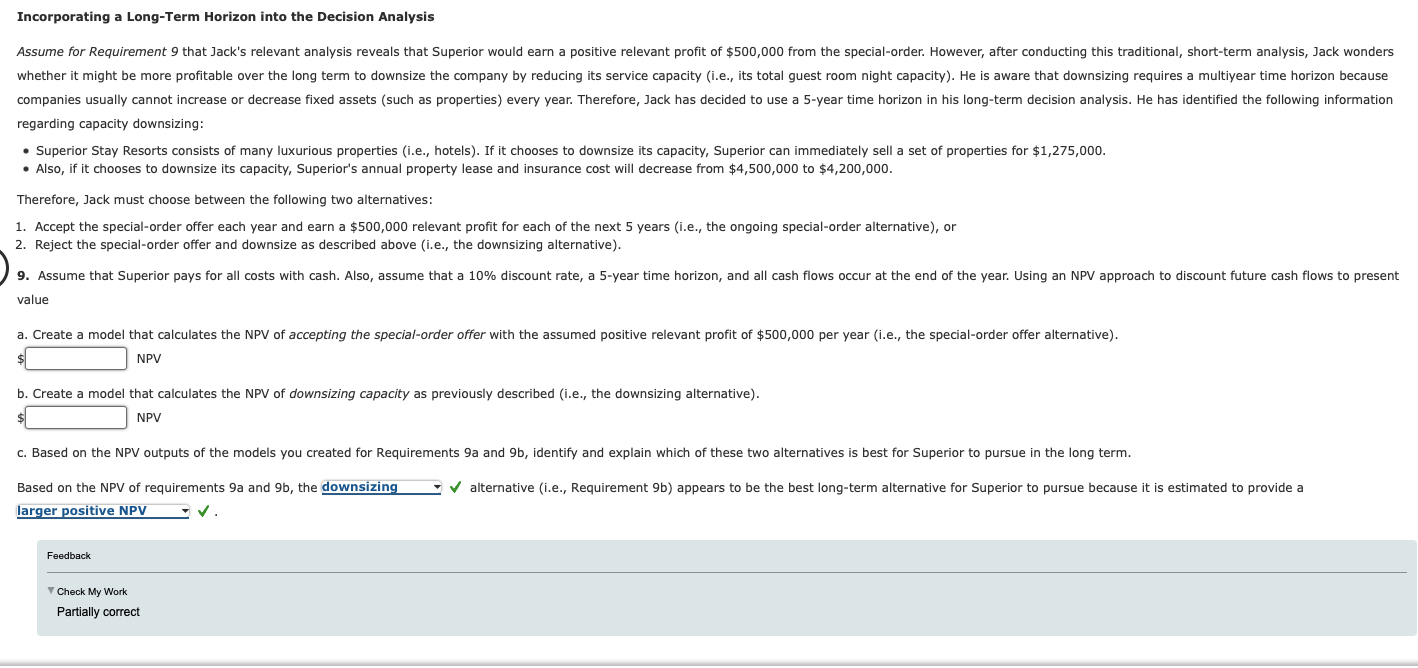

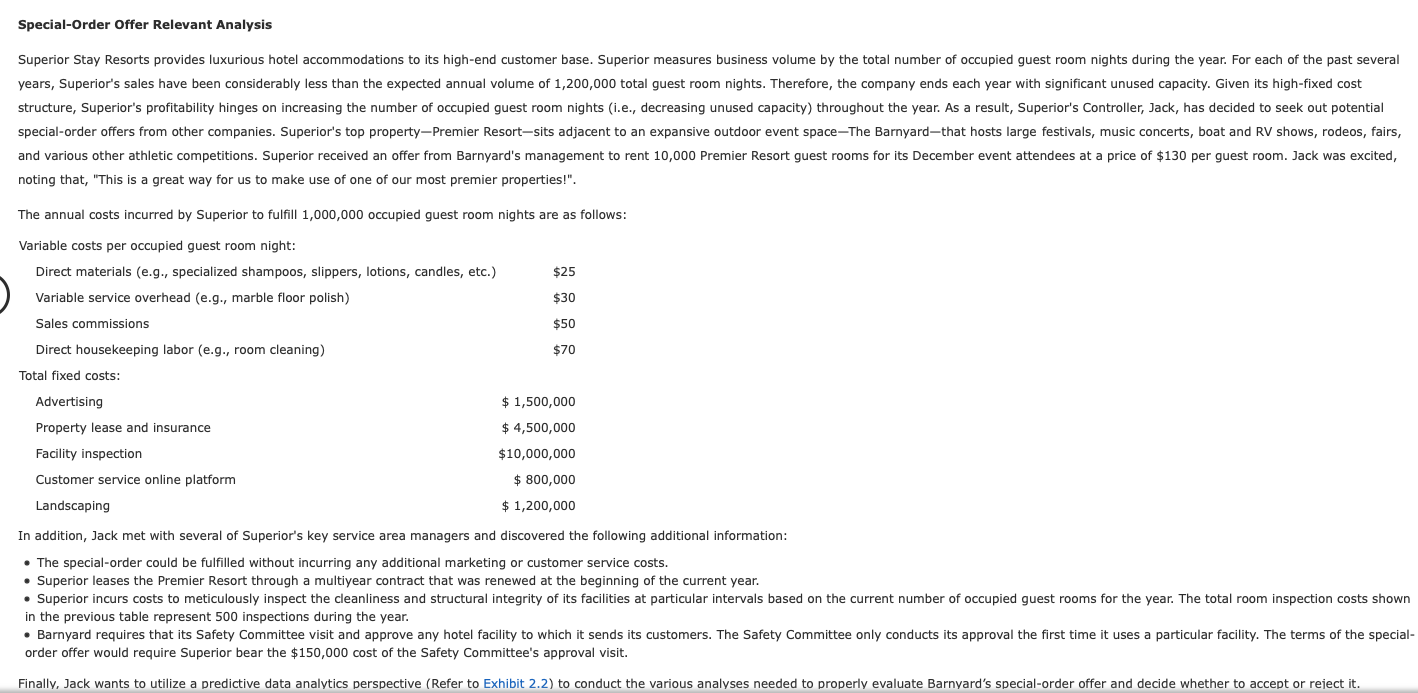

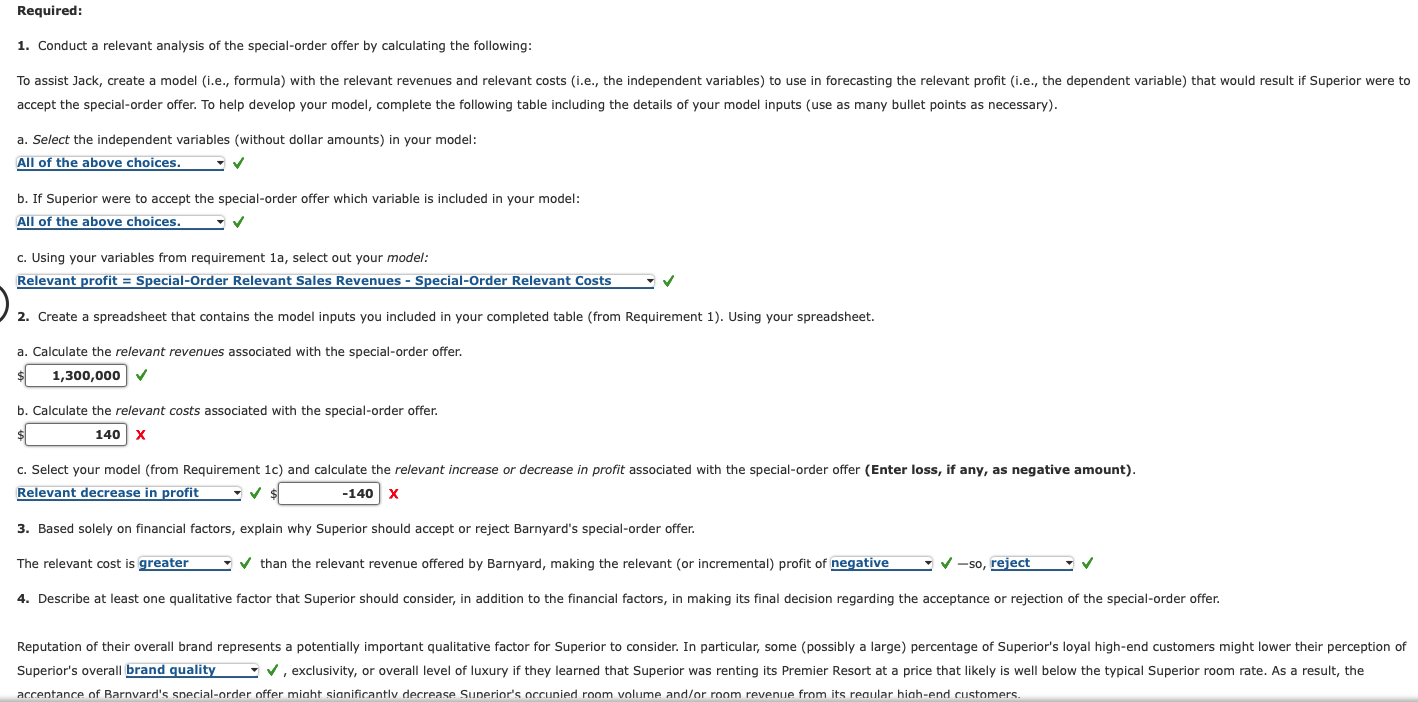

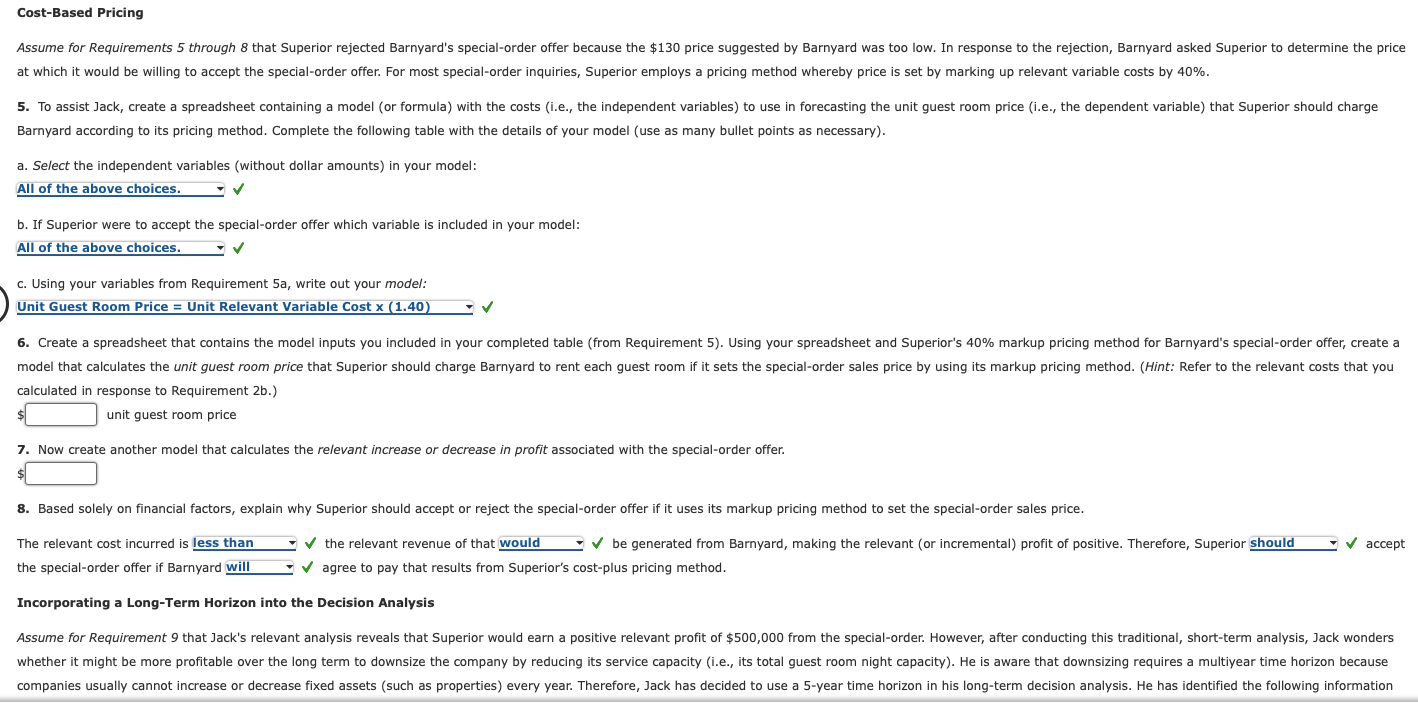

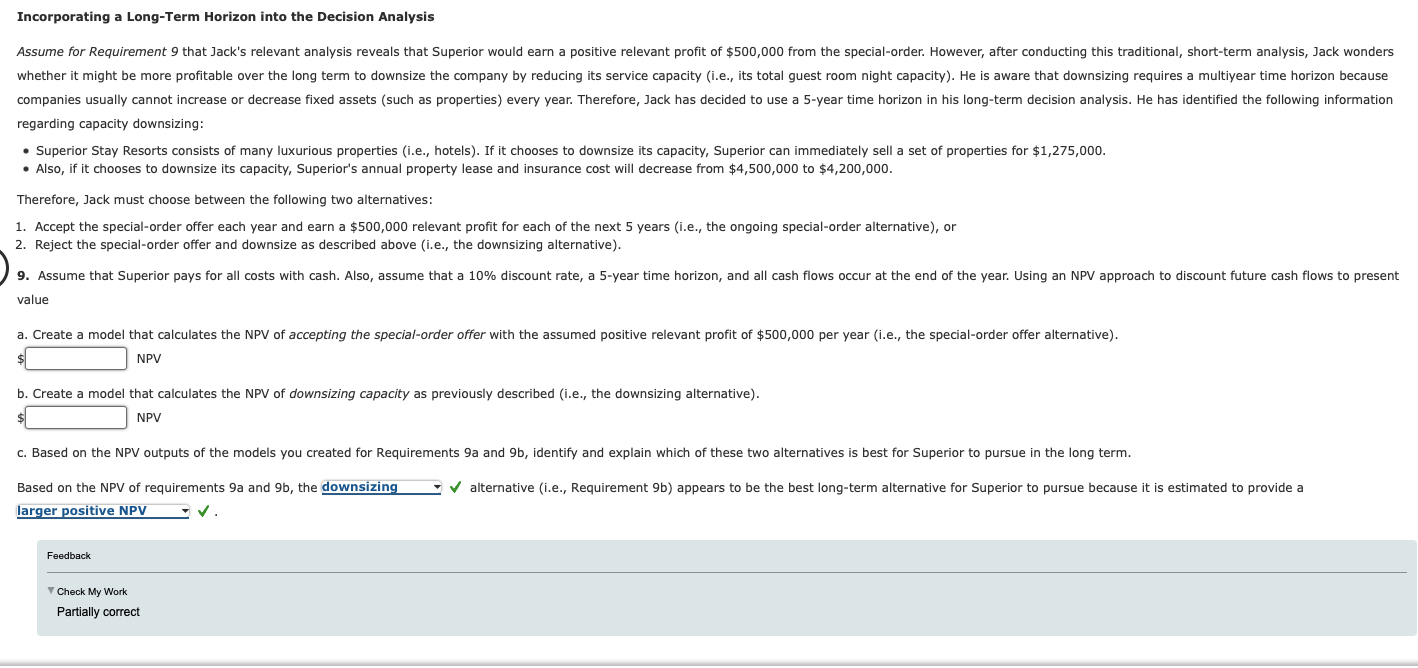

Special-Order Offer Relevant Analysis noting that, "This is a great way for us to make use of one of our most premier properties!". The annual costs incurred by Superior to fulfill 1,000,000 occupied guest room nights are as follows: In addition, Jack met with several of Superior's key service area managers and discovered the following additional information: - The special-order could be fulfilled without incurring any additional marketing or customer service costs. - Superior leases the Premier Resort through a multiyear contract that was renewed at the beginning of the current year. in the previous table represent 500 inspections during the year. order offer would require Superior bear the $150,000 cost of the Safety Committee's approval visit. 1. Conduct a relevant analysis of the special-order offer by calculating the following: accept the special-order offer. To help develop your model, complete the following table including the details of your model inputs (use as many bullet points as necessary). a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from requirement 1a, select out your model: Relevant profit = Special-Order Relevant Sales Revenues Special-Order Relevant Costs 2. Create a spreadsheet that contains the model inputs you included in your completed table (from Requirement 1). Using your spreadsheet. a. Calculate the relevant revenues associated with the special-order offer. $ b. Calculate the relevant costs associated with the special-order offer. $X c. Select your model (from Requirement 1c) and calculate the relevant increase or decrease in profit associated with the special-order offer (Enter loss, if any, as negative amount). Relevant decrease in profit $X 3. Based solely on financial factors, explain why Superior should accept or reject Barnyard's special-order offer. The relevant cost is than the relevant revenue offered by Barnyard, making the relevant (or incremental) profit of so, Superior's overall , exclusivity, or overall level of luxury if they learned that Superior was renting its Premier Resort at a price that likely is well below the typical Superior room rate. As a result, the accentance of Barnvard's snecial-order offer miaht sianificantlv decrease Sunerior's occunied ronm volume and/or room revenue from its reaular hiah-end customers. Barnyard according to its pricing method. Complete the following table with the details of your model (use as many bullet points as necessary). a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from Requirement 5a, write out your model: Unit Guest Room Price = Unit Relevant Variable Cost x(1.40) calculated in response to Requirement 2b.) $ unit guest room price 7. Now create another model that calculates the relevant increase or decrease in profit associated with the special-order offer. 8. Based solely on financial factors, explain why Superior should accept or reject the special-order offer if it uses its markup pricing method to set the special-order sales price. the special-order offer if Barnyard agree to pay that results from Superior's cost-plus pricing method. Incorporating a Long-Term Horizon into the Decision Analysis Incorporating a Long-Term Horizon into the Decision Analysis regarding capacity downsizing: - Superior Stay Resorts consists of many luxurious properties (i.e., hotels). If it chooses to downsize its capacity, Superior can immediately sell a set of properties for $1,275,000. - Also, if it chooses to downsize its capacity, Superior's annual property lease and insurance cost will decrease from $4,500,000 to $4,200,000. Therefore, Jack must choose between the following two alternatives: 1. Accept the special-order offer each year and earn a $500,000 relevant profit for each of the next 5 years (i.e., the ongoing special-order alternative), or 2. Reject the special-order offer and downsize as described above (i.e., the downsizing alternative). value a. Create a model that calculates the NPV of accepting the special-order offer with the assumed positive relevant profit of $500,000 per year (i.e., the special-order offer alternative). NPV b. Create a model that calculates the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). \$ NPV c. Based on the NPV outputs of the models you created for Requirements 9a and 9b, identify and explain which of these two alternatives is best for Superior to pursue in the long term. Based on the NPV of requirements 9a and 9b, the alternative (i.e., Requirement 9b) appears to be the best long-term alternative for Superior to pursue because it is