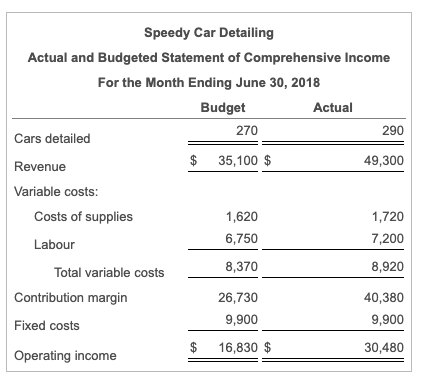

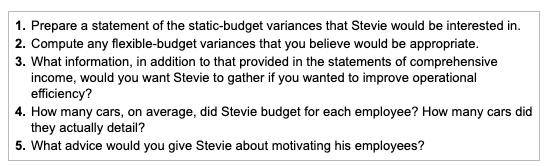

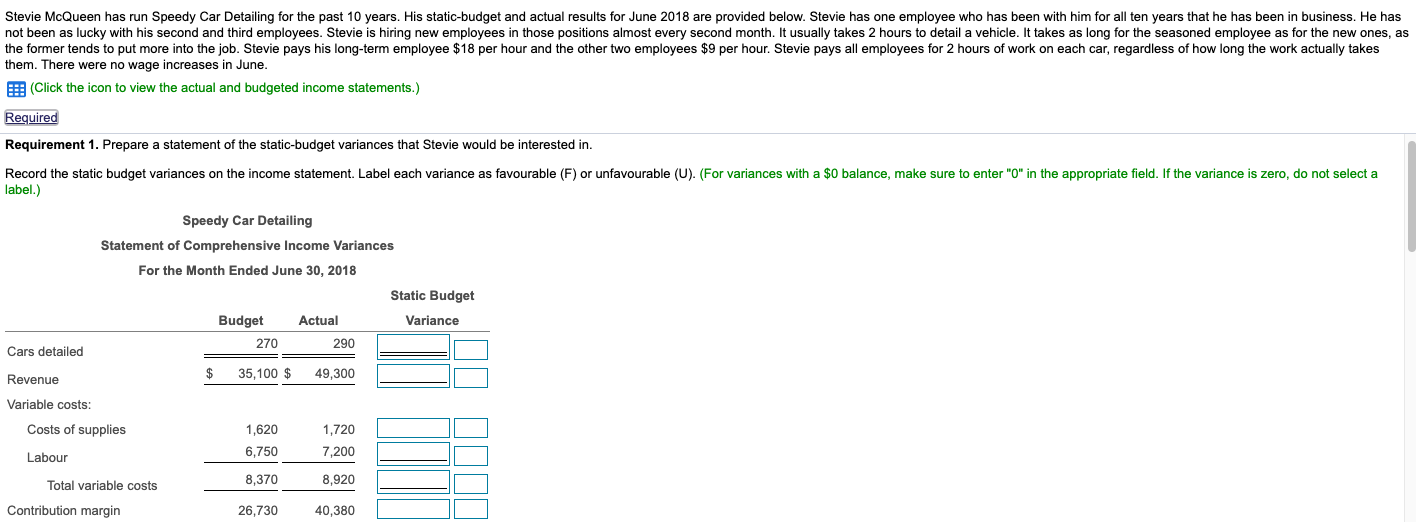

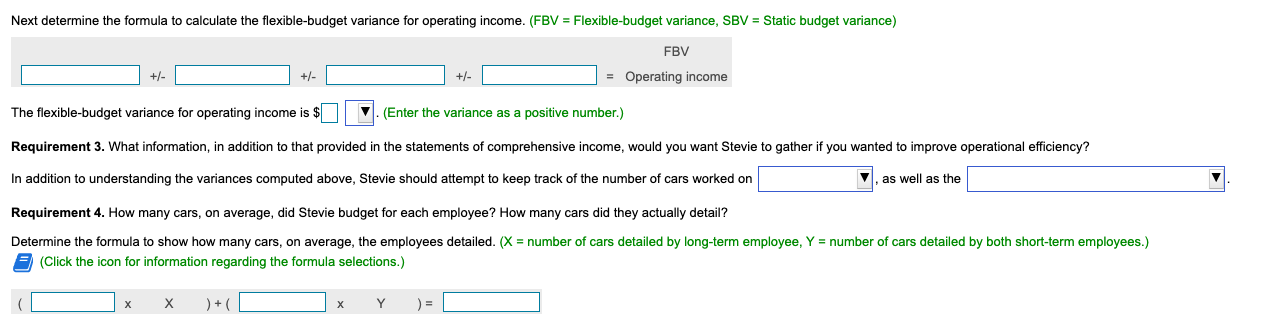

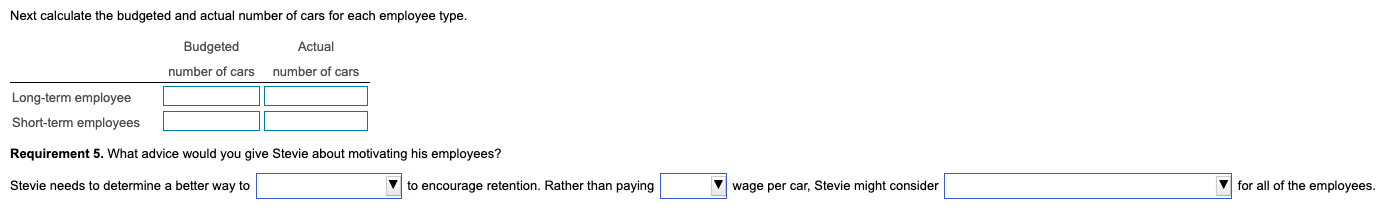

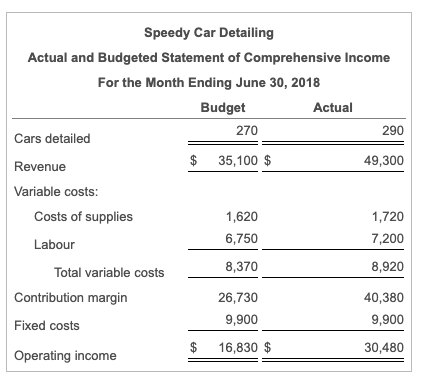

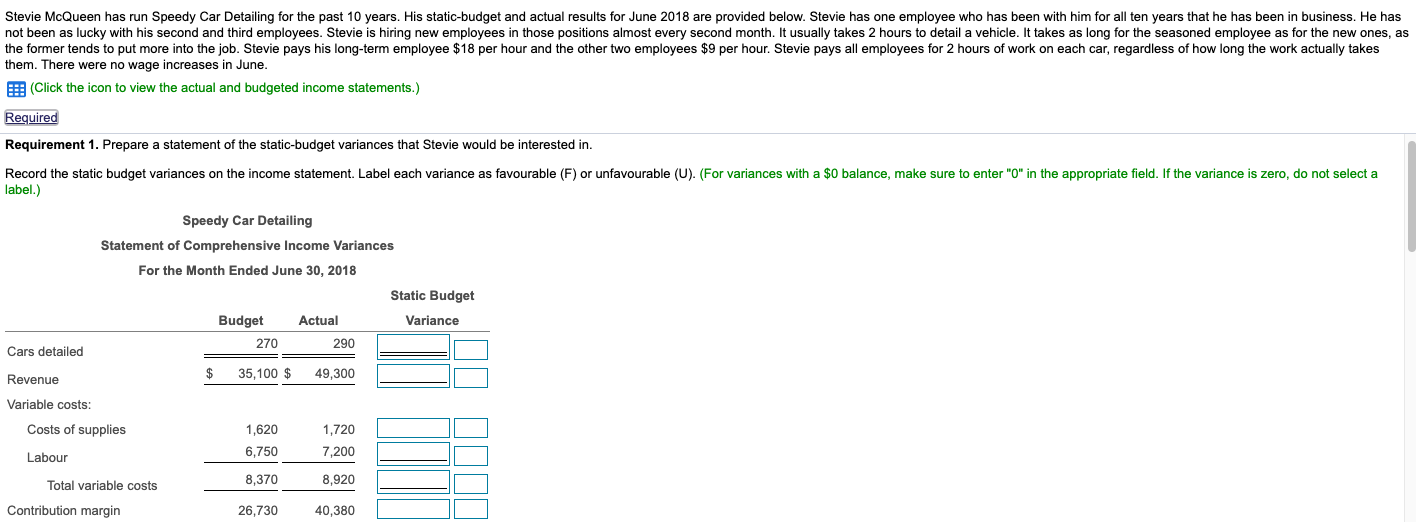

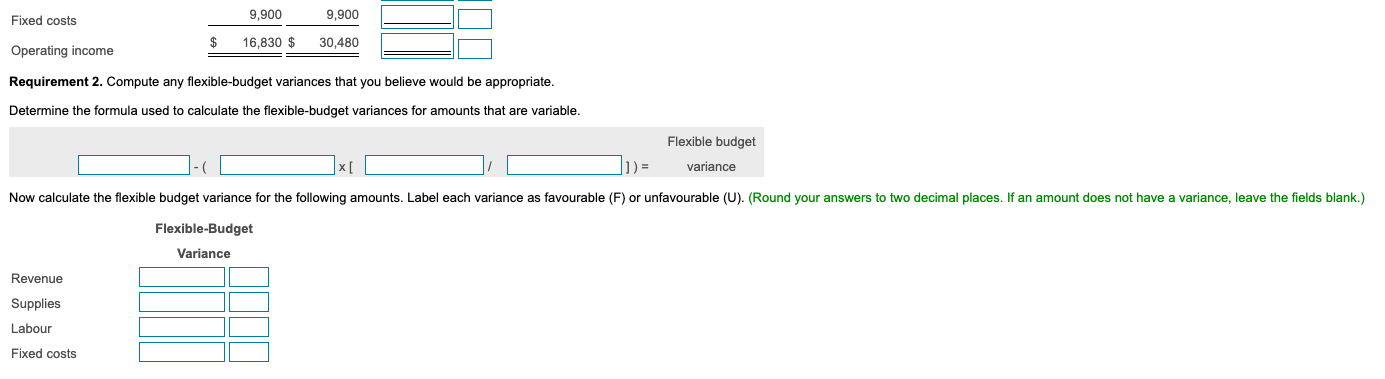

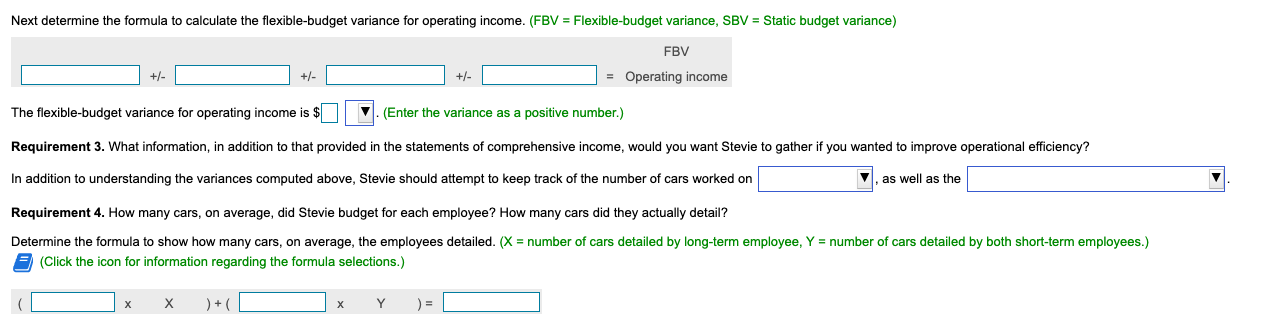

Speedy Car Detailing Actual and Budgeted Statement of Comprehensive Income For the Month Ending June 30, 2018 Budget Actual 270 290 Cars detailed Revenue $ 35,100 $ 49,300 Variable costs: Costs of supplies 1,620 1,720 Labour 6,750 7,200 Total variable costs 8,370 8,920 Contribution margin 26,730 40,380 Fixed costs 9,900 9,900 $ 16,830 $ 30,480 Operating income 1. Prepare a statement of the static-budget variances that Stevie would be interested in. 2. Compute any flexible-budget variances that you believe would be appropriate. 3. What information, in addition to that provided in the statements of comprehensive income, would you want Stevie to gather if you wanted to improve operational efficiency? 4. How many cars, on average, did Stevie budget for each employee? How many cars did they actually detail? 5. What advice would you give Stevie about motivating his employees? Stevie McQueen has run Speedy Car Detailing for the past 10 years. His static-budget and actual results for June 2018 are provided below. Stevie has one employee who has been with him for all ten years that he has been in business. He has not been as lucky with his second and third employees. Stevie is hiring new employees in those positions almost every second month. It usually takes 2 hours to detail a vehicle. It takes as long for the seasoned employee as for the new ones, as the former tends to put more into the job. Stevie pays his long-term employee $18 per hour and the other two employees $9 per hour. Stevie pays all employees for 2 hours of work on each car, regardless of how long the work actually takes them. There were no wage increases in June. (Click the icon view the actual and budgeted income statements.) Required Requirement 1. Prepare a statement of the static-budget variances that Stevie would be interested in. Record the static budget variances on