Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Splish Mining Company recently purchased a quartz mine that it intends to work for the next 10 years. According to state environmental laws, Splish must

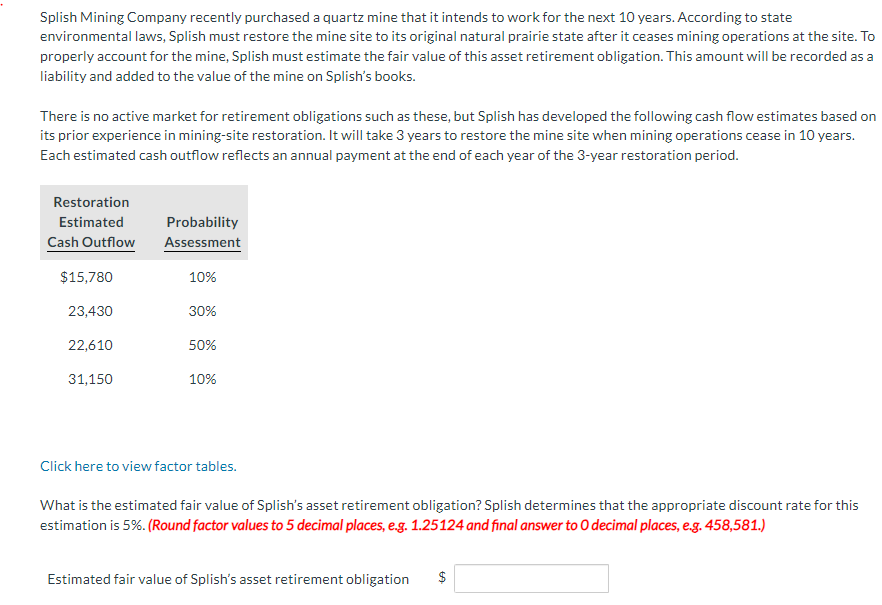

Splish Mining Company recently purchased a quartz mine that it intends to work for the next 10 years. According to state environmental laws, Splish must restore the mine site to its original natural prairie state after it ceases mining operations at the site. To properly account for the mine, Splish must estimate the fair value of this asset retirement obligation. This amount will be recorded as a liability and added to the value of the mine on Splish's books. There is no active market for retirement obligations such as these, but Splish has developed the following cash flow estimates based on its prior experience in mining-site restoration. It will take 3 years to restore the mine site when mining operations cease in 10 years. Each estimated cash outflow reflects an annual payment at the end of each year of the 3-year restoration period. Click here to view factor tables. What is the estimated fair value of Splish's asset retirement obligation? Splish determines that the appropriate discount rate for this estimation is 5%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Estimated fair value of Splish's asset retirement obligation $

Splish Mining Company recently purchased a quartz mine that it intends to work for the next 10 years. According to state environmental laws, Splish must restore the mine site to its original natural prairie state after it ceases mining operations at the site. To properly account for the mine, Splish must estimate the fair value of this asset retirement obligation. This amount will be recorded as a liability and added to the value of the mine on Splish's books. There is no active market for retirement obligations such as these, but Splish has developed the following cash flow estimates based on its prior experience in mining-site restoration. It will take 3 years to restore the mine site when mining operations cease in 10 years. Each estimated cash outflow reflects an annual payment at the end of each year of the 3-year restoration period. Click here to view factor tables. What is the estimated fair value of Splish's asset retirement obligation? Splish determines that the appropriate discount rate for this estimation is 5%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Estimated fair value of Splish's asset retirement obligation $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started