estimated to provide a 3 Feedback Special-Order Offer Relevant Analysis noting that, "This is a great way for us to make use of one of our most premier properties!". The annual costs incurred by Superior to fulfill 1,000,000 occupied guest room nights are as follows: In addition, Jack met with several of Superior's key service area managers and discovered the following additional information: - The special-order could be fulfilled without incurring any additional marketing or customer service costs. - Superior leases the Premier Resort through a multiyear contract that was renewed at the beginning of the current year. in the previous table represent 500 inspections during the year. order offer would require Superior bear the $150,000 cost of the Safety Committee's approval visit. 1. Conduct a relevant analysis of the special-order offer by calculating the following: accept the special-order offer. To help develop your model, complete the following table including the details of your model inputs (use as many bullet points as necessary). a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from requirement 1a, select out your model: Relevant profit = Special-Order Relevant Sales Revenues Special-Order Relevant Costs 2. Create a spreadsheet that contains the model inputs you included in your completed table (from Requirement 1). Using your spreadsheet. a. Calculate the relevant revenues associated with the special-order offer. $ b. Calculate the relevant costs associated with the special-order offer. $X c. Select your model (from Requirement 1c) and calculate the relevant increase or decrease in profit associated with the special-order offer (Enter loss, if any, as negative amount). Relevant decrease in profit $X 3. Based solely on financial factors, explain why Superior should accept or reject Barnyard's special-order offer. The relevant cost is than the relevant revenue offered by Barnyard, making the relevant (or incremental) profit of so, Superior's overall , exclusivity, or overall level of luxury if they learned that Superior was renting its Premier Resort at a price that likely is well below the typical Superior room rate. As a result, the accentance of Barnvard's snecial-order offer miaht sianificantlv decrease Sunerior's occunied ronm volume and/or room revenue from its reaular hiah-end customers. Barnyard according to its pricing method. Complete the following table with the details of your model (use as many bullet points as necessary). a. Select the independent variables (without dollar amounts) in your model: b. If Superior were to accept the special-order offer which variable is included in your model: c. Using your variables from Requirement 5a, write out your model: Unit Guest Room Price = Unit Relevant Variable Cost x(1.40) calculated in response to Requirement 2b.) $ unit guest room price 7. Now create another model that calculates the relevant increase or decrease in profit associated with the special-order offer. 