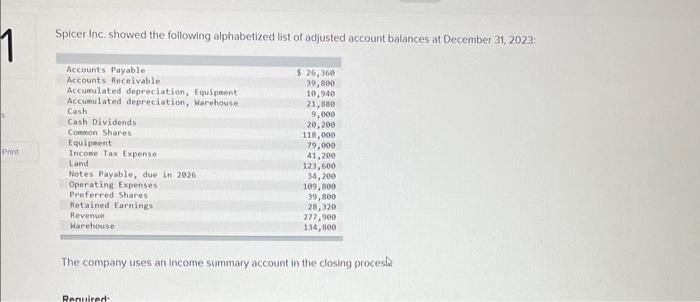

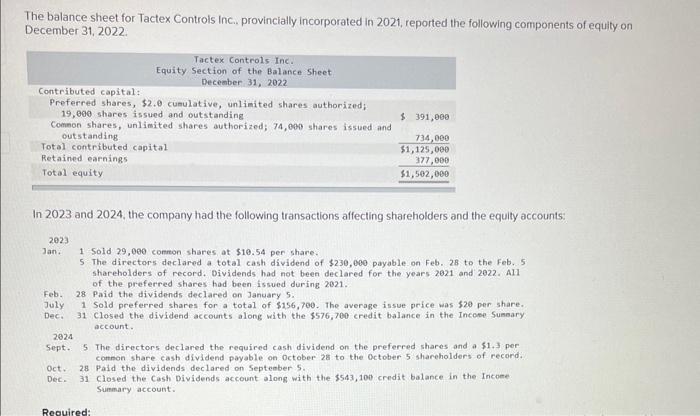

Spicer inc. showed the following aiphabetized list of adjusted account balances at December 31,2023 : The company uses an income summary account in the closing proces@. The balance sheet for Tactex Controis inc., provincially incorporated in 2021, reported the following components of equity on December 31,2022 In 2023 and 2024, the company had the following transactions affecting shareholders and the equity accounts: lan. 1 Sold 29,000 conmon shares, at $10.54 per share. 5 The directors declared a total cash dividend of $230,000 payable on Feb. 28 to the Feb. 5 shareholders of record. Dividends, had not been declared for the years 2821 and 2022. A11 of the preferred shares had been issued during 2021 . Feb. 28 Paid the dividends declared on January 5 . July 1 Sold preferred shares for a total of $156,700. The average issue price was 520 per share. Dec. 31 closed the dividend accounts along with the $576,700 credit balance in the Incose 5unsary. account. 2024 Sept: 5 The directors declared the required cash dividend on the preferred shares and a $1,3 per comnon share cash dividend payable on October 28 to the October 5 shareholders of record: Oct. 28 Paid the dividends declared on Septenber 5. Dec. 31 Closed the Cash Dividends account along with the $543,100 credit balance in the incoee Summary account. Spicer inc. showed the following aiphabetized list of adjusted account balances at December 31,2023 : The company uses an income summary account in the closing proces@. The balance sheet for Tactex Controis inc., provincially incorporated in 2021, reported the following components of equity on December 31,2022 In 2023 and 2024, the company had the following transactions affecting shareholders and the equity accounts: lan. 1 Sold 29,000 conmon shares, at $10.54 per share. 5 The directors declared a total cash dividend of $230,000 payable on Feb. 28 to the Feb. 5 shareholders of record. Dividends, had not been declared for the years 2821 and 2022. A11 of the preferred shares had been issued during 2021 . Feb. 28 Paid the dividends declared on January 5 . July 1 Sold preferred shares for a total of $156,700. The average issue price was 520 per share. Dec. 31 closed the dividend accounts along with the $576,700 credit balance in the Incose 5unsary. account. 2024 Sept: 5 The directors declared the required cash dividend on the preferred shares and a $1,3 per comnon share cash dividend payable on October 28 to the October 5 shareholders of record: Oct. 28 Paid the dividends declared on Septenber 5. Dec. 31 Closed the Cash Dividends account along with the $543,100 credit balance in the incoee Summary account