Answered step by step

Verified Expert Solution

Question

1 Approved Answer

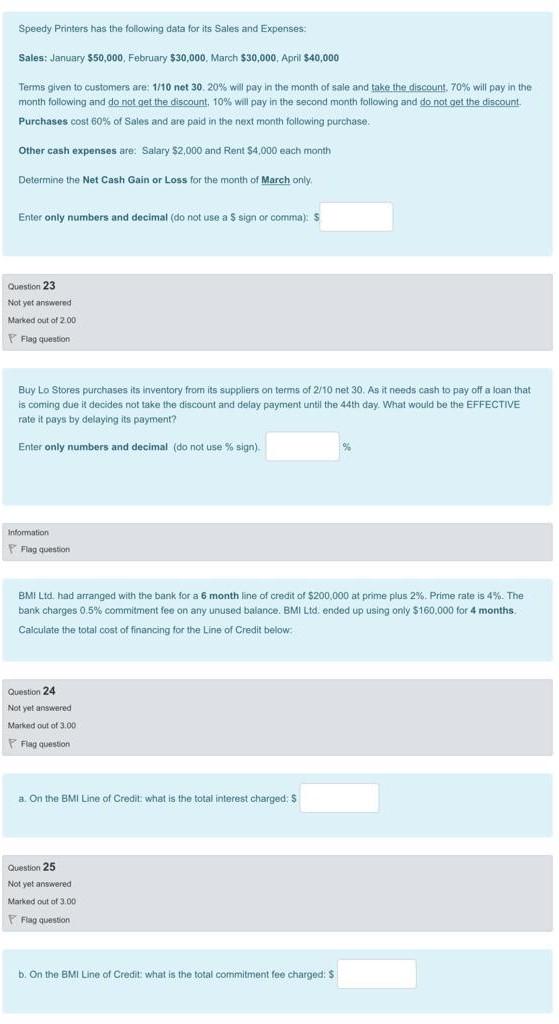

Speedy Printers has the following data for its Sales and Expenses. Sales: January 550,000, February $30,000, March $30,000. April $40,000 Terms given to customers are:

Speedy Printers has the following data for its Sales and Expenses. Sales: January 550,000, February $30,000, March $30,000. April $40,000 Terms given to customers are: 1/10 net 30. 20% will pay in the month of sale and take the discount. 70% will pay in the month following and do not get the discount, 10% will pay in the second month following and do not get the discount Purchases cost 60% of Sales and are paid in the next month following purchase. Other cash expenses are: Salary $2,000 and Rent $4,000 each month Determine the Net Cash Gain or Loss for the month of March only Enter only numbers and decimal (do not use a S sign or comma): $ Question 23 Not yet answered Marked out of 200 Flag question Buy Lo Stores purchases its inventory from its suppliers on terms of 2/10 net 30. As it needs cash to pay off a loan that is coming due it decides not take the discount and delay payment until the 44th day. What would be the EFFECTIVE rate it pays by delaying its payment? Enter only numbers and decimal (do not use % sign) Information P Flag question BMI Ltd had arranged with the bank for a 6 month line of credit of $200,000 at prime plus 2%. Prime rate is 4%. The bank charges 0.5% commitment fee on any unused balance. BMI Ltd ended up using only $160,000 for 4 months Calculate the total cost of financing for the Line of Credit below Question 24 Not yet answered Marked out of 3.00 Flag question a. On the BMI Line of Credit what is the total interest charged: S Question 25 Not yet answered Marked out of 3.00 Flag question b. On the BMI Line of Credit: what is the total commitment fee charged. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started