8. Based solely on financial factors, explain why Superior should accept or reject the special-order offer if it uses its markup pricing method to set the special-order sales price. the special-order offer if Barnyard agree to pay that results from Superior's cost-plus pricing method. Incorporating a Long-Term Horizon into the Decision Analysis Incorporating a Long-Term Horizon into the Decision Analysis regarding capacity downsizing: - Superior Stay Resorts consists of many luxurious properties (i.e., hotels). If it chooses to downsize its capacity, Superior can immediately sell a set of properties for $1,275,000. - Also, if it chooses to downsize its capacity, Superior's annual property lease and insurance cost will decrease from $4,500,000 to $4,200,000. Therefore, Jack must choose between the following two alternatives: 1. Accept the special-order offer each year and earn a $500,000 relevant profit for each of the next 5 years (i.e., the ongoing special-order alternative), or 2. Reject the special-order offer and downsize as described above (i.e., the downsizing alternative). value a. Create a model that calculates the NPV of accepting the special-order offer with the assumed positive relevant profit of $500,000 per year (i.e., the special-order offer alternative). NPV b. Create a model that calculates the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). \$ NPV c. Based on the NPV outputs of the models you created for Requirements 9a and 9b, identify and explain which of these two alternatives is best for Superior to pursue in the long term. Based on the NPV of requirements 9a and 9b, the alternative (i.e., Requirement 9b) appears to be the best long-term alternative for Superior to pursue because it is estimated to provide a 3 Feedback