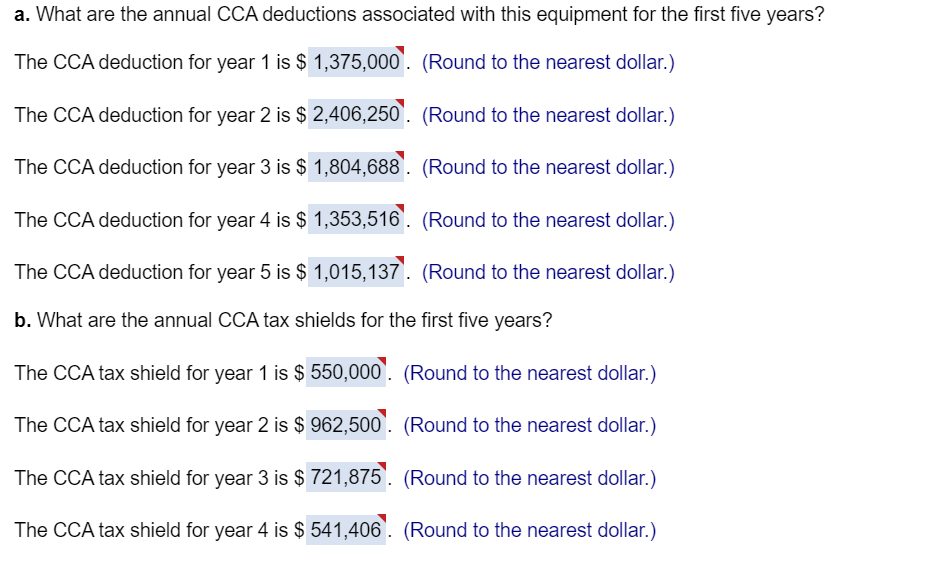

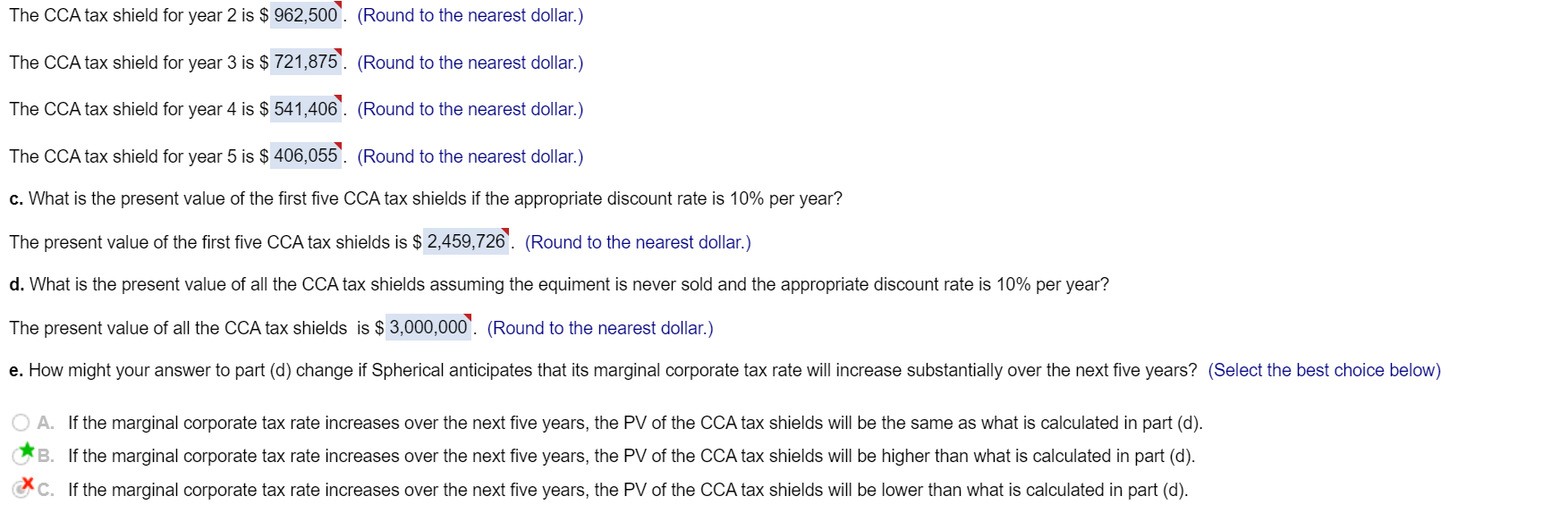

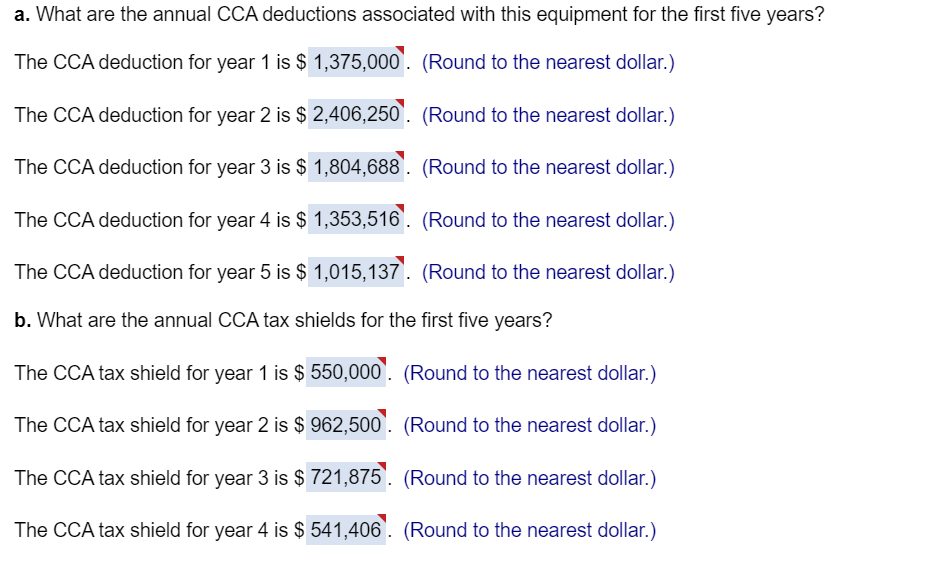

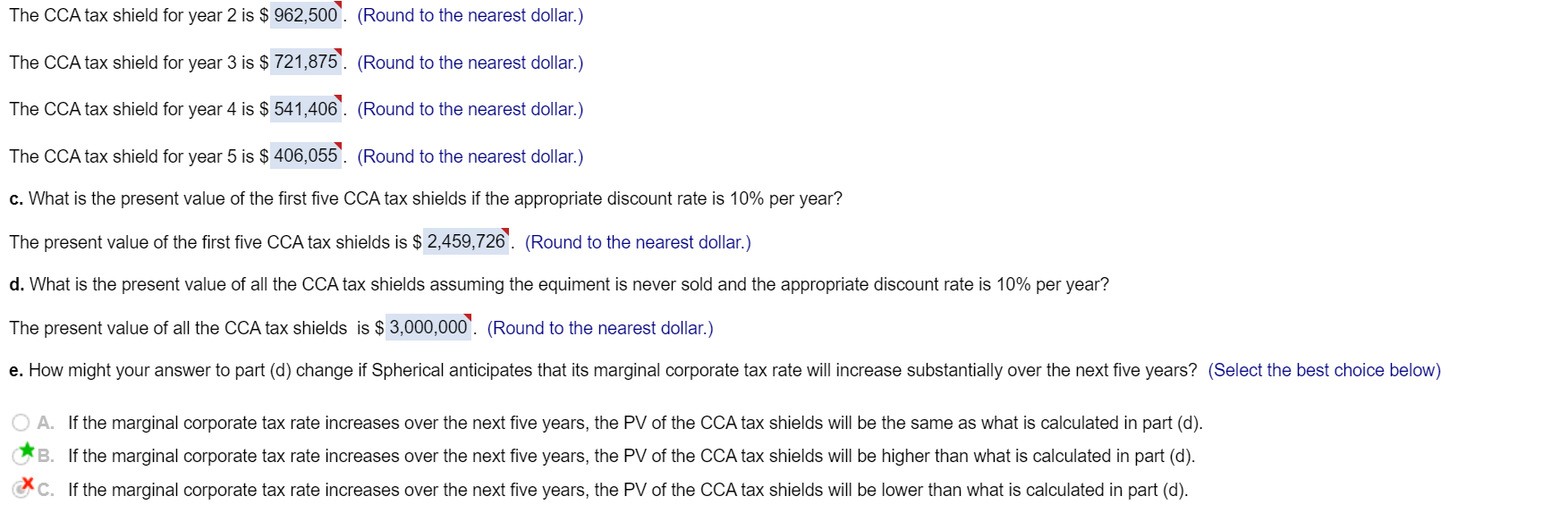

Spherical Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk brakes. This equipment has a CCA rate of 45% and Spherical's marginal corporate tax rate is 37%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 12% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 12% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? a. What are the annual CCA deductions associated with this equipment for the first five years? The CCA deduction for year 1 is $ 1,375,000. (Round to the nearest dollar.) The CCA deduction for year 2 is $ 2,406,250. (Round to the nearest dollar.) The CCA deduction for year 3 is $ 1,804,688. (Round to the nearest dollar.) The CCA deduction for year 4 is $ 1,353,516. (Round to the nearest dollar.) The CCA deduction for year 5 is $ 1,015,137'. (Round to the nearest dollar.) b. What are the annual CCA tax shields for the first five years? The CCA tax shield for year 1 is $ 550,000" (Round to the nearest dollar.) The CCA tax shield for year 2 is $ 962,500". (Round to the nearest dollar.) The CCA tax shield for year 3 is $ 721,875. (Round to the nearest dollar.) The CCA tax shield for year 4 is $ 541,406. (Round to the nearest dollar.) The CCA tax shield for year 2 is $ 962,500. (Round to the nearest dollar.) The CCA tax shield for year 3 is $ 721,875'. (Round to the nearest dollar.) The CCA tax shield for year 4 is $ 541,406). (Round to the nearest dollar.) The CCA tax shield for year 5 is $ 406,055. (Round to the nearest dollar.) c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 10% per year? The present value of the first five CCA tax shields is $ 2,459,726". (Round to the nearest dollar.) d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 10% per year? The present value of all the CCA tax shields is $ 3,000,000". (Round to the nearest dollar.) e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? (Select the best choice below) O A. If the marginal corporate tax rate increases over the next five years, the PV of the CCA tax shields will be the same as what is calculated in part (d). B. If the marginal corporate tax rate increases over the next five years, the PV of the CCA tax shields will be higher than what is calculated in part (d). C. If the marginal corporate tax rate increases over the next five years, the PV of the CCA tax shields will be lower than what is calculated in part (d)