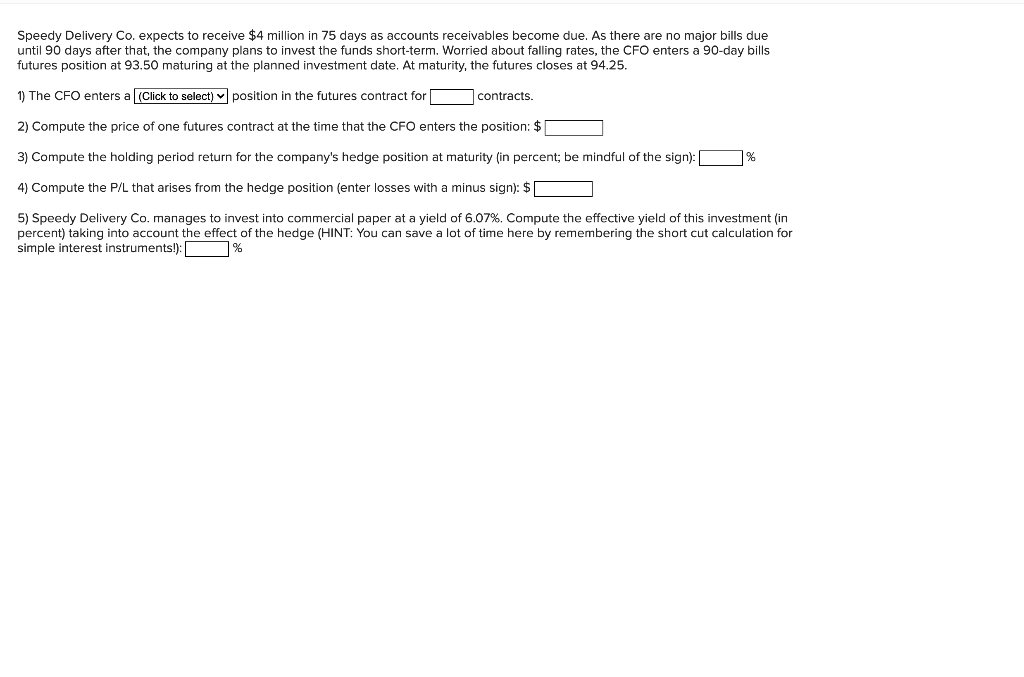

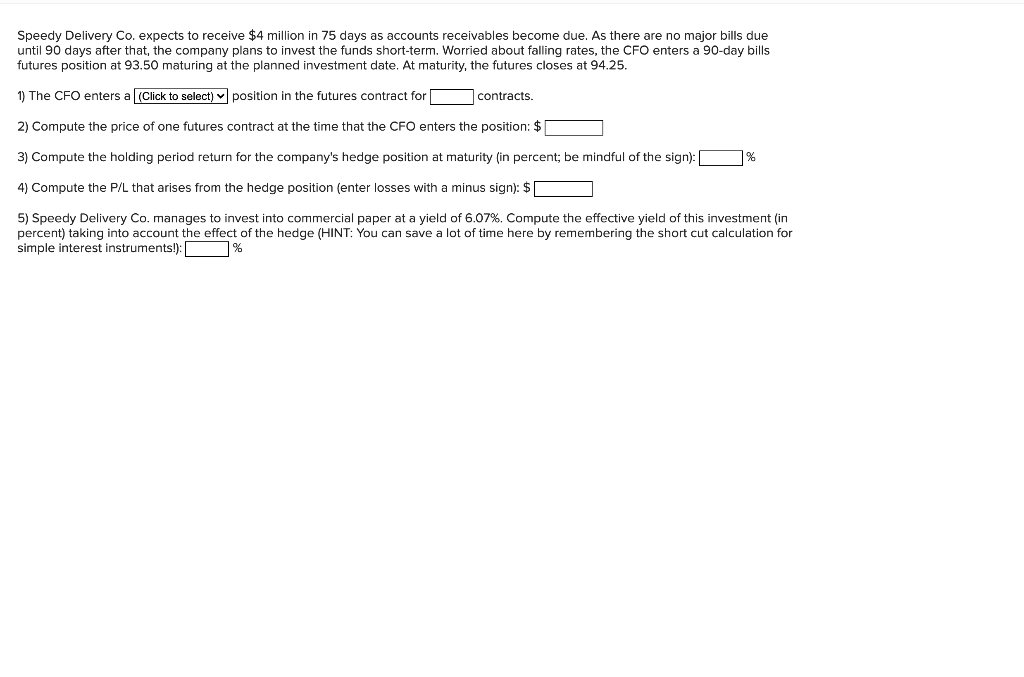

Speedy Delivery Co. expects to receive $4 million in 75 days as accounts receivables become due. As there are no major bills due until 90 days after that, the company plans to invest the funds short-term. Worried about falling rates, the CFO enters a 90-day bills futures position at 93.50 maturing at the planned investment date. At maturity, the futures closes at 94.25. 1) The CFO enters a (Click to select)y position in the futures contract for contracts. 2) Compute the price of one futures contract at the time that the CFO enters the position: $ 3) Compute the holding period return for the company's hedge position at maturity (in percent; be mindful of the sign): % 4) Compute the P/L that arises from the hedge position (enter losses with a minus sign): $ 5) Speedy Delivery Co. manages to invest into commercial paper at a yield of 6.07%. Compute the effective yield of this investment in percent) taking into account the effect of the hedge (HINT: You can save a lot of time here by remembering the short cut calculation for simple interest instruments!): Speedy Delivery Co. expects to receive $4 million in 75 days as accounts receivables become due. As there are no major bills due until 90 days after that, the company plans to invest the funds short-term. Worried about falling rates, the CFO enters a 90-day bills futures position at 93.50 maturing at the planned investment date. At maturity, the futures closes at 94.25. 1) The CFO enters a (Click to select)y position in the futures contract for contracts. 2) Compute the price of one futures contract at the time that the CFO enters the position: $ 3) Compute the holding period return for the company's hedge position at maturity (in percent; be mindful of the sign): % 4) Compute the P/L that arises from the hedge position (enter losses with a minus sign): $ 5) Speedy Delivery Co. manages to invest into commercial paper at a yield of 6.07%. Compute the effective yield of this investment in percent) taking into account the effect of the hedge (HINT: You can save a lot of time here by remembering the short cut calculation for simple interest instruments!)