Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Splashdown Park plans to install a new spa pool. Construction of the pool requires an immediate outlay of $360,000 and another $40,000 at the end

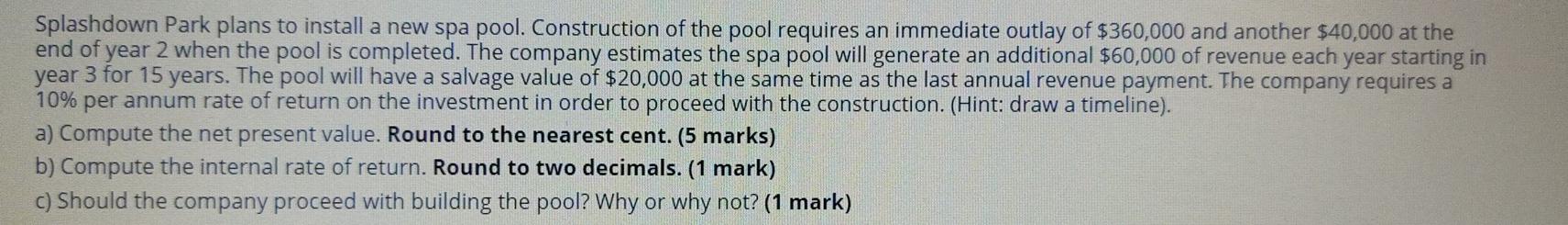

Splashdown Park plans to install a new spa pool. Construction of the pool requires an immediate outlay of $360,000 and another $40,000 at the end of year 2 when the pool is completed. The company estimates the spa pool will generate an additional $60,000 of revenue each year starting in year 3 for 15 years. The pool will have a salvage value of $20,000 at the same time as the last annual revenue payment. The company requires a 10% per annum rate of return on the investment in order to proceed with the construction. (Hint: draw a timeline). a) Compute the net present value. Round to the nearest cent. (5 marks) b) Compute the internal rate of return. Round to two decimals. (1 mark) c) Should the company proceed with building the pool? Why or why not? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started