Answered step by step

Verified Expert Solution

Question

1 Approved Answer

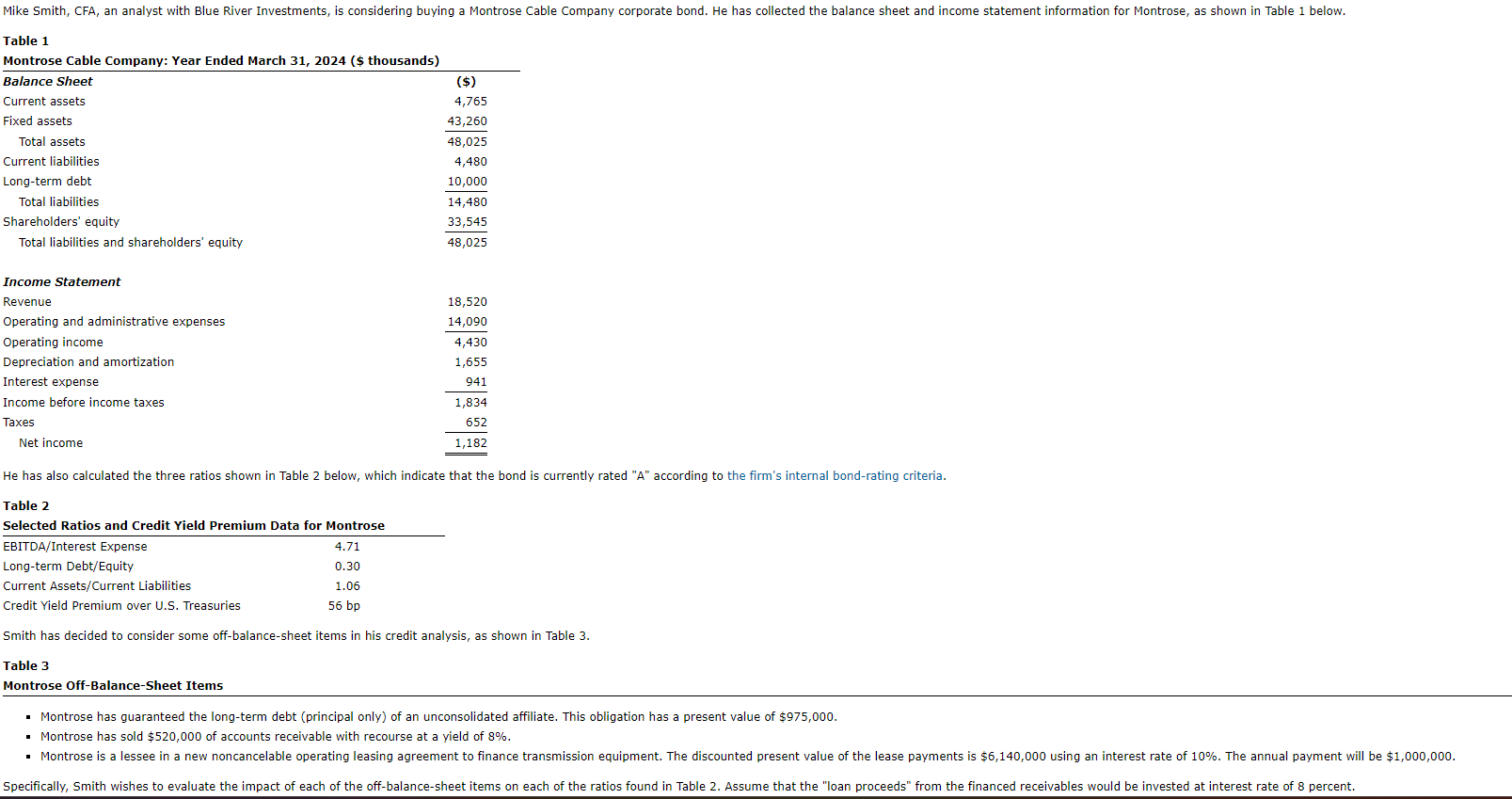

Specifically, Smith wishes to evaluate the impact of each of the off - balance - sheet items on each of the ratios found in Table

Specifically, Smith wishes to evaluate the impact of each of the offbalancesheet items on each of the ratios found in Table Assume that the "loan proceeds" from the financed receivables would be invested at interest rate of percent.

Calculate the combined effect of the three offbalancesheet items in Table on each of the following three financial ratios shown in Table Do not round intermediate calculations. Round your answers to four decimal places.

EBITDAinterest expense:

Longterm debtequity:

Current assetscurrent liabilities:

The bond is currently trading at a credit spread of basis points. Evaluate whether this credit yield premium incorporates the effect of the offbalancesheet items. State and justify whether the current credit spread compensates Smith for the credit risk of the bond, based on the internal bondrating criteria found in the firm's internal bondrating criteria. Round your answers to the nearest whole number.

Credit Yield Premium

over US Treasuries

Bond Rating in Basis Points

Interest Coverage

Select

Leverage

Select

Current Ratio

Select

The current A rating of the Montrose bond

Select

the effect of the offbalancesheet items, and the current credit yield premium of basis points

Select

sufficient to compensate Smith for the credit risk of the bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started