the income statement. Label each variance as favourable (F) or unfavourable (U). (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label.) Speedy Car Detailing Statement of Comprehensive Income Variances For the Month Ended June 30, 2018 Static Budget Budget Actual Variance 270 290 Cars detailed Revenue $ 49,300 35,100 $ Variable costs: Costs of supplies 1,620 1,720 7,200 6,750 Labour 1010 Total variable costs 8,370 8,920 Contribution margin 26,730 40,380 9,900 9,900 Fixed costs $ 16,830 $ 30,480 Operating income Requirement 2. Compute any flexible-budget variances that you believe would be appropriate. Determine the formula used to calculate the flexible-budget variances for amounts that are variable. Flexible budget variance Now calculate the flexible budget variance for the following amounts. Label each variance as favourable (F) or unfavourable (U). (Round your answers to two decimal places. If an amount does not have a variance, leave the fields blank.) Flexible-Budget Variance Revenue Supplies Labour Fixed costs Next determine the formula to calculate the flexible-budget variance for operating income. (FBV = Flexible-budget variance, SBV = Static budget variance) FBV +- +/- +/- = Operating income The flexible-budget variance for operating income is $ V. (Enter the variance as a positive number.) Requirement 3. What information, in addition to that provided in the statements of comprehensive income, would you want Stevie to gather if you wanted to improve operational efficiency? In addition to understanding the variances computed above, Stevie should attempt to keep track of the number of cars worked on V as well as the Requirement 4. How many cars, on average, did Stevie budget for each employee? How many cars did they actually detail? Determine the formula to show how many cars, on average, the employees detailed. (X = number of cars detailed by long-term employee, Y = number of cars detailed by both short-term employees.) (Click the icon for information regarding the formula selections.) ) + x Y Next calculate the budgeted and actual number of cars for each employee type. Actual Budgeted number of cars number of cars Long-term employee Short-term employees Requirement 5. What advice would you