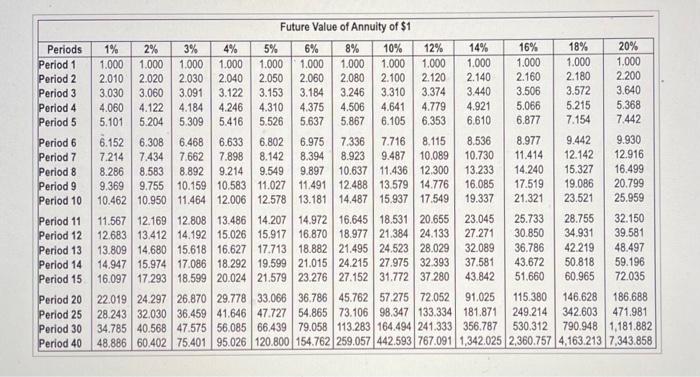

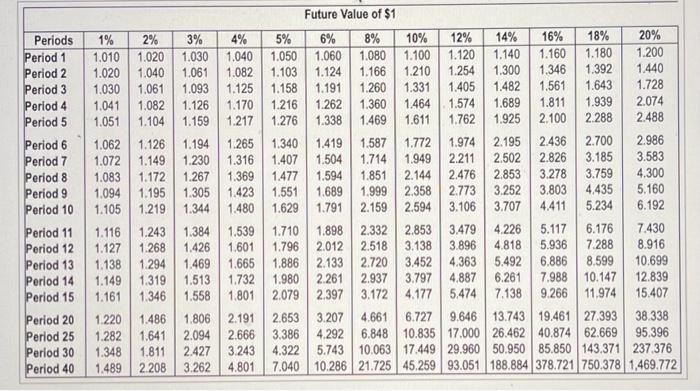

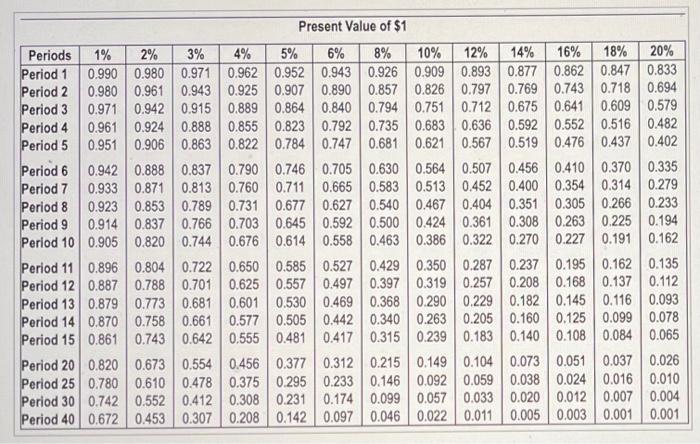

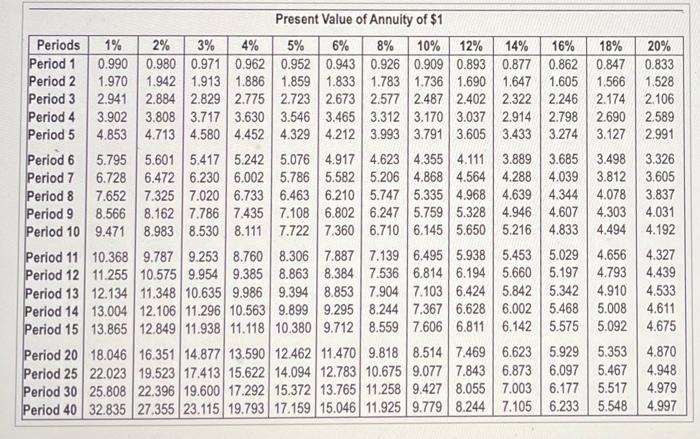

Splash World is consideting purchasing a water pack in San Diego, Calfornla, Sor $1,950,000. The new focilty wil generale annual net cash infows or $490,000 for eight years. Engineers estimate that the facility will romain usetul for eight years and heve no residual vatue. The company uses stralghthline depreciation. Its owners want paybock in less than five years and an ARR of 12 th of more. Management uses a 14% hurdle rate on investenents of this nature (Click the icon to view the prosant value antulty table.) (Cick the icon to vien the peesent value tabie.) (Click the icon to viow the future value annuity table,y (Click the icen to vaw the future valuo tablo) Reas the tequiremnnts. Requirements bles to compule the IRff, answer with the closest intoreat rate shown 1. Compuite the poytsck period, the APR, the NPV, and the approvimase IRR of this investment. (if you use the tables to compuit the IRR, answer whith the cosest interest rale shown in the tables.) 2. Fecommend whether the conpany chould invest in this project. Splash World is consibering purchasing a water park in San Diego, Calfornia, for $1,950,000. The new faciity wil generate annual not cash infous of \$490,000 for eight years. Engineers estmate thet the facily will remain useful for elight years and have no residual value. The company uses straght-ine depreciation. Its owners want paybock in loss than five years and an ARR of 12% of more. Management uses a 14% hurdle rate on investenents of this nature. (Click the icon to view the present value annuity table.) (Cick the icon to view the present value table.) (Cick the ioon to view the future valie annuity tabie.) (Click the icon to viow the future value table.) Fead the reevirements. Requirement 1. Compute the paybock period, the AFR, the NPV, and the approximate IRR of this inveatment (if you use the tables to compule the iRR, answer with the closelt interest rale shown in the tables) (Round the paytock perlod to one decimal place.) The payback pericd (in years) is (Hound the percontage to the nearet fenth poroent) The ARR (accounteng rate of rotum) is (Round your anwwer to the nearest wholo dollar) Nat present value The IRR (internal rate of retam) is between Requirement 2. Recommend whether the compary ahould invest in this