Answered step by step

Verified Expert Solution

Question

1 Approved Answer

spen the business and now shares in the profits with him. Zach will only b Kevin owns a furniture store and is personally liable for

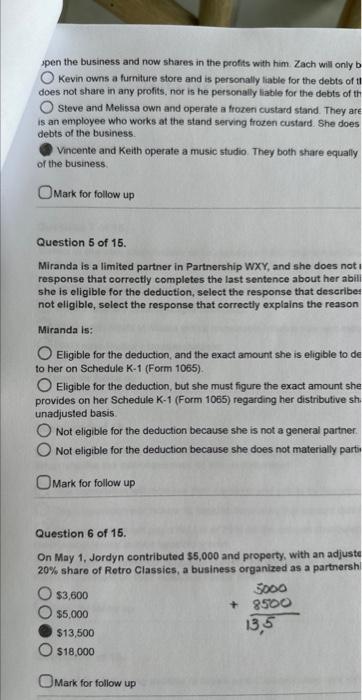

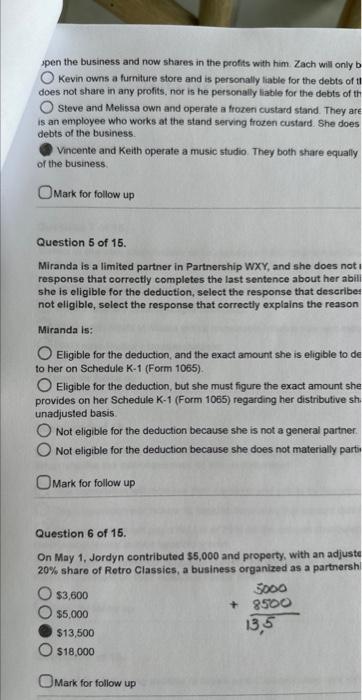

spen the business and now shares in the profits with him. Zach will only b Kevin owns a furniture store and is personally liable for the debts of tI does not share in any profits, nor is he personally liable for the debts of th Steve and Melissa own and operate a frozen custard stand. They are is an employee who works at the stand serving frozen custard. She does debts of the business. Vincente and Keith operate a music studio. They both share equally of the business. Mark for follow up Question 5 of 15. Miranda is a limited partner in Partnership WXY, and she does not I response that correctly completes the last sentence about her abili she is oligible for the deduction, select the response that describer not eligible, solect the response that correctly explains the reason Miranda is: Eligible for the deduction, and the exact amount she is eligible to de to her on Schedule K-1 (Form 1065). Eligible for the deduction, but she must figure the exact amount she provides on her Schedule K-1 (Form 1065) regarding her distributive sh. unadjusted basis Not eligible for the deduction because she is not a general partner. Not eligible for the deduction because she does not materially parti Mark for follow up Question 6 of 15. On May 1, Jordyn contributed \$5,000 and property, with an adjuste 20% share of Retro Classics, a business organized as a partnersh $3,600 $5,000 $13,500 $18,000 Mark for follow up spen the business and now shares in the profits with him. Zach will only b Kevin owns a furniture store and is personally liable for the debts of tI does not share in any profits, nor is he personally liable for the debts of th Steve and Melissa own and operate a frozen custard stand. They are is an employee who works at the stand serving frozen custard. She does debts of the business. Vincente and Keith operate a music studio. They both share equally of the business. Mark for follow up Question 5 of 15. Miranda is a limited partner in Partnership WXY, and she does not I response that correctly completes the last sentence about her abili she is oligible for the deduction, select the response that describer not eligible, solect the response that correctly explains the reason Miranda is: Eligible for the deduction, and the exact amount she is eligible to de to her on Schedule K-1 (Form 1065). Eligible for the deduction, but she must figure the exact amount she provides on her Schedule K-1 (Form 1065) regarding her distributive sh. unadjusted basis Not eligible for the deduction because she is not a general partner. Not eligible for the deduction because she does not materially parti Mark for follow up Question 6 of 15. On May 1, Jordyn contributed \$5,000 and property, with an adjuste 20% share of Retro Classics, a business organized as a partnersh $3,600 $5,000 $13,500 $18,000 Mark for follow up

spen the business and now shares in the profits with him. Zach will only b Kevin owns a furniture store and is personally liable for the debts of tI does not share in any profits, nor is he personally liable for the debts of th Steve and Melissa own and operate a frozen custard stand. They are is an employee who works at the stand serving frozen custard. She does debts of the business. Vincente and Keith operate a music studio. They both share equally of the business. Mark for follow up Question 5 of 15. Miranda is a limited partner in Partnership WXY, and she does not I response that correctly completes the last sentence about her abili she is oligible for the deduction, select the response that describer not eligible, solect the response that correctly explains the reason Miranda is: Eligible for the deduction, and the exact amount she is eligible to de to her on Schedule K-1 (Form 1065). Eligible for the deduction, but she must figure the exact amount she provides on her Schedule K-1 (Form 1065) regarding her distributive sh. unadjusted basis Not eligible for the deduction because she is not a general partner. Not eligible for the deduction because she does not materially parti Mark for follow up Question 6 of 15. On May 1, Jordyn contributed \$5,000 and property, with an adjuste 20% share of Retro Classics, a business organized as a partnersh $3,600 $5,000 $13,500 $18,000 Mark for follow up spen the business and now shares in the profits with him. Zach will only b Kevin owns a furniture store and is personally liable for the debts of tI does not share in any profits, nor is he personally liable for the debts of th Steve and Melissa own and operate a frozen custard stand. They are is an employee who works at the stand serving frozen custard. She does debts of the business. Vincente and Keith operate a music studio. They both share equally of the business. Mark for follow up Question 5 of 15. Miranda is a limited partner in Partnership WXY, and she does not I response that correctly completes the last sentence about her abili she is oligible for the deduction, select the response that describer not eligible, solect the response that correctly explains the reason Miranda is: Eligible for the deduction, and the exact amount she is eligible to de to her on Schedule K-1 (Form 1065). Eligible for the deduction, but she must figure the exact amount she provides on her Schedule K-1 (Form 1065) regarding her distributive sh. unadjusted basis Not eligible for the deduction because she is not a general partner. Not eligible for the deduction because she does not materially parti Mark for follow up Question 6 of 15. On May 1, Jordyn contributed \$5,000 and property, with an adjuste 20% share of Retro Classics, a business organized as a partnersh $3,600 $5,000 $13,500 $18,000 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started