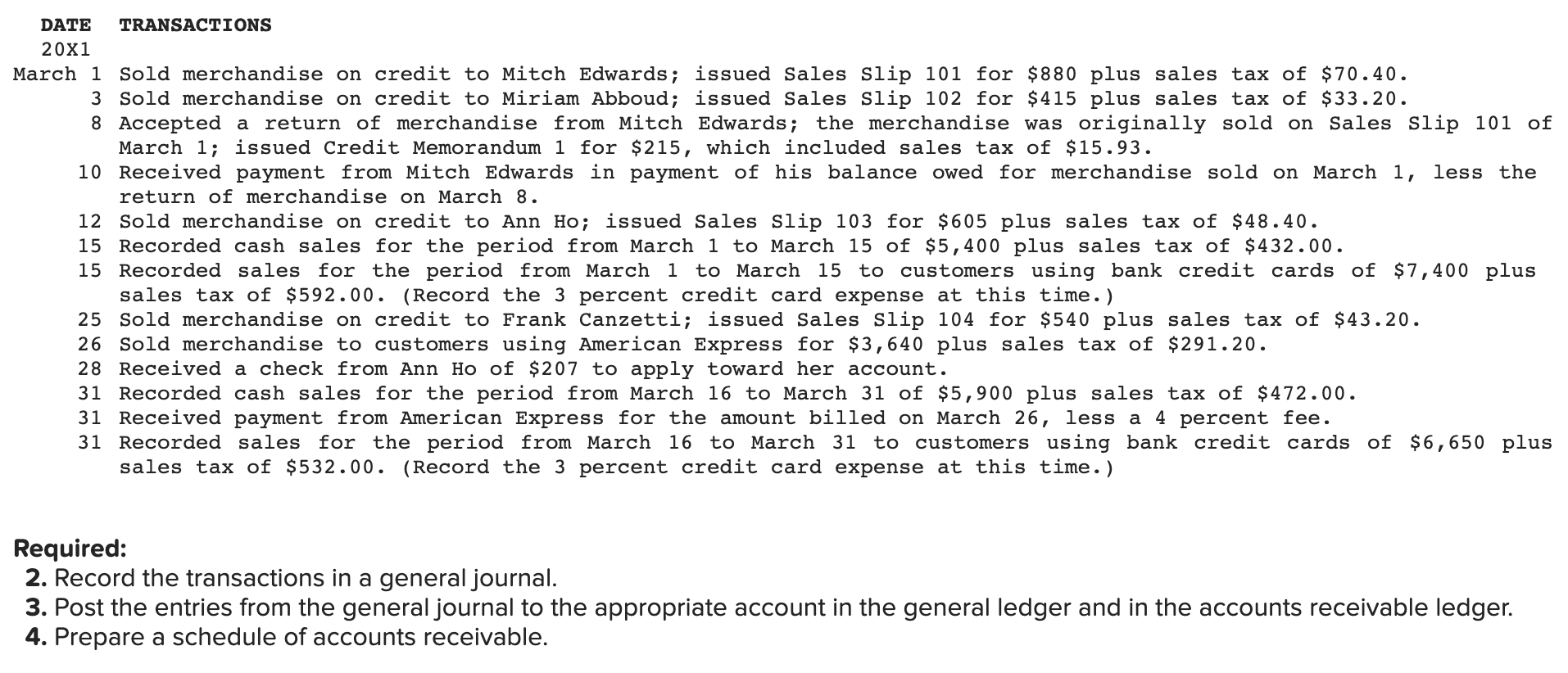

Sports junction began operations March 1, 20X1. The firm sells its merchandise for cash; on open account; to customers using bank credit cards, such as MaterCard and Visa; and to customers using American Express. Merchandise sales are. subject to an 8 percent sales tax. the bank credit cards charge 3 percent fee. American Express charges a $ percent fee. during March, Sports Junction engaged in the following transactions:

