Specifically parts 2 & 3 (a and b)

Specifically parts 2 & 3 (a and b)

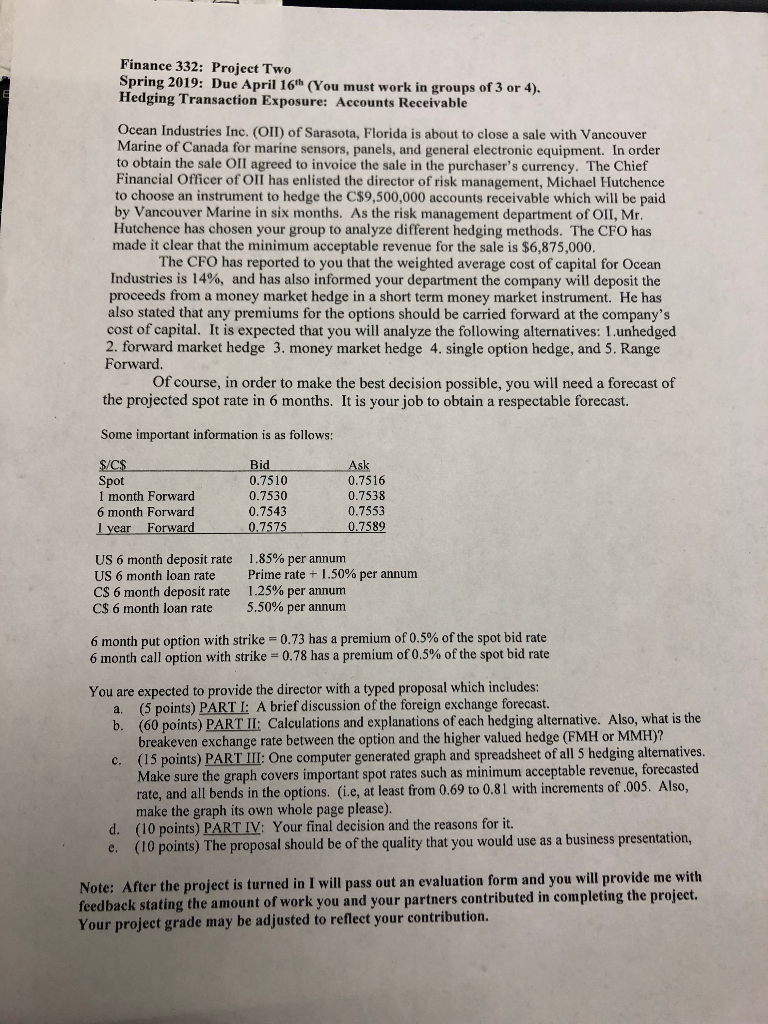

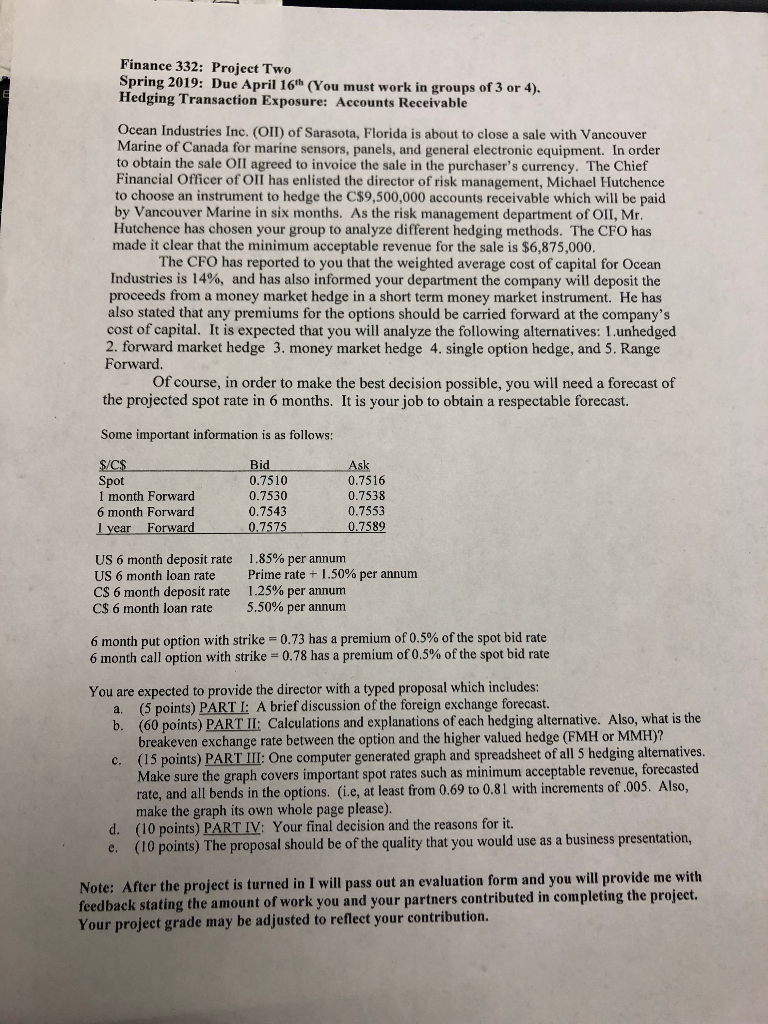

Finance 332: Project Two Spring 2019: Due April 16th (You must work in groups of 3 or 4) Hedging Transaction Exposure: Accounts Receivable Ocean Industries Inc. (Oll) of Sarasota, Florida is about to close a sale with Vancouver Marine of Canada for marine sensors, panels, and general electronic equipment. In order to obtain the sale OII agreed to invoice the sale in the purchaser's currency. The Chief Financial Officer of OlI has enlisted the director of risk management, Michael Hutchence to choose an instrument to hedge the C$9,500,000 accounts receivable which will be paid by Vancouver Marine in six months. As the risk management department of OII, Mr Hutchence has chosen your group to analyze different hedging methods. The CFO has made it clear that the minimum acceptable revenue for the sale is $6,875,000 The CFO has reported to you that the weighted average cost of capital for Ocean Industries is 14%, and has also informed your department the company will deposit the proceeds from a money market hedge in a short term money market instrument. He has also stated that any premiums for the options should be carried forward at the company's cost of capital. It is expected that you will analyze the following alternatives: 1unhedged 2. forward market hedge 3. money market hedge 4. single option hedge, and 5. Range Forward. the projected spot rate in 6 months. It is your job to obtain a respectable forecast. Some important information is as follows Of course, in order to make the best decision possible, you will need a forecast of S/CS Spot 1 month Forward 6 month Forward I year Forward 0.7510 0.7530 0.7543 0.7575 Ask 0.7516 0.7538 0.7553 0.7589 US 6 month deposit rate US 6 month loan rate CS 6 month deposit rate 1.85% per annum Prime rate + 1.50% per annum 1.25% per annum 5.50% per annum 6 month loan rate 6 month put option with strike-0.73 has a premium of 0.5% of the spot bid rate 6 month call option with strike-0.78 has a premium of0.5% of the spot bid rate You are expected to provide the director with a typed proposal which includes: a. (5 points) PART I: A brief discussion of the foreign exchange forecast. b. (60 points) PART II: Calculations and explanations of each hedging alternative. Also, what is the breakeven exchange rate between the option and the higher valued hedge (FMH or MMH)? (15 points) PART III: One computer generated graph and spreadsheet of all 5 hedging alternatives Make sure the graph covers important spot rates such as minimum acceptable revenue, forecasted rate, and all bends in the options. (i.e, at least from 0.69 to 0.81 with increments of.005. Also make the graph its own whole page please) (10 points) PART IV: Your final decision and the reasons for it. (10 points) The proposal should be of the quality that you would use as a business presentation c. d. e. Note: After the project is turned in I will pass out an evaluation form and you will provide me with feedback stating the amount of work you and your partners contributed in completing the project Your project grade may