Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Splish Splash Art is a centre that offers children's music and dance lessons. Splish Splash prepares annual financlal statements and has a December 31, 2017,

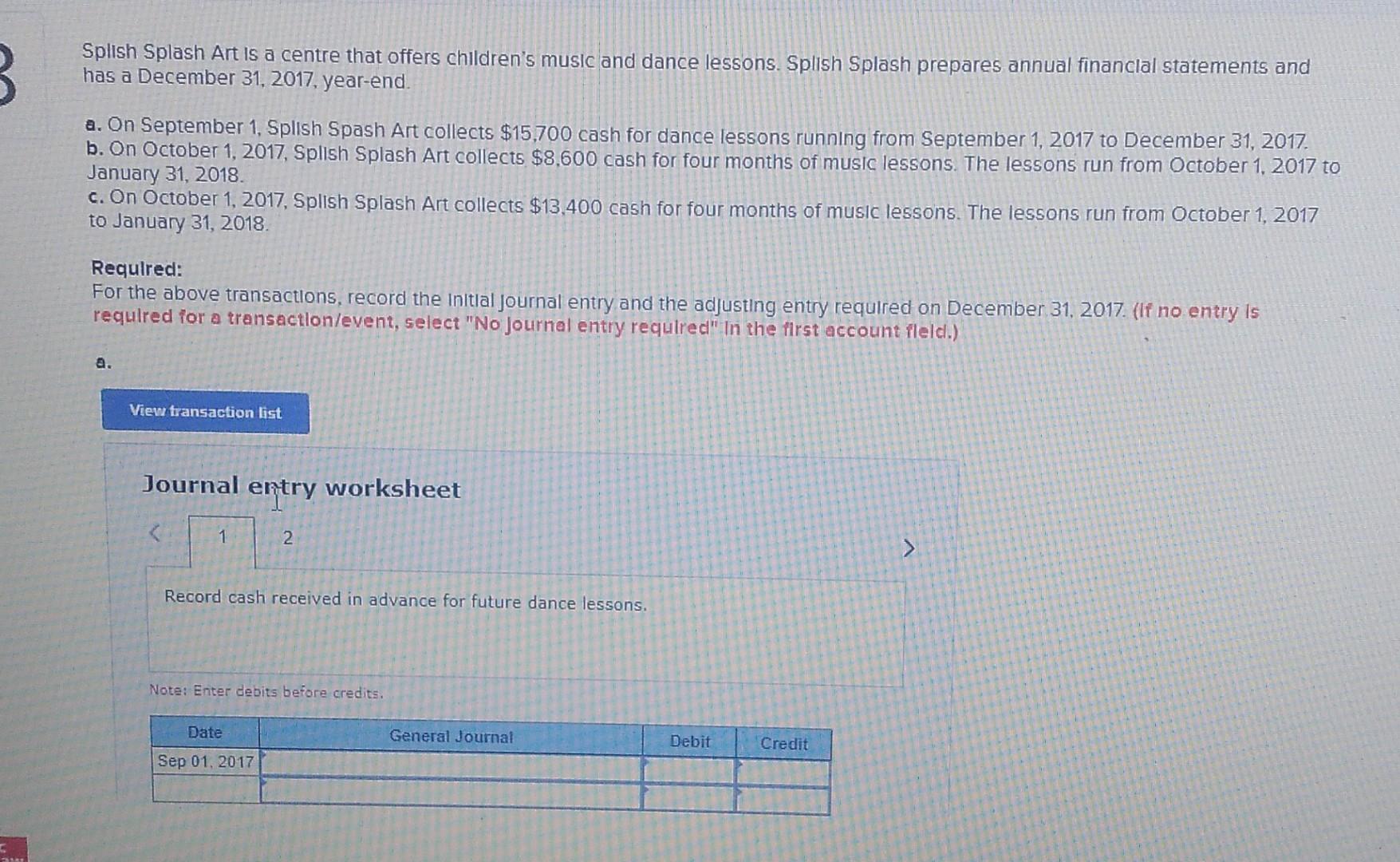

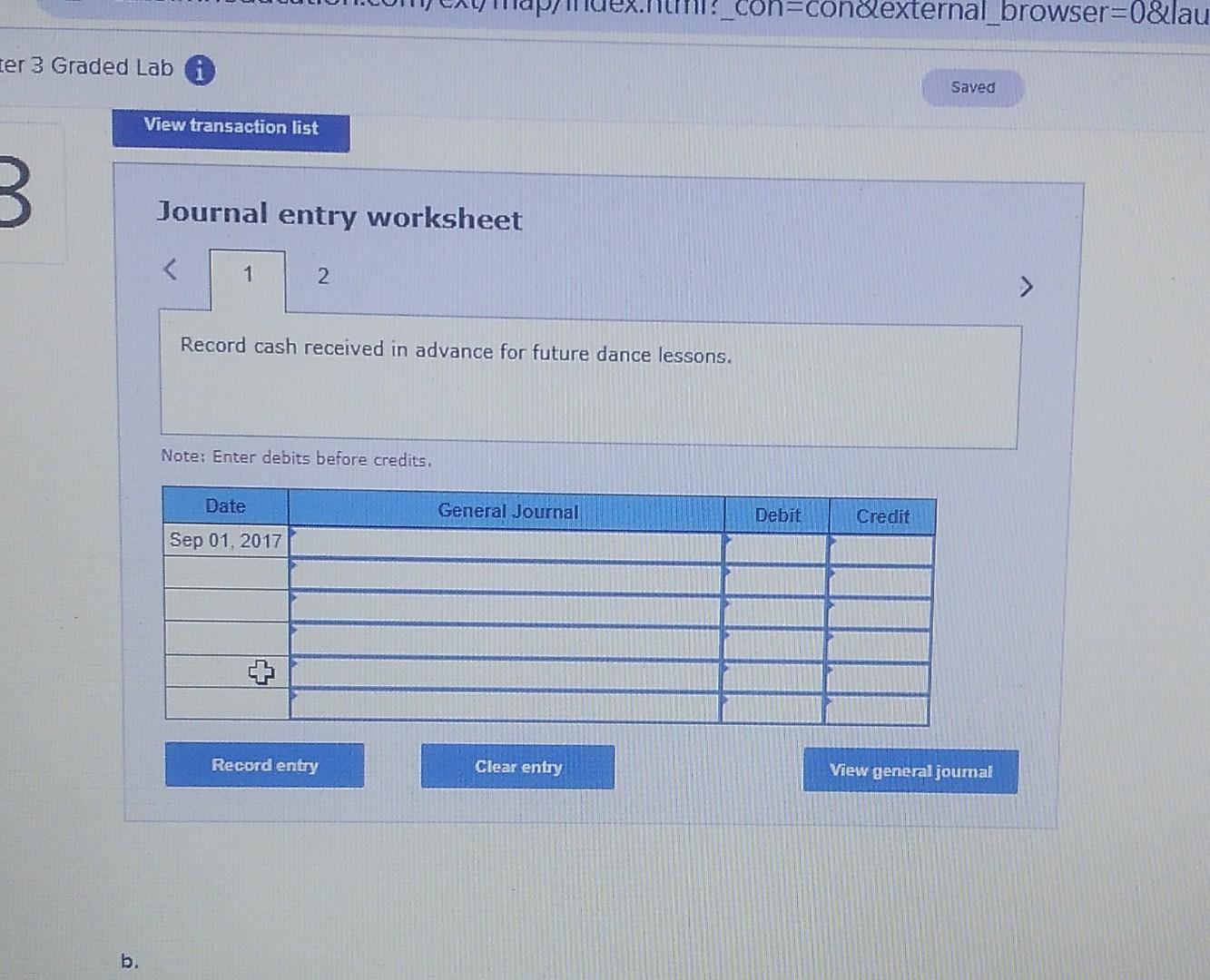

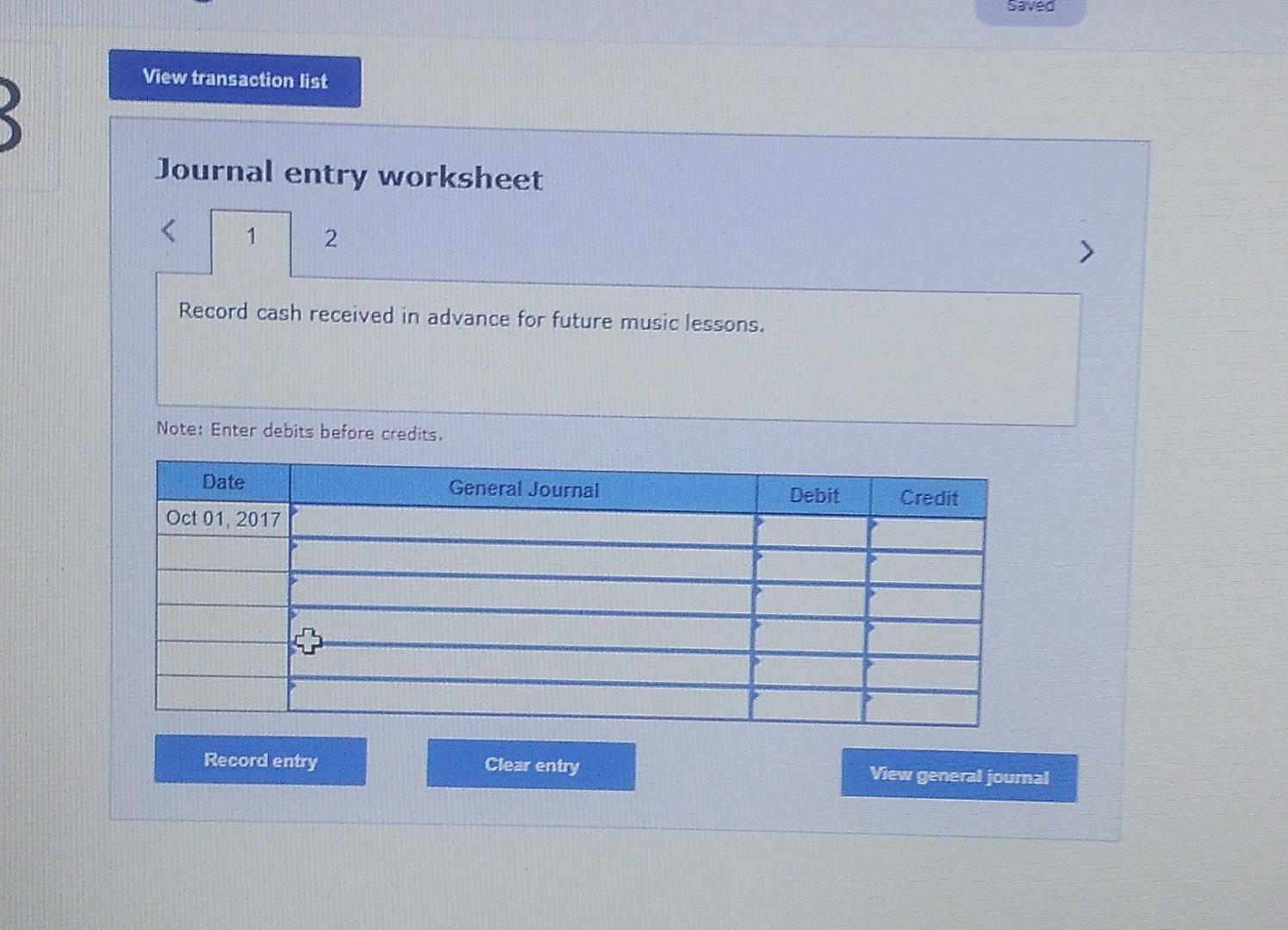

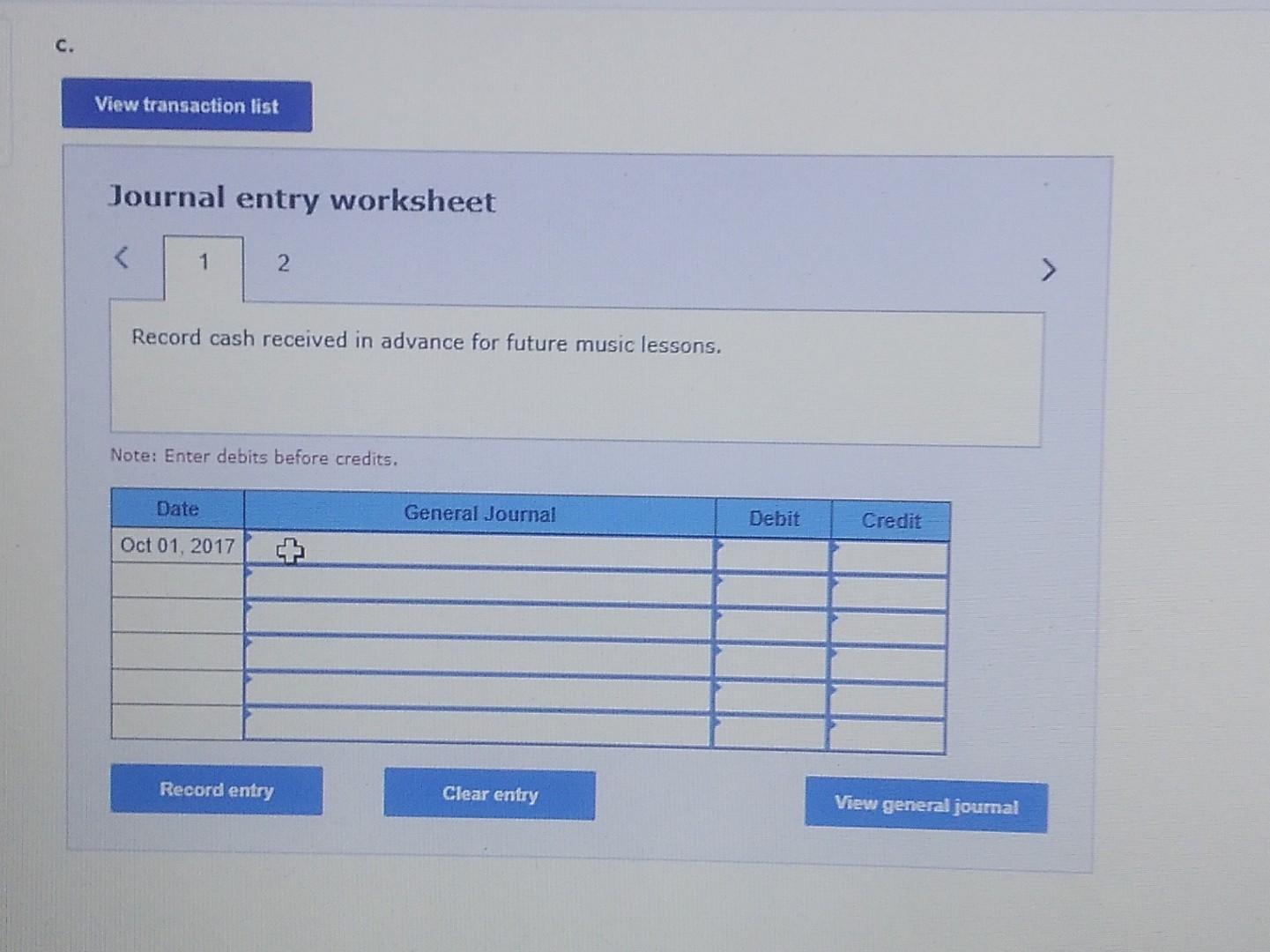

Splish Splash Art is a centre that offers children's music and dance lessons. Splish Splash prepares annual financlal statements and has a December 31, 2017, year-end. a. On September 1, Splish Spash Art collects $15,700 cash for dance lessons running from September 1,2017 to December 