specific help with C and D please!

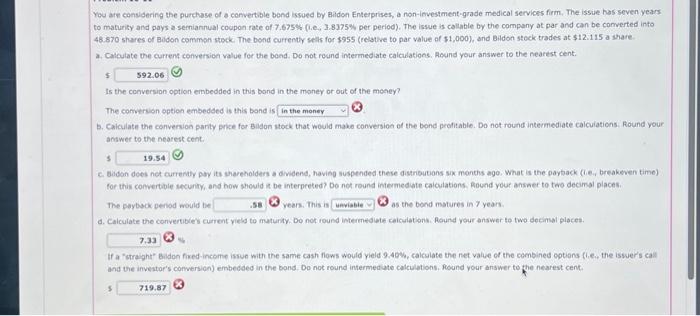

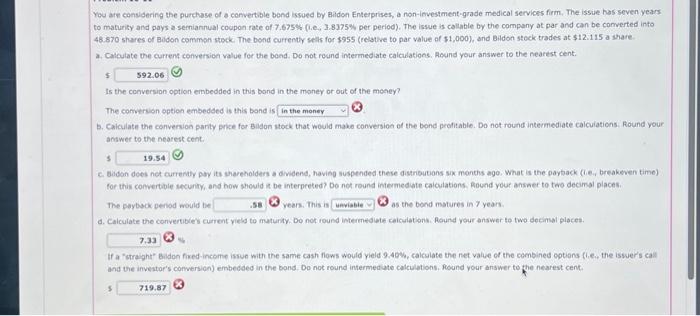

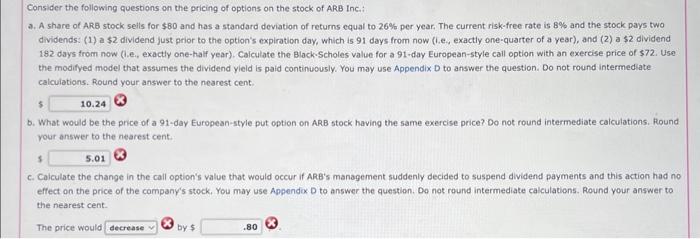

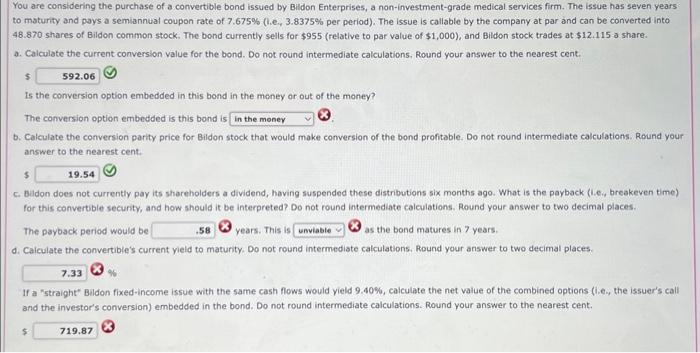

You aren consldering the purthase of a convertable bond issued by Elidon Enterprises, a non-investment-grade medical servicss firm, The issie has seven years to maturity and pays a semiannual coopon rate of 7.675% (i.e, 3.8375% per period). The iswue is callable by the company at par and can be comverted into 48.870 shares of Bodon common stock. The bond currently selks for $955 (relatve to par value of $1,000 ), and Bildon stock trades at $12.115 a share. a. Calculate the current conversion value for the bond. Do not round intermediate calculations. Round your answer to the nearest cent. 5 Is the conversion option embedded in this bond in the money or out of the money? The comverion option embedded is this band is b. Caiculate the conversioo parity price for Bildon stock that would make conversion of the bond profitable. Do not round intermediate calcuiations. Round your answer bo the nearesk cent. 3 c. bidon does net currenty poy its shareholders a dideend, having suspended these distribubons six months ago. What is the paytiack ( me., breakeven time) for this convertuble security, and how should ig be interpeeted? Do not round intermed wte caiculations. Bound your ansaer to two decimal places. The paybuck period would tie 6 vears, This is 6 as the bond matures in 7 yeari. d. Calculate the convertibles curent yield to muturity. Do not round intermedief calculationk. Aound your answer to two decinal places. If a "straght" Budon fixed-income issue with the same cash flows would yield 9.40 . and the investar's comversion) embedded in the bond. Do not round intermed ate calculations, foound your answer to the nearest cent. 5 Consider the following questions on the pricing of options on the stock of ARB Inc. a. A share of ARB stock sells for $80 and has a standard deviation of returns equal to 26% per year. The current risk-free rate is B% and the stock pays two dividends: (1) a $2 dividend just prior to the option's expiration day, which is 91 days from now (i.e., exactly one-quarter of a year), and (2) a $2 dividend 182 days from now (1.e., exactly one-half year). Calculate the Block-Scholes value for a 91 -day European-style call option with an exereise price of \$72. Use the modifyed model that assumes the dividend yield is paid continuously. You may use Appendix D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. 5 b. What would be the price of a 91-day European-style put option on ARB stock having the same exercise price? Do not round intermediate caiculations. Round your answer to the nearest cent. 5 c. Calculate the change in the call option's value that would occur if ARB's management suddenly decided to suspend dividend payments and this action had no effect on the price of the company's stock, You may use Appendox D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. The price would by $ You are considering the purchase of a convertible bond issued by Bildon Enterprises, a non-investment-grade medical services firm. The issue has seven years to maturity and pays a semiannual coupon rate of 7.675% (i.e., 3.8375% per period). The issue is callable by the company at par and can be converted into 48.870 shares of Bildon common stock. The bond currently sells for $955 (relative to par value of $1,000 ), and Bildon stock trades at $12.115 a share. a. Calculate the current conversion value for the bond. Do not round intermediate calculations, Round your answer to the nearest cent. 5 Is the conversion option embedded in this bond in the meney or out of the money? The corversion option embedded is this bond is b. Calculate the conversion parity price for Bildon stock that would make conversion of the bond profitable. Do not round intermediate calculations. Round your answer to the nearest cent. 5 C. Badon does not currently pay its shareholders a dividend, having suspended these distributions six months ago. What is the payback (i.e., breakeven time) for this convertible security, and how should it be interpreted? Do not round intermediate calculations. Round your answer to two decimal places. The payback period would be (3) years. This is (3) as the bond matures in 7 years. d. Caiculate the convertible's current yield to maturity. Do not round intermediate calculations. Round your answer to two decimal places. If a "straight" Bildon fixed-income issue with the same cash flows would yield 9.40%, calculate the net value of the combined options (i.e., the issuer's call and the investor's conversion) embedded