be adjusted to reflect your contribution. Finance 332: Project Two Spring 2019: Due April 16th (You must work in groups of 3 or 4) Hedging Transaction Exposure: Accounts Receivable Ocean Industries Inc. (Oll) of Sarasota, Florida is about to close a sale with Vancouver Marine of Canada for marine sensors, panels, and general electronic equipment. In order to obtain the sale OII agreed to invoice the sale in the purchaser's currency. The Chief Financial Officer of OlI has enlisted the director of risk management, Michael Hutchence to choose an instrument to hedge the C$9,500,000 accounts receivable which will be paid by Vancouver Marine in six months. As the risk management department of OII, Mr Hutchence has chosen your group to analyze different hedging methods. The CFO has made it clear that the minimum acceptable revenue for the sale is $6,875,000 The CFO has reported to you that the weighted average cost of capital for Ocean Industries is 14%, and has also informed your department the company will deposit the proceeds from a money market hedge in a short term money market instrument. He has also stated that any premiums for the options should be carried forward at the company's cost of capital. It is expected that you will analyze the following alternatives: 1unhedged 2. forward market hedge 3. money market hedge 4. single option hedge, and 5. Range Forward. the projected spot rate in 6 months. It is your job to obtain a respectable forecast. Some important information is as follows Of course, in order to make the best decision possible, you will need a forecast of S/CS Spot 1 month Forward 6 month Forward I year Forward 0.7510 0.7530 0.7543 0.7575 Ask 0.7516 0.7538 0.7553 0.7589 US 6 month deposit rate US 6 month loan rate CS 6 month deposit rate 1.85% per annum Prime rate + 1.50% per annum 1.25% per annum 5.50% per annum 6 month loan rate 6 month put option with strike-0.73 has a premium of 0.5% of the spot bid rate 6 month call option with strike-0.78 has a premium of0.5% of the spot bid rate You are expected to provide the director with a typed proposal which includes: a. (5 points) PART I: A brief discussion of the foreign exchange forecast. b. (60 points) PART II: Calculations and explanations of each hedging alternative. Also, what is the breakeven exchange rate between the option and the higher valued hedge (FMH or MMH)? (15 points) PART III: One computer generated graph and spreadsheet of all 5 hedging alternatives Make sure the graph covers important spot rates such as minimum acceptable revenue, forecasted rate, and all bends in the options. (i.e, at least from 0.69 to 0.81 with increments of.005. Also make the graph its own whole page please) (10 points) PART IV: Your final decision and the reasons for it. (10 points) The proposal should be of the quality that you would use as a business presentation c. d. e. Note: After the project is turned in I will pass out an evaluation form and you will provide me with feedback stating the amount of work you and your partners contributed in completing the project Your project grade may be adjusted to reflect your contribution

Specifically parts 2 & 3 (a and b)

Specifically parts 2 & 3 (a and b)