give Stevie about motivating his employees? Stevie needs to determine better way to to encourage retention. Rather than paying wage per car, Stevie might consider for all of the employees. Speedy Car Detailing Actual and Budgeted Statement of Comprehensive Income For the Month Ending June 30, 2018 Budget Actual 270 290 Cars detailed Revenue $ 35,100 $ 49,300 Variable costs: Costs of supplies 1,620 1,720 Labour 6,750 7,200 Total variable costs 8,370 8,920 Contribution margin 26,730 40,380 Fixed costs 9,900 9,900 $ 16,830 $ 30,480 Operating income 1. Prepare a statement of the static-budget variances that Stevie would be interested in. 2. Compute any flexible-budget variances that you believe would be appropriate. 3. What information, in addition to that provided in the statements of comprehensive income, would you want Stevie to gather if you wanted to improve operational efficiency? 4. How many cars, on average, did Stevie budget for each employee? How many cars did they actually detail? 5. What advice would you give Stevie about motivating his employees? Stevie McQueen has run Speedy Car Detailing for the past 10 years. His static-budget and actual results for June 2018 are provided below. Stevie has one employee who has been with him for all ten years that he has been in business. He has not been as lucky with his second and third employees. Stevie is hiring new employees in those positions almost every second month. It usually takes 2 hours to detail a vehicle. It takes as long for the seasoned employee as for the new ones, as the former tends to put more into the job. Stevie pays his long-term employee $18 per hour and the other two employees $9 per hour. Stevie pays all employees for 2 hours of work on each car, regardless of how long the work actually takes them. There were no wage increases in June. (Click the icon view the actual and budgeted income statements.) Required Requirement 1. Prepare a statement of the static-budget variances that Stevie would be interested in. Record the static budget variances on the income statement. Label each variance as favourable (F) or unfavourable (U). (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label.) Speedy Car Detailing Statement of Comprehensive