propect Recominendation Future Value of Annuity of $1 Fufurn Value of $1 Present Value of $1 \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 8% & 10% & 12% & 14% & 16% & 18% & 20% \\ \hline Period 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.926 & 0.909 & 0.893 & 0.877 & 0.862 & 0.847 & 0.833 \\ Period 2 & 0.980 & 0.961 & 0.943 & 0.925 & 0.907 & 0.890 & 0.857 & 0.826 & 0.797 & 0.769 & 0.743 & 0.718 & 0.694 \\ Period 3 & 0.971 & 0.942 & 0.915 & 0.889 & 0.864 & 0.840 & 0.794 & 0.751 & 0.712 & 0.675 & 0.641 & 0.609 & 0.579 \\ Period 4 & 0.961 & 0.924 & 0.888 & 0.855 & 0.823 & 0.792 & 0.735 & 0.683 & 0.636 & 0.592 & 0.552 & 0.516 & 0.482 \\ Period 5 & 0.951 & 0.906 & 0.863 & 0.822 & 0.784 & 0.747 & 0.681 & 0.621 & 0.567 & 0.519 & 0.476 & 0.437 & 0.402 \\ Period 6 & 0.942 & 0.888 & 0.837 & 0.790 & 0.746 & 0.705 & 0.630 & 0.564 & 0.507 & 0.456 & 0.410 & 0.370 & 0.335 \\ Period 7 & 0.933 & 0.871 & 0.813 & 0.760 & 0.711 & 0.665 & 0.583 & 0.513 & 0.452 & 0.400 & 0.354 & 0.314 & 0.279 \\ Period 8 & 0.923 & 0.853 & 0.789 & 0.731 & 0.677 & 0.627 & 0.540 & 0.467 & 0.404 & 0.351 & 0.305 & 0.266 & 0.233 \\ Period 9 & 0.914 & 0.837 & 0.766 & 0.703 & 0.645 & 0.592 & 0.500 & 0.424 & 0.361 & 0.308 & 0.263 & 0.225 & 0.194 \\ Period 10 & 0.905 & 0.820 & 0.744 & 0.676 & 0.614 & 0.558 & 0.463 & 0.386 & 0.322 & 0.270 & 0.227 & 0.191 & 0.162 \\ Period 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.429 & 0.350 & 0.287 & 0.237 & 0.195 & 0.162 & 0.135 \\ Period 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.397 & 0.319 & 0.257 & 0.208 & 0.168 & 0.137 & 0.112 \\ Period 13 & 0.879 & 0.773 & 0.681 & 0.601 & 0.530 & 0.469 & 0.368 & 0.290 & 0.229 & 0.182 & 0.145 & 0.116 & 0.093 \\ Period 14 & 0.870 & 0.758 & 0.661 & 0.577 & 0.505 & 0.442 & 0.340 & 0.263 & 0.205 & 0.160 & 0.125 & 0.099 & 0.078 \\ Period 15 & 0.861 & 0.743 & 0.642 & 0.555 & 0.481 & 0.417 & 0.315 & 0.239 & 0.183 & 0.140 & 0.108 & 0.084 & 0.065 \\ Period 20 & 0.820 & 0.673 & 0.554 & 0.456 & 0.377 & 0.312 & 0.215 & 0.149 & 0.104 & 0.073 & 0.051 & 0.037 & 0.026 \\ Period 25 & 0.780 & 0.610 & 0.478 & 0.375 & 0.295 & 0.233 & 0.146 & 0.092 & 0.059 & 0.038 & 0.024 & 0.016 & 0.010 \\ Period 30 & 0.742 & 0.552 & 0.412 & 0.308 & 0.231 & 0.174 & 0.099 & 0.057 & 0.033 & 0.020 & 0.012 & 0.007 & 0.004 \\ Period 40 & 0.672 & 0.453 & 0.307 & 0.208 & 0.142 & 0.097 & 0.046 & 0.022 & 0.011 & 0.005 & 0.003 & 0.001 & 0.001 \\ \hline \end{tabular} Precant Valua nf A nuilfu af 11