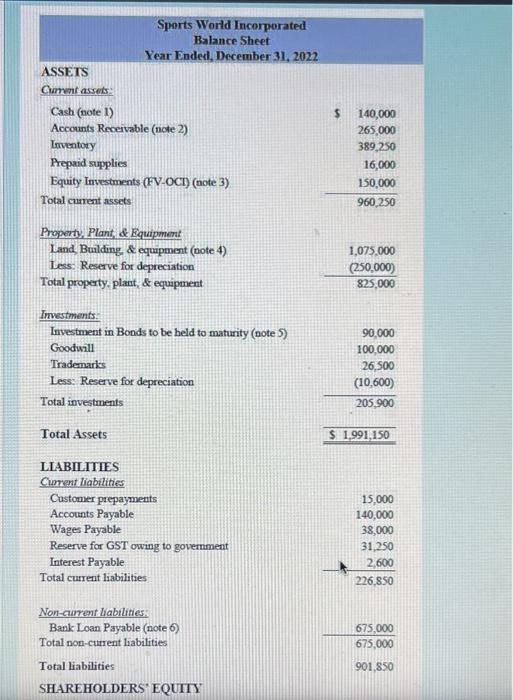

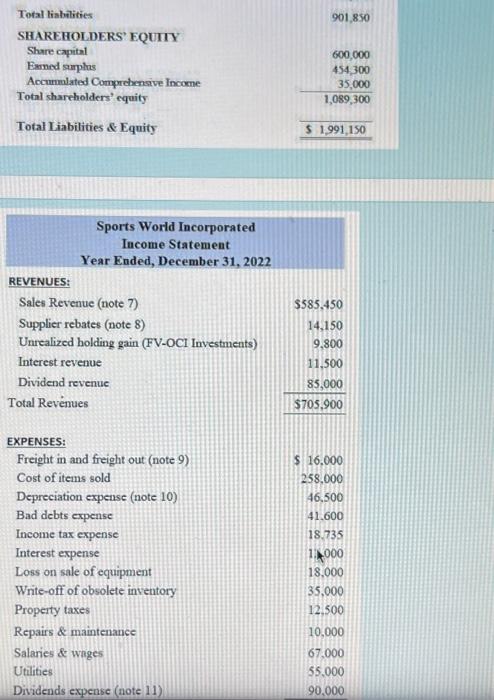

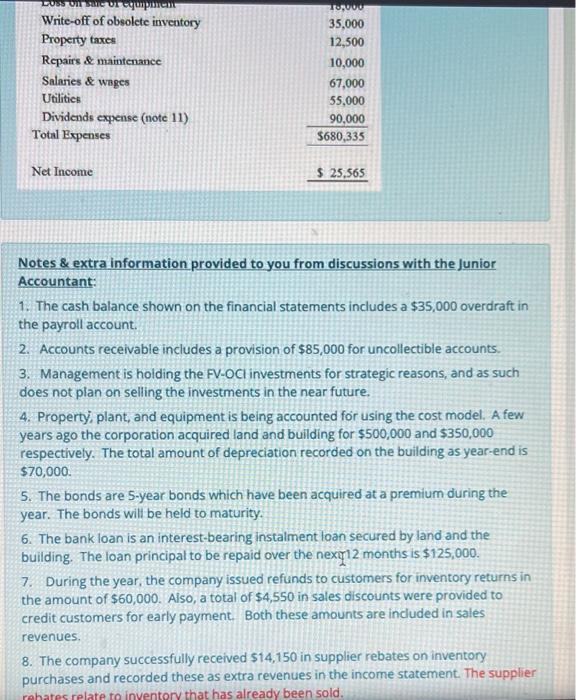

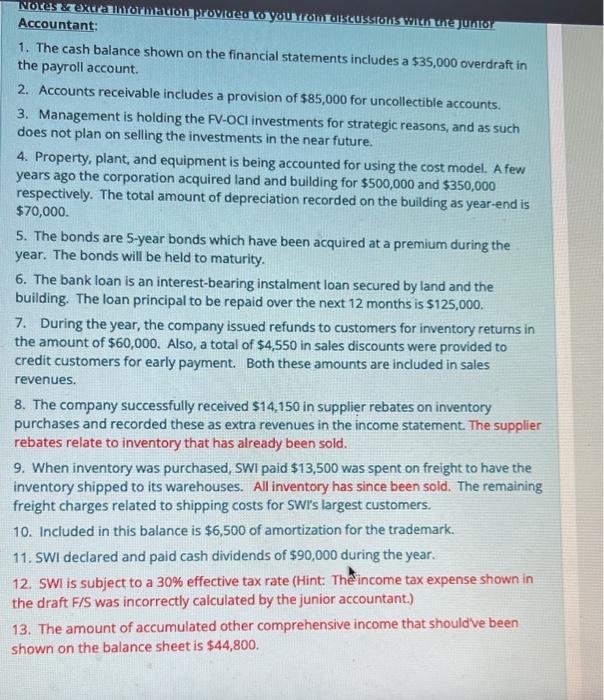

"Sports World Incorporated" Sports World Incorporated (SWI) is a publicly-traded wholesaler of sporting clothing and equipment specializing in skiing, hockey, figure skating, and mountain climbing with operating locations in British Columbia and Alberta. SWI has an operating bank account held at TD Bank as well as a payroll account at Royal Bank of Canada. SWI has dealt with TD Bank since incorporation, but the payroll service agency who processes SWI's monthly payroll insisted on SWI opening an account at Royal Bank since this is their "preferred" financial institution. As a result, SWI makes monthly bank transfers between the operating account and the payroll account to ensure all employees get paid. Both bank accounts have overdraft protection. Upon incorporation, SWI was authorized to issue an unlimited number of common shares and 50,000$2.00 non-cumulative preferred shares. At December 31,2022 the company had 250,000 common shares and 10,000 preferred shares issued and outstanding. The total "paid in capital" from common shares and preferred shares was $500,000 and $100,000, respectively. SWI declared and paid cash dividends of $90,000 during the year. No hares were issued or retired during 2022. The main accountant employed by SWI was recently hospitalized due to COVID-19 and as such, could not prepare the financial statements for the year-ended, December 31, 2022. Instead, a junior accountant was approached to draft the financial statements which have been given to you for your review which appears below: Sports World Incorporated Balance Sheet Year Ended, December 31, 2022 ASSEIS Cument assets: \begin{tabular}{lr|} \hline Cash (note 1) & 5,000 \\ Accounts Receivable (ncte 2) & 140,000 \\ Inventory & 389,250 \\ Prepaid supplies & 16,000 \\ Equity Imvestments (FV-OCI) (note 3) & 150,000 \\ \hline Total cument assets & 960,250 \\ \hline \end{tabular} Property, Plant, \& Equipment Land, Burilding & equipment (note 4) Less: Reserve for depreciation Total property. plant, \& equipment 1,075,000(250,000)825,000 Imvestments: \begin{tabular}{lr} Investment in Bonds to be beld to maturity (note 5) & 90,000 \\ Goodwill & 100,000 \\ Trademaris & 26,500 \\ Less: Reserve for depreciation & (10,600) \\ Total investments & 205,900 \\ Total Assets & \\ \hline \end{tabular} LIABILIIIES Ciment liabilities CastomerprepaymentsAccountsPayableWagesPayableReserveforGSTowingtogovernmentInterestPayableTotalcurrentliabilities15,000140,00038,00031,2502,600226,850 Non-curent Liabilities: Bank Loan Payable (note 6) Total non-current liabilities Total liabilities \begin{tabular}{r} 675,000 \\ \hline 675,000 \\ 901,850 \end{tabular} SHAREHOLDERS' EQUIIY Total liabntities SHAREHOIDERS' EQUIY Share capital Ewnned supphs Accumblated Comprehensive Income Totnl sharcholders' equity Total Liabilities \& Equity 600,000454,30035,0001,089,30051,991,150 Sports World Incorporated Income Statement Year