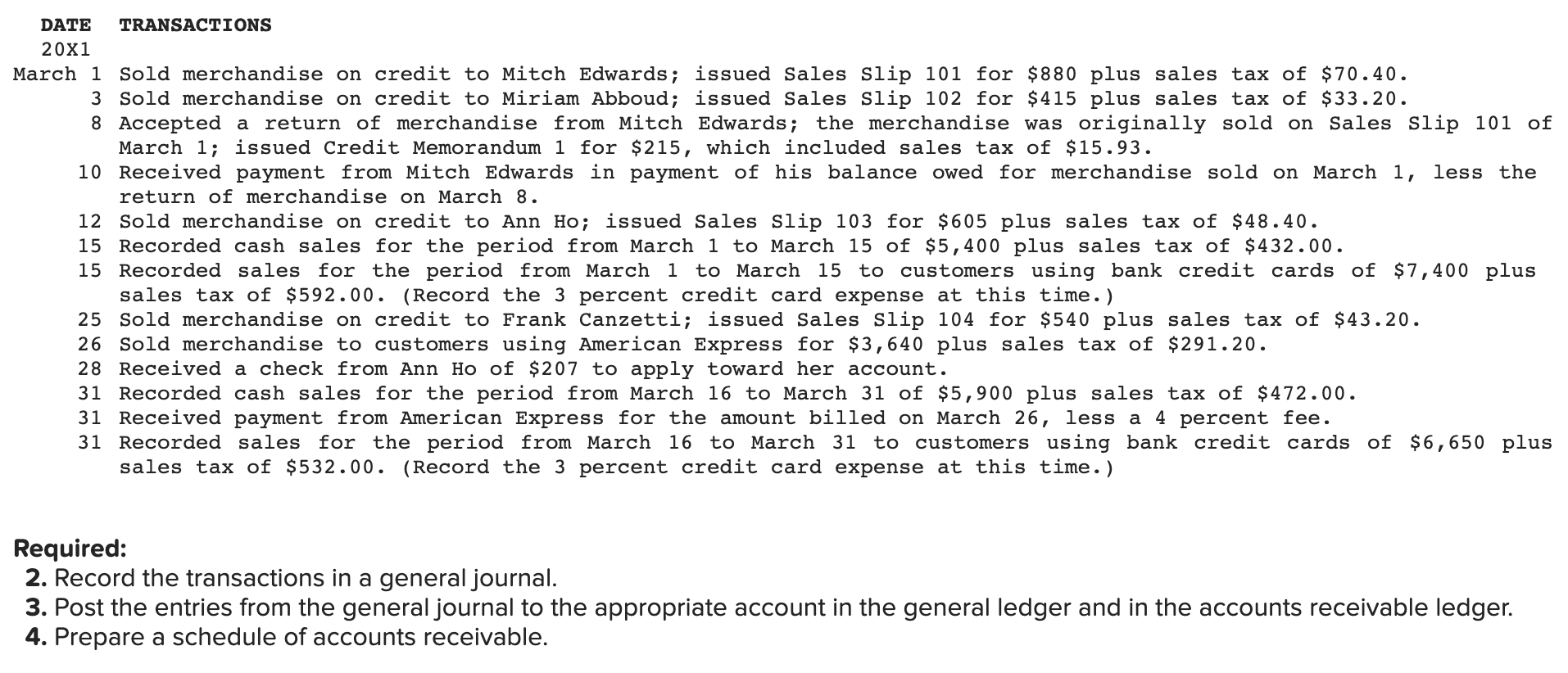

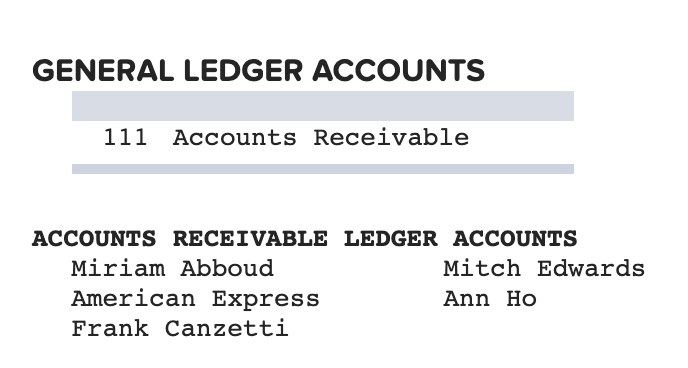

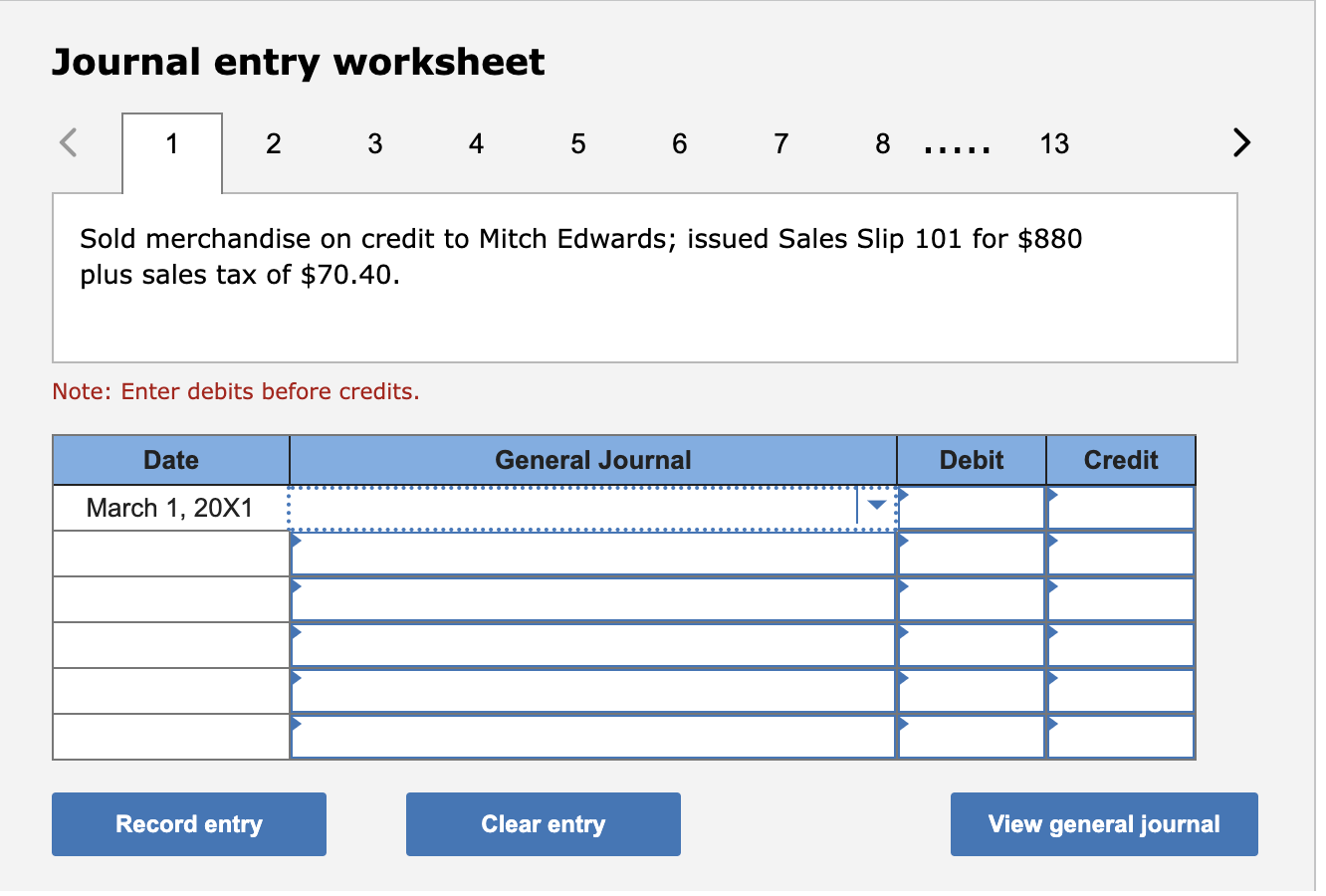

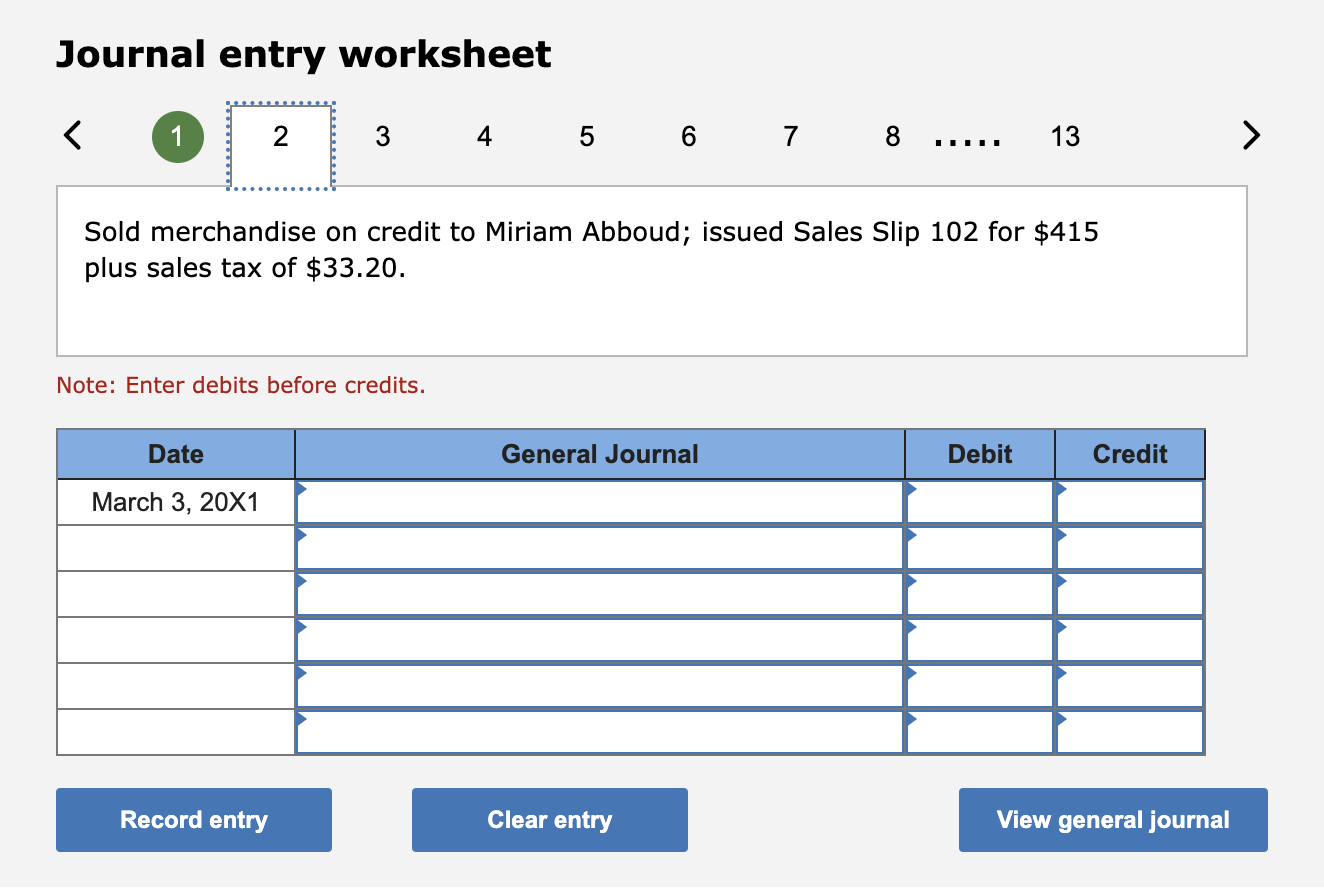

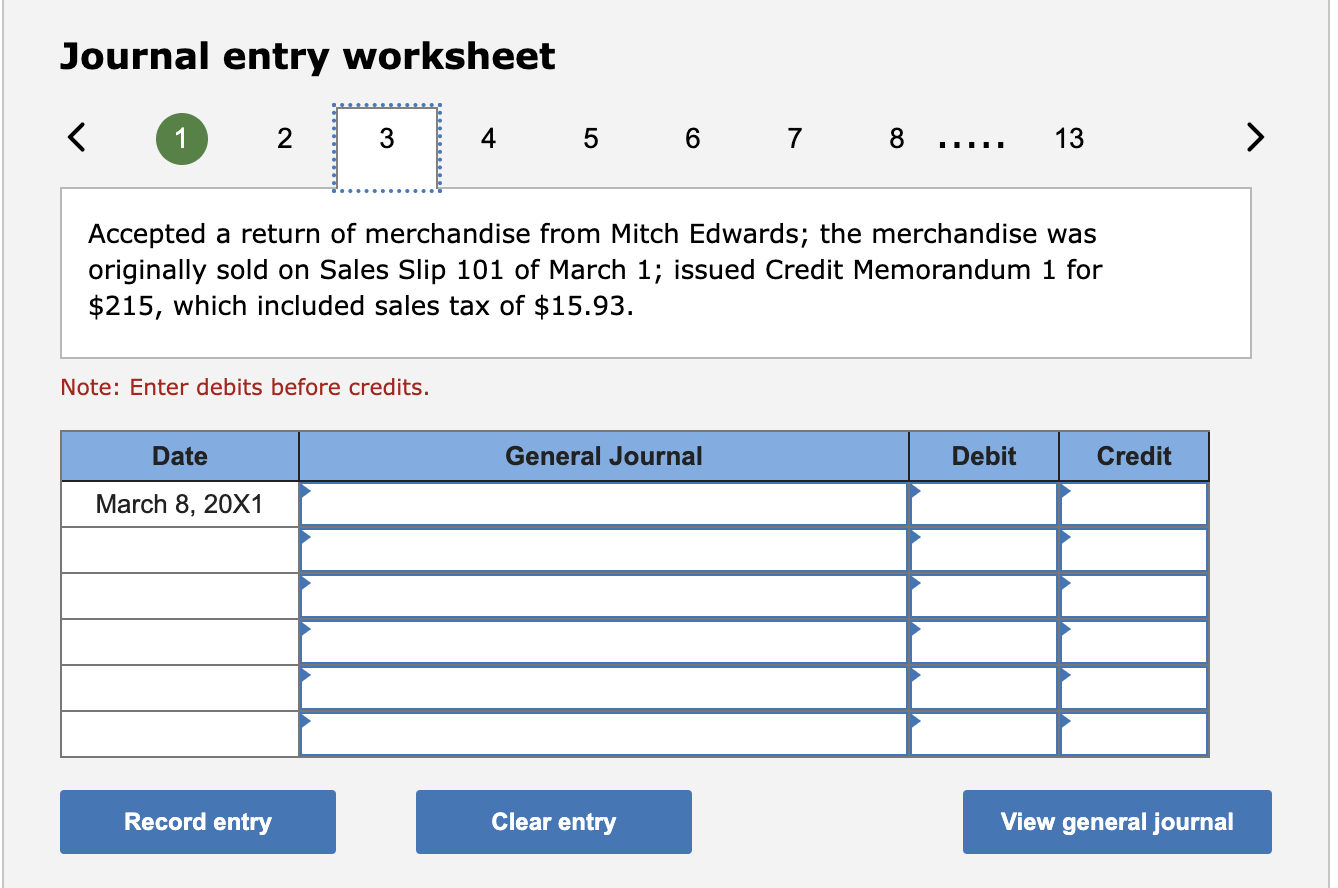

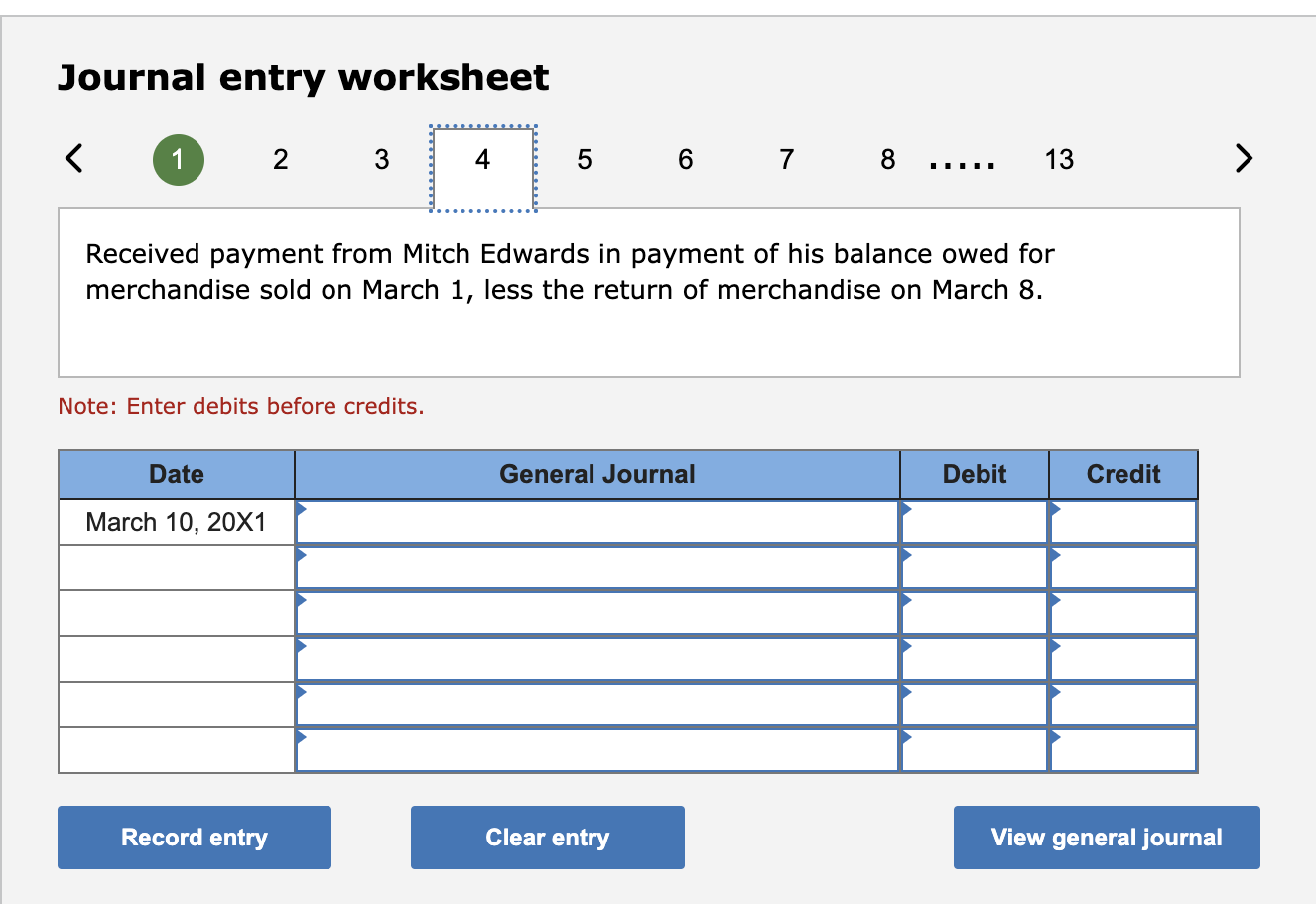

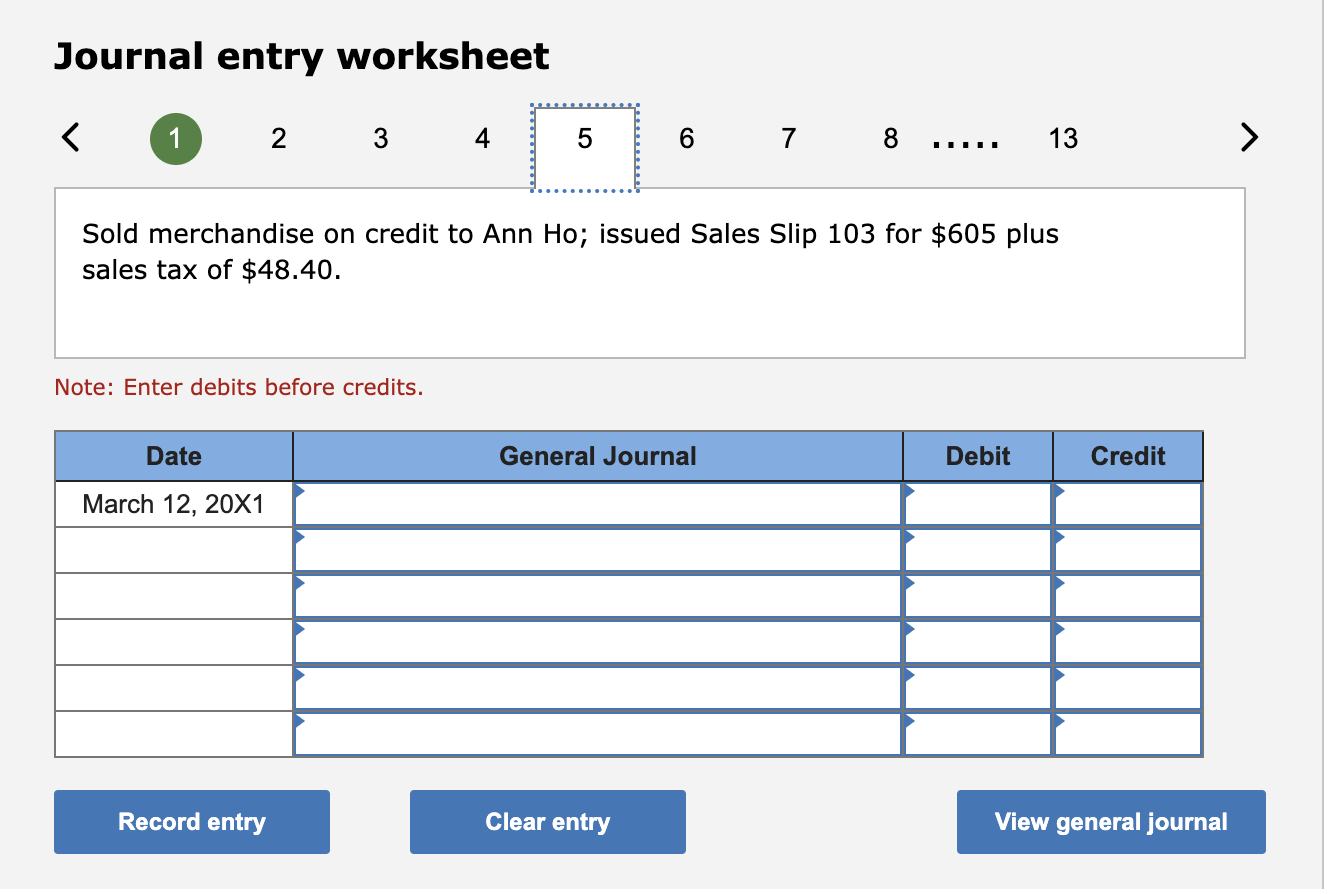

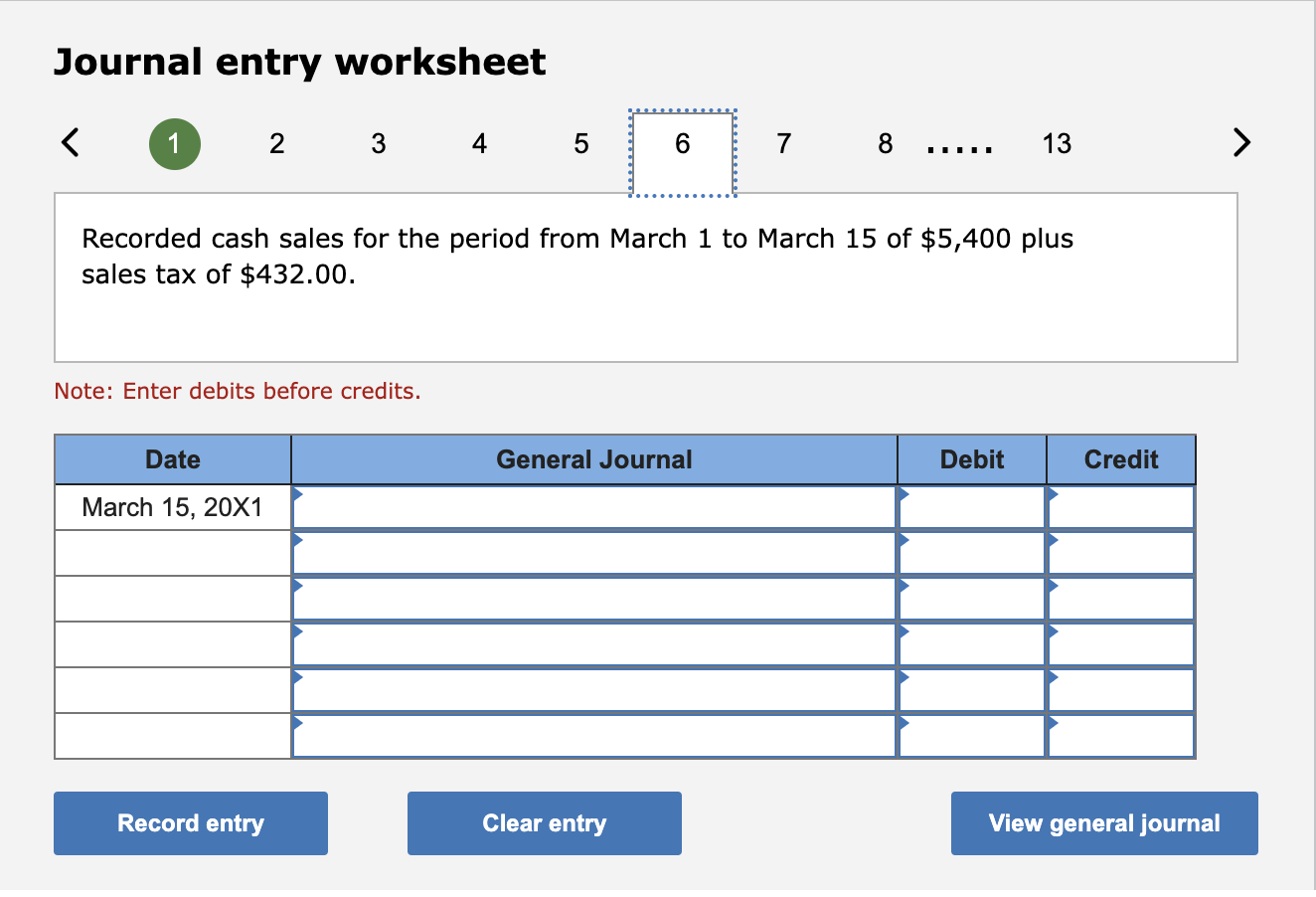

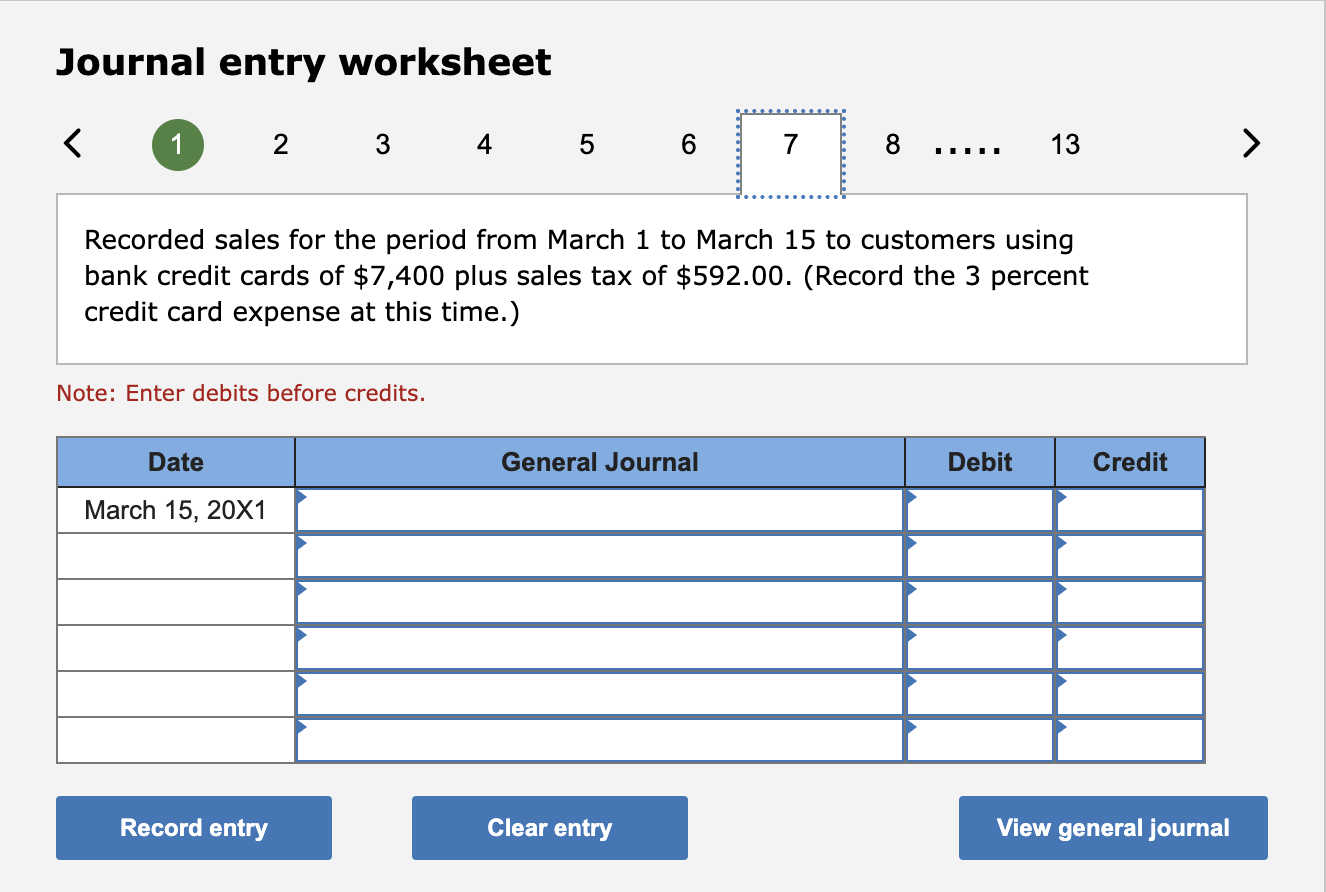

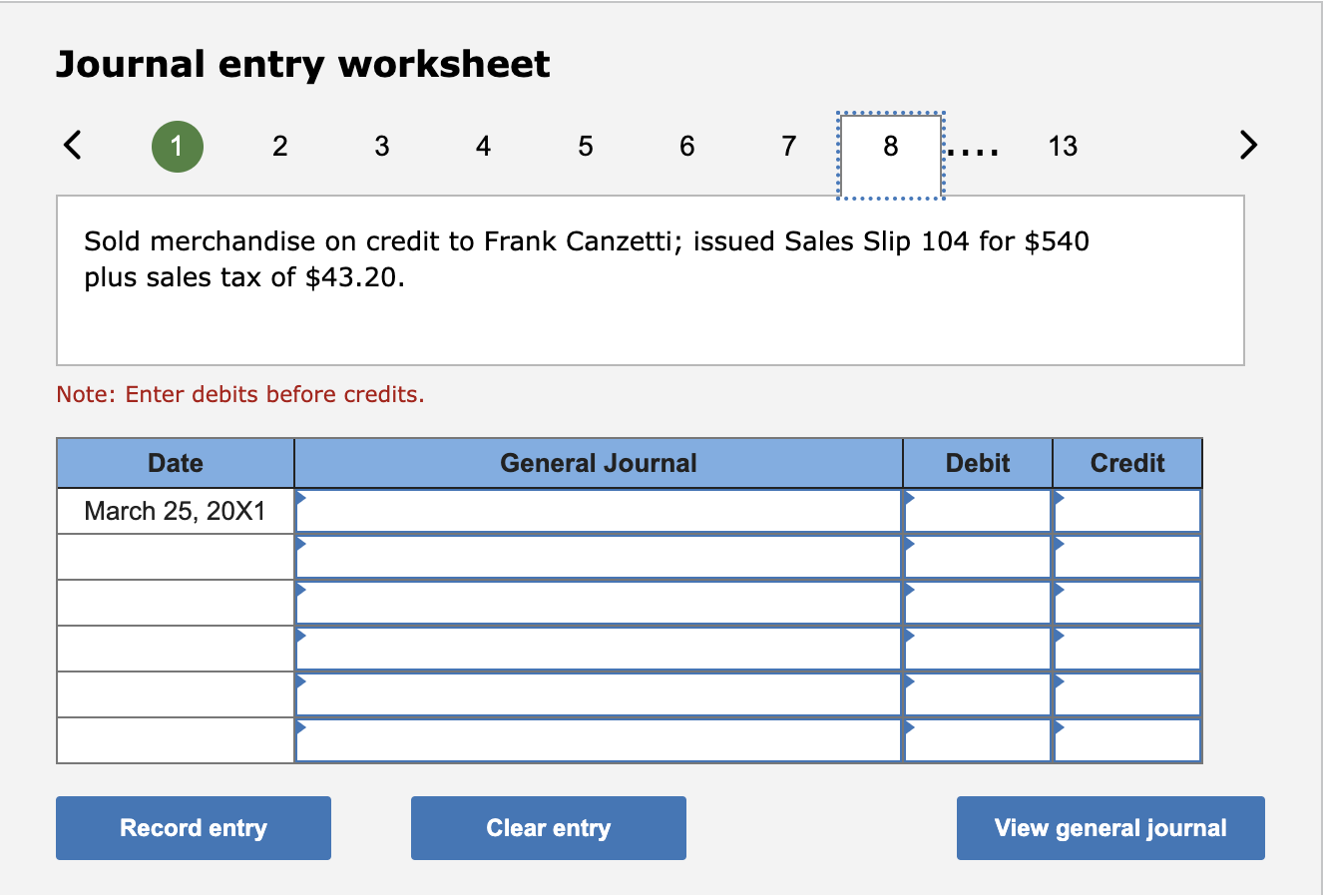

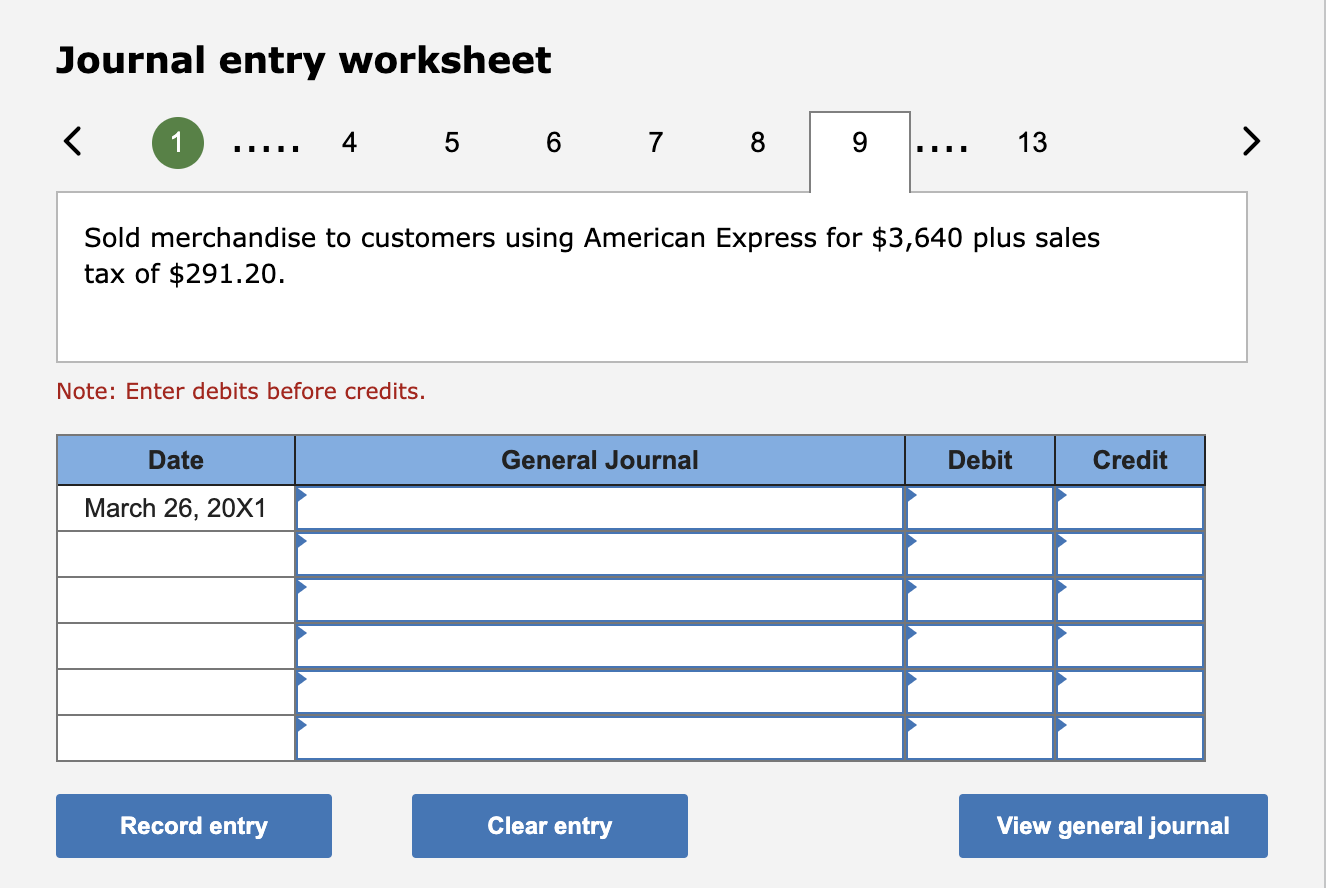

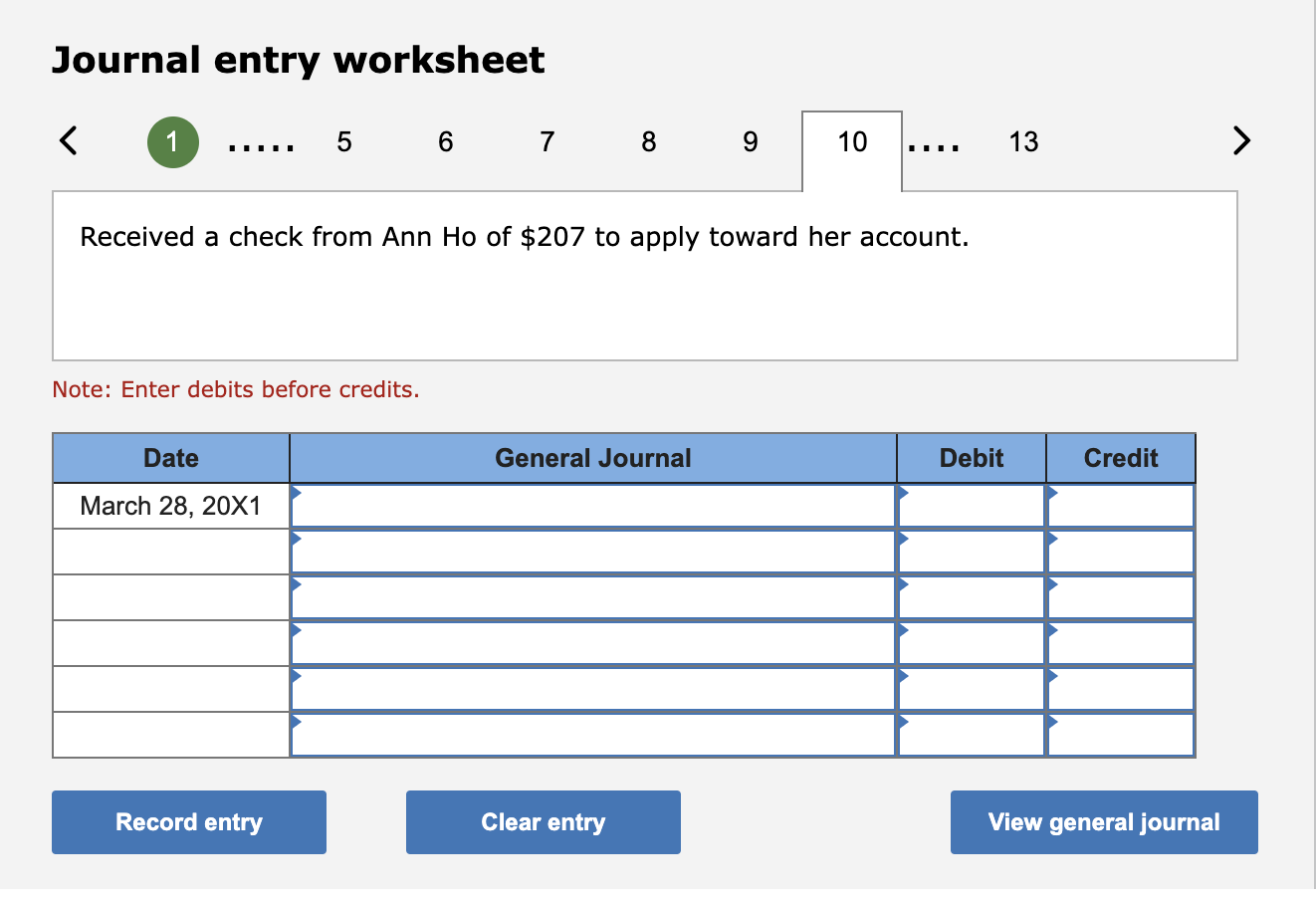

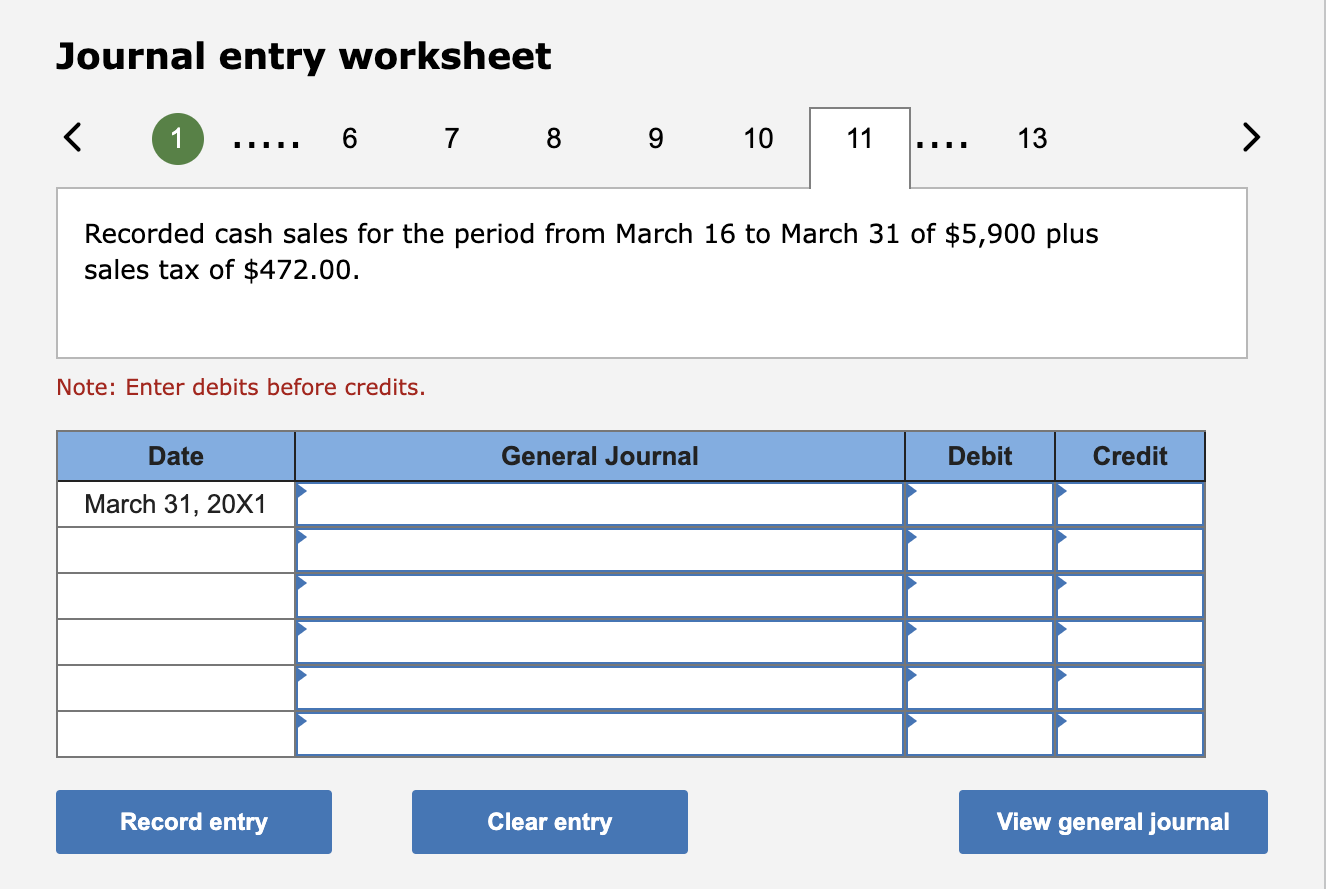

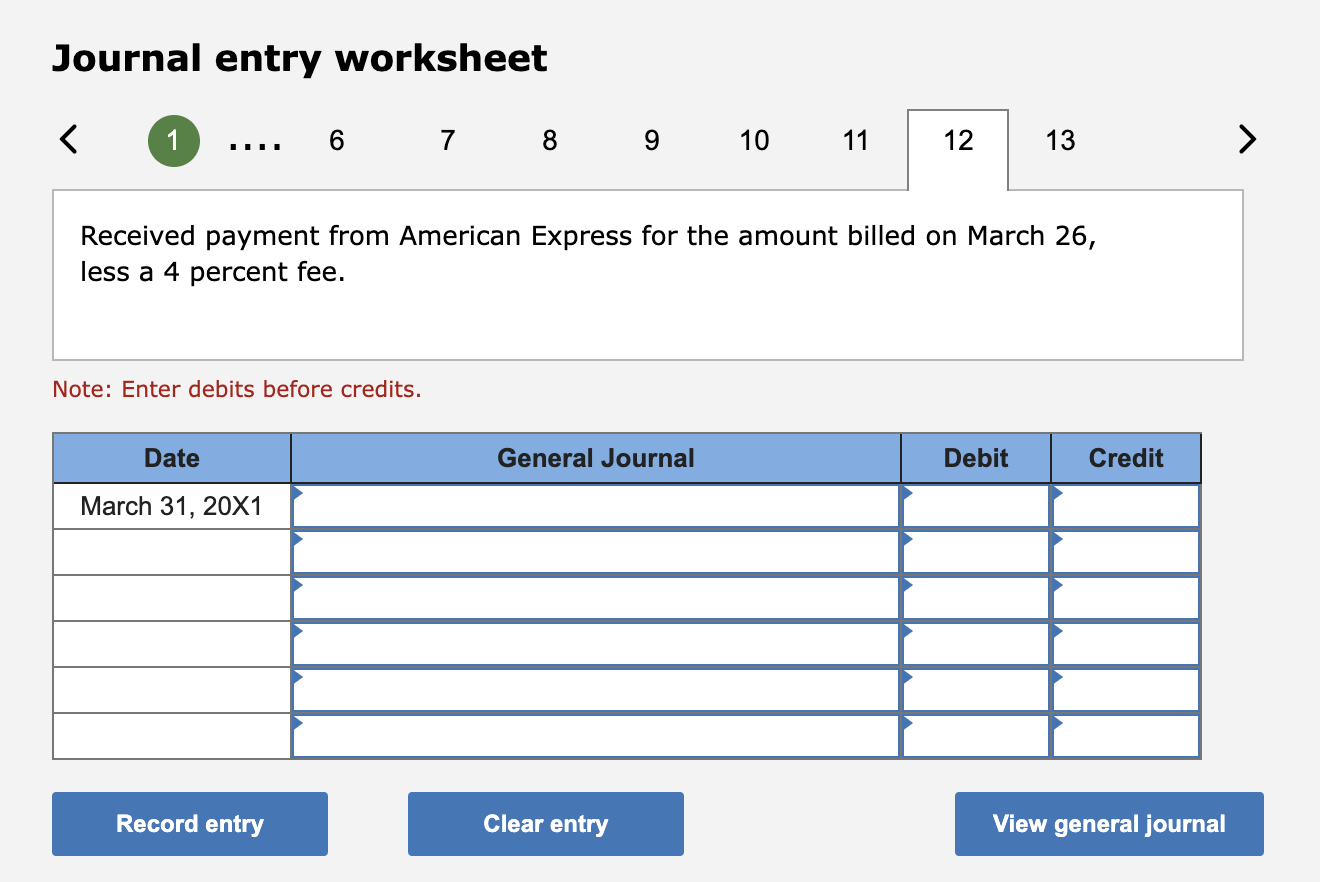

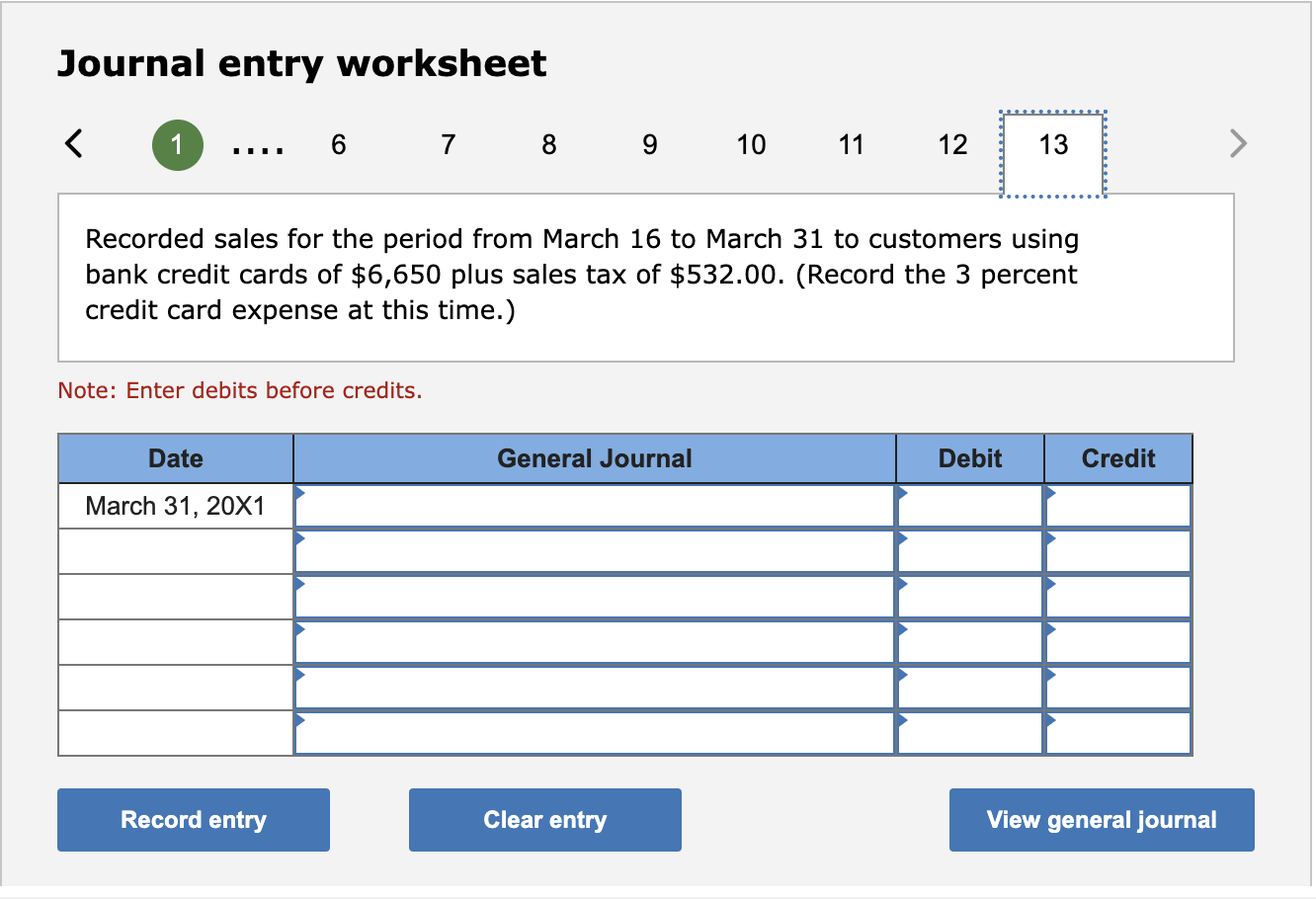

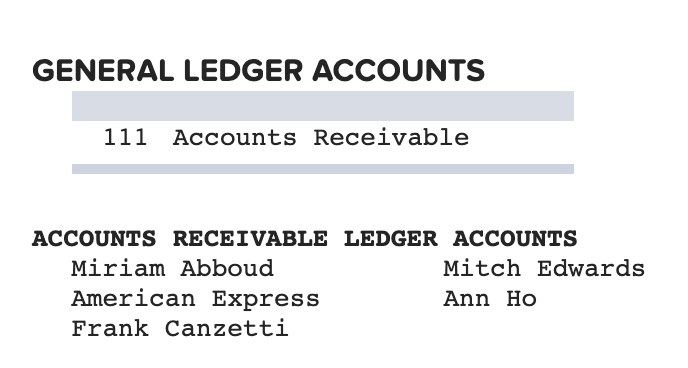

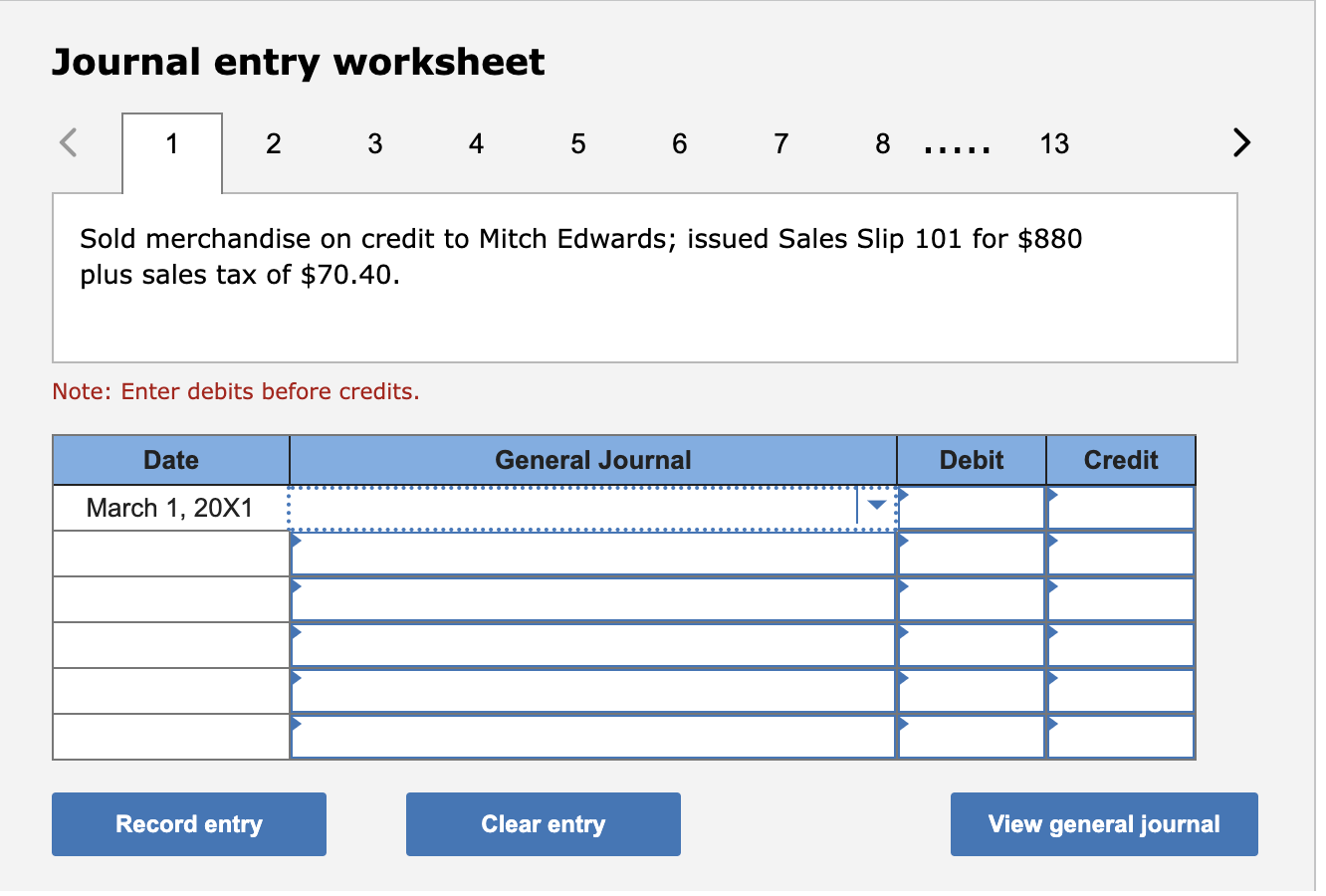

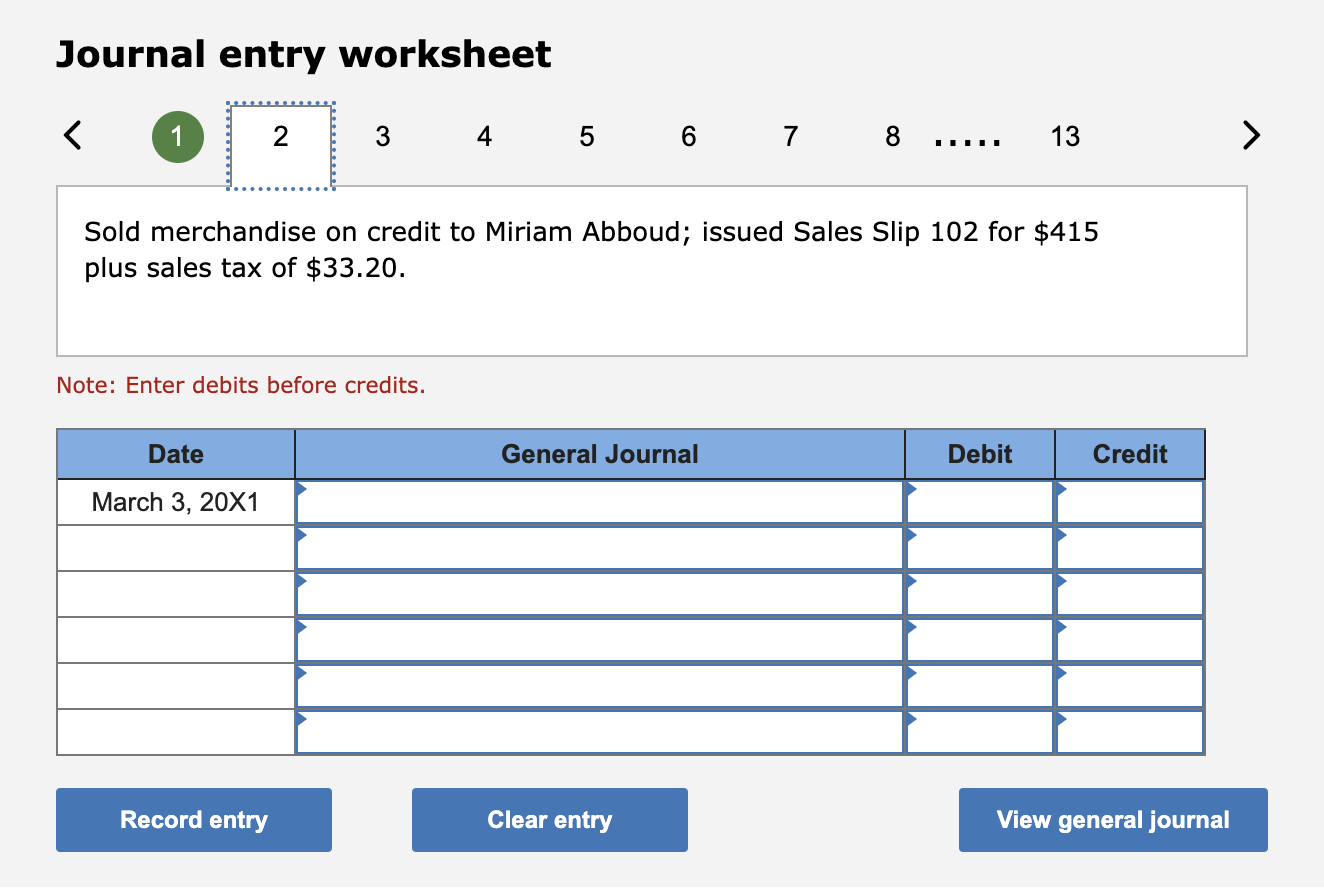

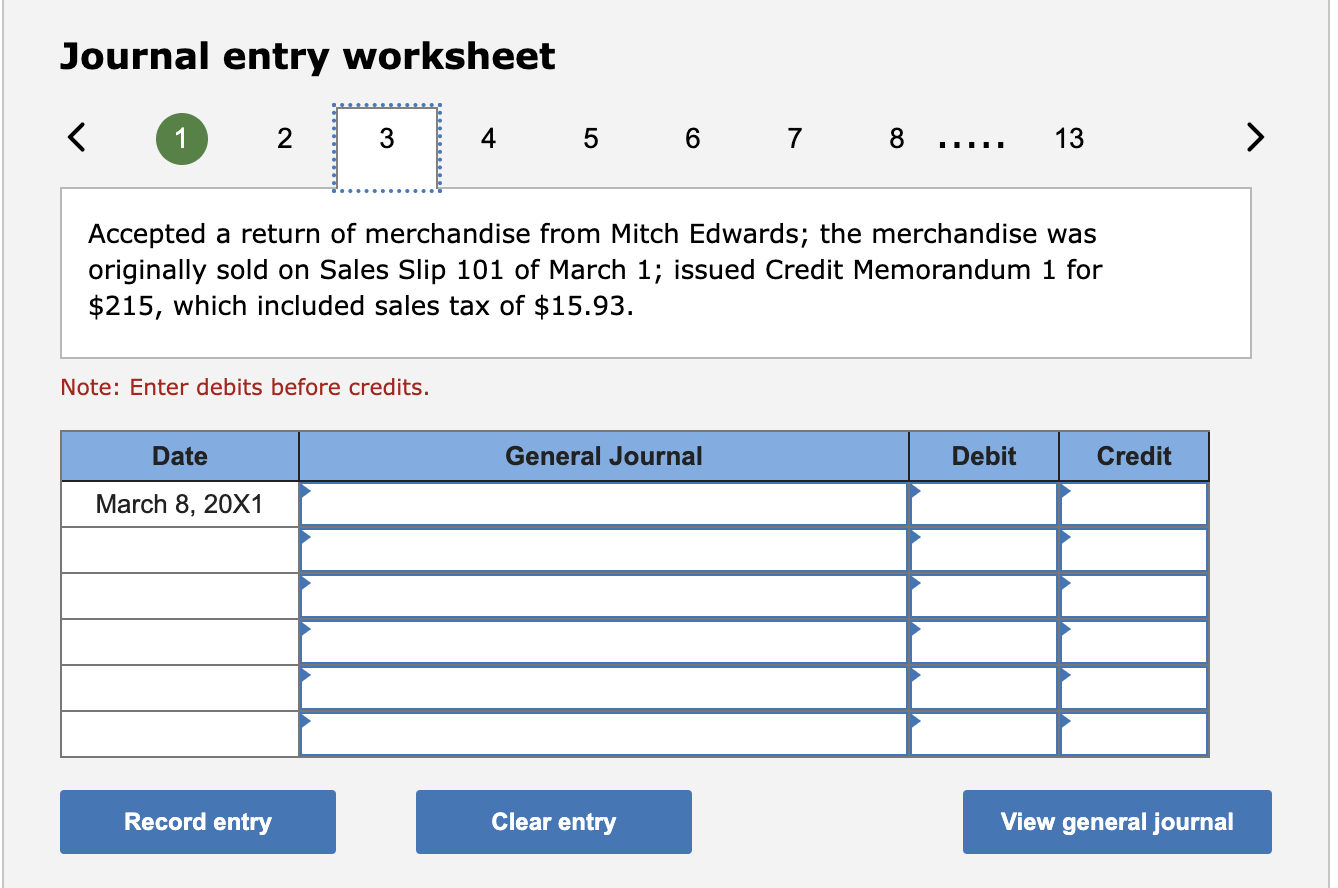

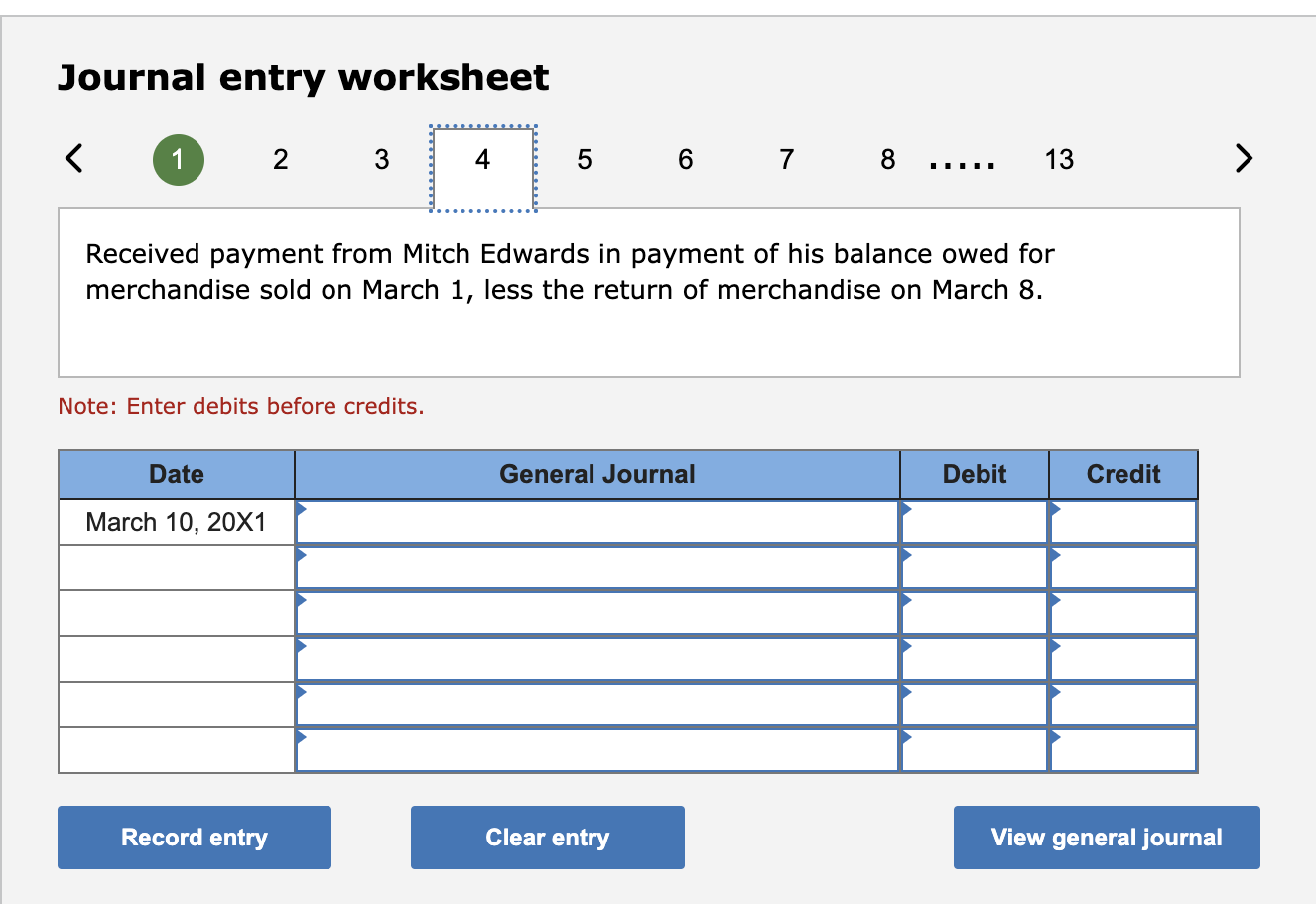

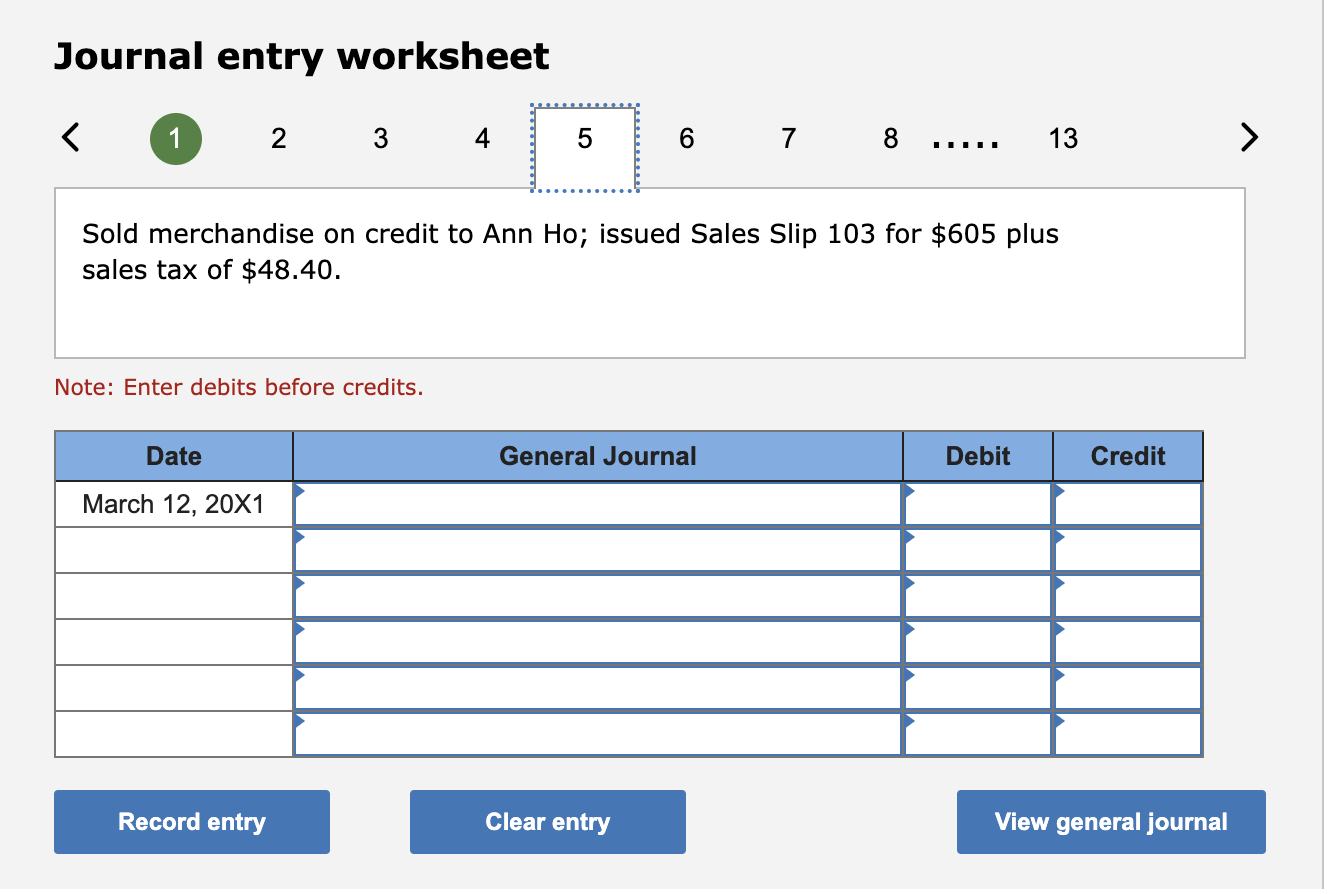

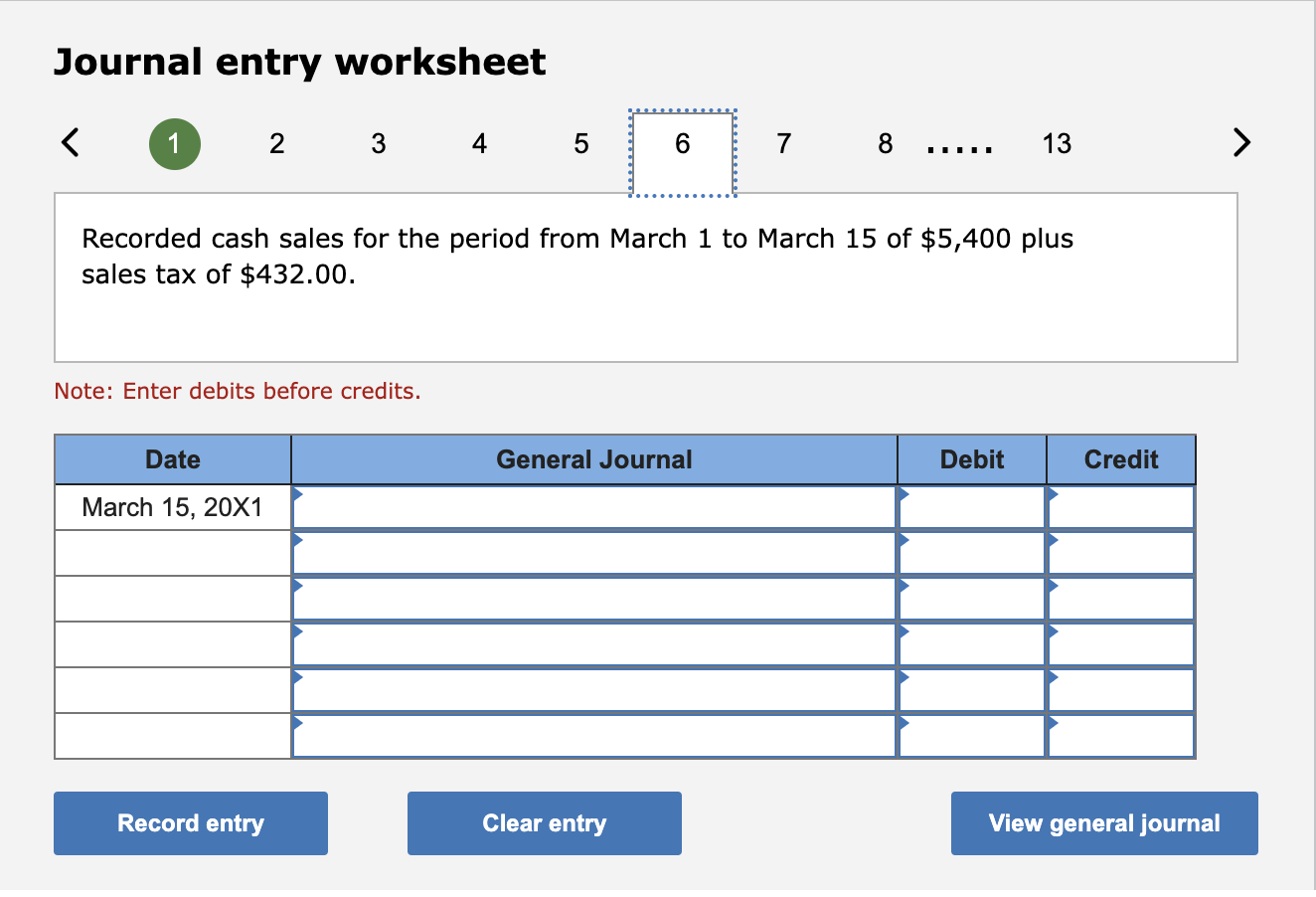

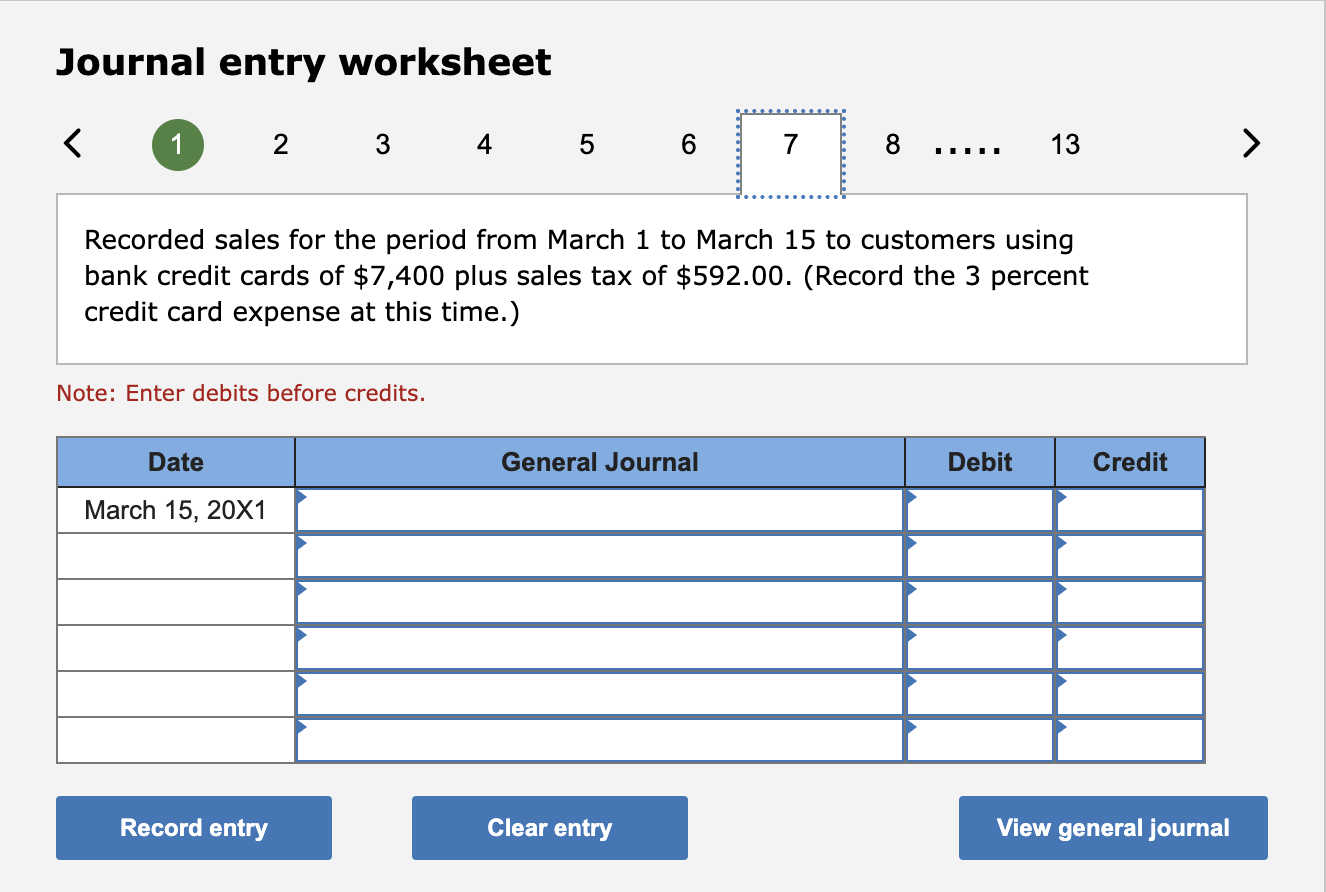

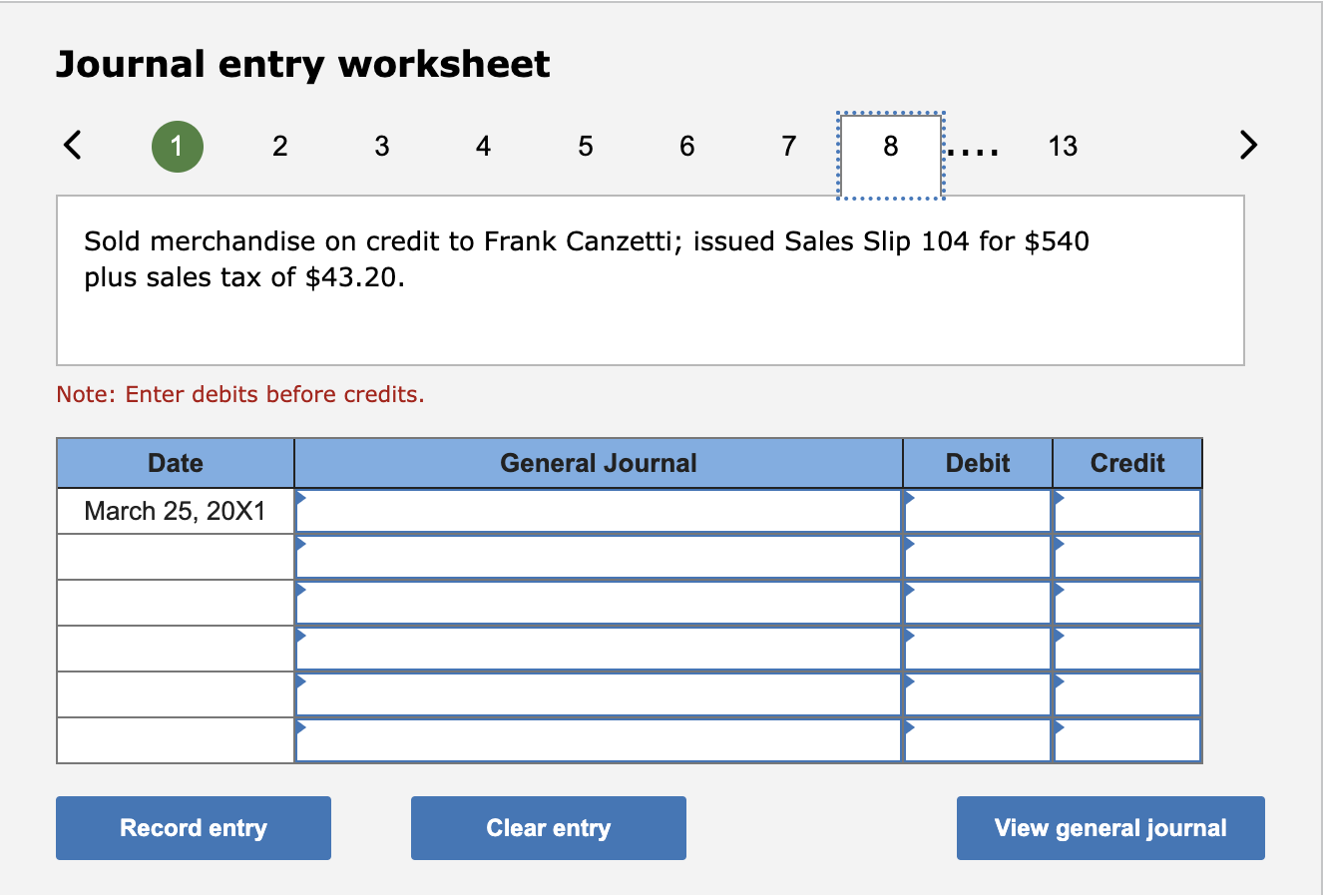

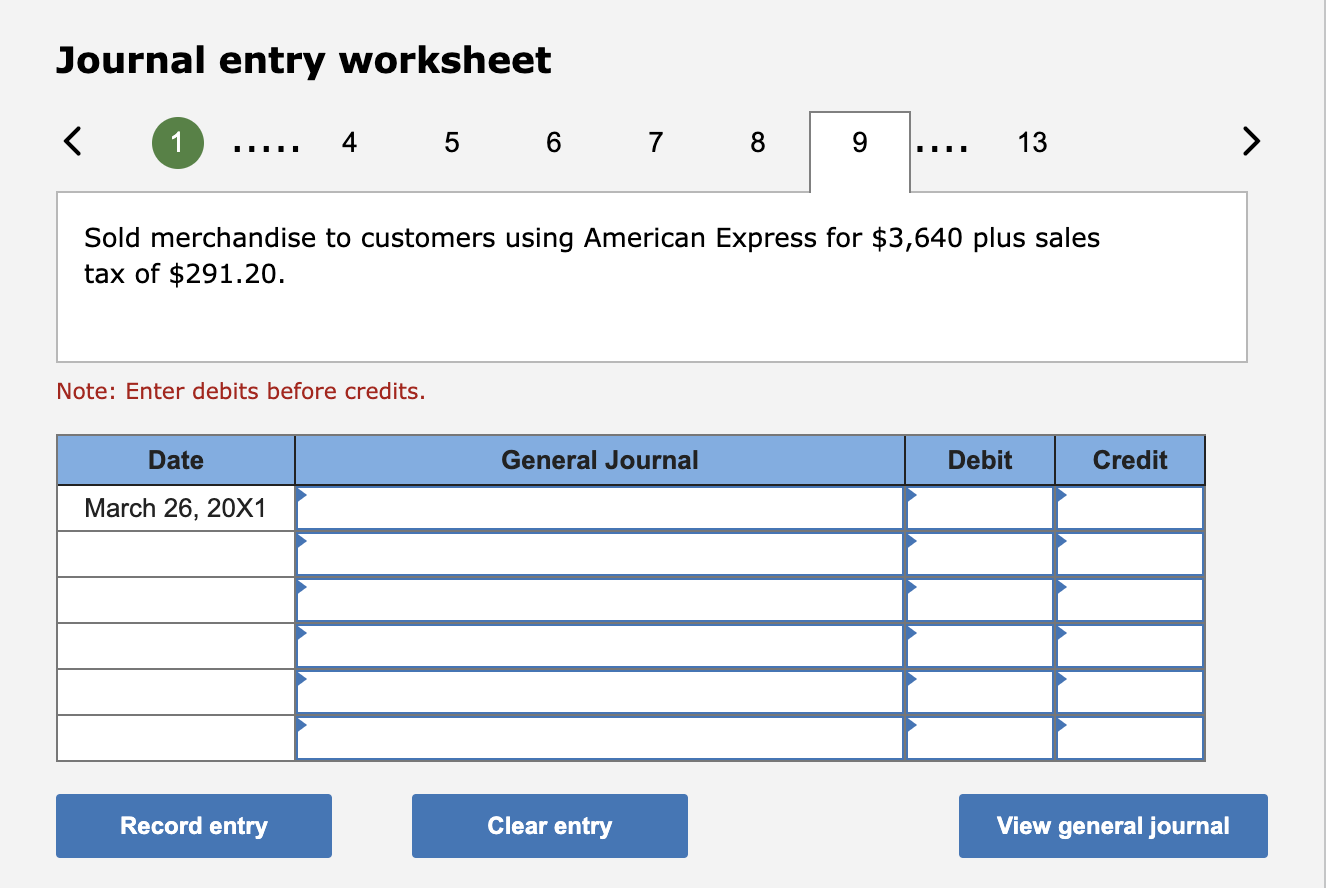

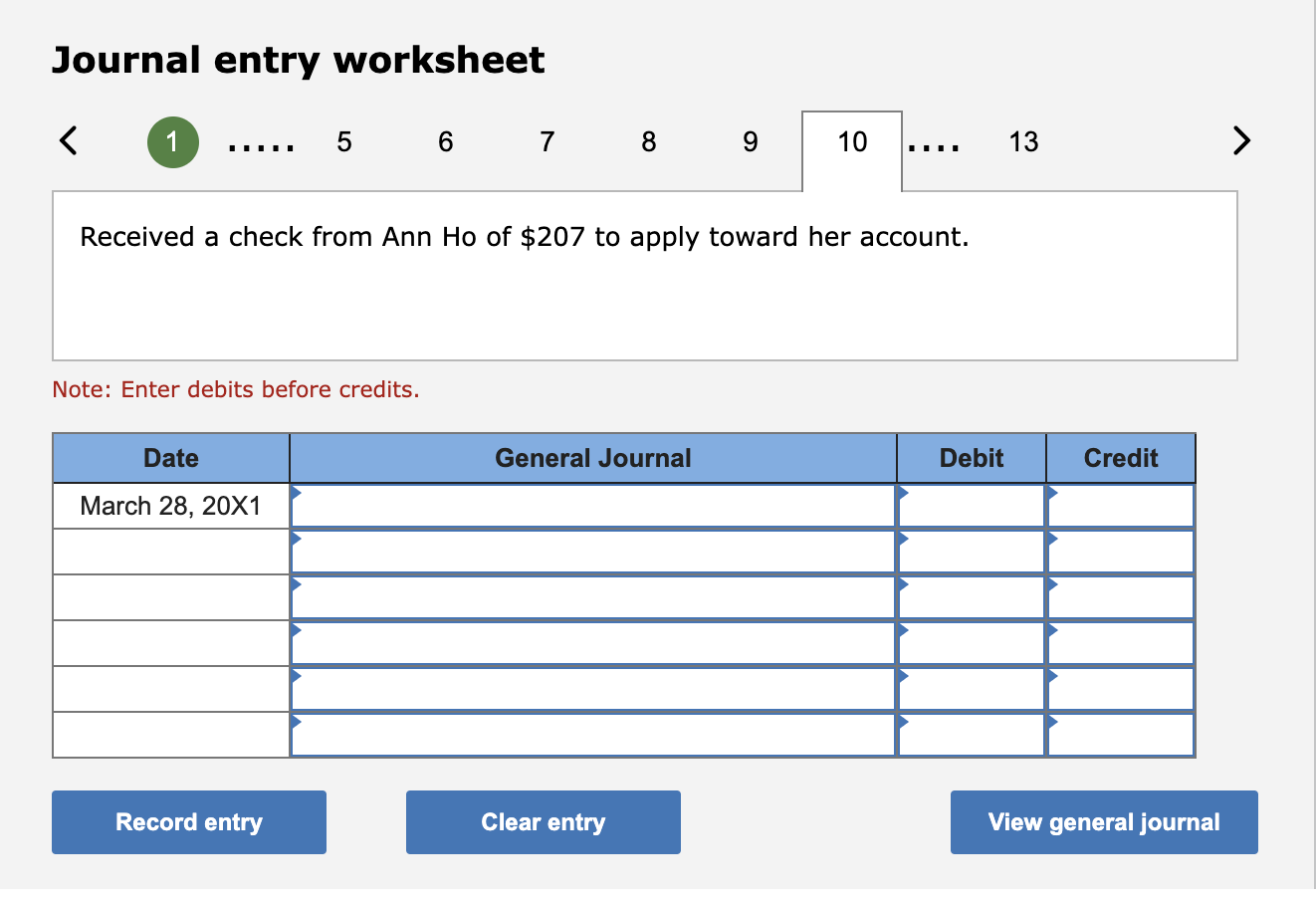

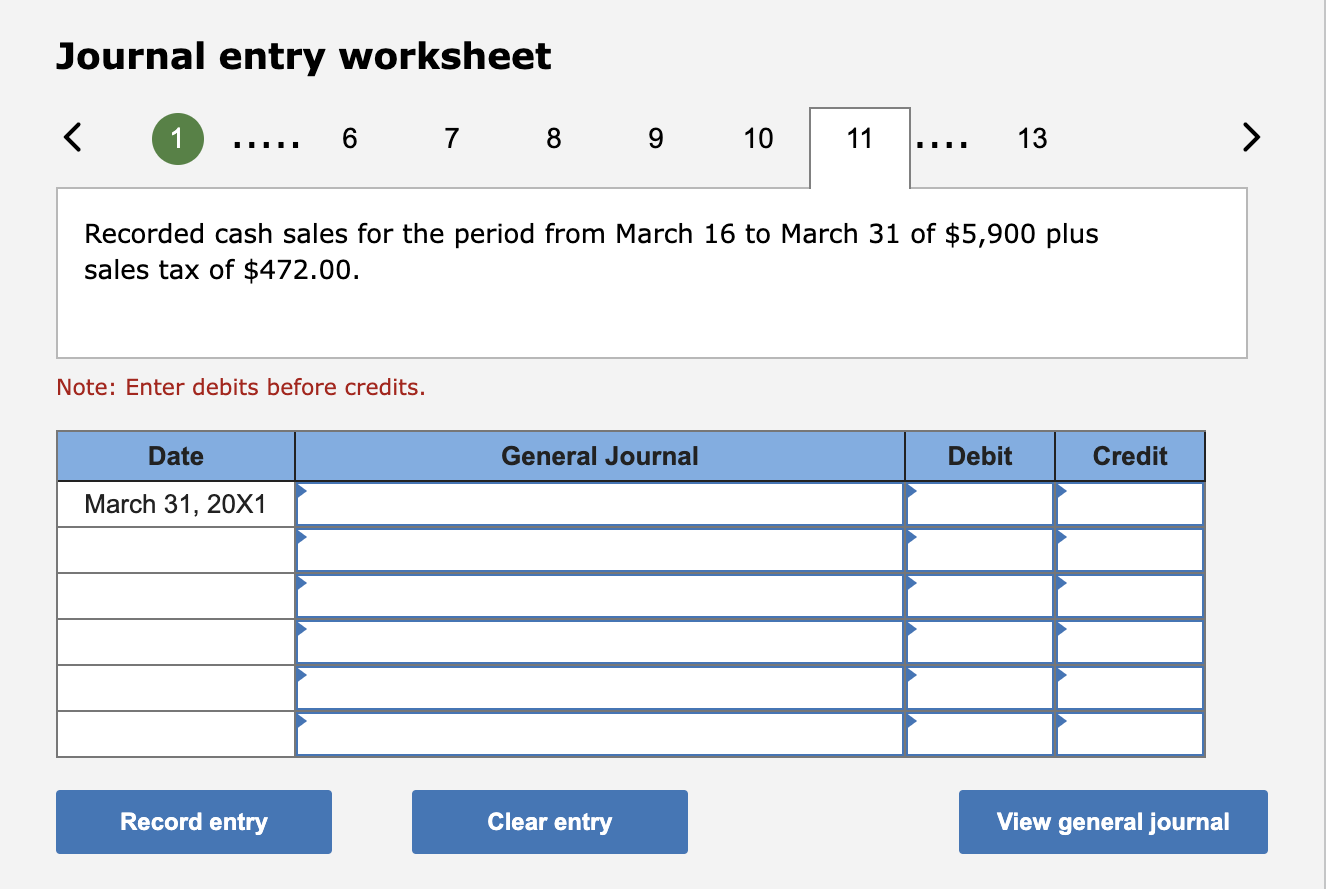

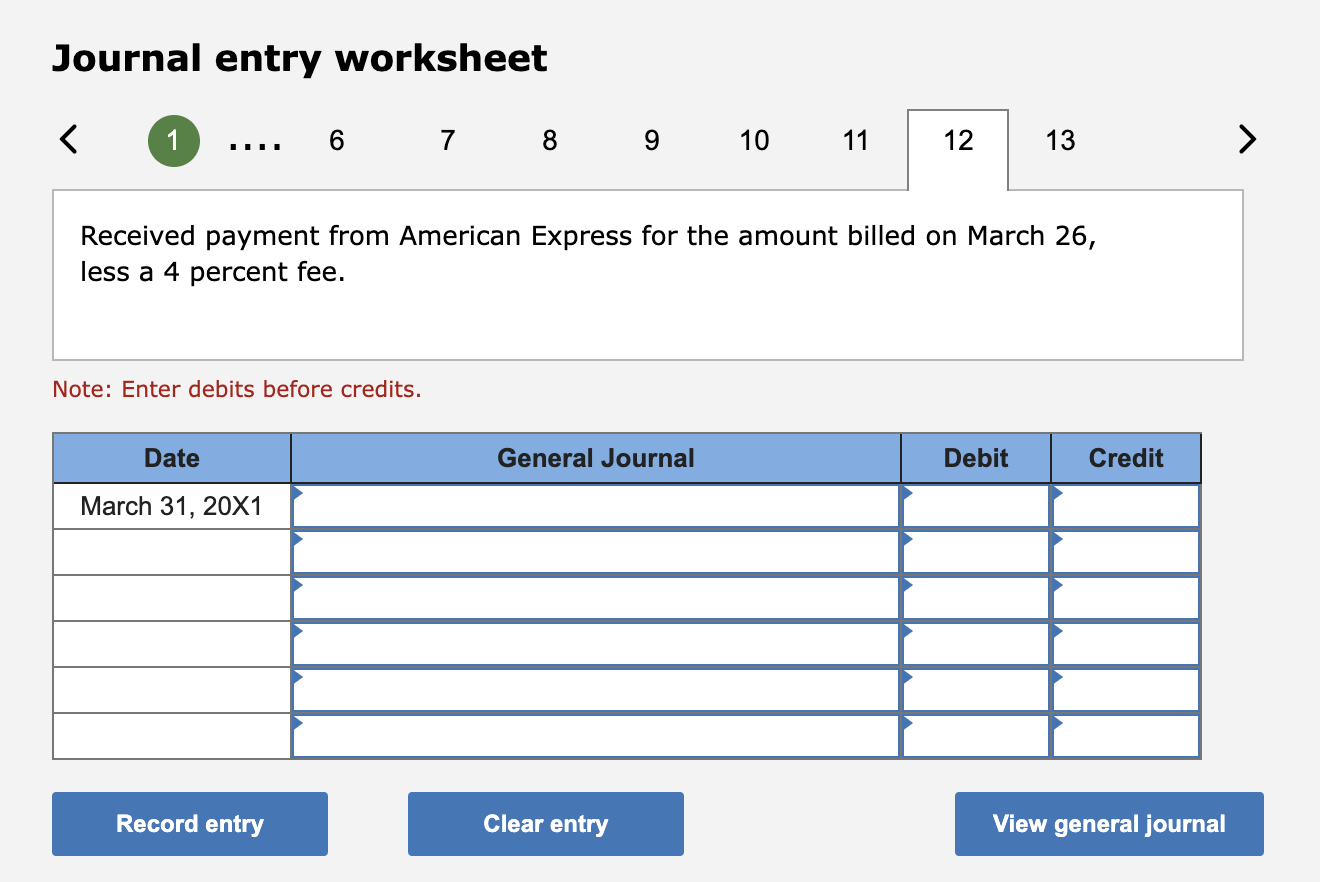

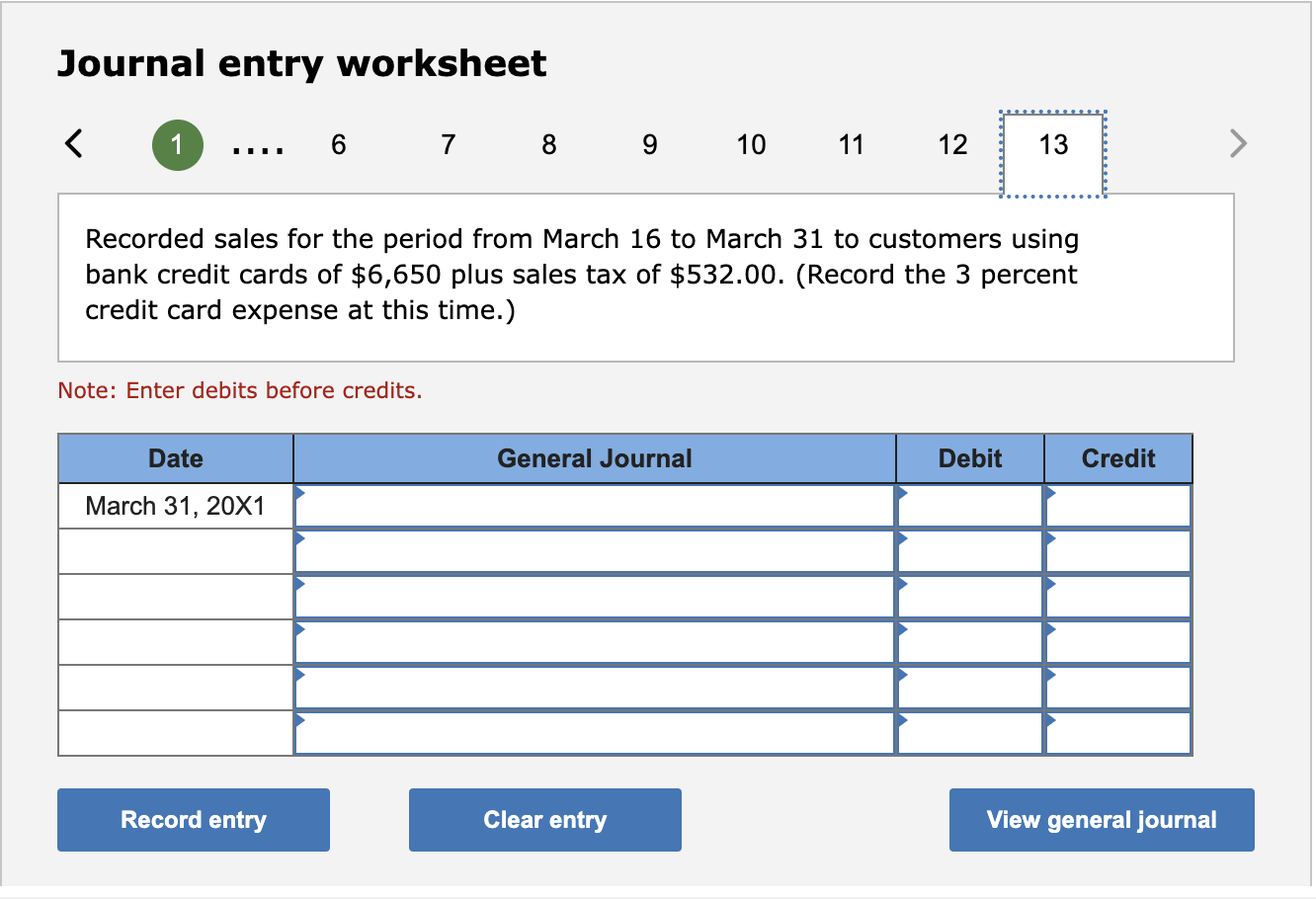

DATE TRANSACTIONS 201 March 1 Sold merchandise on credit to Mitch Edwards; issued Sales Slip 101 for $880 plus sales tax of $70.40. 3 Sold merchandise on credit to Miriam Abboud; issued Sales Slip 102 for $415 plus sales tax of $33.20. 8 Accepted a return of merchandise from Mitch Edwards; the merchandise was originally sold on Sales Slip 101 of March 1; issued Credit Memorandum 1 for $215, which included sales tax of $15.93. 10 Received payment from Mitch Edwards in payment of his balance owed for merchandise sold on March 1 , less the return of merchandise on March 8. 12 Sold merchandise on credit to Ann Ho; issued Sales Slip 103 for $605 plus sales tax of $48.40. 15 Recorded cash sales for the period from March 1 to March 15 of $5,400 plus sales tax of $432.00. 15 Recorded sales for the period from March 1 to March 15 to customers using bank credit cards of $7,400 plus sales tax of $592.00. (Record the 3 percent credit card expense at this time.) 25 Sold merchandise on credit to Frank Canzetti; issued Sales Slip 104 for $540 plus sales tax of $43.20. 26 Sold merchandise to customers using American Express for $3,640 plus sales tax of $291.20. 28 Received a check from Ann Ho of $207 to apply toward her account. 31 Recorded cash sales for the period from March 16 to March 31 of $5,900 plus sales tax of $472.00. 31 Received payment from American Express for the amount billed on March 26 , less a 4 percent fee. 31 Recorded sales for the period from March 16 to March 31 to customers using bank credit cards of $650 plus sales tax of $532.00. (Record the 3 percent credit card expense at this time.) Required: 2. Record the transactions in a general journal. 3. Post the entries from the general journal to the appropriate account in the general ledger and in the accounts receivable ledger. 4. Prepare a schedule of accounts receivable. GENERAL LEDGER ACCOUNTS Journal entry worksheet Sold merchandise on credit to Mitch Edwards; issued Sales Slip 101 for $880 plus sales tax of $70.40. Note: Enter debits before credits. Journal entry worksheet Sold merchandise on credit to Miriam Abboud; issued Sales Slip 102 for $415 plus sales tax of $33.20. Note: Enter debits before credits. Journal entry worksheet Accepted a return of merchandise from Mitch Edwards; the merchandise was originally sold on Sales Slip 101 of March 1; issued Credit Memorandum 1 for $215, which included sales tax of $15.93. Note: Enter debits before credits. Journal entry worksheet Received payment from Mitch Edwards in payment of his balance owed for merchandise sold on March 1 , less the return of merchandise on March 8. Note: Enter debits before credits. Journal entry worksheet Sold merchandise on credit to Ann Ho; issued Sales Slip 103 for $605 plus sales tax of $48.40. Note: Enter debits before credits. Journal entry worksheet Recorded cash sales for the period from March 1 to March 15 of $5,400 plus sales tax of $432.00. Note: Enter debits before credits. Journal entry worksheet Recorded sales for the period from March 1 to March 15 to customers using bank credit cards of $7,400 plus sales tax of $592.00. (Record the 3 percent credit card expense at this time.) Note: Enter debits before credits. Journal entry worksheet Sold merchandise on credit to Frank Canzetti; issued Sales Slip 104 for $540 plus sales tax of $43.20. Note: Enter debits before credits. Journal entry worksheet Sold merchandise to customers using American Express for $3,640 plus sales tax of $291.20. Note: Enter debits before credits. Journal entry worksheet (1) 5 Received a check from Ann Ho of $207 to apply toward her account. Note: Enter debits before credits. Journal entry worksheet Recorded cash sales for the period from March 16 to March 31 of $5,900 plus sales tax of $472.00. Note: Enter debits before credits. Journal entry worksheet Received payment from American Express for the amount billed on March 26, less a 4 percent fee. Note: Enter debits before credits. Journal entry worksheet 1) 66 Recorded sales for the period from March 16 to March 31 to customers using bank credit cards of $6,650 plus sales tax of $532.00. (Record the 3 percent credit card expense at this time.) Note: Enter debits before credits. DATE TRANSACTIONS 201 March 1 Sold merchandise on credit to Mitch Edwards; issued Sales Slip 101 for $880 plus sales tax of $70.40. 3 Sold merchandise on credit to Miriam Abboud; issued Sales Slip 102 for $415 plus sales tax of $33.20. 8 Accepted a return of merchandise from Mitch Edwards; the merchandise was originally sold on Sales Slip 101 of March 1; issued Credit Memorandum 1 for $215, which included sales tax of $15.93. 10 Received payment from Mitch Edwards in payment of his balance owed for merchandise sold on March 1 , less the return of merchandise on March 8. 12 Sold merchandise on credit to Ann Ho; issued Sales Slip 103 for $605 plus sales tax of $48.40. 15 Recorded cash sales for the period from March 1 to March 15 of $5,400 plus sales tax of $432.00. 15 Recorded sales for the period from March 1 to March 15 to customers using bank credit cards of $7,400 plus sales tax of $592.00. (Record the 3 percent credit card expense at this time.) 25 Sold merchandise on credit to Frank Canzetti; issued Sales Slip 104 for $540 plus sales tax of $43.20. 26 Sold merchandise to customers using American Express for $3,640 plus sales tax of $291.20. 28 Received a check from Ann Ho of $207 to apply toward her account. 31 Recorded cash sales for the period from March 16 to March 31 of $5,900 plus sales tax of $472.00. 31 Received payment from American Express for the amount billed on March 26 , less a 4 percent fee. 31 Recorded sales for the period from March 16 to March 31 to customers using bank credit cards of $650 plus sales tax of $532.00. (Record the 3 percent credit card expense at this time.) Required: 2. Record the transactions in a general journal. 3. Post the entries from the general journal to the appropriate account in the general ledger and in the accounts receivable ledger. 4. Prepare a schedule of accounts receivable. GENERAL LEDGER ACCOUNTS Journal entry worksheet Sold merchandise on credit to Mitch Edwards; issued Sales Slip 101 for $880 plus sales tax of $70.40. Note: Enter debits before credits. Journal entry worksheet Sold merchandise on credit to Miriam Abboud; issued Sales Slip 102 for $415 plus sales tax of $33.20. Note: Enter debits before credits. Journal entry worksheet Accepted a return of merchandise from Mitch Edwards; the merchandise was originally sold on Sales Slip 101 of March 1; issued Credit Memorandum 1 for $215, which included sales tax of $15.93. Note: Enter debits before credits. Journal entry worksheet Received payment from Mitch Edwards in payment of his balance owed for merchandise sold on March 1 , less the return of merchandise on March 8. Note: Enter debits before credits. Journal entry worksheet Sold merchandise on credit to Ann Ho; issued Sales Slip 103 for $605 plus sales tax of $48.40. Note: Enter debits before credits. Journal entry worksheet Recorded cash sales for the period from March 1 to March 15 of $5,400 plus sales tax of $432.00. Note: Enter debits before credits. Journal entry worksheet Recorded sales for the period from March 1 to March 15 to customers using bank credit cards of $7,400 plus sales tax of $592.00. (Record the 3 percent credit card expense at this time.) Note: Enter debits before credits. Journal entry worksheet Sold merchandise on credit to Frank Canzetti; issued Sales Slip 104 for $540 plus sales tax of $43.20. Note: Enter debits before credits. Journal entry worksheet Sold merchandise to customers using American Express for $3,640 plus sales tax of $291.20. Note: Enter debits before credits. Journal entry worksheet (1) 5 Received a check from Ann Ho of $207 to apply toward her account. Note: Enter debits before credits. Journal entry worksheet Recorded cash sales for the period from March 16 to March 31 of $5,900 plus sales tax of $472.00. Note: Enter debits before credits. Journal entry worksheet Received payment from American Express for the amount billed on March 26, less a 4 percent fee. Note: Enter debits before credits. Journal entry worksheet 1) 66 Recorded sales for the period from March 16 to March 31 to customers using bank credit cards of $6,650 plus sales tax of $532.00. (Record the 3 percent credit card expense at this time.) Note: Enter debits before credits