Question

SPI Company has the following data for the year ended December 31, Year 1: Sales (credit) Sales returns and allowances Accounts receivable (December 31,

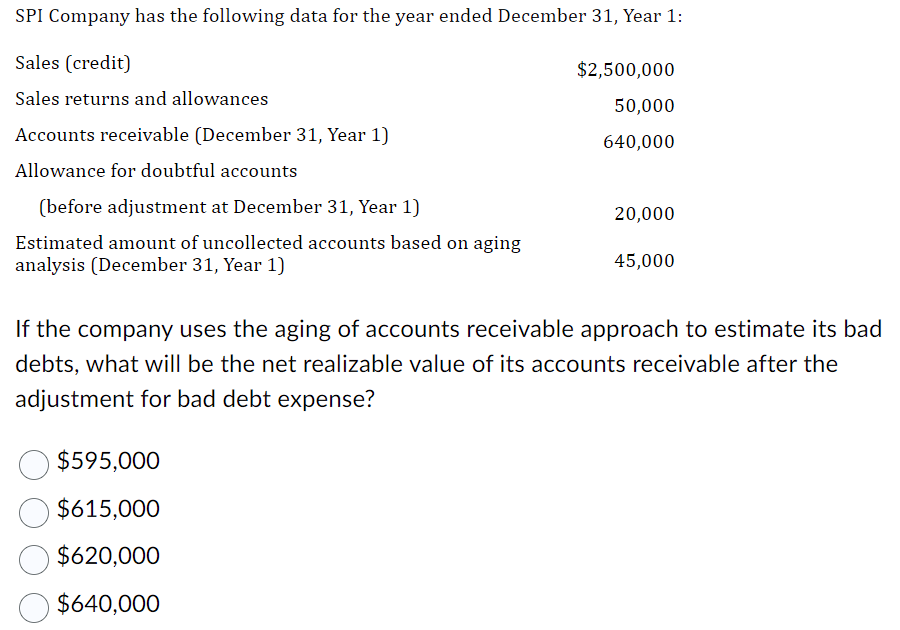

SPI Company has the following data for the year ended December 31, Year 1: Sales (credit) Sales returns and allowances Accounts receivable (December 31, Year 1) Allowance for doubtful accounts (before adjustment at December 31, Year 1) Estimated amount of uncollected accounts based on aging analysis (December 31, Year 1) $2,500,000 50,000 640,000 $595,000 $615,000 $620,000 $640,000 20,000 45,000 If the company uses the aging of accounts receivable approach to estimate its bad debts, what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The net realizable value NRV of accounts receivable is calculated by subtracting the allowance for d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App