in the bond. Do not round intermediate calculations. Round your answer to the nearest cent. 5 You aren consldering the purthase of a convertable bond issued by Elidon Enterprises, a non-investment-grade medical servicss firm, The issie has seven years to maturity and pays a semiannual coopon rate of 7.675% (i.e, 3.8375% per period). The iswue is callable by the company at par and can be comverted into 48.870 shares of Bodon common stock. The bond currently selks for $955 (relatve to par value of $1,000 ), and Bildon stock trades at $12.115 a share. a. Calculate the current conversion value for the bond. Do not round intermediate calculations. Round your answer to the nearest cent. 5 Is the conversion option embedded in this bond in the money or out of the money? The comverion option embedded is this band is b. Caiculate the conversioo parity price for Bildon stock that would make conversion of the bond profitable. Do not round intermediate calcuiations. Round your answer bo the nearesk cent. 3 c. bidon does net currenty poy its shareholders a dideend, having suspended these distribubons six months ago. What is the paytiack ( me., breakeven time) for this convertuble security, and how should ig be interpeeted? Do not round intermed wte caiculations. Bound your ansaer to two decimal places. The paybuck period would tie 6 vears, This is 6 as the bond matures in 7 yeari. d. Calculate the convertibles curent yield to muturity. Do not round intermedief calculationk. Aound your answer to two decinal places. If a "straght" Budon fixed-income issue with the same cash flows would yield 9.40 . and the investar's comversion) embedded in the bond. Do not round intermed ate calculations, foound your answer to the nearest cent. 5 Consider the following questions on the pricing of options on the stock of ARB Inc. a. A share of ARB stock sells for $80 and has a standard deviation of returns equal to 26% per year. The current risk-free rate is B% and the stock pays two dividends: (1) a $2 dividend just prior to the option's expiration day, which is 91 days from now (i.e., exactly one-quarter of a year), and (2) a $2 dividend 182 days from now (1.e., exactly one-half year). Calculate the Block-Scholes value for a 91 -day European-style call option with an exereise price of \$72. Use the modifyed model that assumes the dividend yield is paid continuously. You may use Appendix D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. 5 b. What would be the price of a 91-day European-style put option on ARB stock having the same exercise price? Do not round intermediate caiculations. Round your answer to the nearest cent. 5 c. Calculate the change in the call option's value that would occur if ARB's management suddenly decided to suspend dividend payments and this action had no effect on the price of the company's stock, You may use Appendox D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. The price would by $ You are considering the purchase of a convertible bond issued by Bildon Enterprises, a non-investment-grade medical services firm. The issue has seven years to maturity and pays a semiannual coupon rate of 7.675% (i.e., 3.8375% per period). The issue is callable by the company at par and can be converted into 48.870 shares of Bildon common stock. The bond currently sells for $955 (relative to par value of $1,000 ), and Bildon stock trades at $12.115 a share. a. Calculate the current conversion value for the bond. Do not round intermediate calculations, Round your answer to the nearest cent. 5 Is the conversion option embedded in this bond in the meney or out of the money? The corversion option embedded is this bond is b. Calculate the conversion parity price for Bildon stock that would make conversion of the bond profitable. Do not round intermediate calculations. Round your answer to the nearest cent. 5 C. Badon does not currently pay its shareholders a dividend, having suspended these distributions six months ago. What is the payback (i.e., breakeven time) for this convertible security, and how should it be interpreted? Do not round intermediate calculations. Round your answer to two decimal places. The payback period would be (3) years. This is (3) as the bond matures in 7 years. d. Caiculate the convertible's current yield to maturity. Do not round intermediate calculations. Round your answer to two decimal places. If a "straight" Bildon fixed-income issue with the same cash flows would yield 9.40%, calculate the net value of the combined options (i.e., the issuer's call and the investor's conversion) embedded in the bond. Do not round intermediate calculations. Round your answer to the nearest cent. 5