Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spirited Co. produces a sports drink that they sell to the local retailers in their suburban community. The drink is popular among the local athletes,

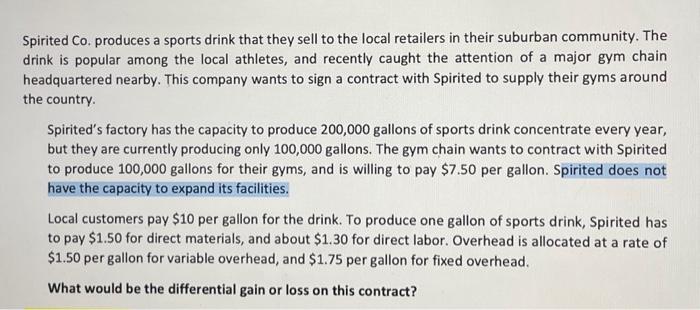

Spirited Co. produces a sports drink that they sell to the local retailers in their suburban community. The drink is popular among the local athletes, and recently caught the attention of a major gym chain headquartered nearby. This company wants to sign a contract with Spirited to supply their gyms around the country. Spirited's factory has the capacity to produce 200,000 gallons of sports drink concentrate every year, but they are currently producing only 100,000 gallons. The gym chain wants to contract with Spirited to produce 100,000 gallons for their gyms, and is willing to pay $7.50 per gallon. Spirited does not have the capacity to expand its facilities. Local customers pay $10 per gallon for the drink. To produce one gallon of sports drink, Spirited has to pay $1.50 for direct materials, and about $1.30 for direct labor. Overhead is allocated at a rate of $1.50 per gallon for variable overhead, and $1.75 per gallon for fixed overhead. What would be the differential gain or loss on this contract?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started