Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023: Accounts Payable $ 25,460 Accounts Receivable 38,900 Accumulated depreciation, Equipment

Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023:

| Accounts Payable | $ | 25,460 | |

| Accounts Receivable | 38,900 | ||

| Accumulated depreciation, Equipment | 10,490 | ||

| Accumulated depreciation, Warehouse | 20,980 | ||

| Cash | 8,100 | ||

| Cash Dividends | 19,300 | ||

| Common Shares | 109,000 | ||

| Equipment | 78,100 | ||

| Income Tax Expense | 40,300 | ||

| Land | 114,600 | ||

| Notes Payable, due in 2026 | 33,300 | ||

| Operating Expenses | 108,900 | ||

| Preferred Shares | 38,900 | ||

| Retained Earnings | 27,420 | ||

| Revenue | 268,450 | ||

| Warehouse | 125,800 | ||

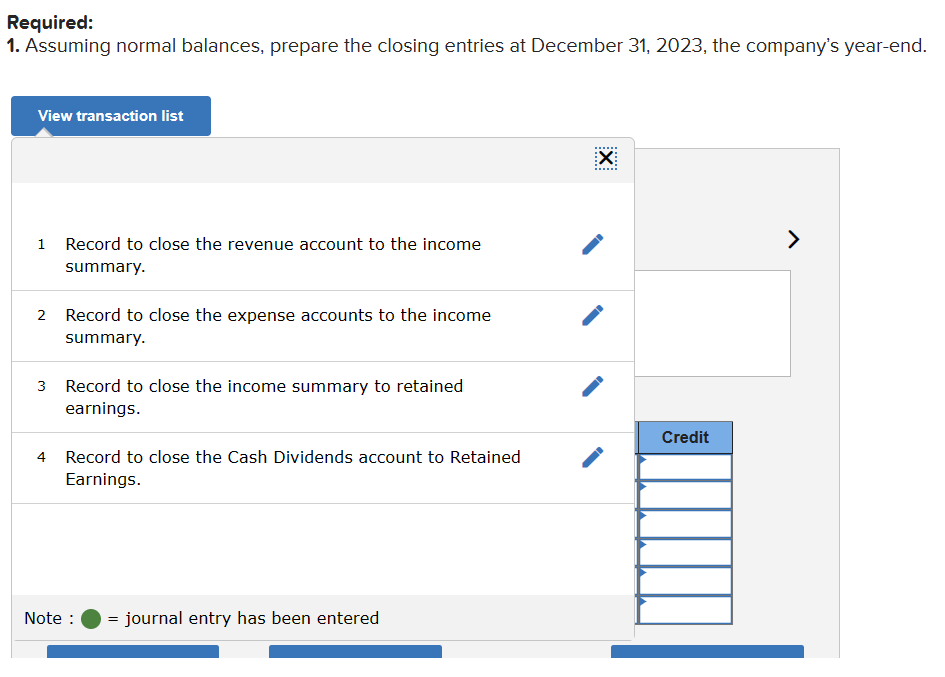

The company uses an income summary account in the closing process. Required: 1. Assuming normal balances, prepare the closing entries at December 31, 2023, the companys year-end.

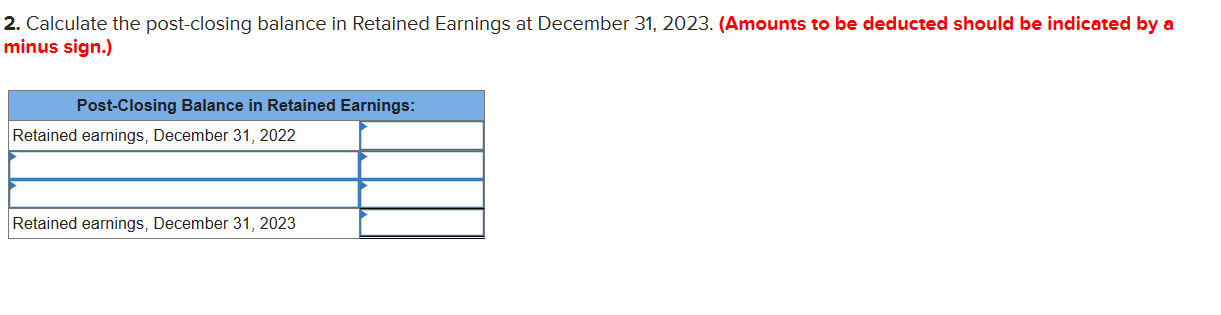

Required: 1. Assuming normal balances, prepare the closing entries at December 31, 2023, the company's year-end. \begin{tabular}{|l|l|} \hline 1 & \\ \hline 1 & Recordtoclosetherevenueaccounttotheincomesummary. \\ \hline 2 & Recordtoclosetheexpenseaccountstotheincomesummary. \\ \hline 3 Record to close the income summary to retained \\ earnings. \end{tabular} Calculate the post-closing balance in Retained Earnings at December 31, 2023. (Amounts to be deducted should be indicated by a ninus sign.)

Required: 1. Assuming normal balances, prepare the closing entries at December 31, 2023, the company's year-end. \begin{tabular}{|l|l|} \hline 1 & \\ \hline 1 & Recordtoclosetherevenueaccounttotheincomesummary. \\ \hline 2 & Recordtoclosetheexpenseaccountstotheincomesummary. \\ \hline 3 Record to close the income summary to retained \\ earnings. \end{tabular} Calculate the post-closing balance in Retained Earnings at December 31, 2023. (Amounts to be deducted should be indicated by a ninus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started