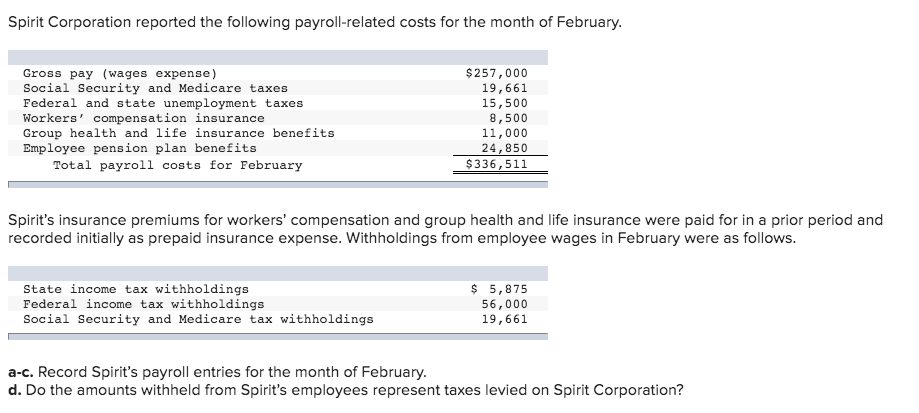

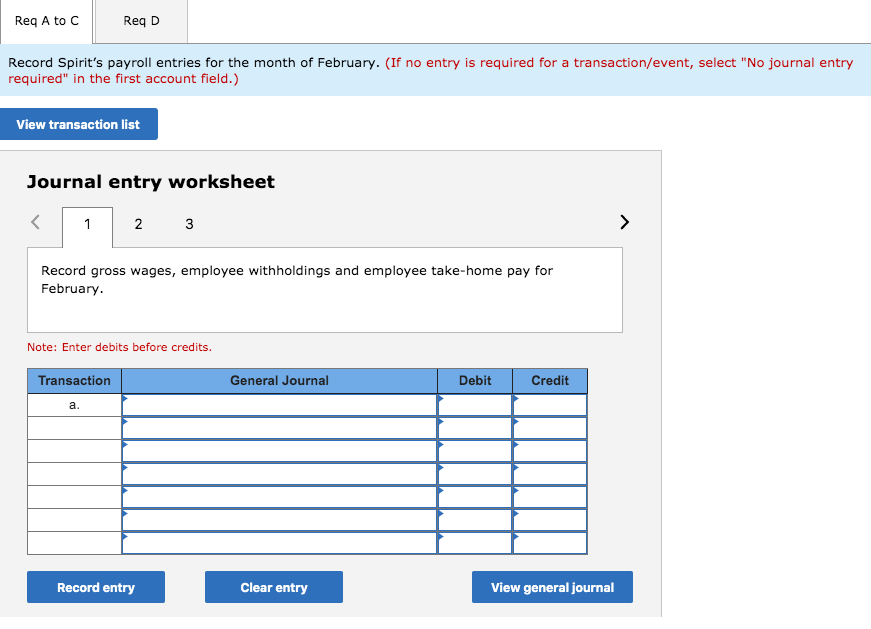

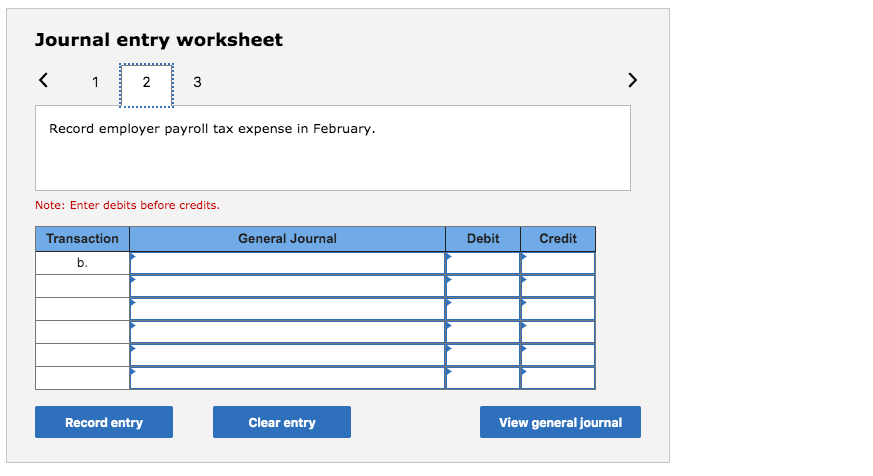

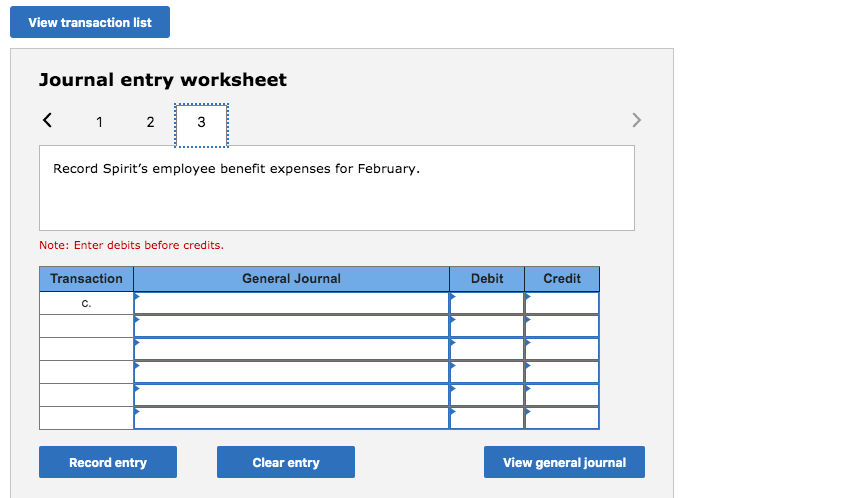

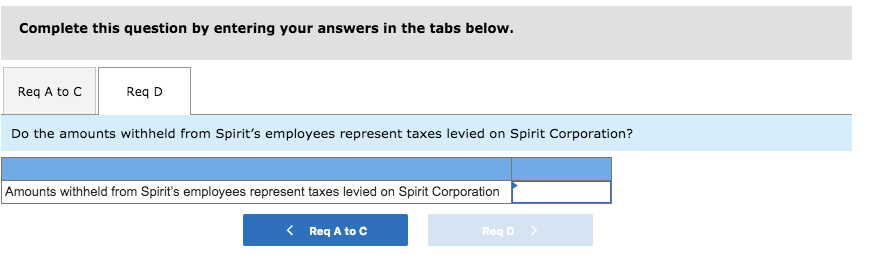

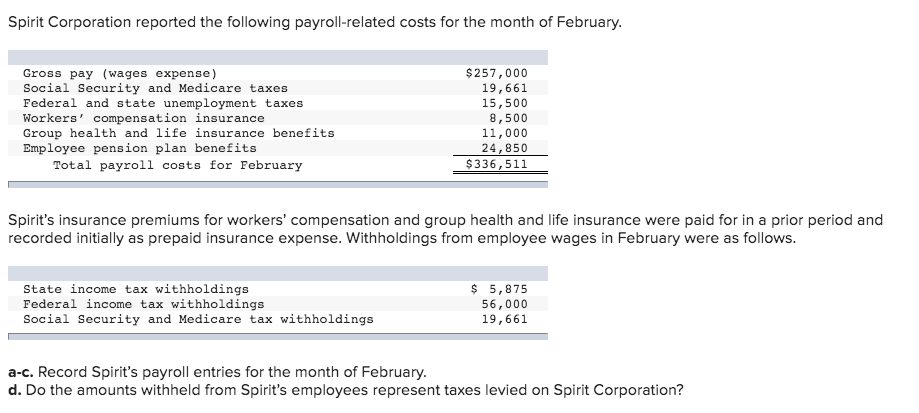

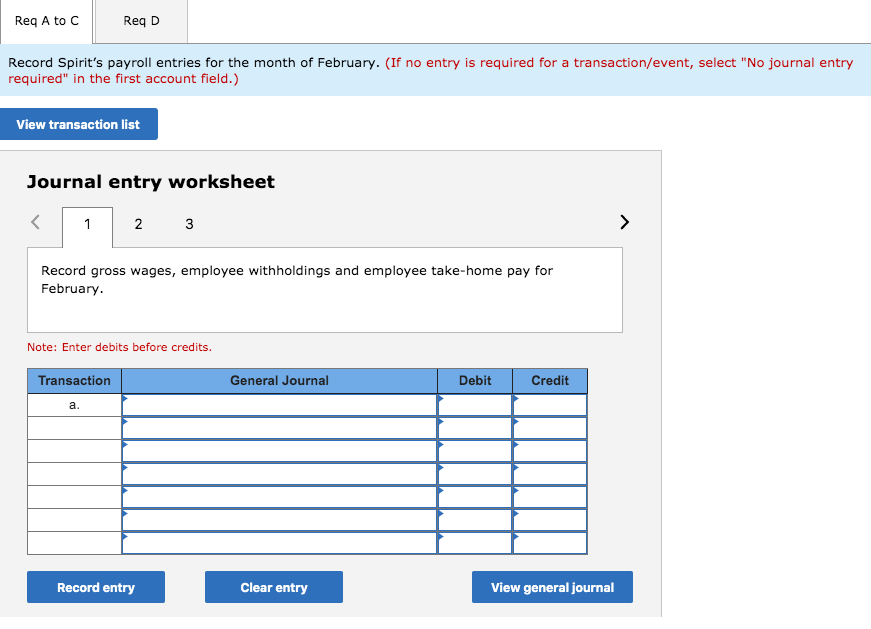

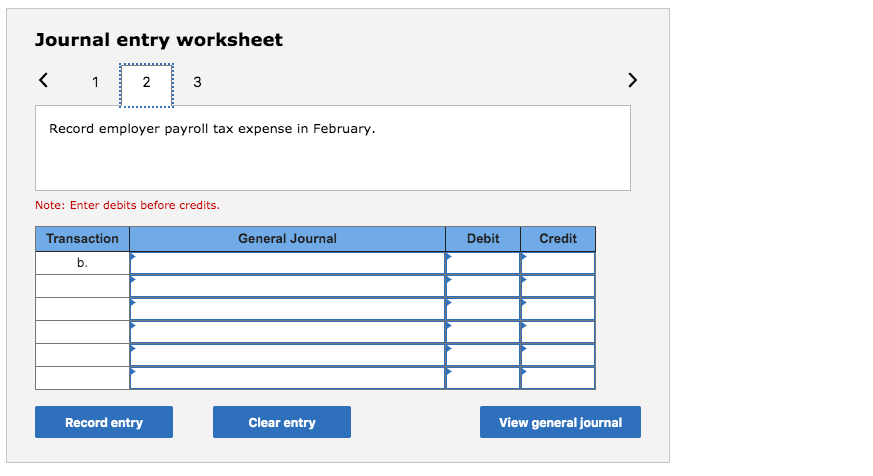

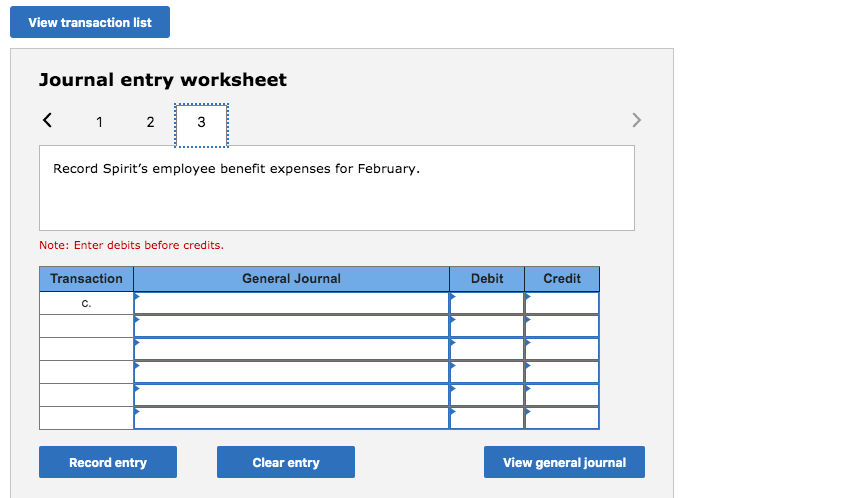

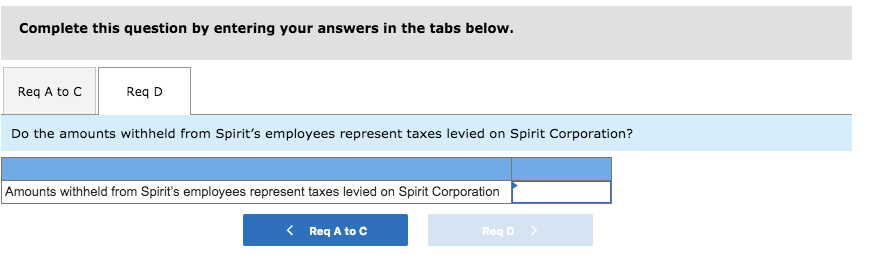

Spirit Corporation reported the following payroll-related costs for the month of February. Gross pay (wages expense) Social Security and Medicare taxes Federal and state unemployment taxes Workers' compensation insurance Group health and life insurance benefits Employee pension plan benefits Total payroll costs for February $ 257,000 19,661 15,500 8,500 11,000 24,850 $336,511 Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense. Withholdings from employee wages in February were as follows. $ State income tax withholdings Federal income tax withholdings Social Security and Medicare tax withholdings 5,875 56,000 19,661 a-c. Record Spirit's payroll entries for the month of February. d. Do the amounts withheld from Spirit's employees represent taxes levied on Spirit Corporation? Req A to C Req D Record Spirit's payroll entries for the month of February. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Spirit Corporation reported the following payroll-related costs for the month of February. Gross pay (wages expense) Social Security and Medicare taxes Federal and state unemployment taxes Workers' compensation insurance Group health and life insurance benefits Employee pension plan benefits Total payroll costs for February $ 257,000 19,661 15,500 8,500 11,000 24,850 $336,511 Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense. Withholdings from employee wages in February were as follows. $ State income tax withholdings Federal income tax withholdings Social Security and Medicare tax withholdings 5,875 56,000 19,661 a-c. Record Spirit's payroll entries for the month of February. d. Do the amounts withheld from Spirit's employees represent taxes levied on Spirit Corporation? Req A to C Req D Record Spirit's payroll entries for the month of February. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet