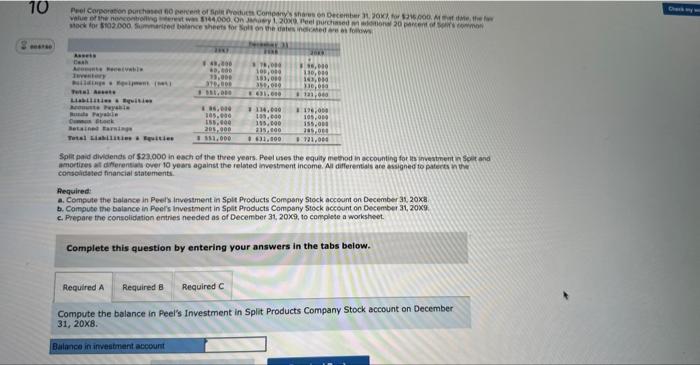

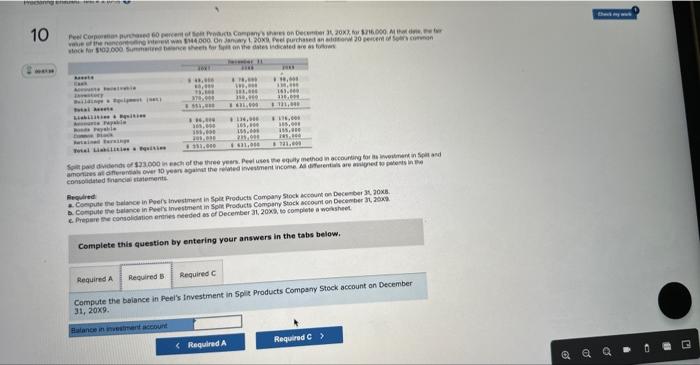

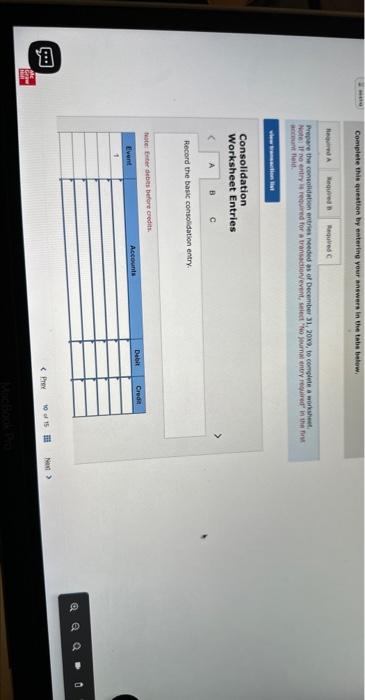

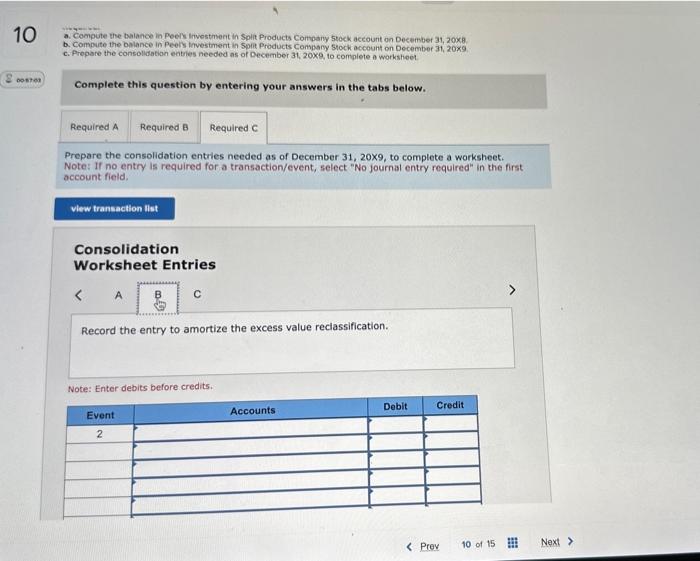

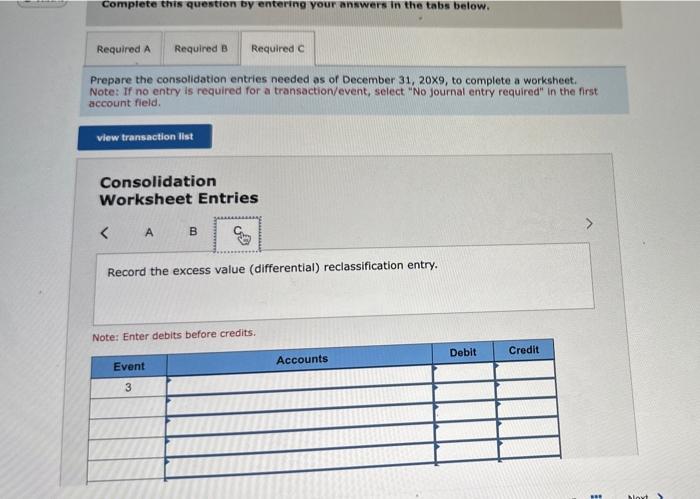

Spit paid dividends of 527000 in each of the theee years. Peel uses the equify method in accounting for its investinent in Spit and condolitated francial statements. Pequired: a. Compute the talance in Peels investment in Spit Products Compeny Stock account on December 3t, 201. b. Compute the balance in Peers investment in Splt Products Company Stock account on December 31, 20x9. c. Prepare the consolidation entries needed as of December 31, 20.9, 10 complete a workshwet. Complete this question by entering your answers in the tabs below. Compute the balance in Peel's Investment in Split Products Company Stock account on December 31,208. consontated friencial riatemants. Replired. Complete this question by entering your answers in the tabs below. Complete this question by etstering youi answees in the tabs beliowi antimatit tielit. Consolidation Worksheet Entries Record the basic consolidaticn entry fuste: triter debles before ordits. a. Compute the bulance in Peely Irvestment in Split Products Corthpary 5 tock account on December 31, 20x. b. Compute the bylance in Peel's tivestment in 5plit Products Company Sock account on December 31, 209 c. Propare the consolidation entries needed as of December 31, 20x9, to compiete a worksheet. Complete this question by entering your answers in the tabs below. Prepare the consolidation entries needed as of December 31,209, to complete a worksheet. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the entry to amortize the excess value reclassification. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the consolidation entries needed as of December 31, 20x9, to complete a worksheet. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Consolidation Worksheet Entries Record the excess value (differential) reclassification entry. Note: Enter debits before credits. Spit paid dividends of 527000 in each of the theee years. Peel uses the equify method in accounting for its investinent in Spit and condolitated francial statements. Pequired: a. Compute the talance in Peels investment in Spit Products Compeny Stock account on December 3t, 201. b. Compute the balance in Peers investment in Splt Products Company Stock account on December 31, 20x9. c. Prepare the consolidation entries needed as of December 31, 20.9, 10 complete a workshwet. Complete this question by entering your answers in the tabs below. Compute the balance in Peel's Investment in Split Products Company Stock account on December 31,208. consontated friencial riatemants. Replired. Complete this question by entering your answers in the tabs below. Complete this question by etstering youi answees in the tabs beliowi antimatit tielit. Consolidation Worksheet Entries Record the basic consolidaticn entry fuste: triter debles before ordits. a. Compute the bulance in Peely Irvestment in Split Products Corthpary 5 tock account on December 31, 20x. b. Compute the bylance in Peel's tivestment in 5plit Products Company Sock account on December 31, 209 c. Propare the consolidation entries needed as of December 31, 20x9, to compiete a worksheet. Complete this question by entering your answers in the tabs below. Prepare the consolidation entries needed as of December 31,209, to complete a worksheet. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the entry to amortize the excess value reclassification. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the consolidation entries needed as of December 31, 20x9, to complete a worksheet. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Consolidation Worksheet Entries Record the excess value (differential) reclassification entry. Note: Enter debits before credits