31,2017. b. On October 1, 2017, Splish Splash Art collects $8,600 cash for four months of music lessons. The lessons run from October 1,2017 to January 31, 2018. c. On October 1, 2017, Splish Splash Art collects $13,400 cash for four months of music lessons. The lessons run from October 1,2017 to January 31, 2018 Requlred: For the above transactions, record the Inltial journal entry and the adjusting entry required on December 31, 2017. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld.) a. Journal entry worksheet Record cash received in advance for future dance lessons. Note: Enter debits before credits. Journal entry worksheet Record cash received in advance for future music lessons. Note: Enter debits before credits. Journal entry worksheet Record cash received in advance for future music lessons. Note: Enter debits before credits. Splish Splash Art is a centre that offers children's music and dance lessons. Splish Splash prepares annual financlal statements and has a December 31, 2017, year-end. a. On September 1, Splish Spash Art collects $15,700 cash for dance lessons running from September 1,2017 to December 31,2017. b. On October 1, 2017, Splish Splash Art collects $8,600 cash for four months of music lessons. The lessons run from October 1,2017 to January 31, 2018. c. On October 1, 2017, Splish Splash Art collects $13,400 cash for four months of music lessons. The lessons run from October 1,2017 to January 31, 2018 Requlred: For the above transactions, record the Inltial journal entry and the adjusting entry required on December 31, 2017. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld.) a. Journal entry worksheet Record cash received in advance for future dance lessons. Note: Enter debits before credits. Journal entry worksheet Record cash received in advance for future music lessons. Note: Enter debits before credits. Journal entry worksheet Record cash received in advance for future music lessons. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started