Income Variances For the Month Ended June 30, 2018 Static Budget Budget Actual Variance 270 290 Cars detailed Revenue $ 49,300 35,100 $ Variable costs: Costs of supplies 1,620 1,720 7,200 6,750 Labour 1010 Total variable costs 8,370 8,920 Contribution margin 26,730 40,380 9,900 9,900 Fixed costs $ 16,830 $ 30,480 Operating income Requirement 2. Compute any flexible-budget variances that you believe would be appropriate. Determine the formula used to calculate the flexible-budget variances for amounts that are variable. Flexible budget variance Now calculate the flexible budget variance for the following amounts. Label each variance as favourable (F) or unfavourable (U). (Round your answers to two decimal places. If an amount does not have a variance, leave the fields blank.) Flexible-Budget Variance Revenue Supplies Labour Fixed costs Next determine the formula to calculate the flexible-budget variance for operating income. (FBV = Flexible-budget variance, SBV = Static budget variance) FBV +- +/- +/- = Operating income The flexible-budget variance for operating income is $ V. (Enter the variance as a positive number.) Requirement 3. What information, in addition to that provided in the statements of comprehensive income, would you want Stevie to gather if you wanted to improve operational efficiency? In addition to understanding the variances computed above, Stevie should attempt to keep track of the number of cars worked on V as well as the Requirement 4. How many cars, on average, did Stevie budget for each employee? How many cars did they actually detail? Determine the formula to show how many cars, on average, the employees detailed. (X = number of cars detailed by long-term employee, Y = number of cars detailed by both short-term employees.) (Click the icon for information regarding the formula selections.) ) + x Y Next calculate the budgeted and actual number of cars for each employee type. Actual Budgeted number of cars number of cars Long-term employee Short-term employees Requirement 5. What advice would you give Stevie about motivating his employees? Stevie needs to determine better way to to encourage retention. Rather than paying wage per car, Stevie might consider for all of the employees