Ended, December 31, 2022 REVENUES: Sales Revenue (note 7) Supplier rebates (note 8) Unrealized holding gain (FV-OCI Investments) 9,800 Interest revenue Dividend revenue Total Revenues EXPENSES: Freight in and freight out (note 9) Cost of items sold Depreciation expense (note 10) Bad debts expense Income tax expense Interest expense Loss on sale of equipment Write-off of obsolete inventory Property taxes Repairs \& maintenance Salaries \& wages Utilities Dividends expense (note 11) 16,000258,00046,50041.60018,7351.00018.00035,00012.50010,00067,00055,00090,000 Notes \& extra information provided to you from discussions with the Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. Property, plant, and equipment is being accounted for using the cost model. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000 5. The bonds are 5-year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the nexy12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues, 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. The supplier 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. Property, plant, and equipment is being accounted for using the cost model. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000. 5. The bonds are 5 -year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the next 12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues. 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. The supplier rebates relate to inventory that has already been sold. 9. When inventory was purchased, SWI paid $13,500 was spent on freight to have the inventory shipped to its warehouses. All inventory has since been sold. The remaining freight charges related to shipping costs for SWI's largest customers. 10. Included in this balance is $6,500 of amortization for the trademark. 11. SWI declared and paid cash dividends of $90,000 during the year. 12. SWI is subject to a 30% effective tax rate (Hint: The income tax expense shown in the draft F/S was incorrectly calculated by the junior accountant.) 13. The amount of accumulated other comprehensive income that shouldve been shown on the balance sheet is $44,800. 3. Prepare a corrected classified statement of financial position (balance sheet). Hint: When preparing corrected financial statements, ensure all proper terminology is being used. Correct for any errors you identify with respect to valuation, recognition, and/or dassification. Be sure to consider all information provided to you. This includes information in the case "introduction" as well as the extra information provided to you by the junior accountant (summarized in the "notes" following the financial statements). 3. Prepare a corrected classified statement of financial position (balance sheet). Hint: When preparing corrected financial statements, ensure all proper terminology is being used. Correct for any errors you identify with respect to valuation, recognition, and/or dassification. Be sure to consider all information provided to you. This includes information in the case "introduction" as well as the extra information provided to you by the junior accountant (summarized in the "notes" following the financial statements). "Sports World Incorporated" Sports World Incorporated (SWI) is a publicly-traded wholesaler of sporting clothing and equipment specializing in skiing, hockey, figure skating, and mountain climbing with operating locations in British Columbia and Alberta. SWI has an operating bank account held at TD Bank as well as a payroll account at Royal Bank of Canada. SWI has dealt with TD Bank since incorporation, but the payroll service agency who processes SWI's monthly payroll insisted on SWI opening an account at Royal Bank since this is their "preferred" financial institution. As a result, SWI makes monthly bank transfers between the operating account and the payroll account to ensure all employees get paid. Both bank accounts have overdraft protection. Upon incorporation, SWI was authorized to issue an unlimited number of common shares and 50,000$2.00 non-cumulative preferred shares. At December 31,2022 the company had 250,000 common shares and 10,000 preferred shares issued and outstanding. The total "paid in capital" from common shares and preferred shares was $500,000 and $100,000, respectively. SWI declared and paid cash dividends of $90,000 during the year. No hares were issued or retired during 2022. The main accountant employed by SWI was recently hospitalized due to COVID-19 and as such, could not prepare the financial statements for the year-ended, December 31, 2022. Instead, a junior accountant was approached to draft the financial statements which have been given to you for your review which appears below: Sports World Incorporated Balance Sheet Year Ended, December 31, 2022 ASSEIS Cument assets: \begin{tabular}{lr|} \hline Cash (note 1) & 5,000 \\ Accounts Receivable (ncte 2) & 140,000 \\ Inventory & 389,250 \\ Prepaid supplies & 16,000 \\ Equity Imvestments (FV-OCI) (note 3) & 150,000 \\ \hline Total cument assets & 960,250 \\ \hline \end{tabular} Property, Plant, \& Equipment Land, Burilding & equipment (note 4) Less: Reserve for depreciation Total property. plant, \& equipment 1,075,000(250,000)825,000 Imvestments: \begin{tabular}{lr} Investment in Bonds to be beld to maturity (note 5) & 90,000 \\ Goodwill & 100,000 \\ Trademaris & 26,500 \\ Less: Reserve for depreciation & (10,600) \\ Total investments & 205,900 \\ Total Assets & \\ \hline \end{tabular} LIABILIIIES Ciment liabilities CastomerprepaymentsAccountsPayableWagesPayableReserveforGSTowingtogovernmentInterestPayableTotalcurrentliabilities15,000140,00038,00031,2502,600226,850 Non-curent Liabilities: Bank Loan Payable (note 6) Total non-current liabilities Total liabilities \begin{tabular}{r} 675,000 \\ \hline 675,000 \\ 901,850 \end{tabular} SHAREHOLDERS' EQUIIY Total liabntities SHAREHOIDERS' EQUIY Share capital Ewnned supphs Accumblated Comprehensive Income Totnl sharcholders' equity Total Liabilities \& Equity 600,000454,30035,0001,089,30051,991,150 Sports World Incorporated Income Statement Year Ended, December 31, 2022 REVENUES: Sales Revenue (note 7) Supplier rebates (note 8) Unrealized holding gain (FV-OCI Investments) 9,800 Interest revenue Dividend revenue Total Revenues EXPENSES: Freight in and freight out (note 9) Cost of items sold Depreciation expense (note 10) Bad debts expense Income tax expense Interest expense Loss on sale of equipment Write-off of obsolete inventory Property taxes Repairs \& maintenance Salaries \& wages Utilities Dividends expense (note 11) 16,000258,00046,50041.60018,7351.00018.00035,00012.50010,00067,00055,00090,000 Notes \& extra information provided to you from discussions with the Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. Property, plant, and equipment is being accounted for using the cost model. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000 5. The bonds are 5-year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the nexy12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues, 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. The supplier 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. Property, plant, and equipment is being accounted for using the cost model. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000. 5. The bonds are 5 -year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the next 12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues. 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. The supplier rebates relate to inventory that has already been sold. 9. When inventory was purchased, SWI paid $13,500 was spent on freight to have the inventory shipped to its warehouses. All inventory has since been sold. The remaining freight charges related to shipping costs for SWI's largest customers. 10. Included in this balance is $6,500 of amortization for the trademark. 11. SWI declared and paid cash dividends of $90,000 during the year. 12. SWI is subject to a 30% effective tax rate (Hint: The income tax expense shown in the draft F/S was incorrectly calculated by the junior accountant.) 13. The amount of accumulated other comprehensive income that shouldve been shown on the balance sheet is $44,800. 3. Prepare a corrected classified statement of financial position (balance sheet). Hint: When preparing corrected financial statements, ensure all proper terminology is being used. Correct for any errors you identify with respect to valuation, recognition, and/or dassification. Be sure to consider all information provided to you. This includes information in the case "introduction" as well as the extra information provided to you by the junior accountant (summarized in the "notes" following the financial statements). 3. Prepare a corrected classified statement of financial position (balance sheet). Hint: When preparing corrected financial statements, ensure all proper terminology is being used. Correct for any errors you identify with respect to valuation, recognition, and/or dassification. Be sure to consider all information provided to you. This includes information in the case "introduction" as well as the extra information provided to you by the junior accountant (summarized in the "notes" following the financial statements)